SeedFAST is the new Seed Round

On SeedLegals, more companies now raise money outside a funding round than inside a round. We explain what's happening a...

With evolving investor expectations, the rise of alternative funding options, and economic fluctuations shaping decision-making, founders in 2025 need to be more strategic than ever.

Based on our data at SeedLegals, we can see the shift to more flexible ways of raising capital continues to gain popularity. Using agile funding tools, companies are raising in faster, smaller rounds to extend their runway and fund the work needed to hit key milestones.

This article will cover our top three fundraising strategies for a lean and agile approach to your fundraising in 2025. We’ll also give you some extra tips to boost your appeal to investors and have a successful year.

Get the latest insights from our funding experts, find out what investors are looking for and gain practical tips on how to raise this year.

Download the ebookThe traditional method of fundraising in formal rounds is far from the ideal scenario for a lot of startups:

Anthony RoseA funding round is like a bus trip

You need to round up all the investors, wait until the last of them arrives, pack them all on the bus, agree a destination, and then trundle off together.

Agile fundraising is the Uber alternative

You find individual investors who arrive either before the bus has arrived or after it’s left, grab a cab for them, and away they go. Repeat as needed.Co-founder and CEO,

Luckily, there are other ways to fundraise that allow you to take in money quickly at a fair valuation, without going through each and every step of a priced equity round.

Agile funding allows you to take in cash quicker, when you need it:

🥳You don’t need to wait until all investors are lined up and on the same page to take the money

🥳You don’t have to settle for raising a smaller amount than you planned to access the money you have negotiated

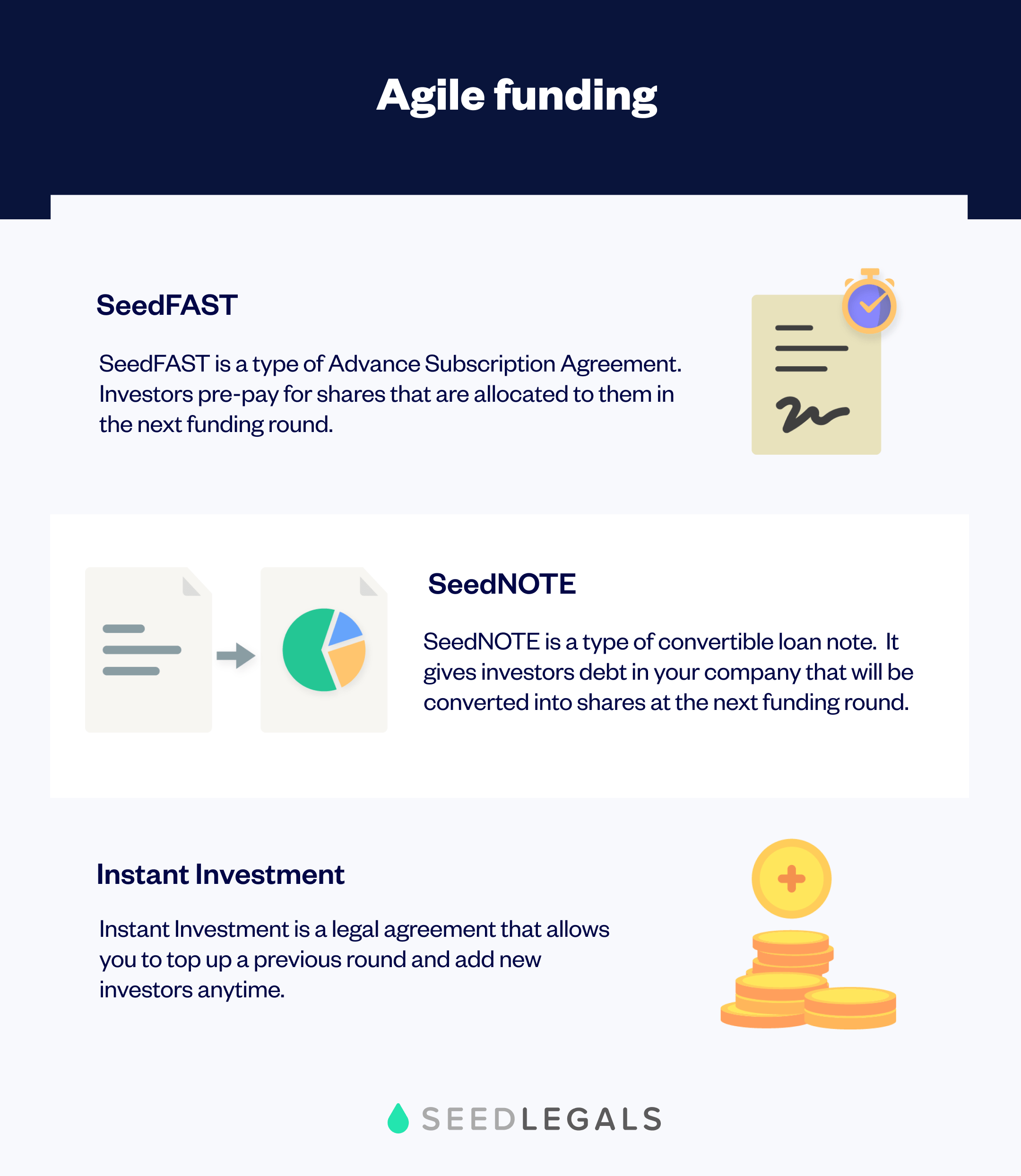

There are three agile funding agreements that are easy to access on SeedLegals. SeedFAST and SeedNOTE allow you to raise before your round, and Instant Investment allows you to top up your round after it closes.

What’s a SeedFAST?

SeedFAST is a type of Advance Subscription Agreement (ASA). These are individual, simple, quick agreements for future equity in the company where investors pre-pay for shares that will then be allocated to them in the next funding round. SeedFAST is our version of the YC SAFE and it can be used for overseas investors as well as UK investors.

What’s a SeedNOTE?

SeedNOTE is a type of convertible loan note. Convertible loan notes (or just convertible notes) give investors debt in your company. This will then be converted into shares at the next funding round. Being in debt gives an investor more protection if things go wrong, and SeedNOTEs usually have an interest rate which your company pays to the investor.

What’s an Instant Investment?

Instant Investment is a legal agreement that allows you to top up a previous round and add new investors anytime.

Running out of runway? You can use agile funding as a bridge between rounds to keep you going for longer.

Whether you’re in crisis mode and need an emergency capital injection or you want to delay your next round so that you can raise at a higher valuation than you could now, you can use SeedFASTs and Instant Investments to bridge the gap between rounds.

Both SeedFASTs and Instant Investments can work wonders in this scenario. Use Instant Investment if you’ve got a valuation you’re happy with. Use SeedFAST if you haven’t pinpointed a valuation.

🤩 Benefits of this strategy

Since we launched SeedFASTs in 2018, we’re increasingly seeing founders using full-round-size SeedFASTs to skip the traditional round altogether (read more in our post).

If you use this strategy, remember:

We’ve also seen founders using Instant Investments to continually top up their last round for longer than we first anticipated. Instant Investment allows you to raise small amounts as and when you need them, based on your last valuation.

You can create an Instant Investment agreement in minutes on SeedLegals, so many founders prefer to ditch the full funding round altogether and just raise money as they need it.

🤩 Benefits of this strategy

Use Instant Investment to top up a previous round and add new investors anytime

Learn moreSo far, we’ve covered the two main ways to think of agile funding strategies: to get you from one round to another and as a replacement for a full round.

But at SeedLegals we’re seeing the huge benefits of using SeedFASTs inside a funding round. More powerful than a bridge – with this strategy, SeedFASTs work as rocket fuel for your raise.

With SeedFASTs, you can:

Let’s break down how it works.

As a founder, you’re at a disadvantage by committing to a valuation at the beginning of your round. You probably haven’t yet built enough traction to justify a high valuation to your investors. But you still want to give away as little equity as possible in the early stages of your business.

With SeedFASTs, you can defer the valuation and use the early investment to make your company more attractive to investors.

What’s in it for investors? If their gamble pays off and you grow your valuation significantly before their SeedFAST investment converts, they benefit from a discount on shares at a higher valuation. They get more equity at a lower price.

It’s easier to win over investors when you already have an investor in your corner. If you can show you already have investors committed to your round through a SeedFAST, that helps you build credibility with other investors later in your round.

It also can help you get over the lead investor problem. With a traditional round, you typically can’t get any momentum until you’ve secured a lead investor and agreed the terms with them. But with SeedFASTs, you can take funds from investors without waiting to fill the rest of the round – or even securing a lead investor.

Liliana ConradLead investors need to be confident that you can complete a raise before they jump on board. Ultimately, their decision won’t just be made on the strength of the company’s traction or the founder’s reputation within their industry. If they don’t trust that you can win the full investment amount, they won’t put their money at stake. That’s why building investor momentum through SeedFASTs is such a powerful strategy, especially if you’re looking to try to capture institutional investors or VCs.

Funding Strategist,

🤩 Benefits of this strategy:

Aim to build a solid foundation. Here are our top tips to help.

Growth-at-all-costs is a tougher strategy in this volatile market. The best thing for startups to focus on this year is building a safe, solid company – which means:

Jonny SeamanMake sure you have enough runway in your bank account (minimum 9 to 12 months, ideally 18 months or more) and prioritise getting towards break-even. Keep your customers happy and focus on generating revenue from them. This will make you a safer bet for investors.

Investor Partnerships Manager,

Investors want to see that you’re clear on what you’re creating and that you have a step-by-step plan to achieve your business goals. They want to see that you’re aware of your challenges and advantages.

Yana AbramovaWhile the market might become a bit easier, the engagement rules for startups are still the same – namely that you have to know what you want to build, you have to know how you want to build it, you have to know your weaknesses, and you have to know not to beat around the bush.

Founder of Pretiosum Ventures,

If you can show that you’re already on your path to success with tangible results, investors will be more inclined to invest in your company.

If your startup has traction, it means you’ve moved beyond the idea stage and have some real business going on in the form of:

It’s expensive to replace employees. Make sure you’re taking measures to keep your employees engaged and happy. This can also contribute to building the type of consistent, solid company investors are looking for.

A common way for startups to incentivise and motivate employees and contractors is with share options schemes – set up an EMI scheme for full-time employees and an Unapproved scheme for contractors, advisors and employees overseas.

If your company has spent money developing a new product or service, or significantly improved one that already exists, you could claim R&D tax credits, which can help to improve cash flow in your company.

R&D tax relief is an HMRC initiative that pays your company back a percentage of what you spend on qualifying activity for research and development. You get the money back in the form of Corporation Tax relief or, if you’re a loss-making company, as a tax credit (that is, a cash payment).

To find out more about the scheme, read our post: R&D tax credits: the ultimate guide

Ben ConryR&D tax relief is often an under-used way of boosting a company’s cash flow.

For startups in particular, R&D is a great way to extend your runway and bring much-needed cash into the business.

Tax Specialist,

When you use SeedLegals to raise, you get unlimited support from our funding strategists, who can guide you through your funding journey.

With over £2 billion in deals closed through our platform, we have the experience and data to help you:

✅ Understand all your funding options

✅ Make informed decisions about your investment deals

✅ Navigate your deal to achieve the best outcome for you

✅ Save time and money on your funding admin

Not sure what’s best for your company? Want to find out more about our alternatives to a traditional funding round? Book a free chat with one of our funding strategists to get answers, fast.