How to find startup funding

One of the most common questions founders ask is ‘How do I get funding?’ Read our comprehensive guide to finding funding...

‘Going public’ can be the crowning achievement for founders and employees who’ve grown a company from an idea into a thriving business worth billions. But while successful IPOs make news headlines, some IPOs make the headlines for the wrong reasons, with the share price plummeting or controversy about how, where and when the company went public.

At SeedLegals, we encourage founders to think about their exit strategy – and IPO is just one of several ways to exit. In this post, we explain how an IPO works, what you need to consider, and alternative ways to sell or exit your business.

An Initial Public Offering (IPO) is when a private company makes shares available for the public to buy. The process raises money for the company and after the IPO, shares in the company can be traded publicly.

At IPO, the company can issue new shares, and investors, founders and other shareholders also have the opportunity to sell their existing shares.

The exact rules and process for an IPO depend on the market where you choose to go public. In the UK, many companies choose to list on the main London Stock Exchange or the Alternative Investment Market (AIM). But whichever market you choose (and you can choose to ‘float’ in countries other than where you’re based, see below), IPO involves expensive and time-consuming processes and paperwork. IPO transforms your private limited company into a public enterprise and, like all public companies, it will be under much more scrutiny and outside control.

IPO is not a common way for startups to exit. In fact, a merger or acquisition (M&A) is far more likely.

Total number of IPOs in the UK

From 2000 to 2009, the average number of IPOs per year in the UK was 150. From 2010 to 2019, the average was 82 per year.

Fast forward to 2022: 45 companies made their IPO in the UK, 61% less than in 2021 when 119 companies made an IPO. Of these 45 companies, only 22 went public on the main London Stock Exchange and AIM. The new listings in 2022 raised £1.6B, just 10% of the £16.3B raised in 2021. This downward trend for IPOs reflects increased caution from both companies and investors. (sources: University of Oxford, EY, PwC)

Total number of M&As in the UK

In 2022, 4,232 companies in the UK went through an M&A process. In 2021, this figure was 5,033 (source: PwC)

In summary, a UK company is 100x more likely to merge or be acquired than to make an initial public offering.

Every company making an initial public offering has its own reasons but usually these boil down to:

As we saw above, IPO isn’t a common event for companies in the UK, partly because many companies never reach the stage where an IPO is possible, but also because there are various disadvantages:

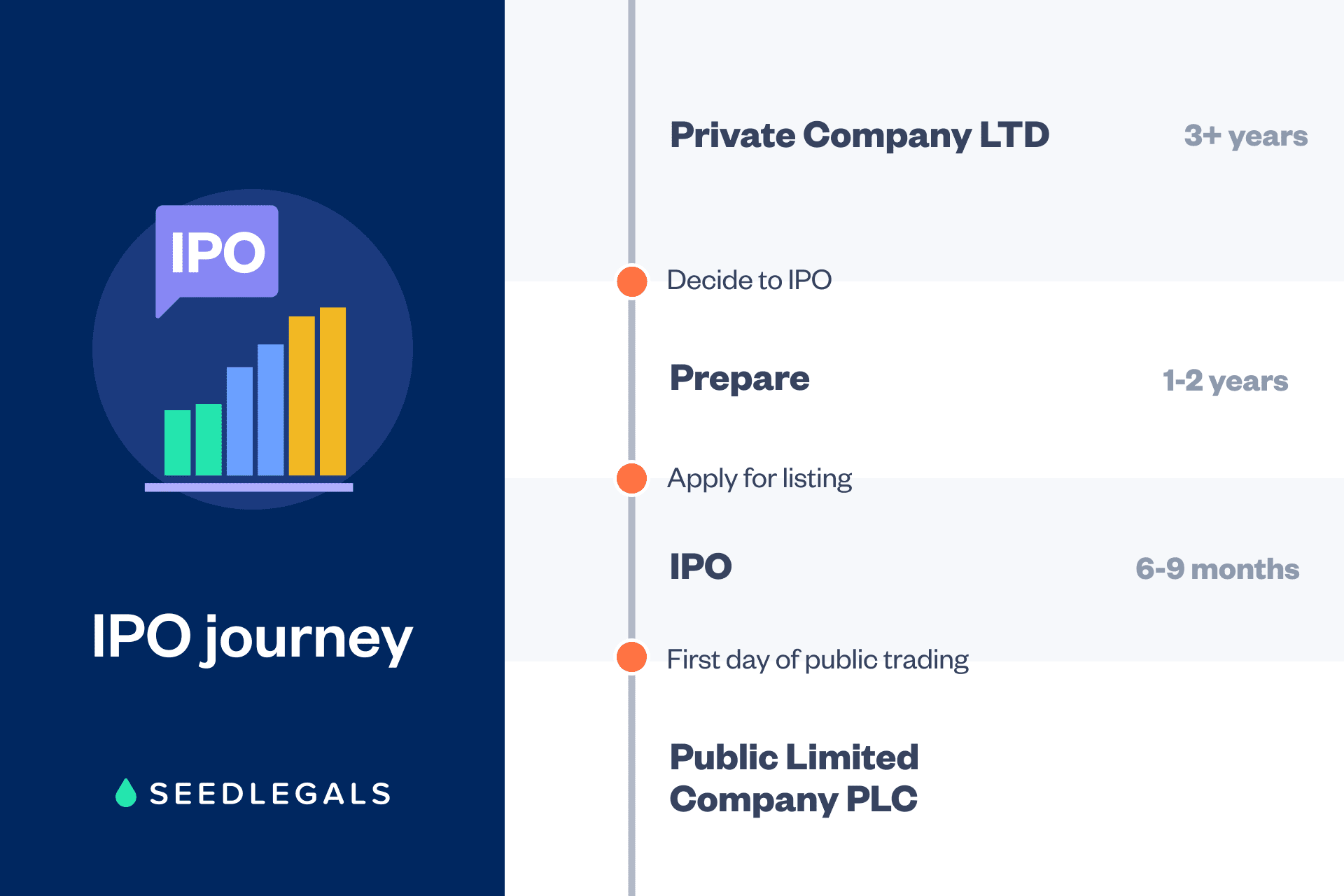

When you take your private limited company through the process of an Initial Public Offering in the UK, here’s what typically happens, step by step:

The process is similar for companies making an Initial Public Offering in the USA or on any other stock exchange, but the rules and regulations are different.

Don’t go it alone. Any company considering an IPO should seek professional legal and financial advice to make a fully informed decision.

When you’ve decided to go public, how do you decide where? Governments try to persuade companies to list in their country – a healthy stock market is a strong indicator of the state of a country’s business ecosystem. And stock markets are businesses in themselves so they compete for companies to list on their market.

Here’s what to consider when thinking about in which country and on which stock market to go public:

To decide where to make your IPO, seek advice from legal, financial, and regulatory professionals with expertise in international listings.

It can take many years before a company is ready to IPO. To list on the London Stock Exchange, companies usually have to have been trading for at least three years. (source: FCA, p29, 3.3)

When you’ve decided to kick off the process, in the UK it can take six to eight months, from initiating the IPO with the regulators and market, to the first day of trading. On some markets, such as London’s AIM (Alternative Investment Market), an IPO can take place more rapidly.

PwC looked at the public records for 1,175 companies which had completed an IPO in the US and found that the cost is roughly 4% to 7% of the gross IPO proceeds. (source: PwC)

The costs are likely to be similar in the UK. According to PwC’s costs calculator, the biggest expenses for an IPO are:

Like any decision to give away equity, it can be tricky to judge when the time is right. It depends on your company’s finances and strategic objectives, and the market conditions. To help you weigh up whether IPO might be right for your company, here are six questions to consider:

Anthony RoseTwenty years ago IPO’ing (‘going public’) was the way for founders to make their fortunes, selling their shares in a public market, and using the liquidity that a public listing provided to raise capital for the business. But going public has largely gone out of fashion, killed by high costs (£100K+), public scrutiny of finances, onerous reporting obligations, insider trading worries and more.

Scarcely 100 companies a year go public in the UK compared to tens of thousands that raise capital in private funding rounds. Private equity buyouts and secondary market private share sales are now the preferred exit route for founders to sell and unlock the value of their shares.

Stock exchanges are trying to innovate to reverse the drop in IPOs, but while public market listings remain so ensnared in regulation, and with a widening choice of alternatives that are faster, cheaper and less restrictive, the chance of a company IPO’ing is miniscule.

CEO and Co-Founder,

IPO isn’t the only way to ‘go public’ – and there are ways to drive your company forward while staying private:

Instead of issuing new shares for sale publicly, and involving an investment bank to help with the IPO process, private companies can float on a stock exchange directly. This happens very rarely and means shares that already exist are offered for sale publicly. Music platform Spotify (in 2018) and collaboration platform Slack (in 2019) went public via direct listing on the New York Stock Exchange.

While this approach is no good if you want to raise money for the company, it’s a way to allow existing shareholders to cash in their shares and, if they decide to keep hold of the shares, they avoid being diluted.

There’s still plenty to do to comply with the regulations of going public, but it costs less to IPO this way and without underwriters involved, you keep more control over the process. And as with any IPO, private companies taking a direct route should bring in specialist legal and accounting experts.

Another way to take a company public is to use a Special Purpose Acquisition Company (SPAC). Compared to the US, this is relatively rare in the UK.

Going public via a SPAC involves forming a publicly listed shell company (the SPAC), raising money through an IPO of the SPAC, then merging the SPAC with your private company – which effectively takes your private company public.

This process comes with its own pros and cons. Private companies taking this route rely on expert legal and accounting guidance.

Form strategic partnerships or joint ventures

Join forces with another company to gain access to new markets, technologies or customers that perhaps you couldn’t reach before. Yes, it’s time-consuming to research and secure partnerships – but it’s a tried-and-tested way to accelerate growth, and considerably less of a drain on your money and time compared to going public.

Like any partnership, be ready to negotiate and compromise. Be clear about what you want, how long the partnership will last and check your cultures are aligned. And if a partnership is no longer working, be ready to move on.

Raise more with venture capital or private equity

If your primary aim for an IPO is to raise money, then you might decide that private funding from angel investors or VCs is a better idea. The company gets a big cash injection and access to the networks and expertise of your investors, and you can stay focused on building the business without the pressure and scrutiny involved in being a publicly traded company.

However, when you onboard more investors, you dilute ownership of the company and reduce your decision-making power. Your investors might have their sights firmly fixed on a future sale or IPO, and add pressure for your team to meet milestones and financial targets. And you’ll need to spend time creating reports and updates, and building your relationship with investors.

From first investment to Series A and beyond, close your deal fast on SeedLegals.

Find out moreExit with a private share sale

If your aim is to exit your business, a private share sale can be far quicker and more discreet than an IPO, and you’ll have much more control over the process. You’ll have more flexibility to negotiate the terms of the sale, including the share price, payment structure and any agreements you want to include. A private sale is confidential, the details of your transaction stay private, and you avoid the public scrutiny of an IPO.

Compared to an IPO, you’ll have a smaller pool of potential buyers. Private buyers are usually other companies, private equity firms or individual investors – and this smaller pool can mean a lower valuation than if the company goes through an IPO.

Your existing investors will have an opinion on a share sale versus IPO, depending on whether they want to keep or sell their shares after you exit. The possible restrictions on selling shares in a private company could make it challenging for them to exit in the future – it’s much easier to sell shares if a company is public.

Forget billable hours and expensive back-and-forth with a traditional law firm. With SeedLegals, it's quick, simple and cost-effective to sell your business.

Get exit readyExciting times! Maybe you’re a founder, director or employee with shares or you have vested options from your company’s share option scheme.

Firstly, check what conditions there are on when and how you can sell your shares or when you can exercise your options (and sell the shares you get). You might be able to sell your shares at the IPO, or there might be conditions preventing you from selling for a while after the IPO.

At and after the IPO, the value of all shares in the company – including your shares – is influenced by what the market is doing. This can make it difficult to know whether to sell up and pocket the cash (and pay the tax you’ll owe) or to sit tight and hope the share price rises.

If you’re in this situation, talk to an independent, qualified adviser to fully understand the impact on your finances.

For many companies, an IPO simply isn’t an option. But if it is or might be, you’ll need to weigh up the pros and cons, and take professional advice to make a fully informed decision.

At SeedLegals, we help startups and small businesses create and organise the legal documents you need, and take investments from angel investors and VCs. To find out how we can help you get your company in great shape to be ready for IPO in the future, book a free call with one of our friendly experts.

Sources

University of Oxford, Faculty of Law | The future of the IPO | Accessed 03/07/23

EY | Challenging 2022 for London stock markets as proceeds fall by 90% | Accessed 03/07/23

PwC | How to prepare now to be able to take advantage of the IPO windows when the markets re-open | Accessed 03/07/23

PwC | UK M&A activity in 2022 | Accessed 03/07/23

BBC | Saudi Aramco raises $25.6bn in world’s biggest share sale | Accessed 03/07/23

Statista | Largest IPOs in Europe in 2022, by deal value | Accessed 03/07/23

Reuters | Oil producer Ithaca shares sink in UK’s largest IPO of 2022 | Accessed 03/07/23

BBC | Deliveroo shares tumble on stock market debut | Accessed 03/07/23

BBC | Uber posts $1bn loss weeks after stock market listing | Accessed 03/07/23

CNN | HOOD-winked? Investors not celebrating one year after Robinhood’s IPO | Accessed 03/07/23

Gov.uk | Register a private or public company | Accessed 03/07/23

London Stock Exchange | Market Ceremonies | Accessed 03/07.23

London Stock Exchange

New York Stock Exchange

Nasdaq

AIM

Accessed 03/07/23

FCA | The Listing Rules PDF | Accessed 03/07/23

PwC | Considering an IPO? First, understand the costs | Accessed 03/07/23