Run multiple option grants in one go – now live on SeedLegals

We’ve made option grants faster and easier to run on SeedLegals. Set shared terms once, tailor where needed and send agr...

In the old days before SeedLegals, you could be looking at spending up to £10,000 on EMI option scheme set-up. Now, you can create unlimited EMI option schemes and get unlimited HMRC EMI valuations as part of our Share Options Subscription for £2,490 (+VAT) per year.

It used to be complex, expensive and time-consuming to design and implement an EMI option scheme, with months spent creating the paperwork with lawyers and accountants.

Technology and automation have changed that for good. Now, in just a few clicks, anyone can generate the option scheme paperwork and issue equity to their team.

In this post, we run you through a breakdown of the costs involved in setting up your EMI scheme on SeedLegals.

There are two parts to setting up an option scheme:

You can get started on both parts in parallel to save time. After you’ve sent off your EMI valuation to HMRC and are waiting for a reply, you can get your scheme rules drafted and ready to go.

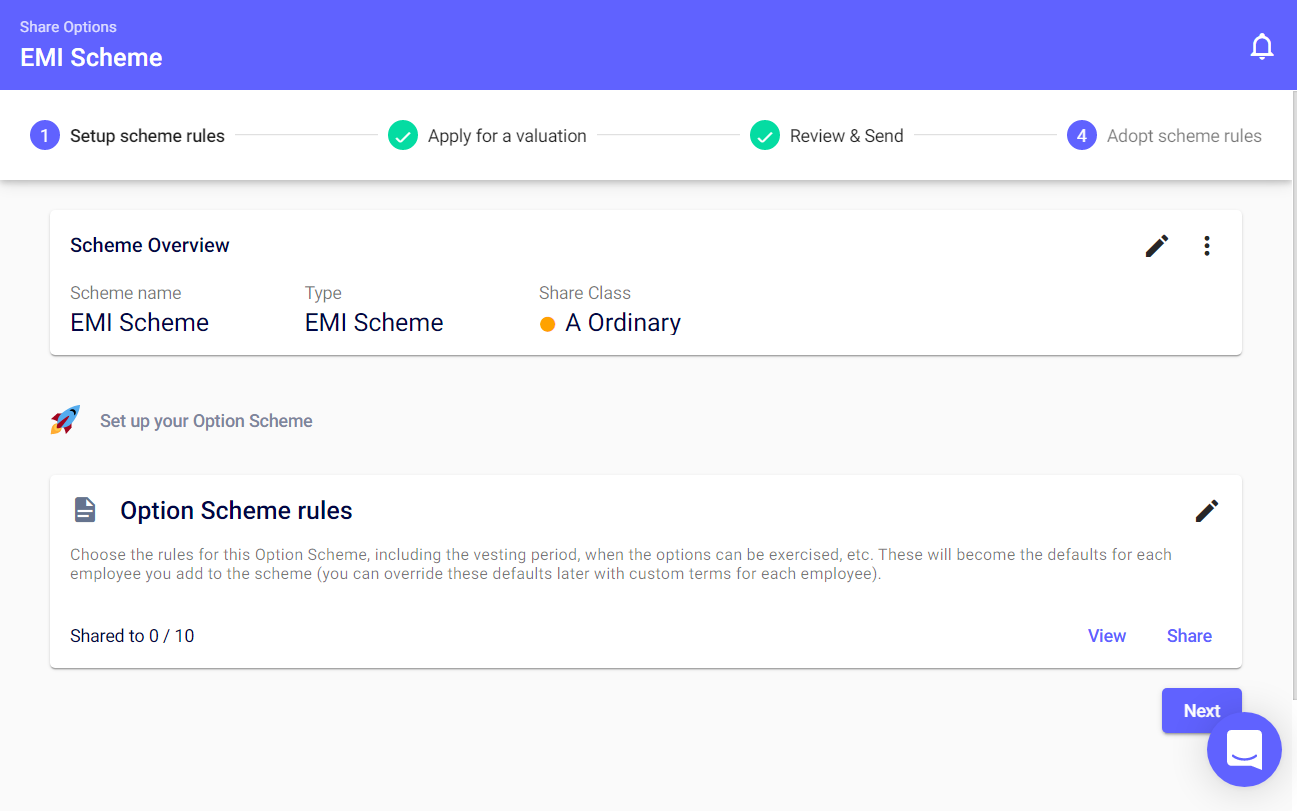

When you set up your EMI option scheme through SeedLegals, it’s easy to work through the steps in our guided workflow.

To get started with your option scheme, sign up for a Share Options Subscription on SeedLegals, create your company and select the EMI Option Scheme from your company dashboard. You can see how it works by signing up for a 7-day free trial.

Follow our step-by-step wizard to generate all the paperwork you need, or if you’d like to see the SeedLegals platform in action, book a demo with one of our EMI experts.

To make the process easier and faster, we’ve added the EMI valuation into our workflow. This is an important step, because it helps guarantee the best-possible share prices for your employees.

You can choose to use our market leading valuation builder tool to generate a comprehensive report for you, or build your EMI scheme without it. You can also just use the EMI Valuation service by itself, without the full EMI scheme.

At SeedLegals, EMI schemes are included in our Share Options Subscription, which renews annually. For just £2,490 per year, you get:

Here’s what’s included in our EMI scheme service:

✔ Add up to 250 employees (the EMI scheme limit)

✔ Customise scheme rules

✔ Get unlimited support from our team

✔ Add and remove employees at any time

✔ Manage your scheme online

✔ Your team get their own account so they can track and manage their holdings

✔ All documents included, including board resolution and option agreements

Here’s what’s included in our EMI valuation service:

✔ Build a comprehensive valuation report for the best-possible valuation discount

✔ Access all the documentation needed for valuation approval, supported by the SeedLegals team

✔ We answer any questions from HMRC to agree your valuation

Any questions about EMI option schemes? Need to check any part of the process? Find a time to chat with a SeedLegals equity specialist.