SEIS/EIS Advance Assurance

Boost your investor appeal with SEIS/EIS Advance Assurance

SEIS and EIS Advance Assurance helps you attract angel investors and VCs by reducing their risk. Our team can help you get approved fast.

2/3

of UK angel investors only invest in SEIS/EIS eligible startups.

98%

success rate through SeedLegals vs. 62% industry average (HMRC stats)

SEIS is a win-win for you and your investors

Find out why founders use SeedLegals to certify their SEIS status. Our CEO Anthony Rose explains what SEIS investment is, why it’s so important and how you can use it to attract investment.

Try the SeedLegals SEIS/EIS tax relief calculator

Calculate your tax relief benefits

Investors in qualifying startups can claim huge tax benefits with SEIS and EIS. Are you a founder looking to make a compelling case to investors? Or an investor exploring tax-saving opportunities? Just enter the investment amount, forecast the return and see how SEIS/EIS can maximise your potential gains.

Free SEIS/EIS Tax Relief Calculator

Clear, easy steps to SEIS/EIS approval

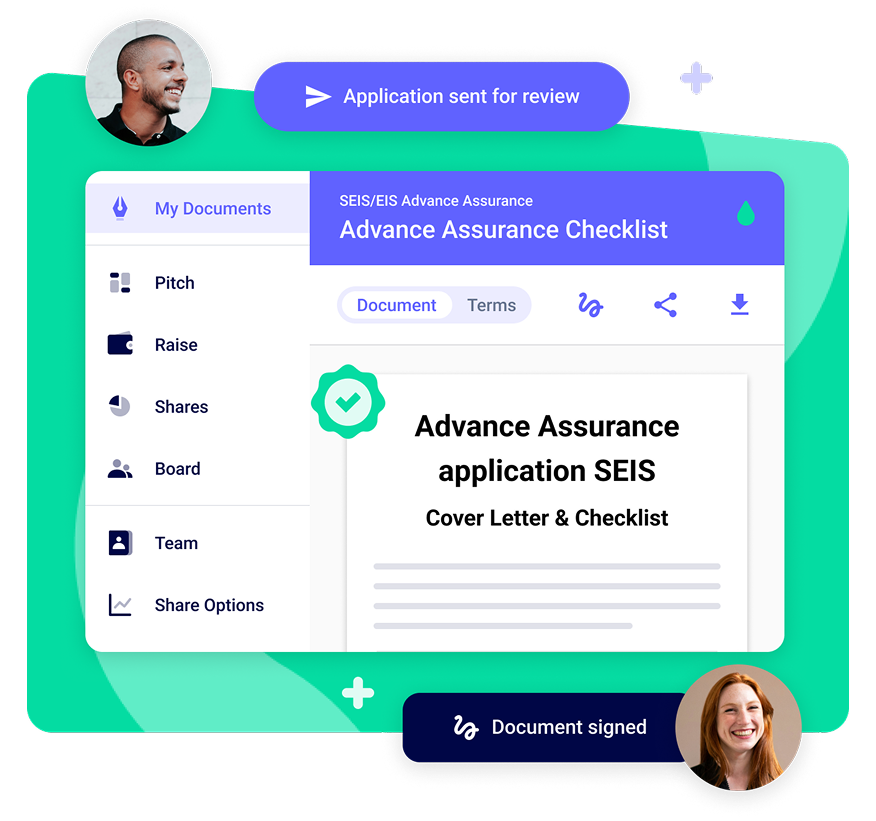

Apply for SEIS/EIS in a simple and intuitive workflow

Get your SEIS/EIS Advance Assurance application handled by the experts. We generate your completed application, check it’s ready to go and submit it to HMRC for you.

Answer questions to quickly build your application

Get a full review from SEIS/EIS experts

Submit through SeedLegals in one smooth end-to-end process

Based outside the UK? We can help you apply

No SEIS/EIS experience? No problem!

Carefully reviewed and submitted by our experts

We make sure your application complies with the latest HMRC guidelines (even the ones they don’t tell you about!) to get you the most reliable approval possible.

Get your application right first time

We act as your agent with HMRC and handle all comms

All your SEIS/EIS documents securely stored, ready for SEIS/EIS Compliance

How to apply for SEIS/EIS Advance Assurance

More resources on the SEIS and EIS schemes

FAQs

Frequently asked questions about SEIS/EIS Advance Assurance

Do I need SEIS/EIS Advance Assurance?

If you're still looking for investors or are in the early stages, then Advance Assurance will help you when you are pitching to potential investors.

Most SEIS/EIS investors require the company to have Advance Assurance from HMRC before they invest. If your investors are willing to invest regardless of tax relief, then you don't need to worry about applying for Advance Assurance.

Find out whether your investors are eligible for SEIS and what the benefits are for them.Do I need SEIS Advance Assurance or EIS Advance Assurance?

It mainly depends on how big and established your company is. Smaller startups can use the Seed Enterprise Investment Scheme (SEIS) to give their investors a greater rate of tax relief for coming in at an early, and riskier, stage.

Larger companies - and SEIS-qualifying companies that have reached the SEIS limits - can raise under the Enterprise Investment Scheme (EIS).

Find out more about the differences between SEIS and EIS.How do I find out if my company is eligible for SEIS and/or EIS?

My company isn't based in the UK. Can I still benefit from SEIS/EIS?

Many people don’t know that non-UK companies can offer investments to UK investors which qualify for the Enterprise Investment Schemes. To qualify for SEIS / EIS, your company doesn’t need to be incorporated in the UK, but it does need to register as having a permanent establishment in the UK. Read our guide to SEIS/EIS for foreign companies for more information.

At SeedLegals, we can support you with your application wherever you're based.What are the changes to SEIS from April 2023?

In autumn 2022, the government announced changes to the Seed Enterprise Investment Scheme, to come into effect from 6 April 2023:

- raise up to £250,000 in SEIS investment (up from £150,000)

- raise with SEIS for up to three years from when you first started trading (up from two years)

- raise SEIS with company gross assets up to £350,000 (previously £200,000)

- individual investors can now invest up to £200,000 in any tax year (up from £100,000)

Why should I apply for SEIS/EIS Advance Assurance through SeedLegals?

Our combined expert support and automated workflow help to streamline the process. Our SEIS/EIS experts are with you every step of the way and can guide you through the process from start to finish – unlimited support is included at no extra cost.

At the end of the process once your documents are finalised, we will also submit on your behalf on HMRC’s website. It’s free to sign up and get started.How long does Advance Assurance take?

It takes roughly 30 minutes to complete the application on our platform. Please allow for one to two weeks for our team to review and to make any changes needed before we submit it.

Then the rest of the time is with HMRC (they take about 15 days).What documents do I need for the application?

As a minimum you'll need to send HMRC your:

- business plan or pitch deck

- 3 year projected financials

- Share Register

You should also be prepared to send your:

- Company accounts or bank statement

- details of previous investment and/or grants

- letter of engagement from your crowdfunding/investment partner

- Articles of Association

- Investment Proposal / Term SheetDo I need to create a new business plan for my SEIS/EIS application?

To get SEIS/EIS approval it’s important that you show how your business meets HMRC’s risk to capital condition.

That means, while you want to play up the reward part of the risk/reward equation to investors, you want to do the opposite to HMRC.

Below, we’ve listed a few resources to help you create your business plan for your SEIS/EIS application:

- What to include in your business plan for SEIS/EIS advance assurance

- How to address the SEIS/EIS risk to capital requirement in your application

- Common mistakes to look out for in your SEIS/EIS business plan

Remember, a SeedLegals SEIS/EIS expert will review all the materials you send so you can be confident your application meets all the requirements.

What are the excluded activities that stop my company from being SEIS/EIS eligible?

This is a long list but the most common are: legal services, financial services, leasing / renting, energy, property development and agriculture.

Read more about what counts as an SEIS/EIS qualifying trade.We incorporated over 2 years ago, can we qualify?

Yes! For SEIS you need to prove that you haven't been 'trading' for longer than two years and for EIS you have to be within seven years of your first commercial sale.

From 6 April 2023, for SEIS this time limit for trading is changing from two years to three years. But until around July 2023, you'll only be able to get SEIS Advanced Assurance if you've been trading for less than two years - to find out more, read our post.

To see what counts as trading for HMRC, read our post, What is 'trading' for SEIS and EIS?Why do I need to give the details of a potential investor?

HMRC introduced this to the SEIS/EIS application process to deter speculative applications from companies that weren’t yet ready to raise.

There’s no obligation for the investor you name to actually invest. You can change the name of the investor and their investment amounts at any time. But don’t just make an investor up. It’s better to find investors who are, on balance, likely to invest and to get their permission first.

To see who’s eligible to invest under SEIS and EIS, go to SEIS rules for investors.How long does SEIS/EIS Advance Assurance last?

There’s no expiry date for SEIS and EIS Advance Assurance.

But, when your company no longer meets the SEIS/EIS eligibility criteria (which includes a limit on how long you’ve been trading for), you won’t be able to offer SEIS/EIS tax relief to your investors.SEIS and EIS for Film & Television production companies

An overview of recent HMRC rule changes for film and television companies:

HMRC have been paying particular attention to film and television production companies looking to apply for SEIS and EIS. Basically, SEIS/EIS is designed for growth companies creating a scalable business and where there's a 'risk to capital' (as HMRC define that) rather than e.g. financing a single film.

In most cases it's pretty clear that you're either a film production company that won't be able to claim SEIS/EIS, or a company that's not at all affected by this.

But, in other cases it's more subtle - e.g. what if you're a games studio or film production studio creating a tech platform, business or backend technology provider that will power multiple productions?

One of our customers put together this handy set of resources that may help you understand what will and won't be possible if you're in this not-sure zone, and also how to frame your product offering and services in order to be able to qualify.

HMRC SEIS/EIS rules changes for Film and Television

Risk to Capital Condition - Factors to be considered

An overview of risk to capital

Further reading:

UK Gov Venture capital Schemes Manual example 3, a film company

EIS GOV application information

An interpretation by Sapphire Capital partners of the new rules

The Rules Changes:

This article pre- the EIS rules changes might be useful to read as background and lists the main players, Ingenious etc

This pre-rules change investment sector overview by Allenbridge has some useful info on what to present for investors, including an overview of how the film & TV sector works. Note some things have changed and some continue to change.Introduction to SEIS & EIS for foreign / non-UK companies

Foreign companies can qualify for SEIS & EIS too, here are the requirements:

Many people aren't aware that you can offer SEIS & EIS to UK investors even if your company is not a UK company.

In order to qualify for SEIS & EIS, a company doesn't need to be incorporated in the UK, but it does need to be registered as a foreign company.

You'll also need a UK presence, which means either:- you have a fixed place of business in the UK through which the company’s business is wholly or partly carried on; or

- an agent acting on behalf of the company has and habitually exercises authority to enter into contracts on behalf of the company.

For more info, check out our SEIS & EIS for Foreign Companies" article.What is Trading for SEIS or EIS?

What does HMRC mean by Trading, Date of Trading, and a New Qualifying Trade?

What is trading?

Before you can submit your Advance Assurance Application you need to find out when you actually started to trade.

Frustratingly there is no clear definition of trading aside from the general observation that it would involve “undertaking activities with a view to a profit”. HMRC use the analogy of a shop: if you have something on the shelf that someone could buy even if they don’t, you can turn the sign to ‘Open’ and that’s you trading.

When did I start trading?

To qualify for SEIS, the date you started trading must be within 3 years of the date of issue of the SEIS shares. For EIS share issue the time limit is 7 years from the date of first commercial sale (please note this is not the date of first trade), and for a Knowledge Intensive Company the time limit moves up to 10 years.

Therefore, you need to quantify the date you started trading as per the slightly ambiguous definition above. To help you, it is important to note, this start date of trading will always be before (or most often equal to) the date you first received revenue. On the Advance Assurance Application Form, for EIS applications, it actually asks for the Date of First Commercial Sales. This date indicates your start of trading and it is something that needs to be consistent throughout your application form, business plan, financial forecast, and bank statements/accounts. It is also important to note, the date you start trading will almost always be different to the age of the Company (the date of incorporation). And if you haven't started trading yet then great! You will just have to demonstrate this in the documents attached to your application

Careful! If you are running consultancy work through the Company to help keep the lights on, HMRC may see this as a trading even though the product isn’t ready, as revenues will show on your financials.

What counts as a "new qualifying trade"?

The SEIS regime includes rules to prevent structures that circumvent the core requirement which is “the Company raising the capital must be a genuine start-up”. A new qualifying trade is defined as a trade that has not been carried out by the company, or any other person or Company, for longer than 3 years at the date of issue of the shares.

This means if the trade was operating in a different company and you have bought the intellectual property of that company to develop it further and even take it to market, then you need to ensure that it still satisfies these time limit rules. The time limit for SEIS/EIS eligibility refers to the trade and not the company, the start of trade date doesn’t reset when you transfer the intellectual property.

For example, if you buy a marketplace platform that has customers trading on the platform and therefore has produced revenue prior to you buying the platform, then the start date of trading will be taken as the date the platform facilitated its first sale, not the date you bought the marketplace platform.

More information on the HMRC site

Want to deep dive into the definition of "trading" to determine what was a first trade? This HMRC article goes into more detail.How to address the SEIS/EIS New Qualifying Trade Requirement

How to address the SEIS/EIS New Qualifying Trade Requirement

A guide on how to satisfy the new qualifying trade requirement, and how to address potential continuation of trade for directors

One of the requirements of the SEIS/EIS scheme is that the funds go towards a new qualifying trade - this means that neither the company, nor any other person from that company, has carried out the trade for longer than three years at the date of issue of the shares. This also includes where neither the company nor any qualifying subsidiary has carried out any other trade before the company applying began to carry on the new trade, (as set out in S.257HF of the Income Tax Act 2007, amended by the S.15 Finance (No.2) Act 2023).

As part of your Advance Assurance application, HMRC will verify whether any directors of the company applying have also been, or still are, directors of other companies on Companies House. They will be looking out for other companies that have a similar business purpose and nature to the one applying - so any companies that have a similar name, or are listed under a similar SIC code, could get flagged.

The goal is to prevent applicants that have shut down their previous company and set up a new company, using the same business plan, contacts, experience, to then apply for S-EIS relief. Part of this rule goes to HMRC’s risk to capital requirements, as it would minimise the possibility that investors stood to lose more than they gained if the directors had the expertise to run the company. This will ensure that directors cannot circumvent the three year trading limit - it is not enough for the company applying (or the group of companies) to fall within the 3 year trading limit. Instead, the directors themselves cannot be involved in the trade via other companies that might avoid the limit.

If you, or one of the directors of the company applying, have also been directors of another company (or companies) with a similar name or business nature, we recommend you directly address this in your application. You can include a sentence in the additional information of your Application Form that states “X Director is also a director of X company, but this company has not engaged in any trading activity/has a different business purpose to the company applying, and there is no continuation of trade between these companies”.

What happens if you do fall into the continuation of trade limitation?

There are a couple of options here:

- If you satisfy the trading limit for SEIS/EIS

If you satisfy the trading limit for S-EIS, i.e. you prove that the previous company has not engaged in trading for over 3 years for SEIS (or 7 years for EIS), you can mention this in the application to HMRC. In this case, it's unlikely that HMRC will see this as a breach of the continuation of trade requirement - we can advise on how best to do this.

- If you are over the trading limit (3 years for SEIS, 7 years for EIS)

If the previous company is over the 3 year trading limit (within the 7 year limit), the company can apply for only EIS (as long as you are raising over £250,000).

If you are over the 7 year trading limit and therefore unable to claim EIS, we recommend looking at Condition B (S.175A Income Tax Act) - you will have to prove that the new company is moving into a new product market or geographical market. Please see our guide on Condition A and B if your company is seeking to issue EIS shares after the 7 year limit.What level of commitment do we need from investors to apply for Advance Assurance?

The application must include the full name, address, and intended investment amount of at least 1 potential investor. This is a soft commit, and these investors will not be obliged to invest in the round based off of this.

- If this is a Crowdfunding platform then the Letter of Engagement must be included.

- If this is a Corporate entity (for example a SEIS Fund or Nominee vehicle), the Letter of Engagement must be included.

At SeegLegals we recommend that the intended investment amount from your investor(s) should be 25% of the total amount of Advance Assurance that you're applying for.How can I qualify as a Knowledge Intensive Company for EIS?

Knowledge Intensive Companies get extended EIS benefits - here's how to meet the requirements.

The key rules for applying for EIS as a Knowledge Intensive Company (KIC) are all found within our guide to KIC criteria.

Generally speaking, it's best not to apply as a KIC unless you absolutely need to rely on one of the benefits. (As you can always apply later).

If you do need to rely on KIC status, then it's best to attach a separate letter, detailing how you meet the requirements listed in our article above. You may need to attach financials, employee profiles, and patent records.Where can I find my UTR Number?

If you're applying for SEIS or EIS, HMRC will ask for your Company's Unique Tax Reference Number, here's where to find yours.

Before you can apply for SEIS or EIS Advance Assurance you'll need your company's Unique Tax Reference number (UTR). Please note, this is for the Company itself, and not a personal tax reference number.

In almost all cases, HMRC will automatically create a UTR and post it to the company's registered address within 3 weeks of the company being incorporated on Company House.

The UTR number is a 10 digit reference found on a document which appears like this:

123 12345 12345 A

In this case the UTR is 12345 12345 (The middle 10 digits of the full reference)

If you haven't received this form. (or it wound up mysteriously disappearing) You'll need to contact HMRC to get it sorted, you can do so at their page for registering for Corporation Tax.

HMRC take a week or two to send this number, and you'll need it before you can submit your SEIS Advance Assurance application.

for more info check this page:Common mistakes to look out for in your business plan

Things to avoid in your business plan for SEIS and EIS Advance Assurance and Compliance

The business plan (also referred to as the pitch deck/investor plan) is a required part of your SEIS/EIS Advance Assurance Application to HMRC and ensuring your business plan meets all of HMRC’s requirements is therefore an important part of your overall application. We have a guide on what to include in your business plan for an SEIS/EIS Advance Assurance Application, this article will cover 6 common mistakes to look out for in your business plan, to ensure the best chance of success with HMRC:

Add a clear product description

This may appear obvious but is often overlooked by founders. It is easy to jump from a problem to a solution without a clear demonstration of what the product is, and what role it plays in fixing the solution. This is crucial as part of HMRC’s requirements relates to the activities carried out by the company. HMRC has a list of “what is the SEIS/EIS Risk to Capital Condition. This is often overlooked in business plans, as identifying areas of risk within your business or the wider market is typically not something founders will want to focus on.

However, it is worth noting that the business plan you send to HMRC is not the same one you need to show to potential investors, so identifying risks will not deter any potential future funding. We recommend including risks in the form of a Strengths, Threats, Opportunities and Weaknesses analysis (SWOT).

An additional slide in your business plan covering some key bullet points under each of these headings is sufficient.

Have a look at this article here on how to address the SEIS/EIS Risk to Capital requirement in your business plan - a slide template.

Include a breakdown of how you intend to use the investment

A breakdown of what you intend to use the investment for, including details of which work will be outsourced. This is also an important way of ensuring that the amount on the application matches the amount on your business plan. More often than not, the “ask” and details of the intended use of investment are not included in the business plan. It is also worth pointing out that the way the company intends to spend the investment is also part of the risk to capital consideration - if the money is spent on a disqualifying trade, this will invalidate the risk element for investors. For example, if 80% of the money invested is spent on acquiring new property, this will eliminate the element of risk in the application.

Don’t mention any exit strategy

This is something founders will naturally tend to include to make their company more attractive to investors, however it can invalidate your Advance Assurance application as HMRC will see it as de-risking the investment. Exit strategies, buy outs, and potential acquisitions should all be removed from the business plan you send to HMRC.

Don’t mention that you are SEIS/EIS eligible

It is not necessary to mention SEIS/EIS approval on your business plan, however if you do choose to include this, it is essential to note that this is pending approval. HMRC do not like seeing applications that say they are SEIS/EIS approved before they have had the chance to do so. Approval from HMRC can take up to 6-8 weeks, so it is not worth including this and potentially raising queries from potential investors who may wish to see the approval even though it has not yet been approved.

Include your Financial Projections

A chart outlining the projected profit and loss over the next 3 years is required from HMRC. This is also a good indication that the company is financially healthy - however it is also ok to include a negative net profit for the first few years, as HMRC are aware that this is a natural part of a company’s financial growth in its early years. The financial projections can be included as a separate Excel, or within the business plan.What business plan is needed for my SEIS/EIS Advance Assurance application?

HMRC will require your Advance Assurance application to inclu">de a business plan - here's what to attach.

For your business plan, HMRC is looking for whatever information would be presented to potential investors to entice them to invest in the business.

So, generally speaking, whatever you have already prepared is usually the best starting point.

These are the main headings we suggest including in your business plan:

The ‘Problem’

Solution

Business Model

Intellectual Property and Structure

Competitors and Market Size

Risk to Capital [SWOT Analysis]

The Team Profile

History and Progress

Roadmap

Financials

The Ask

We'll be sure to help you ensure the business plan is clear and concise as part of our Advance Assurance review. However, to be sure you're prepared, check out our full content guide for the Advance Assurance application business plans.

In addition, HMRC has made some business plan templates available.How to address the SEIS/EIS Risk to Capital requirement in your business plan - a slide template

Whether you’re just starting your SEIS/EIS Advance Assurance, or completing your Compliance Statement, you should be aware of HMRC’s Risk to Capital Condition.

This condition was introduced by HMRC in early 2018, however from 8th October 2019 all applications for Advanced Assurance are required to directly address the Risk to Capital Condition.

In summary, the principles are that the company must have the intention to grow and develop and that the qualifying investment poses a significant risk of a loss of capital. There is no exhaustive list of factors that HMRC consider but they include:

Increasing number of employees

Sources of income

Assets

Subcontracting

Ownership/ Management structure

Marketing of the investment to potential investors

Fragmentation

You can make a slide similar to the one below to address the Risk to Capital directly in your business plan.

In the slide only address factors that apply to your business. And it’s a good idea to explain how these factors contribute to the risk of the investment and/or show the company’s objective to develop and grow.

If you find yourself in a grey area, or if you think something might negatively affect your application don’t try and hide this. And don’t worry too much if you’re in this position, HMRC don’t consider each factor individually but will look at all relevant factors and the overall context of the investment. For example, it might be that using an SPV, or subcontractors, is a standard practice in your industry or that despite having high value assets you do not intend to sell these for profit and they are required by your company to generate income.

When addressing the condition, you should analyse the strengths and weaknesses of your company proposition and how this contributes to a significant risk to capital investment. For example, the company might have an income-stream lined up, but this isn’t enough to protect the investment, and the company intends use the income to reinvest in the growth of the company and its infrastructure.

If HMRC believe that your company is at risk of failing this condition, they will inform you first, and will ask for more information on the relevant points. And if your application is rejected due to this there is a right to appeal.

If you are uncertain about the Risk to Capital or you have more questions on this topic, hit the chat button in the bottom right of this page and send us a message!What should and should I not include in my business plan for Advance Assurance

Your business plan can be anything given to potential investors.

What you should include:

Details of the Trading and other activities - this must be clear, concise, and understandable to someone with no prior knowledge of the industry.

Details of how the funds will be used : it must be for the growth of the Company.

Demonstrate that you meet the Risk to Capital condition - you can use the SWOT analysis for this (strengths, weaknesses, opportunities and threats).

Here is a more detailed article on the subject.

It should NOT include :

The Company cannot be a Partnership (LLP), and must not be Public

Any exit strategy: remove any reference of an exit strategy, HMRC don’t like to see this since it de-risks the business.

HMRC don't like to see Companies stating that they are eligible without them first receiving Advance Assurance.How long do HMRC take to approve SEIS/EIS applications?

For both Advance Assurance and Compliance HMRC can take as long 6-8 weeks, though we see ours being approved as fast as 1 week!

It seems that HMRC take on average 6-8 weeks to approve an SEIS or EIS application, for both Advance Assurance and Compliance.

They tell us that simple applications (simple in that the company hasn't been trading yes, there are no complex subsidiaries, etc.) are approved quite quickly, but EIS applications for millions of Pounds in Advance Assurance can take up to 8 weeks.

We're seeing typical approval times of 3-4 weeks for applications done using SeedLegals.

Reaching HMRC

There are two ways you can reach HMRC:

1. Email enterprise.centre@hmrc.gov.uk

Use the same email the application was originally sent with.

It may take 2 weeks for them to reply

2. Phone 0300 123 1083

They no longer have a direct line therefore you can leave a message and they will determine whether a call back is required.How do I follow up with HMRC on my SEIS/EIS application?

Follow up with HMRC on your Advance Assurance or Compliance application with these contact details.

When to follow up with HMRC on your application:

Please note, HMRC can take up to 7 weeks to respond to an Advance Assurance or Compliance application. Whilst this is usually much quicker, please wait for the 7 weeks prior to sending a follow up.

The next step would be to check any possible address HMRC may have sent a response to. This would include the registered address at Companies House, with an accountant, your spam folder etc...

That said, if there's still no sign of a reply, there's 2 ways to follow up:

1. By email

The best way to contact HMRC to follow up with your application is by reaching out to them over email.

The email address is enterprise.centre@hmrc.gov.uk

Please note that HMRC may take up to 2 weeks to reply to email follow ups.

2. By phone

Alternatively, HMRC also have a telephone answering machine. (This is no longer a direct line). You can leave a message, and they will determine whether a call back is needed.

The phone number is 0300 123 3440.

Please note, we generally see that emails are replied to faster than phone messages.What to do once you've completed your Advance Assurance

Congratulations! You've received your Advance Assurance, now it's time to raise.

Here are some useful resources to get you started:

How to find startup investors

Here are some of the VCs / Funds we work with closely

Active funds & angels in the space: Startup Funding in the UK

Database for VCs within our network (password: "nextround")

And finally, here's the database we have with some of the known angels groups and funds in the UK (password: "showmethemoney") - share your pitch link with them!

General tips for fundraising:

Pitch is our free product to share information with the investors you reach out to. Here is a step by step guide.

Attend and be active at events. Sign up for our Events newsletter here and find other events such as Paradigm Talks Events

Make sure you understand Agile Fundraising, EIS & SEIS, How to Value Your Startup Company and have perfected your pitch deck.

Don't underestimate the power of reaching out on LinkedIn / other socials and asking your network for introductions.

Use the help articles from SeedLegals as well as other resources.

Where to find investors? Here is another list of resources that several founders have shared:

Directory of active VCs

See the investor directory section on the Seedlegals website.

Here's RLC's article on active funds & angels in the space: Startup Funding in the UK

OpenVC provide a cool way to search VCs / Funds by what they invest in

AngelPath are facilitating investor outreach.

Sifted have lists of top investors in Europe, including Top female angel investors in Europe

SEIS fund calling for pitch decks

Gritt.io - Helping Founders Get Funded

Active investor list - Google Sheets

Investor Scout is an investor database of 37,000+ investors

Gen Z VCs

Airtable - No-Warm-Intro-Required Investor List

OpenVC | All VC firms by thesis. Radically free and open.

List of Venture Capital investors (mountsideventures.com)

Wholesale Investor - Venture Capital and Capital Raising Opportunities

The Investors Panel – theinvestorspanel.com

Angels Partners - Find business angels for your startup, connecting Entrepreneurs and Investors

Top tips:

Do your research: Make sure you reach out to funds / angels who invest in your industry and stage

On first outreach, keep it brief: If you send VCs a wall of text and a 50 page business plan, they're not going to read it. 3-5 key bullet points around growth/revenue to get them excited and a line about why you reached out to them should get more responses. You can always provide more detail after the first response.

Twitter/Medium/Notion: VC tend to be most active on these platforms.

Due Diligence

3 Easy Steps for Founders to do Investor Due Diligence | by Isabel Russ | Speedinvest | Medium

Once you have found an investor, it is always important to understand who they are, and do some research by:

Asking your current investors / network what they know about them

Checking on Landscape - Anonymous Investor Reviews

In depth due diligence - especially important for larger sums or investors you do not know much about - companies like THEMIS can help perform checks on investors. Let me know if you would like a personal intro to them.

Other resources:

Accelerators

Venture Capital Term Sheet Guide

Up & to the Right (U2R) have put together brilliant resources on raising capital and ensuring your pitch-deck is 100% ready.

Creating the Pitch deck is easy on SeedLegals

First 1000 users

Website Traffic - Check and Analyze Any Website | Similarweb

There's more detail in the articles linked above, which should be helpful. Also don't be afraid to reach out to your own network - you never know who else is active in this space, under the radar.SEIS/EIS Advance Assurance and Compliance - What's the difference?

Do I need Advance Assurance or Compliance?

The Seed Enterprise Investment Scheme [SEIS] and the Enterprise Investment Scheme [EIS] are two UK Government initiatives designed to help grow your business by offering tax reliefs to investors who buy new shares in your company.

The main difference between Advance Assurance and Compliance is the time at which each is done.

Before you start raising, you can request Advance Assurance from HMRC. Advance Assurance is obtained to show potential investors that your business qualifies for the scheme and that they will be able to claim a SEIS (50%) or EIS (30%) income tax relief on their investment.

Advance Assurance is not required by HMRC in order for you to raise S-EIS investment but is in place to give your investors confidence, and in fact, many would want to see this before investing. Plus, even if your investors haven’t asked to see Advance Assurance, it would be a good idea to have this in case they do further down the line or in case you bring investors on at a later stage in your round.

If you are certain your business is not an excluded activity and that your investors are eligible, then you could just submit a Compliance Statement after you close your round. This is the process to issue certificates to your investors so they can claim their tax relief.

Every Company will need to submit a Compliance Statement after their round closes, but not all companies will need to apply for Advance Assurance.The Control and Independence Requirement under SEIS/EIS Explained

If you're looking to raise SEIS/EIS and have corporate shareholders...

Complicated corporate structures such as Holding and Subsidiary Companies tend to put off investors and can create complications when it comes to SEIS/EIS tax relief. For these reasons we recommend just having a single Company registered on Companies House with the founders as shareholders in their individual capacity.

In this article we’re going to cover the SEIS/EIS rules around your company controlling another company or being under the control of another company or another company and person or persons connected with that company. We’ll also discuss how you could still qualify for SEIS/EIS despite these rules.

If you own a Holding Company and a Subsidiary then you should also have a read of I have a holding and a subsidiary company, what to do about SEIS - EIS?

The Control Test

SEIS

When it comes to SEIS companies must not at any time during Period A, defined as the period from incorporation to the third anniversary of the share issuance, control any company which is not a qualifying subsidiary of the company issuing shares. This applies to both companies that solely own another company and where the company together with any person connected with it own another company.

EIS

During Period B, defined as the period from the date of share issue to three years after, the company cannot control another company which is not a qualifying subsidiary.

‘Control’ is defined in the Income Tax Act as the power of any company or company and connected person by means of the holding or shares or voting power in any company, or as a result of any powers conferred to them by any document regulating the company, that the company’s activities are carried out in accordance with their wishes. The Income Tax Act sets 51% as the threshold for control. In short, if a person or a company or a person connected with a company own more than 51% in the other company then the control test will be met.

‘Connected Persons’ are persons connected in relation to a company if they act together to secure or exercise control in that company.

‘Qualifying subsidiary’ is a company that is owned by at least 51% of the investee company whereby the investee company directly or indirectly holds more than 50% of the ordinary share capital. There must be no other person which controls the subsidiary other than the Holding Company. This means that a qualifying subsidiary must satisfy the above test.

The Independence Test

The Independence test is the inverse of the Control Test.

SEIS

A company cannot qualify for SEIS if it is under the control of another company or of another company and any person or persons connected with that other company in Period A. So, it cannot be a subsidiary from the date of incorporation to the third anniversary of the SEIS share issuance.

Example: If Company A owns 51% or more of Company B at any time from incorporation to three years after the share issuance then Company B would not qualify for SEIS.

EIS

The company won’t qualify under EIS if at any time during Period B it is under the control of another company or of another company and any person or persons connected with that company.

The company must not be a 51% subsidiary of another company whereby another company must not directly or indirectly hold more than 50% of the ordinary share capital of the company.

Example: If Company A owns 51% or more of Company B at any time from the share issuance to three years after the share issuance then Company B would not qualify for EIS

The Exception

Under SEIS, for the purposes of Independence, HMRC ignores the ‘on-the-shelf-period’. This is defined as the period during which the issuing company has not issued any shares other than subscriber shares (at incorporation) AND has not begun to carry on, or make preparations for carrying on, any trade or business.

This means that if your company had a corporate shareholder from incorporation that owns 51% or more of your company but your company has only issued shares at incorporation and you are not yet trading or preparing to trade you would still qualify for SEIS. At this point we’d recommend transferring the corporate shareholder’s shares to individuals ahead of any share issuance.

Example: At incorporation a corporate shareholder received 51% shares in Company A along with the founders. The Company has not issued any more shares and has not yet started trading or preparing to trade. The Company then transfers shares from the corporate shareholder, so that it no longer owns 51% or more, prior to trading, preparing to trade or issuing new shares. Company A would then be SEIS eligible.

If your company does not qualify under SEIS because it fails either part of the test above it is possible that it can still qualify for EIS. Under EIS, the Independence Test only applies during Period B i.e. from the date of share issue to 3 years after. So if the company has issued shares other than subscriber shares or has started trading or preparing to trade it can satisfy the Independence Test for EIS if this is addressed prior to the share issuance.

Example: Company B has a 51% corporate shareholder and has already started trading or preparing to trade OR has issued more shares in the company. The company then transfers control away from the corporate shareholder before issuing EIS shares. Company B would then be EIS eligible.

You’re in safe hands

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Beautifully organised

Your company's core agreements, all in one place

Secure signatures

Share and collect signatures online via SeedLegals

Backed by real lawyers

Create the exact documents you need at every stage of growth

Serious about security

Your information stays safe and confidential in our secure system

Helpful humans

Talk to one of our friendly team anytime on live chat

Extra protection

Don't worry, our insurance covers claims related to our platform

We’ve helped over 60,000 companies

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories