Introducing SeedLegals Performance Options

Some of the 2,000+ companies who’ve set up an option scheme with SeedLegals have told us that they want a way to allocat...

You’ve heard of ordinary shares and preference shares – but what are growth shares? You might have heard that growth shares are an alternative to share options.

In this article, we explain what growth shares are, how they work, and when it’s better to issue growth shares instead of share options.

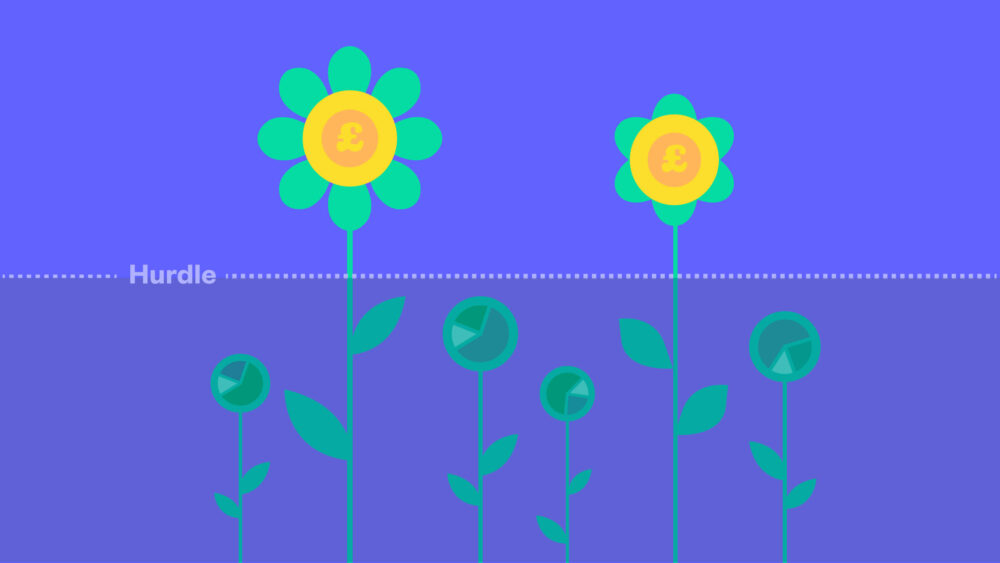

Growth shares are a special class of shares that have a hurdle. Growth shares only have a value if the company’s share price is above the hurdle.

This means when you give someone growth shares, and you choose a hurdle that matches the company valuation today, the growth shares have zero value when they’re issued. They only have a value if the share price goes up – we’ll explain below the advantages and disadvantages of that.

You might also see growth shares called ‘hurdle shares’ or ‘flowering shares’. And in the USA, growth shares are called growth stocks.

Growth shares are issued at a ‘hurdle’. The hurdle is the amount the share price must be over for the shareholder to benefit when they sell those shares.

Example

🚧 You issue growth shares to Alex at a hurdle of £1 per share.

📈 Three years later, you sell the company, at a valuation of £10 per share.

💰 Each shareholder who has ordinary shares gets a payout of £10 per share.

9️⃣ But because Alex’s growth shares have a hurdle of £1, he only gets £9 per share.

📉 If you sell the company for less than £1 per share, Alex gets nothing.

The #1 use for growth shares is to give shares to late-joining founders and key employees who don’t qualify for EMI options without the tax liabilities that normally come with giving ‘free’ shares. (An employee might not qualify for EMI options because either they or the company would be over the EMI scheme limit of 250 people.)

Example

🍾 Startup Xampl has recently closed its Series A round, at a price of £10 per share.

🤝 Xampl plans to hire a new CEO and to give her 10,000 shares, vesting over 3 years.

🎫 Xampl doesn’t qualify for EMI and the new CEO wants voting shares not share options, so they agree to issue shares.

💰 If Xampl give the CEO ordinary shares, those shares would have a value of £100,000. This would mean the CEO, because she’s an employee of the company, might incur an income tax charge as if she’d been paid £100,000 in cash. And Xampl would need to pay PAYE and National Insurance as if it had paid the CEO £100,000 as part of her salary.

😱 The CEO gets a big unwelcome surprise when her accountant informs her that she has a £40,000 tax liability for the £100,000 worth of shares – which she can’t sell anytime soon.

So, is there a way to avoid the tax issues?

Yes: growth shares.

The solution for our example is that the company issues the CEO with growth shares with a hurdle of £10 per share. Normally, you pick a hurdle that’s a bit higher than the last round price per share to be certain there won’t be any tax issues, but here we’ll go with £10 per share.

This means that the shares have zero value today so Xampl can issue the growth shares to their new CEO without tax liabilities for either party.

The downside is that the growth shares only have a value if the share price goes up. But this is an incentive for the new CEO – until she’s helped the company increase the share price, her shares are worth nothing.

Issuing Growth shares does not inherently disqualify a company from SEIS/EIS eligibility. The compatibility depends on how the liquidation waterfall is structured in the company’s Articles of Association. That’s because S/EIS shares cannot have a preference over any other shares in the waterfall. Let’s break it down.

The liquidation waterfall must be carefully structured to maintain SEIS/EIS compliance:

If the Articles of Association mistakenly grant a preference to S/EIS shareholders (e.g., by paying them back first), it would violate SEIS/EIS rules and could disqualify the shares.

This risk arises not because of the Growth shares themselves but because of incorrect legal wording.

When you create Articles or set up Growth shares, ensure the wording explicitly follows SEIS/EIS rules. Use carefully crafted legal wording to define how the liquidation proceeds are shared among different share classes.

When you issue growth shares, because they have no value at that point, the recipient isn’t liable to pay Income Tax on those shares. And there’s no National Insurance contribution for you to pay.

When your shareholders sell their shares, they might be liable to pay Capital Gains Tax – this depends on their personal circumstances. There are full details about CGT on the sale of shares at the gov.uk website.

Sales of growth shares aren’t usually eligible for Business Asset Disposal Relief (formerly Entrepreneurs’ Relief) – to see why, take a look at the rules on the gov.uk website.

Bear in mind that HMRC can change how share issues and gains are taxed – you should brief recipients of growth shares that the tax treatment might change in future.

If the recipient of the growth shares isn’t a tax resident in the UK, the tax implications for them depend on the rules in the region where they pay tax.

You can issue growth shares as an alternative to EMI options, or you can run an EMI option scheme and issue growth shares too. You can even set up an EMI scheme and an unapproved scheme and issue growth shares.

Here’s how an EMI option scheme stacks up against growth shares:

| EMI option scheme | Growth shares | |

| Create from option pool | ✓ | ✕ |

| Can be issued to anyone | ✕ PAYE employees only | ✓ |

| Shares issued immediately | ✕ Options are usually issued to a vesting schedule | ✓ But you can add conditions so the shareholder doesn’t automatically get to keep all the shares |

| Dilutes existing shareholders | ✕ Existing shareholders are diluted only when you create the option pool | ✓ If the share price goes above hurdle ✕ If the share price doesn’t go above the hurdle |

| Income Tax for recipient when they get the shares | ✕ | ✕ Because the shares have no value when they’re issued |

| Corporation Tax relief for company when shareholder sells | ✓ Employer gets a CT deduction equal to the financial gain of the employee | ✕ |

| Employer’s National Insurance Contribution when shareholder sells | ✕ | ✕ |

| Capital Gains Tax for shareholder when they sell the shares CGT liability depends on the individual’s circumstances. | ✓ 10% CGT is 10% if the recipient has held the options and/or shares for 24 months from the grant date, otherwise it’s 20% | ✓ 20% |

| Can be conditional You can set requirements the holder and/or the company has to meet | ✓ | ✓ |

| Can be held for an unlimited time | ✕ Options must be exercised within 10 years ✓ After exercise, shares can be held for unlimited time | ✓ |

To issue growth shares, here are the steps you’ll need to take:

Yes – you can create growth shares on SeedLegals.

If you’re doing a funding round, here’s how it works:

We automatically update the corresponding wording in your Articles of Association.

Interested in offering growth shares? Book a free call with our experts to talk through how it works. (If you’re considering giving equity to your team as share options, take a look at our page about option schemes.)