Agile fundraising has arrived. Don't do a funding round until you've read this

New data shows the way that startups are raising investment is changing, and SeedLegals is pioneering that change.

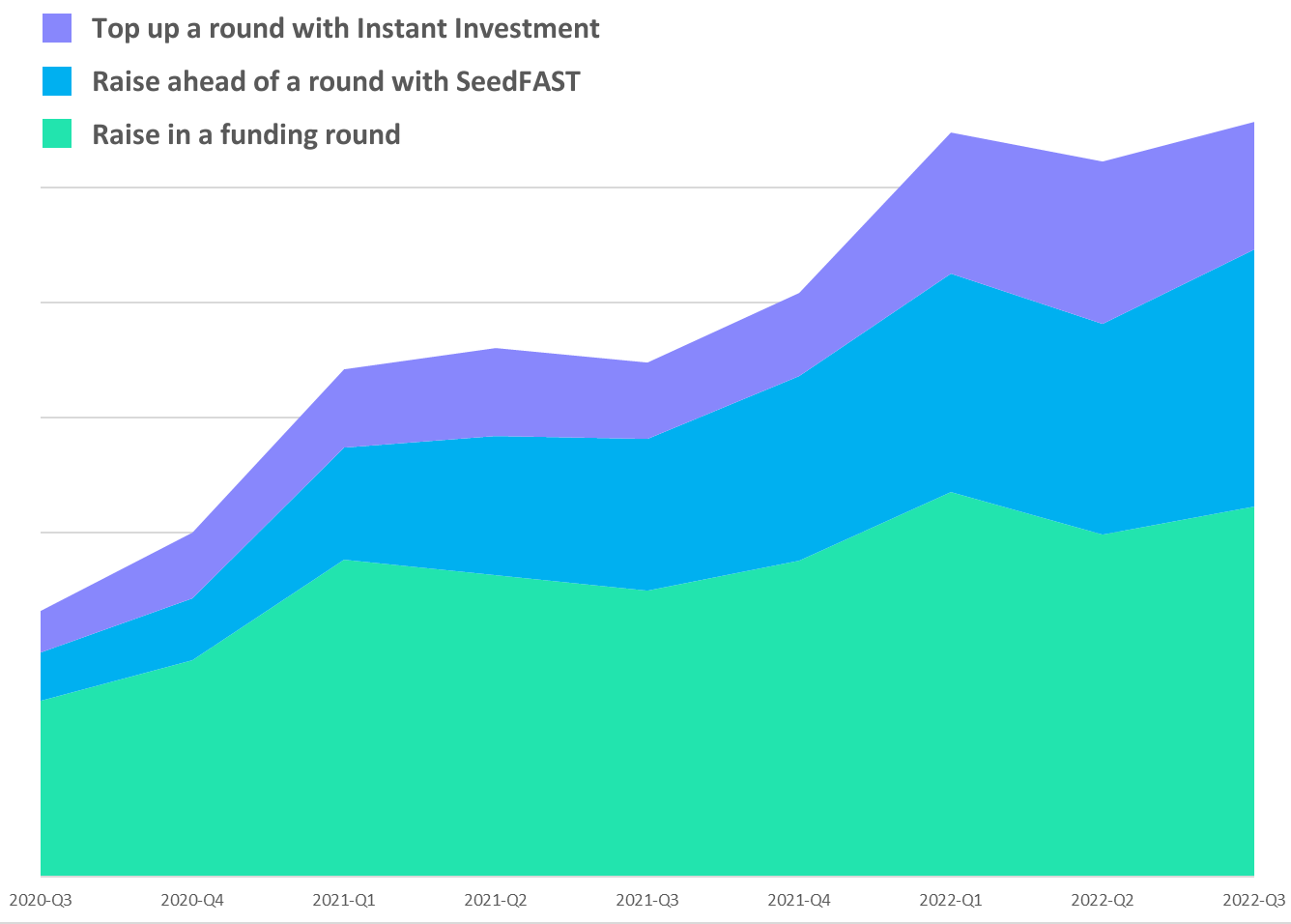

The world of fundraising has changed. Our stats show that UK companies are now raising more outside a round than in a funding round.

In this post, we explain what’s happening and why – and how your company can take advantage of new ways to fundraise.

Embarking on a funding round? Clear your diary. You’ll need to figure out how much you need to fuel the company for the next 12 to 18 months. Find investors and persuade them to invest in your company. Agree a valuation and deal terms. Then do all the legals, close the deal, issue share certificates and sort out the SEIS/EIS.

Because of the time, cost and effort of doing all this, funding rounds have historically been a lengthy cycle of ‘go big or go home’. It’s immensely stressful and time-consuming for founders.

The good news is all that has changed. If you still think that a funding round is the only way to raise investment, you’re behind the times. At SeedLegals we call it agile fundraising, and it’s a game-changer.

Agile funding is raising money outside of a traditional funding round:

The chart below shows amounts raised on SeedLegals from 2020 to 2022. The amounts raised in funding rounds – the green area of the chart – have increased – but the big change is the massive increase in SeedFASTs (in blue) to raise before a round:

When we combine the amount raised with both SeedFASTs (raising before a round) and Instant Investment (topping up after a round), there’s now more raised outside a round than in a round.

At SeedLegals, we didn’t invent the concept of an advance subscription (that is, raising before a round) or a deed of adherence (to top up a round). But we turned them into digital products to make the process quick and easy for you. And we built into funding rounds all the permissions to enable you to easily top up later, including being able to increase the valuation as you go. We’re immensely proud that SeedLegals has completely transformed the way UK companies fundraise.

So are funding rounds becoming redundant?

No. Here’s why…

There’s still a strong case for doing a funding round. In fact, a funding round is the ‘anchor’ that underpins your fundraising efforts – but it’s now (certainly for companies using SeedLegals) more the exception than the norm.

A funding round is like a bus trip 🚌

You need to round up all the investors, wait until the last of them arrives, pack them all on the bus, agree a destination, and then trundle off together.

Agile fundraising is the Uber alternative 🚕

You find individual investors who arrive either before the bus has arrived or after it’s left, grab a cab for them, and away they go. Repeat as needed.

Around 30% of all first SEIS funding rounds in the UK are now done on SeedLegals, so we talk to a lot of founders. When founders contact us for help with their fundraising strategy, the queries typically fall into one of three categories:

(The £300K is just an example – replace it with whatever number applies to you.)

In each case, founders ask us, ‘What’s the best strategy?’ Should the company wait to round up all the investors to set off on the bus together? Or should they grab an Uber for the early arrivals?

For each of the scenarios above, here’s what funding strategies can work well:

The amount you’ve lined up is too small for a funding round, and you probably aren’t yet able to agree a valuation with those investors, or the valuation would be lower than you’d like.

In the past, you’d have to keep bootstrap-funding the company yourself, while you spend your valuable time finding investors rather than focusing on building your product.

But now, this is a good example of when to use a SeedFAST. Use SeedFASTs to take in that £50K now, use that money to hire people to develop the product, and then when you have more traction and data to entice investors, you can start on a funding round to take in the remainder of the money you need.

In the past, you’d have a quandary:

Do you just get on with it and do a smaller funding round?

Or keep looking for investors to make up the full amount you want to raise?

This is where a funding round with a rolling close comes to the rescue – this allows you to do both.

On SeedLegals, more than 75% of all funding rounds have Instant Investment enabled. This builds into the funding round legal documents the permissions you need to be able to top up the round later – at the same or higher company valuation in the funding round – without having to get further permission from your investors to allow each top-up.

In this scenario, the company can start and close a £200,000 funding round now, and enable Instant Investment so you can easily top up later when you find more investors.

Anthony RoseIronically, the time you often find enthusiastic investors is when word gets out that you’ve just closed a funding round. Now instead of saying, ‘Sorry, you’re too late’, you can say: ‘No problem, we’d love to have you onboard – I’ll send you an Instant Investment now.’

CEO and Co-Founder,

You’ve found investors for all the money you intended to raise – that’s awesome, congratulations! You’re ready to close your round on SeedLegals.

Even though you’ve raised the full amount, you can still enable Instant Investment in your round to make it super easy to top up later.

In fact, on SeedLegals many companies now continue for years just topping up their last round, adding investors when they need them and as the opportunities arise, without having to expend the time and effort on doing a new funding round each time.

The primary way to fundraise has transitioned from funding round to agile fundraising over the past four years, starting when we launched SeedFAST in 2018.

But in 2022 we saw a new pattern emerge: the rise of big SeedFASTs. How big is ‘big’? Large enough to be not just a bridge investment before an upcoming funding round – but a replacement for the round itself.

Going back to the scenarios above, a typical situation would be that you’ve lined up perhaps 20% of the total you aimed to raise for your next round. Instead of waiting to find the rest, you can use SeedFASTs as a bridge to the next round, to take in that investment now. Often companies have half a dozen investors ready to invest £5,000 to £50,000 each, and you’d create a SeedFAST for each investment.

But the new pattern we’re seeing – where founders are now using SeedFASTs to raise the entire amount of a funding round – skips the round completely.

Under HMRC rules, a SeedFAST must convert within six months to qualify for SEIS or EIS. If you raise the entire amount you wanted with SeedFASTs, you’ll probably have enough money that you won’t need to do a funding round before that six months is up – which means those SeedFASTs would convert in six months – at the longstop valuation that you agree with your investor when you create the SeedFAST.

If you pick the longstop valuation wisely – perhaps your best estimate of the company valuation as it would be in six months – then this is an effective strategy to kick the can down the road on the need for a funding round. You’ll still need to do a funding round at some point – the SeedFASTs will have to convert in due course – but you can defer that to later.

Previously we were seeing SeedFASTs of £10K, £20K or £50K before a funding round. What we’re seeing now is SeedFASTs of £200K, £500K and even £2M – a different, more agile way to fundraise.

For a small but growing number of companies, SeedFASTs are the new Seed Round.

Got questions about SeedFAST or doing a funding round? Not sure how to structure your round so you can top it up afterwards? Book a free chat with one of our experts to get answers, fast.