Vesting schedules: how to choose the right one for your option scheme

In this post, we explain what vesting is, the pros and cons of different types of vesting schedules and reveal what the...

With around 1 in 4 of all EMI Share Option Schemes in the UK now done on SeedLegals, we see founders consistently asking:

Luckily, we’re in the perfect position to answer those questions. We use data from over 2,500 option schemes done on SeedLegals to understand what’s market standard and what choices companies are making when creating their option schemes.

We then share that knowledge back via our team and tutorials on the SeedLegals platform and turn those choices into 1-click solutions to dramatically simplify the process for everyone.

So, here’s an overview on how to choose the right option scheme for your team:

We dive into the data from all active option schemes on SeedLegals to bring you key takeaways and essential tips. Download it now for free.

Get the reportThe first thing to know is that if you’re giving options to employees, you’ll want an EMI Option Scheme.

Unless you’re a 250+ person company, 99% of the time you can forget about

In short, you’ll want:

With the SeedLegals options subscription, you can create as many types of scheme as you need for one upfront cost of £2,490 per year.

Having decided which type of option scheme you’d like, the next thing is to decide how the options will vest. Vesting means that the employee needs to ‘earn’ their options rather than just being given them all at once.

Broadly, there are two types of vesting that are applicable:

For employees, vesting over a number of years is standard, typically either

The first of these (so-called 3-year straight-line vesting) means that the employee begins ‘earning’ their options from day one at the company. If they stay with the company for 1 year, 1/3rd of their options will have vested.

At this point you might be thinking… if the person leaves after just 6 months, why should they get any options at all? Why should valuable share options, which could be used to incentivise other team members, be given to someone who bailed after a few months?

And that’s where the cliff comes in. Anyone who leaves during the (typically 12 months) cliff forfeits their options. When the cliff ends, they are immediately entitled to the full number of options had there been no cliff.

For someone who is getting rewarded for delivering specific outcomes, you might instead choose to offer vesting by milestone.

For example, if you engage a 3rd-party consultant or agency to build a mobile app for you, you would typically define a set of deliverables (milestones) and then pay them when they hit those milestones. Normally that would be payment in cash, but if cash is tight then you might for example agree half cash, half in share options.

In that case, you would select Milestone Vesting, and then define perhaps 4-6 milestones with some fraction of the options vesting as each milestone is reached.

You should also take care to ensure that you can terminate the contract if things aren’t working out, in which case the contractor or design agency would be entitled to the options that have vested for the milestones they’ve hit, but no more.

When setting up your option scheme on SeedLegals, you can set up your preferred vesting in a few clicks.

This is where it really gets interesting and also where founders get the biggest surprise, so let’s dive into exercising.

The first thing is to understand is the difference between vesting and exercising:

Once you understand the difference it’s obvious, but for many there’s a mental leap to get there, so let’s go through the mechanics:

Let’s look at this step by step:

When someone wants to exercise their options they become a shareholder in your company, and that means you need to do the following:

While most of this is neatly automated on SeedLegals, it’s clear that if you have dozens of employees exercising their share options each time a few more options have vested, it’s going to drive you crazy.

The other thing to note is that once Alice has exercised any of her options she becomes a shareholder in the company. Depending on the rights you assigned to those option shares, that might mean you need to provide her with quarterly management reports, and get her vote on company decisions. This may be appropriate for investors, but usually it’s not something you want employees to have to get involved with.

So, you’ll generally want to prevent employees from exercising their options at any time, and only allow them to be exercised at certain defined windows.

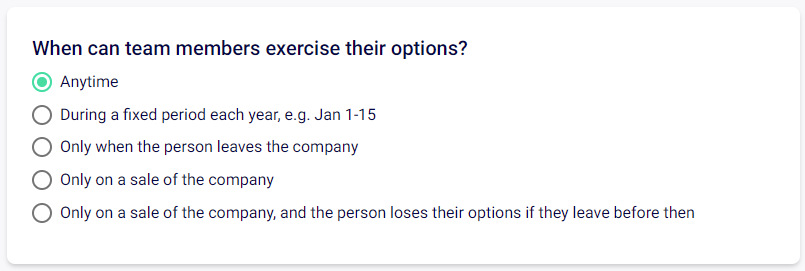

On SeedLegals we’ve neatly factored that into 5 choices:

Let’s go through these in detail:

1. Anytime

This gives your team the most flexibility to exercise their options as soon as they have any options that have vested and haven’t been exercised yet. This makes sense if, for example, you’ve given someone options that vest according to a set of milestones. This way they can exercise those options right after they’ve hit each milestone, if they wish to.

2. During a fixed period each year, e.g. Jan 1-15

The next step beyond that is to specify an ‘exercise window’, perhaps a 2-week period once a year where anyone who has vested options can exercise them then. That means you can group together all the new share issuances, and do just one Companies House filing update each year.

3. Only when the person leaves the company

While option 2 above solves the problem of team members calling you every month asking to exercise a few more options, it still leaves you with the issue that, if current employees are able to be shareholders, then you may have to provide management reports to those employees, and those management reports might contain e.g. budget and salary information that you would prefer to not share with your team.

So that’s where the “only when you leave” choice comes in. It means the person keeps earning their share options over a period of years, as normal. But, the only time they can exercise their options and become a shareholder is when they leave the company. This means you’ll never have employees as shareholders.

Note that “only when you leave” does, however, mean that so long as they remain an employee they won’t have the ability to sell their shares and make a capital gain to pay part of a mortgage. They would have to leave to company to do that. Which is why on SeedLegals we include in the option scheme rules the right for the Board to override some of the rules, because, well, things come up.

4. Only on a sale of the company

Another way to limit having to issue shares to employees is to only allow options to be exercised on a sale of the company. This is interesting, because what you’re really saying is “Hey team, we’re on a journey together. When we have an exit, we’ll all benefit!”.

The median time for a startup exit is 5-7 years, so unless you’re planning for a fast acquisition or sale of the company, team members should treat this as a long game – i.e. hopefully you’ll get rich, but you’ll need to wait.

In this model, if someone leaves the company before an exit or sale of the company, they still keep their options, but they can’t exercise them until a sale happens. Since EMI options have to be exercised within 90 days of an employee leaving the company, it also means that the employee will not get the tax benefits of an EMI scheme when that sale of the company arrives.

5. Only on a sale of the company, and they lose their options if they leave before then

This is the high stakes, double-or-quit game of poker, the most controversial of the available choices.

In this model, the employee can only exercise their options on a sale, acquisition or IPO of the company (like choice 4 above). But, additionally, if they leave the company before that date, they lose all their options, including the vested ones.

This is commonly known as an Exit-Only Scheme, and our data shows that it’s selected by around 10% of companies.

By offering an exit-only scheme, you’re essentially telling your team, “Hey team, we’re on a journey together, when we have an exit we all benefit! But if you leave is before we reach the destination, you’re out. Only the stayers are rewarded.”

From the company’s perspective, this is sending a powerful message that the company is there to reward employees who remain with the company for the journey.

Since many people change jobs every 3 years or so, it means that, like an airline that overbooks its flights knowing some passengers won’t show up, a company can give out more options to early team members, knowing that some fraction of those options will lapse, and they can then be reused for other later joiners. So the company doesn’t need to create as large an option pool, reducing dilution on the founders and early shareholders.

From the employee’s perspective, an exit-only scheme is in theory a motivator to stay with the company until the company exits, as intended. But it could also have the opposite effect. If employees perceive no exit in sight, or an exit that’s years away, they have no incentive to stay out their full vesting period since they’re going to lose everything anyway.

UK employees, international team members, consultants, advisors … whoever’s on your team, we make it simple to manage your employee equity. All for one low flat fee of £2,490 a year.

Explore optionsNow that you know all the choices, there are three patterns that we see and recommend:

Your first hires will usually be paid well below market salary. You just don’t have the funds to pay people market rate initially, and you’ll use share options to compensate them for the difference.

In this case, share options are a reward for work performed, in lieu of salary, and therefore it’s unfair for the person to lose that reward if they don’t stay till exit, which may be 5-7 years away.

For that reason, we’d recommend that early joiners, maybe the first half dozen hires, get 3- or 4-year vesting, exercise anytime. And you might want to add a 1-year cliff, so anyone who doesn’t work out and leaves within the first year, well, they don’t get that reward.

You can specify an exercise window, e.g. you can only exercise your options in Jan each year. But if you only plan to issue these type of options to a few early joiners, it’s not such a big deal to allow them to exercise anytime. Especially because when an employee exercises EMI options, they need to pay the exercise price which, even if you’ve secured a heavily discounted EMI valuation with HMRC, could mean they need to find a few thousand pounds to exercise all their options. That means they’ll usually hold off doing that until an exit, or until they leave. So, typically, they won’t ask to exercise until there’s an opportunity to sell their shares, which could be on an exit or future funding round, i.e. some time away.

Once you’ve gotten to Series A funding stage, you’ve raised sufficient funding to be able to pay your team market rate. And that means options are now just a nice reward for staying the journey, rather than being used to compensate for a lower salary.

And, if someone is joining the company 4 years in, with a median time for a company exit of 5-7 years, they don’t need to stay that long to be there on an exit. And for these reasons, for later joiners the “we’re looking for you to be there with us for the journey” exit-only scheme is a good way to go.

You can mix ‘n match vesting and exercise choices, so for example you can set 3-year vesting with exercise on exit only. That means that if someone joins 1 year before you IPO, they would be able to exercise 1/3rd of their options. Or you can specify accelerated vesting, so that on a sale or IPO, any unvested options vest immediately, so anyone with the company cashes out nicely at that time.

Unlike employees who are assumed to be there for the long term, contractors are usually hired for a fixed period, maybe 6 months, or a year.

And, with a contractor you might be paying them a mix of cash and share options (to keep the costs down), or even in share options only.

In cases where you’re using options in lieu of cash, it’s only fair that the person keeps what they’ve earned so far, i.e. an exit-only scheme wouldn’t be appropriate. But, since a contractor is only around for a short period, it does make sense to say that they can only exercise their options when their contract is up (or before, if you terminate earlier).

When you do your EMI Option Scheme on SeedLegals, you can create an unlimited number of EMI schemes for one annual fee. That means you can easily set up vesting by time and exit-only schemes for different team members, at no extra cost. If you change your mind later, easy, it’s just a few clicks to create a new scheme.

To get started or to talk through your options, pick a time for a free chat with a member of our experienced team.