NEW in SeedLegals for Investors: more functionality, visibility and efficiency

You now have more control to lead your deals and see what’s happening at each stage. See the latest updates in the SeedL...

Your cap table can contain either green flags or red flags for potential investors. A messy cap table isn’t a good sign to investors and can be an admin nightmare for you as well. Plus it’s important that you divide your company equity wisely for the good of all your stakeholders and the company itself.

In this article, we explain why investors care about what’s going on in your capitalisation table and how to keep your cap table clean.

Article contents:

Our online cap table builder takes care of the arithmetic, calculates equity dilution and keeps tabs on who owns what.

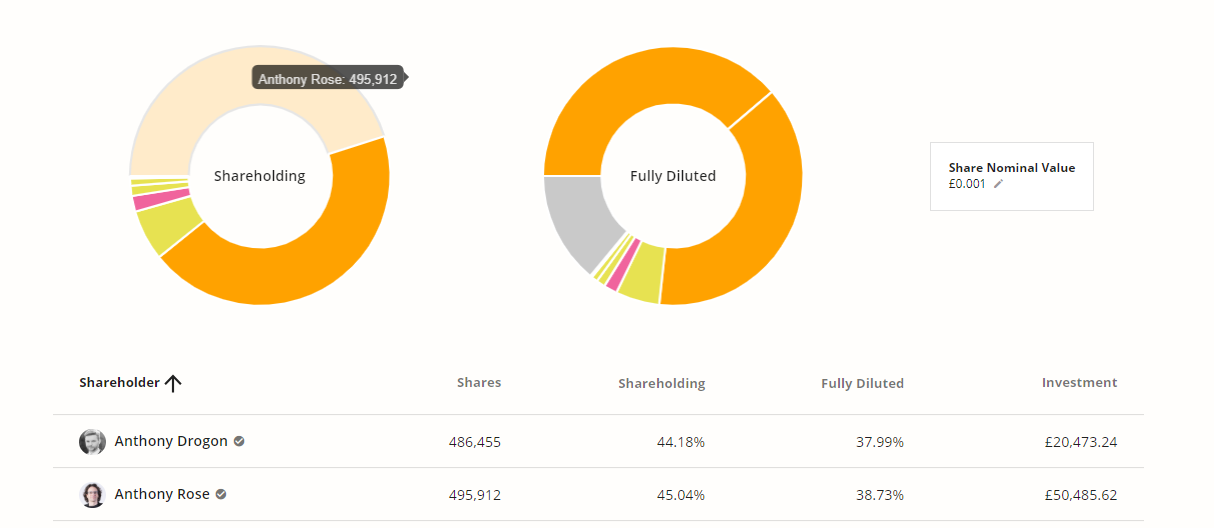

Learn more‘Cap table’ is short for capitalisation table. But exactly what is a cap table? A company’s cap table is a data table (or spreadsheet) that lists all shareholders in the company and their ownership percentages, including allocated share options and company debt as well. Here’s an example:

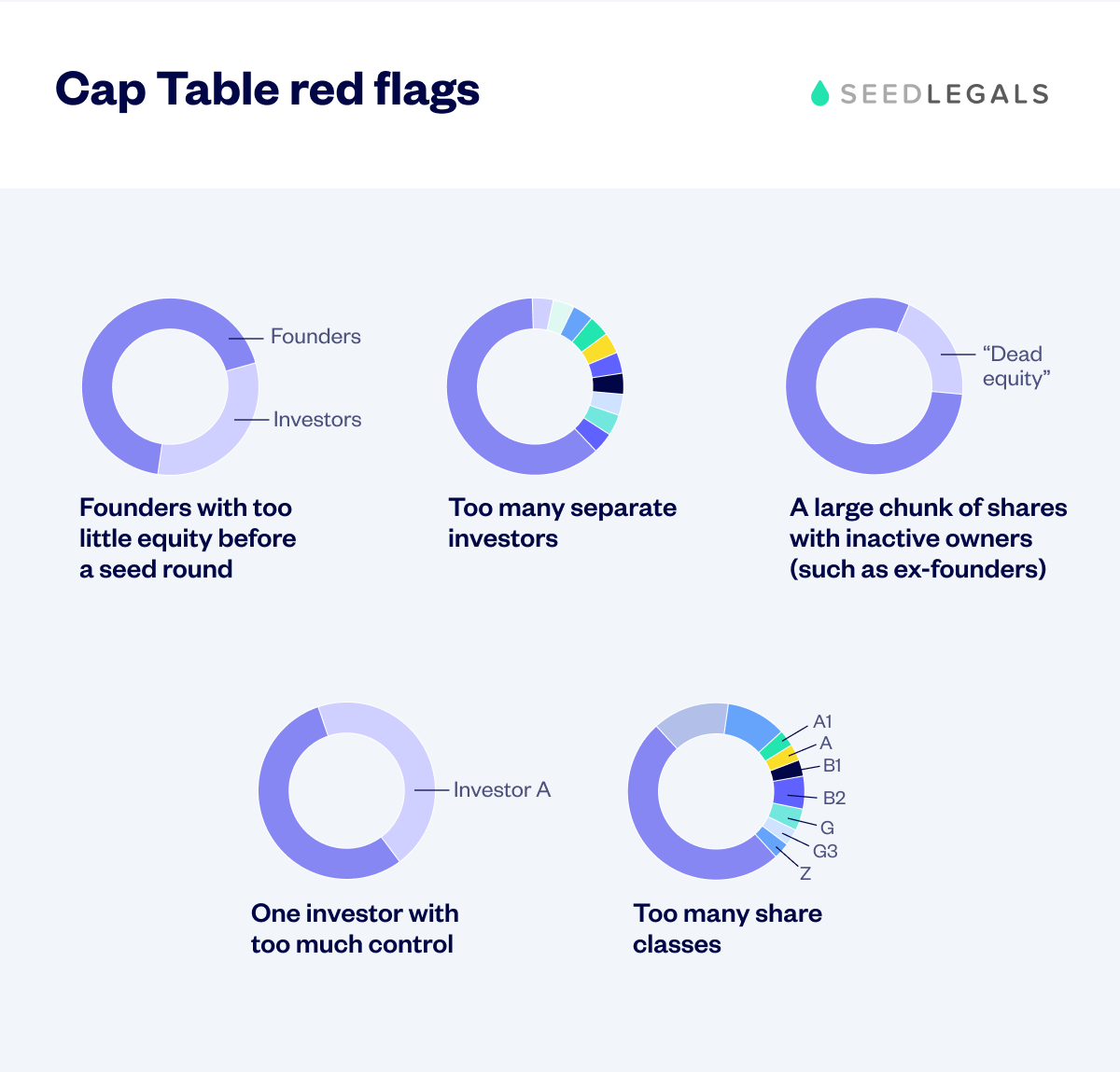

‘Messy’ cap table usually refers to one that has lots of equity stakeholders, and therefore too many decision-makers slowing down your admin and spreading equity thin. It can also refer to other cap table red flags, which we’ve listed below:

Jonny SeamanThere’s no definitive point at which a cap table is ‘messy’ or ‘clean.’ It’s a spectrum. And whether it matters comes down to a potential investor’s preference.

In terms of the number of shareholders you have, a cap table with a couple of founders, around five investors (perhaps one big VC fund and a few angels) and a share option pool is nice and clean. When you start hitting 15, 20 or more entities in your cap table, that’s when it starts getting messy and can be a red flag to some investors.

Investor Partnerships Manager,

A clean cap table is well-organised, accurate and free from complications. It should be easily accessible to all relevant stakeholders.

We’ve found that a lot of our customers assume a ‘clean cap table’ refers to one with few shareholders. While fewer shareholders can be a green flag, and is what a ‘clean’ cap table meant in the past, it’s now become more nuanced than that.

A ‘clean’ cap table also means that you don’t have the following:

Your cap table is a snapshot of the company’s financial health and governance structure. This is important information for investors to know because it’ll help them understand the risk and potential returns of their investment in your company. Clean and well-maintained cap tables instil confidence in investors that your company has a robust foundation.

Here’s a breakdown of why your cap table matters to investors 👇

Decision-making and admin

Too many entities on your cap table can slow down your admin and decision-making. It becomes time-consuming to get decisions approved, and too many people to keep updated. It can become confusing for founders too. Often, the fewer decision-makers you have, the better.

It also slows down the due diligence process because it’ll take longer for investors to gather comprehensive information about your company’s financials and ownership structure.

Risk

When assessing your startup for possible risks, a messy cap table could signal uncertainties around ownership claims, potential legal disputes, and the overall governance structure of the company.

ROI

The way equity is divided in your company affects an investor’s return on investment (ROI). If you keep giving away equity and issuing new shares, it leads to equity dilution, which means stakeholders own less and less over time. For more on this topic, read our article: Dilution: how it works

Company governance

Your cap table is a good indicator of your corporate governance structure.

A messy cap table with too many shareholders or disproportional voting rights can indicate a challenging corporate governance structure that’d be frustrating to work with.

Jonny SeamanA messy cap table is a red flag to some investors. You want it to be as easy as possible for them to say yes to investing in your company, and red flags can be the difference between an investor saying yes or no to you. So as far as possible, you want to limit potential red flags so investors can focus on your merits alone.

Investor Partnerships Manager,

It could complicate future fundraising

Investors might be put off if the ownership structure of your company is convoluted, potentially resulting in legal and operational challenges.

It could lead to legal and financial risks

Inaccurate records may lead to legal disputes and financial complications, potentially harming the company’s reputation and causing financial loss for equity stakeholders.

It could cause operational inefficiency

Difficulty in tracking ownership can slow down your ability to pass resolutions, make decisions and move forward.

A well-maintained cap table gives a clear picture of the ownership stakes and the distribution of equity among various stakeholders. This transparency is vital for potential investors to assess your company’s financial health, risk factors, and potential returns on investment.

Smoother fundraising

A clean cap table is a green flag to investors and can make it easier to get that ‘yes’ when you’re fundraising. It also makes the admin side of your raise easier because it should be quicker to get the deal approved by all stakeholders.

Transparency

A transparent cap table helps align the interests of founders, early employees and investors. Investors are more likely to engage with startups that prioritise transparency and fair treatment of shareholders.

Good financial health

A clean cap table usually means your company is at an advantage in terms of maintaining and fostering financial health.

A cap table that’ll make things easy for you and appeal to investors will be organised, transparent and up-to-date. But what are potential investors really looking for when they look at your cap table?

When potential new investors look at your cap table, they want to see that:

✅ There’s a straightforward share structure (1 to 3 classes of ordinary and/or preference)

✅ They’ll be able to have their say in the company, proportional to their investment

✅ There won’t be any nasty surprises in the next funding round

Here are our expert tips for how to create and maintain a clean cap table 👇

Use special purpose vehicles (SPVs)

Use a Special Purpose Vehicle (SPV) or nominee to bundle shareholders. Instead of appearing as separate investors on your cap table, they appear as only one investor: the nominee company. This has the added benefit of allowing you to onboard investors who want to make smaller investments without adding to how many separate entities you have on the cap table. For example, if you’ve set a minimum investment (‘ticket size’) of £25K for your funding round, you could take an investment from an SPV where five investors each put in £5,000

Turn multiple investors into one easy-to-manage entry on your cap table with a rollup.

Learn moreTake syndicate investments

A syndicate is an arrangement where a lead investor brings other investors with them. The lead investor might simply be a well-connected angel investor who loves investing but doesn’t have the funds (or doesn’t want to take the risk) to fund an entire round themselves. So they introduce the investment to some friends, who pool their money to invest together. A syndicate investment comes from multiple investors, but appears as one entity on the cap table.

Give smaller shareholders non-voting shares

This makes running your company easier because you don’t need their approval on company decisions. Generally, you won’t need to speak to them or wait for them to sign things, so there’s almost zero admin overhead for even hundreds of small investors on your cap table.

Choose ‘You snooze, you lose’

What if an investor goes missing? Maybe they’re trekking in the Himalayas? Usually you’ll only need a majority vote, not 100%, so if one investor is mysteriously absent then it might be fine. But with SeedLegals, you can add the ‘You snooze, you lose’ clause. If your shareholder doesn’t respond within 15 business days, their lack of response is taken as deemed consent. So you can move forward without spending ages chasing up an AWOL investor.

To find out how we can help you create and maintain a clean cap table, automate your legal admin, speed up your funding round negotiations and more, book a free call with one of our experts: 👇