Now live: a smarter way to manage, share and sign your company documents – with powerful AI integration on the horizon

As your company grows, so does your paperwork – new hire contracts, advisor agreements, pitch decks, investor updates an...

Whenever you issue new shares in your company, you need to file an SH01 form with Companies House. In this article, we explain what information you need for your SH01 form, as well as how to file it online with Companies House so that your company’s shareholding is correctly recorded.

When you complete your funding round with SeedLegals, you can file your SH01 directly through our platform.

✅ Make unlimited share transfers and share issues

✅ Save thousands in discounts and perks

✅ Refine your funding strategy with expert reviews

The SH01 is the official form that you file with Companies House when you issue new shares in your UK company. Its full, official name is the Return of allotment of shares.

When you register your company with Companies House, allocating initial shares and naming shareholders is part of this process. You can find out more about how that works in our guide, How to set up a limited company.

You only need to file an SH01 if you allocate new shares after incorporation – for example, after you’ve closed a funding round.

You don’t need to file an SH01 when you transfer shares between people, or split up your existing shares so that you have more individual shares at a lower value each. There’s no change to your overall share capital when you transfer shares or split shares, so you don’t need to file an SH01.

A share issue is the allocation of new shares, whereas a share transfer is the transfer of existing shares from one person to another.

You only need to file an SH01 when your share capital changes. Changing the ownership of already existing shares doesn’t impact the overall number of shares in your company.

Amina Ghafor

Equity expert,

To summarise, you need to file an SH01 when you:

✅ issue new shares to an investor

✅ issue new shares to a co-founder

But not when you:

❌register your company (you need the IN01 form)

❌ transfer shares (you need the J30 form)

❌split shares (you need the SH02 form)

The deadline for submitting an SH01 is within one month of the date you issue the shares.

SH01 filing used to be time-consuming, but you can now file your SH01 online in a matter of minutes.

When you complete a funding round on SeedLegals, we’ll take care of filing your SH01 for you. (Stay tuned – this feature is coming soon for Instant Investment too)

We’ll ask for your authentication code if you have not already inputted it. This is the 6-character code Companies House mails to your registered office a few weeks after you incorporate your company.

Double check the details and hit confirm. You’ll get a confirmation message that your SH01 has been submitted for review to Companies House.

Although you can send your SH01 by snail mail, by far the most common way to file your SH01 form is to do it online on the Companies House website.

Before you get started, you need to have the following information on hand:

If you’re using SeedLegals, we’ll have all this information ready for you to quickly submit it online. Find out more>>

First, you must be signed in to Companies House WebFiling. Most companies are eligible to use this service, but you can check at the Companies House website.

When you’ve logged in, hit the All forms button at the top right corner of the page.

This takes you to a list of all the forms. To file a new SH01, go to Share capital and choose Return of allotment of shares – SH01.

In most cases, you only need to specify an allotment date. If your funding round includes both SEIS and EIS shares, this is when you need to add a period end date. That’s because to remain eligible for both tax-advantaged schemes, you have to allot the SEIS shares at least 24 hours before the EIS shares. The period start and end dates here allow you to include both issuances in the same SHO1.

When you’ve entered the date(s), hit Go to allotment of shares.

On the next screen, hit +Add allotment. This is where you add the details of the new shares you’ve issued.

First, select the currency. Then, you’ll be asked to specify the class of share. As a reminder, here’s a short guide to the different types of share classes. Hit Continue.

The next step is to add the number of shares in the allotment and the nominal value. If you’re not sure what the nominal value of your shares is, you can check it in the IN01 form you filed at incorporation. Hit Continue.

You only need to include the total amount of new shares allotted per currency and type of share class. You don’t need to mention the allocation per shareholder. Individual shareholders are only listed on the annual confirmation statement that needs to be filed at least once a year.

Claire Prentice

Equity expert,

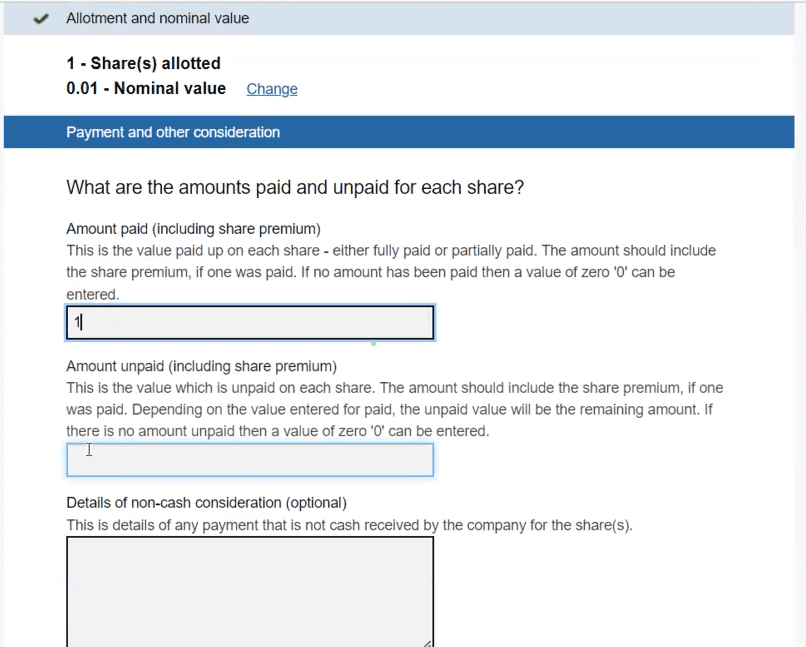

In this next screen, you’ll detail the amount paid and unpaid for the shares.

The share premium is the price actually paid for the shares. So if you’re issuing shares to investors after a funding round, enter the price per share from the sale.

If you’re issuing shares to a new co-founder, typically they’re issued at nominal value, so enter the nominal value amount. Issuing shares may come with tax implications, so we recommend seeking advice from a tax specialist.

If you’re issuing shares in exchange for services, then give a brief description of the transaction in the Details for non-cash consideration field.

Hit Continue.

You can add as many allotments as you need to cover different currencies, share classes and prices.

When you’re finished, hit Go to Statement of capital.

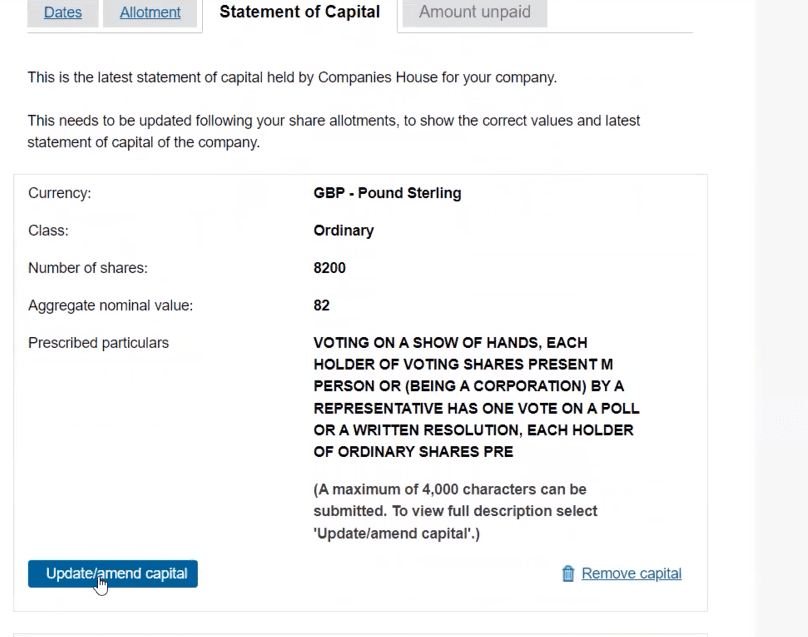

You need to manually update your Statement of Capital to reflect the new allotments you just added in the previous step. When you first get to this screen, remember that you’re seeing the old values – before you added new allotments.

Hit Update/amend capital for each currency and share class in your Statement of Capital affected by your recent allotments.

In the field for Number of shares, include both the newly allotted shares and those already in existence.

To calculate the Aggregate nominal value, multiply the number of shares by the nominal value of the shares. In the example above, we’ve added 1 more share (at a nominal value of 0.01) to the previous shareholding of 8200. The new aggregate value is 82.01.

The Prescribed particulars field is where you give a short description of the rights that are attached to the different share classes.

Here’s the standard legal definition of an Ordinary share, in case you want to copy and paste it:

< The Ordinary Shares are Ordinary Shares that do not carry any present or future preferential right to dividends, to the Company’s assets on a winding up or to be redeemed in preference to shares in any other class of shares. They have attached to them full voting rights and full dividend rights. They do not confer any rights of redemption. They have capital distribution rights limited to pro rata rights in proportion to the total number of Ordinary Shares. >

If you use SeedLegals to issue shares, we’ll generate the text you need for any class of share.

When you’ve finished updating the Statement of Capital, hit Save changes and then Go to amount unpaid.

The final step is to check that the total number of shares issued and their aggregate value are correct.

Type in 0 to confirm that there are no shares left that need to be paid up.

We strongly recommend that you have all shares paid up at the time of allotment or as soon as possible. It can be easy to put off payment for new shares – especially if you’re allocating shares to yourself as a founder or to a new co-founder. But be aware that during a funding round, investors will expect the share capital to be fully registered and paid up as part of their due diligence. That’s why it’s important to clarify and confirm this from the outset on Companies House.

Claire Prentice

Equity expert,

Then hit Submit allotments and statement of capital and you’re done – congratulations!

It’s easy to fix small errors such as an incorrect number of shares, share class, Statement of Capital and dates. Log in as normal to the portal and go to:

>All forms

>Amend an error on a previously filed document

>Amend error on a previously filed return of allotment of shares – RP04 (for SH01)

From here, the process is pretty similar to filing a new SH01. Watch the video below for a demonstration of how it works.

If you’re submitting by post, you’ll need to fill in the PDF form and print it. Post your SH01 along with your Shareholders Resolution (and Articles of Association if you’ve just completed a funding round) to:

Registrar of Companies

Companies House

Crown Way

Cardiff

CF14 3UZ

If your company is registered in Scotland or Northern Ireland, you’ll find an alternative address listed on the SH01 form. You can submit your SH01 to any three of the listed addresses, but Companies House advises the process will be quicker if you send your form to the office in your region.

Whether you’re issuing shares to a new co-founder, director or advisor, selling shares to a new investor as part of a funding round, or issuing shares through an employee option scheme, we’re here to help at SeedLegals. Book a time to talk to our friendly team to find out how we support your plans to grow.

Our automated workflow makes it simple to generate all the documents you need. Plus, there’s unlimited support from our 5-star team.

Simply fill out the questionnaire on our platform, and we’ll either file your SH01 for you (for funding rounds) or generate the answers you need for every field in the SH01. Copy and paste your answers with confidence into the form for Companies House – and if you have any questions, we’re here to guide you through.

✅ Issue, transfer and split shares

✅ Create, send and sign share certificates

✅ Manage your equity on auto-updating cap table

✅ Store all documents securely in your data room

✅ Get unlimited expert help