UK report 2025: How does your share option scheme compare?

Find out how startups structure their option schemes in this report by our experts. Read insights and analysis based on...

At SeedLegals, founders often ask us: when is the perfect time to put in place an EMI option scheme?

Many founders also tell us that they know they need to get their option scheme up and running… but it’s something they’ll get round to doing… eventually.

Your number one priority might never be to set up your EMI option scheme (unless your staff start leaving…). But if you get your EMI scheme set up sooner rather than later, you not only help to build a positive, collaborative culture in your company but also create significant financial benefits for option holders and your company.

We’ve helped thousands of companies with setup and legal support for their EMI scheme. In this post, we explain when’s the right time to set up your EMI scheme, based on what we’ve discovered over the years from working with thousands of founders and investors.

Most founders understand the power of offering options to prospective employees when recruiting and retaining talent. Granting options helps to align your employees with the founders and investors for the long-term, and makes sure everyone has an incentive to work hard towards a successful exit.

But to set up an EMI option scheme, at what stage does your startup need to be? The right time is different for different companies – it depends on your revenue, how many full-time employees you have at the moment, and your plans for hiring and fundraising over the next year.

These are three triggers which could mean it’s the right time for your company to set up an EMI option scheme:

📈 Gained traction

or

💰 Raised funds

or

🧑🤝🧑 Started growing your team

With more and more startups offering options to employees, people joining your team are likely to want/expect options on top of their annual salary, so they can share in the long-term success of the company.

The EMI Valuation is the ‘market value’ of your company which you agree with HMRC to determine the exercise price of the EMI options.

For an EMI scheme, the EMI Valuation is non-negotiable: to be able to grant your employees EMI options, you must have a valid EMI Valuation at the time you grant the options.

Unlike the valuation you want when you’re fundraising, companies want the EMI Valuation to be as low as possible so that you and your option holders get the best possible value.

The good news here is that HMRC accepts arguments to lower the market value of a company. Why? Because the purpose of EMI schemes is to help smaller companies – which can’t match the big corporate salaries – to reward, retain and attract employees.

And don’t worry – your EMI Valuation exists in its own EMI vacuum, solely for the purposes of granting EMI options. It can’t be used for accounting or any other purpose. And you don’t need to share it with anyone.

At SeedLegals, we have a sophisticated valuation methodology to help to drive down your EMI Valuation. You answer a straightforward questionnaire, and from that our advanced algorithm builds your EMI Valuation report based on your company’s financials, last price per share paid, and other factors. We take into account the unique situation of your company, weighting all the factors as appropriate, to create your EMI Valuation report, aiming to help you achieve the best possible EMI Valuation discount.

When you’re setting up your EMI Scheme, as part of the EMI Valuation, HMRC will agree the strike price for your EMI options. (The strike price is how much your option holders will pay when they ‘exercise’ the options – that is, turn them into shares.) The strike price is based on:

or, if your company hasn’t done a funding round involving the same class of shares as the options:

A key input for your EMI Valuation is your company’s share transactions – which are publicly available on the Companies House website. When we’re setting out our proposal to HMRC for your EMI Valuation discount, if you’ve done a funding round, this can greatly increase the starting point for your company valuation. We still aim to help you secure a big valuation discount – but an 80% discount on a valuation at £1 per share is going to lead to a much lower EMI Valuation than an 80% discount on a valuation at £10 per share.

Tommy HackleyThe discount on your EMI valuation is why for many companies, setting up an EMI Scheme before a funding round is best. It’s better value for the options holders, and a bigger Corporation Tax break for your company later on.

Senior Account Manager,

One of the tax perks that comes with EMI schemes is the Corporation Tax relief for the company. And for a future buyer of your company, this could be very enticing. Here’s how it works:

When employees exercise options, you can claim relief worth the difference between the exercise price and the market value of the shares. The bigger the difference, the more Corporation Tax relief the company gets.

Here’s an example:

With EMI schemes, companies tend to grant more options when the equity is less valuable. And this can turn into a hugely valuable asset: you’ll be sitting on the potential for Corporation Tax relief worth thousands of pounds. In fact, it’s such an incentive for a potential buyer that founders usually put this detail on the Heads of Terms document when negotiating a sale.

If you don’t have employees before your funding round and you plan to hire people after fundraising, then you could wait until after your first round.

But there’s a catch. If you wait too long after your round, your valuation will go up as you use the money you raised to continue building traction. And it will become more difficult to argue for a lower valuation with HMRC.

Often we see a surge in recruitment after a funding round. If you’ve just closed a round and were planning to set up an EMI scheme but haven’t got around to it yet, then no problem – but aim to get this done before recruiting.

In fact, for companies that close their round and then set up an EMI scheme on SeedLegals, the average time to do this is just one month and 21 days. ⚡

Build your dream scheme with SeedLegals. Create and manage your EMI option scheme on our platform with unlimited help from our experts.

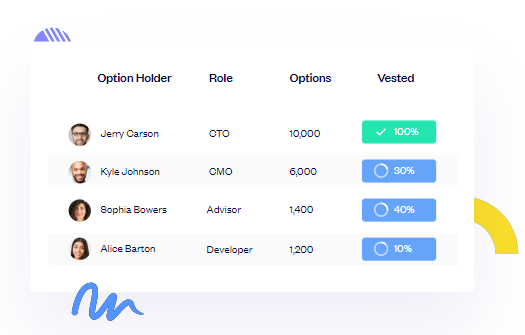

Discover moreAt SeedLegals, we set up 1 in 4 EMI option schemes – that’s more any other provider. When you set up your option scheme with us, our team is on hand to guide you at every step and provide the legal support you need for the EMI scheme. We’re here for ongoing unlimited support and your staff get their own option holder’s dashboard to log in and view their options, vesting schedule and how much their options might be worth.

Got questions about setting up an option scheme or the legal documents you need for EMI? Book a free call with our experts to get answers fast and find out why we’re the UK’s #1.