When is the right time to set up an EMI option scheme?

How well developed does a startup need to be to consider an EMI scheme? Most founders understand the power of offering...

In a nutshell, the EMI option scheme is the most tax-efficient way to grant options to your employees. The EMI, which stands for Enterprise Management Incentive, is a share option scheme backed by HMRC in the UK. It’s designed for employees or directors who work for over 25 hours per week or over 75% of their working hours.

In general, options are often a better deal for employees than shares because the employee pays no tax when the options are granted – only when they’re exercised. The EMI scheme goes even further by offering various appealing tax reliefs on exercised options for both your company and your employees.

Option schemes can seem complex and come with their own set of jargon. To see a quick explanation of key options terminology like share, share option and option pool, jump down to the key terminology section.

This guide will explain everything you need to know about starting an EMI share scheme.

The EMI share option scheme is an HMRC initiative that allows UK businesses to give share options to their employees with significant tax benefits. It’s designed to support smaller businesses and make granting equity easier and more attractive as a tool to attract and incentivise staff.

You don’t need to have a scheme that’s been officially approved by HMRC to grant employee options. If you go with an ‘unapproved’ scheme, you can still grant options, but your employees won’t benefit from the same tax advantages as they would with the EMI.

In practical terms, the key difference between EMI and unapproved schemes is that with the EMI, HMRC will approve a valuation of your shares. You can use this to fix the strike price your employees will pay to exercise their options.

An EMI scheme puts a slightly greater admin burden on your business, but it’s worth it for the associated tax discounts for both you and your employees – and if you use SeedLegals, we’ll keep on top of everything for you. Not every business or employee is eligible for the EMI scheme – you can see the qualifying conditions later in this guide.

Below we’ll explore why EMI options are so popular with businesses and employees.

Financially, your business gets a Corporation Tax (CT) deduction equal to the difference between the market value of the shares at exercise and the amount your employee paid for them.

But the benefits for your business go far deeper than Corporation Tax relief.

Attract talent: A rewarding option scheme is a prerequisite nowadays to attract the best talent in the jobs market. This is especially important for startups and early-stage businesses battling to grow in competitive industries. Indeed, options are fast becoming a must-have and expected ‘perk’ in the tech startup world.

Retain talent: The expectation that their options will grow in value can be a powerful motivator for staff to work through challenging periods and keep faith in the potential of the business. In many cases, the employee loses the right to exercise their options if they leave the company, so a share option scheme can help you nurture your highest performers for senior management roles.

Align interests: If your company succeeds, your employees with EMI options can also enjoy a significant financial reward tied to that success. Staff can see the value of their shares increase as the business grows, which aligns the team to work towards a profitable exit. Options also help staff feel valued, trusted, and involved in building a strong company.

Reward employees: EMI options can be offered as a reward for meeting certain individual or company targets. This provides an incentive for staff to go the extra mile, and it can provide a performance-based reward which doesn’t impact cash reserves and at the same time creates tax benefits for all involved. At SeedLegals we’ve introduced performance options to make it simpler to directly tie the number of options granted to an employee’s performance.

Daniel HoganWith the EMI option scheme, your employees don’t have to pay Income Tax or National Insurance when the options are granted. They will only have to pay CGT at a much lower rate, rather than Income Tax when the options are exercised.

The benefits extend to you as a business owner too – the cost of setting up your scheme is tax deductible against your Corporation Tax as a business expense, reducing your tax bill further.

COO and Accounting Expert,

Employees don’t typically pay any tax on share options when they are granted. This lack of upfront payment gives options the edge over shares as a way to earn equity. You can read more about that point in our shares vs options article.

The specific benefit of EMI options is that they attract less tax than options granted as part of an unapproved scheme.

When unapproved options are exercised, they attract Income Tax and National Insurance (NIC) on the difference between the market value and the amount the employee pays – in essence, the discount is treated like a salary bonus and taxed as income. EMI options are more generous. There’s no Income Tax or National Insurance, provided the option holder pays no less than the HMRC-approved market value at grant.

When the holder comes to sell their shares, they are subject to Capital Gains Tax (CGT). But often EMI option holders are in a better position to claim Business Asset Disposal Relief which reduces the rate to 14%. This is because EMI option holders can count the time in between the grant and exercise of the EMI option towards the qualifying holding period.

Our team is standing by - via chat, phone or video call.

Talk to the teamBelow you can see some simplified examples of how EMI and unapproved schemes work in practice. Please bear in mind that we haven’t taken into account any individual tax-free allowances which vary from person to person.

For the sake of simplicity, we have also not included an explanation of the Income Tax that is payable on the difference between UMV and AMV. This is because it affects unapproved and EMI grants in the same way.

A company offers their employee, Jane, an option to secure 5% equity at a market value of £10,000. Six months later, she exercises this option at a time when her shares are worth £100,000. As with any option scheme, she paid no tax when the option was granted, but when it is exercised this ‘profit’ is treated by HMRC as taxable earnings – meaning Jane is responsible to pay tax on the £90,000 difference.

At the higher-rate of Income Tax (40%), this means a £36,000 tax bill for Jane, even though no actual money has changed hands. When the company is sold 18 months later, Jane sells her shares for £125,000. This is a £25,000 increase in value from the point at which she acquired the shares, and 20% Capital Gains Tax will be due on this – meaning an extra £5,000 bill.

In total, over the process of acquiring shares for £10,000 and selling them for £125,000, Jane has paid £41,000 in tax (£51,000 in total including the purchase of the shares). What’s more, £36,000 of this is due before she actually has her hands on the cash – which leaves her very vulnerable in the case of a sudden collapse in share value.

Sarah is offered the same equity for the same value at a different EMI-qualified business. Like Jane, Sarah acquires her shares worth £10,000 and pays no tax at this point. However, unlike Jane, Sarah does not have to pay Income Tax when she exercises her options six months later. This is because her exercise price matched the HMRC-approved valuation of the shares at the time of grant.

When Sarah sells her shares 18 months later for £125,000, she qualifies for Business Asset Disposal Relief because she’s held the shares for two years in total — including six months while the options were unexercised. This means she pays Capital Gains Tax (CGT) at a reduced rate of 14%.

Sarah pays CGT on the £115,000 gain (the increase from what she paid for the shares to the sale price), which comes to £16,100.

So, Sarah’s total out-of-pocket cost is £16,100 in tax, plus the £10,000 she paid to buy the shares – and importantly, she only pays the tax after she’s received the cash from the sale.

By contrast, her colleague Jane, who didn’t use a tax-advantaged scheme, paid £41,000 in tax.

That’s a saving of over 60% compared to Jane’s tax bill – a difference of £24,900. It’s easy to see why EMI schemes are so popular, and why they’re a must-have for growing startups and small businesses.

One more benefit: Remember that Sarah would also benefit from an HMRC valuation which has been agreed to be as lower than the current market value of the shareholding. This allows her to get the options at a lower strike price, maximising her profit when the company shares are eventually sold.

UK employees, international team members, consultants, advisors … whoever’s on your team, we make it simple to manage your employee equity. All for one low flat fee of £2,490 a year.

Let's talk optionsTo see a full list of EMI rules, head over to the HMRC manual for EMI schemes.

For businesses:

Also, your company must not trade in certain areas, which include:

Learn more about whether your company qualifies for an EMI share option scheme.

For employees:

For the options themselves:

The EMI valuation is something that you propose to HMRC via the VAL231 form. You’ll need to calculate two key numbers for this proposal: the Unrestricted Market Value and the Actual Market Value.

Unlike when you pitch to investors, for the EMI scheme you’ll want a low valuation. This is because the more the value of the shares increases over time, the higher your employees potential profit will be.

Traditionally, setting up an EMI option scheme was expensive: it could cost up to £5,000 – £10,000. You’d need to hire a law firm to draft the scheme rules and bring an accountant in to draft a valuation for submission to HMRC. This could take months and you’d be on your own when managing the scheme with HMRC.

SeedLegals has changed all this. Using our platform, you can create your EMI Scheme, set vesting conditions, have law firm-quality legal drafts, a market-leading valuation, and get help with all the ongoing management of the scheme. This comes at a fraction of the cost of any other solution: just £2,490 per year for our Options Subscription. The subscription includes:

✅Unlimited EMI share option schemes for UK-based, PAYE employees

✅Unlimited EMI valuations to get the best possible price for your team

✅Unlimited Unapproved option schemes for advisers, contractors and anyone based outside the UK

✅All the legal documents you need to ratify your scheme (including board and shareholder resolutions, option agreements and SH01s)

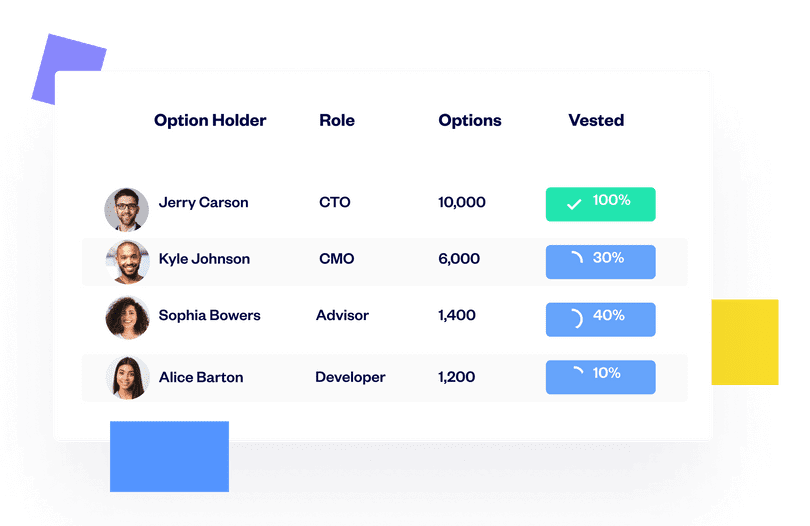

✅Option holder dashboard for your team to view and manage their options

✅Dedicated support from our experienced team via live chat, email or video call

You need a lot of documentation to offer employees EMI options. Until recently, you had to track them in your own complex Excel spreadsheet. But now we’ve got you covered. Here’s what we provide:

Option scheme rules: An EMI scheme needs rules, outlining how the option will vest, when it can be exercised, what happens during an exit, and what happens to an employee’s option when they leave the company. On SeedLegals you can build a fresh set of rules designed to suit you – and our experienced team is on hand for help if you need it.

HMRC filings for your company valuation: Once you have your scheme rules, you need to agree your valuation with HMRC. You can stick with your previous funding round valuation if you have one, but you’ll need to send a VAL231 form to HMRC to be certain of future tax treatment. SeedLegals automatically creates this documentation for you.

Valuation report: If you want to get a lower valuation than your last funding round, or if you’ve never done a funding round, you’ll need to create a valuation report for HMRC. SeedLegals produces your report in a fraction of the time and cost of an accountant to help you achieve the best-possible valuation.

Grant paperwork: Once you have an approved HMRC valuation, you can send out option agreements to your employees. Our platform makes this a breeze. In just a few clicks, you can specify who you’re granting options to, how many options you’re granting, and what their vesting conditions are. We’ll create the grant paperwork for the company and the employee, and you can even sign it with an e-signature.

EMI notifications: You need to tell HMRC about EMI your options grants (a ‘notification’) within 92 days. Late filing charges can quickly add up. But with SeedLegals, you can instantly export the filing and upload it to your HMRC account.

EMI Annual Returns: In addition to the notifications (mentioned above), your company will need to complete an Annual Return. We provide you with a reminder, and what you need to file and when.

Option tracking: As your team grows, it gets harder to figure out exactly who has what, what’s vested, and what’s left to vest. But once you’ve granted options, you’ll have access to our beautiful dashboard, which shows you exactly how many options are outstanding, vested and exercisable. No more Excel.

Option holder view: Your team gets access to their dashboard too. They can see how many options have vested and use our calculator to see how much they could be worth at different exit scenarios.

Exercise of options: To cap it off, once an option is exercisable and the holder chooses to exercise it, the platform can create a notice of exercise (effectively the holder saying they are converting into shares now) and other supporting documents, like certain tax elections and the deed of adherence. You can even create the SH01 form for the company to file with Companies House.

The below video shows you how easy it is to set up an option scheme using SeedLegals.

And here’s a written step-by-step guide to creating your EMI option scheme, including what you need to do to keep HMRC happy.

Step 1: Create an option pool with sufficient shares for current and upcoming team members.

Step 2: You might need to update your Articles of Association to support options, but this isn’t always the case. We will let you know.

Step 3: On your SeedLegals dashboard, click to create your EMI option scheme.

Step 4: Define your Option Plan. The SeedLegals platform will take you through this step-by-step.

Step 5: Complete and agree your company valuation. Here’s a video to show how it works:

Step 6: Submit the VAL231 to HMRC Shares and Assets Valuations (SAV) with your backing documents, and wait until they respond. This will usually be within 4-6 weeks of submission.

Step 7: After the HMRC response arrives, it’s time for you to agree or negotiate with their valuation. Their decision holds for 120 days up to 1 December 2022. Any EMI valuation agreement letters issued by HMRC on or after that date will be valid for 90 days only, after which time you would need to resubmit your documents.

Step 8: Pass resolutions and grant options to team members within 60 days. You can issue these with beautiful options certificates, which the SeedLegals platform will help you create easily. Here’s another short video to demonstrate how this works:

Step 9: You must formally register the scheme with HMRC, and notify them about granting the options to team members within 92 days of the grant date.

Step 10: If you haven’t done so already, register for PAYE online – and then register your option scheme through PAYE online.

Step 11: Add individual option holders to the scheme. Any further option holders added to the scheme need to be notified individually within 92 days of their grant. And as we mentioned earlier in this guide, SeedLegals enables you to automatically download the documents you need for HMRC notification – and you can upload them straight to your HMRC account.

Step 12: Don’t forget to file your EMI Annual Return by 6 July every year. You will incur an automatic penalty fine if these documents arrive late. SeedLegals will send you a reminder.

Note: You can get prior clearance from HMRC to confirm that you do indeed qualify for the EMI scheme, before committing to paying for the valuation process. SeedLegals can submit this Advance Assurance for you, but for most companies this isn’t required.

The EMI-qualified status of your company or a grant you’ve made can change if a disqualifying event happens. Examples of disqualifying events include the following:

If a disqualifying event occurs, the employee’s options must be exercised within 90 days of that event. Failure to do this means that value gains between the disqualifying event and date of exercise will be subject to Income Tax. Essentially, the option then becomes an unapproved share option.

If your company grows to more than 250 employees or to have over £30M in assets, it won’t be seen as a disqualifying event – but it would prevent you from granting EMI share options in the future.

On SeedLegals we’ve automated almost everything you need to do. Simply sign up and register your company details. We’ll help you choose the right option scheme for your team, show you the best option vesting and exercise terms for your company and team, and walk you through every step of the process.

Plus, the SeedLegals platform will create all the documents, including the scheme rules, option grants, tax elections, and more.

Our team is on hand to answer any questions. Book a call to find out how we can help.

Share

A share is a unit of ownership in a company or a financial asset. In most circumstances, the terms ‘stocks’ and ‘shares’ are interchangeable – though stock is more common in the US and share is more common in the UK.

Remember: in the context of this guide to EMI share options, we’re looking at how shares in a business can be owned by its employees – not the wider public market. The world of stocks and shares goes far deeper than the brief explanation above, but this should give a useful baseline understanding.

Option / employee stock option / employee share option

An employee stock option is offered by a business to its employees, and is the option to purchase a share at a fixed price (aka the strike or exercise price) in the future.

The period between when you grant share options and when they can be exercised is called the ‘vesting period’ – this can be time-based, target-based, or event-based – and can also be incremental (e.g. 25 shares after a year, and 25 more after 18 months).

In a nutshell, an employee share option is an equity-based compensation incentive. It doesn’t attract tax when granted, and if the company grows and increases in value between when an option is granted and when it is exercised, the employee’s shares will be worth more than they pay for them.

Share option scheme

As you might imagine, a share option scheme is created to grant options to staff. The main benefit of creating a scheme is to attract and retain the best talent, and to encourage long-term loyalty at an early-stage business. There are two main types of scheme: an Enterprise Management Incentive (EMI) and an unapproved option scheme.

Option pool

The option pool is the percentage of a company which is reserved for ownership by its employees. The percentage depends on the business, but in the UK the average amount of equity reserved in the option pool is 10%. In the US, it’s closer to 20%. VC investors will usually expect a growing option pool to devalue the founders’ share of the business – not their own.

Unapproved and approved share option schemes

Unapproved share options are important to understand in the context of EMI. An unapproved scheme is another type of share option scheme that requires no official involvement or pre-approval from HMRC. The company is free to structure the option scheme how they want, but there are no associated tax benefits as there would be with an approved option scheme.

An approved scheme is less flexible, because you must meet certain HMRC conditions to qualify. However, they do come with significant tax advantages for both employees and companies. In general, approved schemes have the advantage over unapproved schemes.