SEIS for investors: Deduct 50% of your next investment from your UK income tax

SEIS is a fantastic UK government tax incentive to increase investment in UK startups. When you invest in an eligible st...

The days of painstakingly tracking equity allocation on a series of spreadsheets are over – thanks to intuitive online platforms that can do it all for you.

In this post, we explore how UK startup founders can use the services offered by SeedLegals and Carta to:

There’s obviously no point hiding our bias😉

Here’s why we think SeedLegals is the better choice for UK startups – especially at an early stage:

Every pound you spend as an early-stage startup shapes your future. At SeedLegals, we design our pricing so that it’s clear upfront what you’ll be paying. We also separate our pricing by specific services such as funding rounds and option schemes, so it’s adaptable for early-stage startups who are watching their costs.

With SeedLegals, you pay for different levels of membership and a percentage of the amount you raise. For a full breakdown of the membership plans and services, head over to our pricing page.

Carta’s starting plan only caters for 5 shareholders, with pricing then increasing with the number of stakeholders and additional features you need. Unlike SeedLegals, Carta does not list a flat fee for unlimited option schemes. Instead, the pricing for managing options is embedded in their broader equity management plans.

To sum up, SeedLegals has more tailored pricing based on specific services such as funding rounds and option schemes. Carta’s tiered pricing escalates as your business grows, which could lead to higher overall costs for startups.

🔍 To compare the services and functionalities SeedLegals and Carta offer for cap tables, fundraising and options, stay with us – we explain it all below.

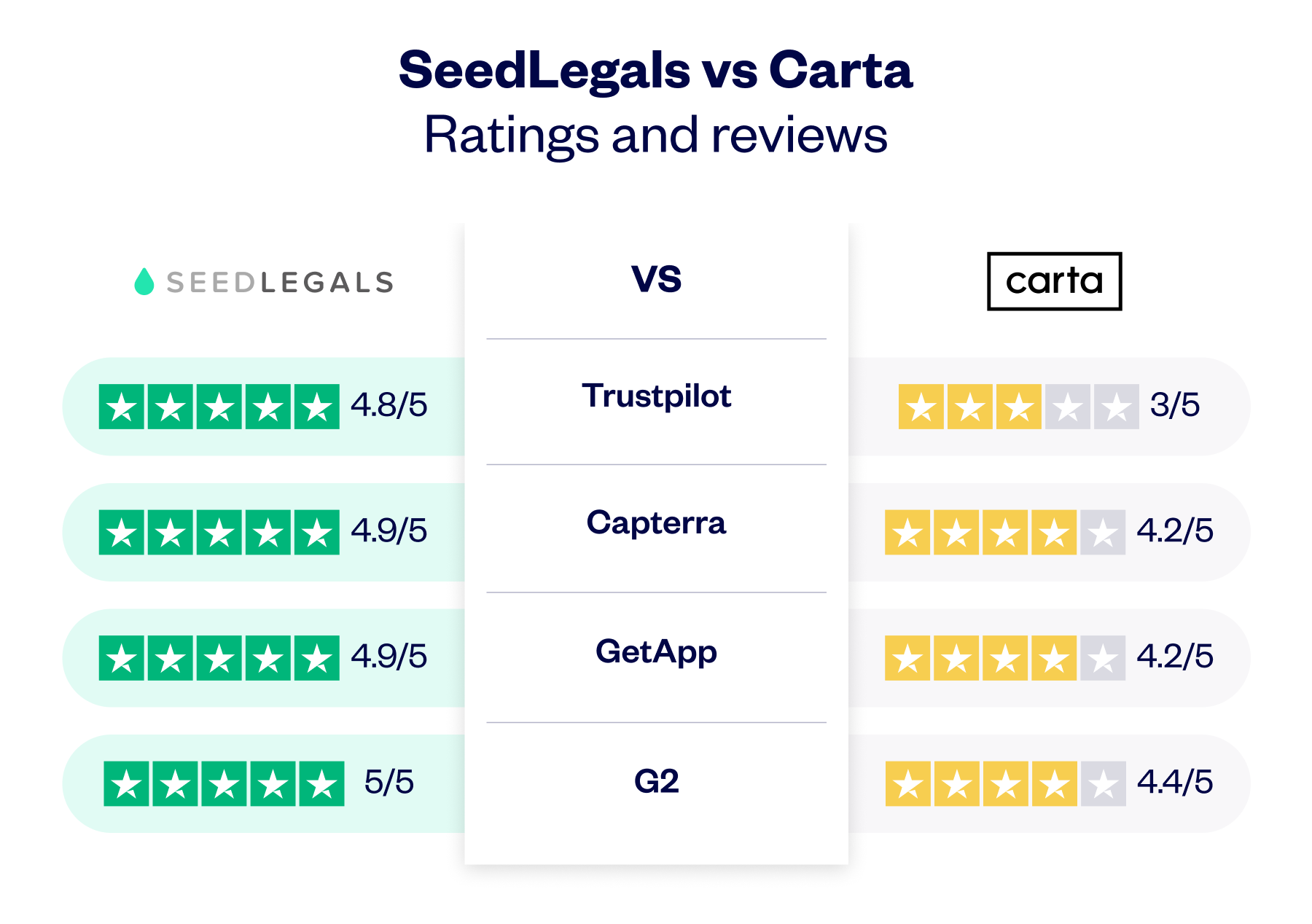

SeedLegals has earned 100s of 5-star ratings from successful founders. Explore the table below to see verified glowing reviews posted across independent sites.

It all starts with your cap table. As the nerve centre of your business, a well-managed cap table keeps track of every stakeholder’s ownership, from your earliest investors to your expanding team. It also reflects the growth of your business, including capital injections and the creation of an option pool to incentivise your team with equity.

Investors will look closely at your cap table – it needs to be clear, without any inconsistencies or red flags. Software solutions, like those offered by SeedLegals and Carta, make it easy to maintain a clean, up-to-date cap table, ensuring transparency and confidence as you scale your business.

Both SeedLegals and Carta help founders streamline the process of obtaining SEIS/EIS HMRC approval, allowing companies to offer investors tax relief in exchange for their support. This tax incentive makes investing in startups more attractive and can significantly boost fundraising efforts.

In addition to SEIS/EIS, SeedLegals and Carta both offer ways for founders to take capital through investment agreements, but only SeedLegals lets you complete a full funding round. While Carta offers SAFE templates, with SeedLegals you can complete the full fundraising process – for example, raising before a round with a SeedFAST (our version of an ASA, Advanced Subscription Agreement) or SAFE (Simple Agreement for Future Equity), completing the formal funding round and topping up after with Instant Investment.

Raising through SAFEs and ASAs are great for speed and flexibility, but they’re only part of the picture. To close the loop, you need the formal legal agreements that make everything official, including the Articles of Association and Shareholders Agreement. These documents protect your investors and ensure you maintain control as your business grows. Completing the full round also makes it easier to manage future funding and avoid messy legal or financial issues down the line.

SeedLegals gives you the option of multiple ways to raise through customisable documents vetted by lawyers – all with 1:1 support at every step.

Below, we’ll break down how each platform supports your fundraising journey and which might be the best fit for your business needs.

When it comes to the UK early-stage startup scene, SeedLegals is completely in tune with the needs of founders.

No one handles more SEIS applications, pre-seed or seed-stage rounds in the UK than SeedLegals, making it the go-to platform for early-stage companies. While Carta brings incredible insights into later-stage funding and larger rounds, our deep knowledge of SEIS/EIS tax relief schemes and early-stage fundraising sets us apart.

SeedLegals is specifically designed for UK founders, with expert guidance and automated tools that simplify the process, helping startups secure investment and grow from the ground up.

The SeedLegals Plus plan is designed to give you maximum value when you raise funding. With it, you get:

With Flex you can pay upfront to raise your target amount. Then you have 18 months to use a combination of any fundraising tool you want: SeedFASTs (the SeedLegals version of a SAFE), a traditional funding round, Instant Investment and Convertible Loan Notes (CLN).

Flex not only gives you the flexibility to take in funds whenever the opportunity comes up. It also saves you money by locking in a low price, because the total fee you pay upfront is based on the lowest cost regardless of which documents you choose to use.

Option schemes reward employees with equity, giving them a stake in the business’s success. It’s a powerful way to align the team’s long-term incentives and attract top talent without upfront cash outlays.

Using platforms like SeedLegals or Carta makes this process seamless. These platforms handle all the complex legal documents, valuations, and compliance, allowing founders to focus on building their business while ensuring their team is motivated and invested in its future.

Companies have a few choices when it comes to option scheme types.

The SeedLegals Options plan covers all your employee equity requirements for just £2,490/ year + VAT, including unlimited EMI and unapproved option schemes, EMI valuations, and all the required legal documents.

With Carta, options services are only available in the larger Grow or Scale plans.

Fast and affordable access to top-quality legal documents and unlimited legal support – we make it simple to get SEIS/EIS Advance Assurance, all funding deal legals and option schemes done.

✅ Live platform chat support, plus unlimited task-specific support

✅ Fundraising strategy support from your dedicated account manager (with Plus membership)

✅ Data insights from the 60,000 companies using SeedLegals – see how we use our data to help you make the right decisions for your business on the Termometer

✅ Guided workflow with built-in tutorials

✅ An invite to our exclusive Founder WhatsApp group (with Plus membership)

✅ A full programme of free webinars and events, plus networking opportunities and discounts on ticket prices

✅ Access to 500+ articles and guides, packed with expert insights from investors and successful entrepreneurs

✅ Exclusive offers and perks worth over £8,000 (with Plus membership)

We’ve supported over 60,000 companies to raise over £2B to date. Book a demo to find out how we can help you too.