SeedLegals vs Carta: which platform to choose for cap table, SEIS/EIS, funding and options

The days of painstakingly tracking equity allocation on a series of spreadsheets are over. In this post, we explore two...

For many angel investors, nothing beats the thrill of finding a startup with huge growth potential.

Even better, because successful startups drive jobs, innovation and the overall economy, the UK government encourages private investment into high-risk, high-potential startups. They do this by providing attractive tax benefits through the Enterprise Investment Scheme (EIS).

Let’s take a look at the types of tax relief you can access as an investor can access under EIS, including Income Tax relief, Capital Gains Tax exemptions. Plus we’ll break down which companies you can buy into and how to claim your EIS tax relief.

Speed up negotiations and cut down on admin with the help of our experts.

Book a demoEIS is one of the UK government’s venture capital schemes. It incentivises private investors to put money into smaller companies.

Younger companies tend to be higher risk for investors. There’s less information to figure out if you’re making a good bet.

To offset this risk, EIS rewards investors with tax relief when they take a chance on young, medium-sized companies.

And the great thing is, you can claim tax relief from multiple venture capital schemes in the same year. So, for example, you can claim both EIS and SEIS tax relief at the same time.

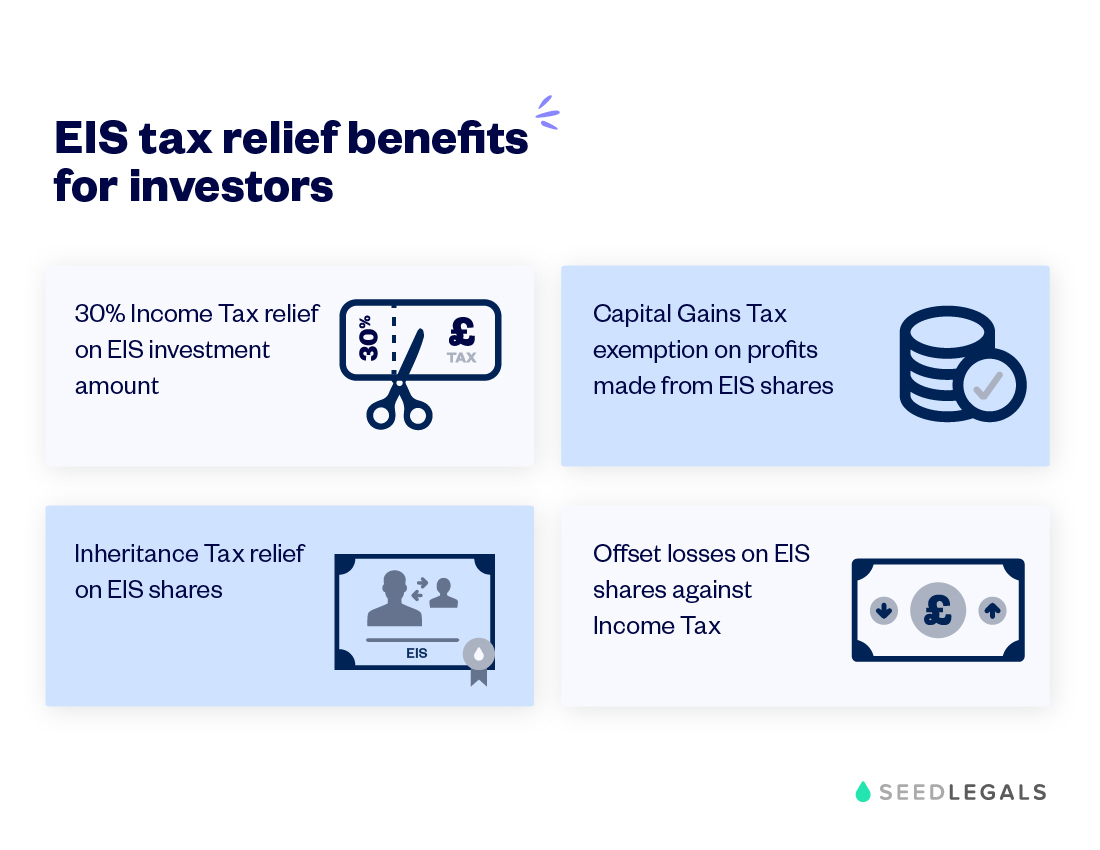

There are several different ways you can claim tax relief through EIS.

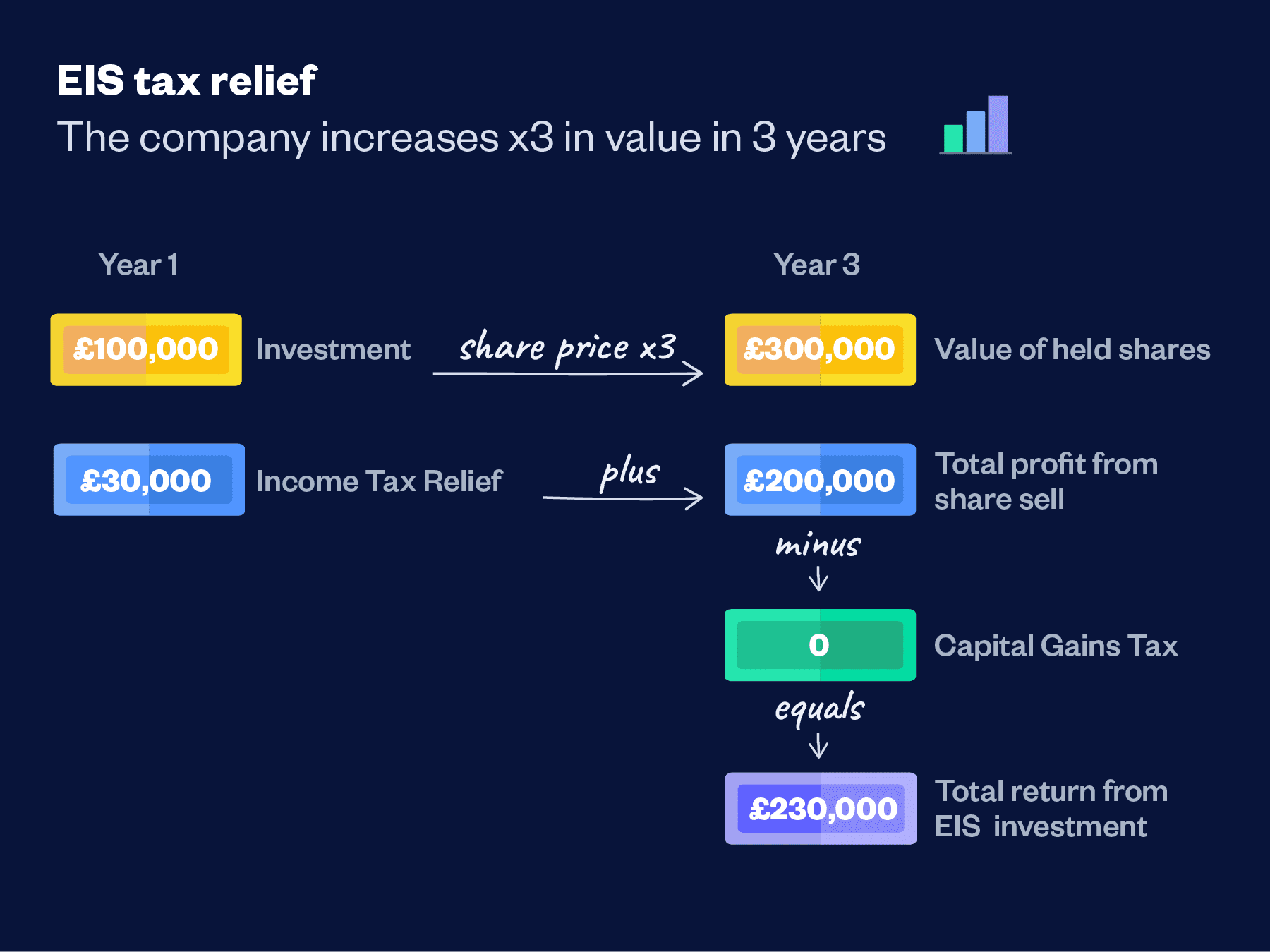

Under EIS, you get back 30% of the amount you invest as a reduction in your Income Tax bill.

For example, say you invested £10,000 in an EIS-eligible company. When you file your tax return, you list the details of your EIS-qualifying investment to reduce your Income Tax bill by £3,000

When you come to sell your shares, usually you’d pay Capital Gains Tax (CGT) on the profit you make. With EIS, you get to keep it all.

You can use EIS to defer payment of an existing Capital Gains Tax (CGT) charge to a later year. By reinvesting the profit made from another asset into an EIS-qualifying company, you can treat the gain as if it occurred in a later year. This can be helpful in optimising your tax liabilities and allowances.

Under the EIS Capital Gains deferral relief rules, you can use your chargeable gains to invest in EIS shares up to one year before or three years after you’d otherwise pay CGT on it.

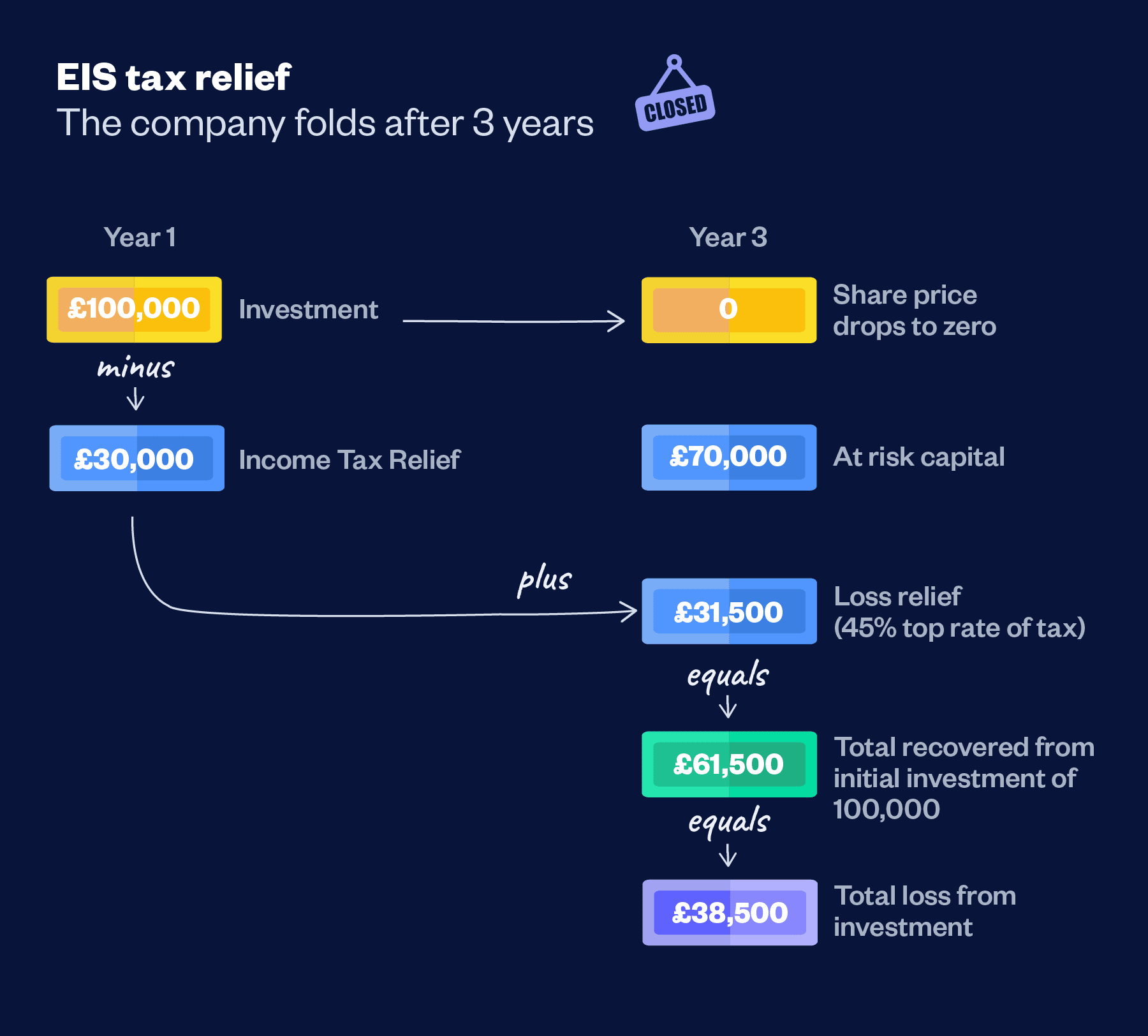

If you haven’t made a profit when you come to sell your shares, you can set that loss against your Income Tax bill. See an example of how that works on this gov.uk page.

EIS shares aren’t subject to Inheritance Tax, so long as they have been held for 2 years.

Jamie WilliamsAs the calculations show, there is significant benefit to an investor when a gain is made on an EIS investment. The scheme also minimises risk – your total exposure as an additional rate taxpayer is just 38.5% on an EIS investment.

Tax Director,

To benefit from EIS tax relief, you have to be a UK taxpayer.

There are various rules for both companies and investors. These rules exist to protect the spirit of the scheme – to reward investors for taking a risk on a company that’s otherwise unconnected to their own financial interests.

See EIS rules for investors for a full explanation of the rules.

EIS rewards investors for supporting medium-sized startups.

To be eligible for SEIS, companies must:

For full details, see our article for startups on the EIS company criteria.

You can claim EIS tax relief up to five years from the 31 January that follows the tax year in which you made the investment. It’s 31 January because that’s the deadline for Self Assessment tax returns.

If you don’t use all of your EIS allowance (£1M per year), you can’t carry forward the EIS limit to the next year.

But you can carry back EIS tax relief to the previous year, if you haven’t already invested the maximum allowed under the scheme in that year.

Jamie WilliamsThe timing of your investment is key. Funds have to be invested before the shares are issued or on the same day. If funds aren’t received by the date the shares are issued, this is a disqualifying event for the scheme and you’ll lose the relief.

Funds can be invested before the share issue, but the gap should be minimal (unless you’re investing via an advanced subscription agreement). If the gap is too long, you risk the funds being deemed a loan which is another disqualifying event, meaning you’ll lose the relief.

Tax Director,

So, you’ve found EIS-eligible companies, checked they have EIS Advance Assurance, completed the negotiations, and invested.

What happens next? How do you actually get the tax relief you were promised?

There are a few limits over when the company can complete the compliance steps. HMRC accepts compliance statements after the company has carried out their qualifying business activity for at least four months.

Typically, HMRC reviews the company’s compliance application in about 15 to 40 working days.

To approve EIS-qualifying status, HMRC sends the investee company two documents:

As an investor, you claim your EIS tax relief when you fill in your annual Self Assessment tax return. On the Additional Information page, under ‘Other tax reliefs’, enter the total you’ve invested in companies under EIS (and any other venture capital scheme you’re applying for).

If things don’t go as planned and you make a loss on your investment, you can claim loss relief. Loss relief allows you to offset a loss, minus any income tax relief you’ve already had from HMRC, against your income.

If you’re claiming the loss for the current tax year, you can contact HMRC to request a change to your PAYE tax code or make an adjustment to your Self Assessment tax payments.

If you’re claiming the loss for the previous tax year, make the claim on your Self Assessment tax return. See full details on how to claim SEIS/EIS loss relief at the gov.uk website.

When the company isn’t profitable and isn’t able to raise more, founders broadly have three choices: to sell, to go into zombie mode (reduce burn to zero, meaning no productivity or revenue) or to shut down. The route they take affects whether you can claim loss relief.

Is loss relief available?

Conditions:

Is loss relief available?

Is loss relief available?

Conditions:

Take a look at this video to hear from SeedLegals co-founder and CEO, Anthony Rose, how each of these three strategies affects your loss relief as an SEIS/EIS investor and when you’ll be able to claim.

If you don’t want to manage the investment process yourself, you can still benefit from EIS tax relief by investing in an EIS fund.

EIS funds pool money from investors to spread across a portfolio of EIS-eligible companies. The fund is responsible for due diligence and making sure that the companies in the portfolio qualify for EIS.

Jonny SeamanEIS funds are professionally managed, so tend to have strong deal flow and processes in place to pick the best startups. Naturally, there are usually fees involved, so it’s important to consider whether paying a cut of profits is worth the increased diversification and hands-off nature of investing in a fund.

Investor Partnerships Manager,

Manage your deals on invest.seedlegals.com, the dedicated portal for angels and funds who’ve invested in startup companies.

Log in to see all your deals, view the total value of your investments, send out Term Sheets, negotiate directly on the document through comments, store your EIS3 and share certificates.

To find out more about how we can help you streamline and manage your deals, choose a time for a friendly call with our investor team.