Raising a glass to flexible fundraising: Shandy Shack’s road to exit

Discover Shandy Shack’s journey to a successful exit, made possible by SeedLegals’ flexible funding tools: SeedFAST and...

A seasoned business veteran, Oliver and his team turned to SeedLegals for help raise funding for his first startup. We helped Sweet Analytics close more than £1.4 million through two rounds and Instant Investment top-ups, saving thousands in legal fees*

Sweet Analytics is a customer data platform that provides a single, unbiased point of truth about offline and online sales to help businesses grow.

The company was founded by CEO Oliver Spark, after having worked in the retail industry for many years and realising that there were no great digital solutions in customer analytics. Sweet Analytics launched in 2018.

Startup life can be a challenge for even the most seasoned of industry veterans.

“I’ve held senior positions at several large businesses but this is the first startup I’ve done,” says Oliver Spark, CEO and founder of Sweet Analytics. “I went from being surrounded by lots of specialist experts who I could rely on for things like legals, to having to tackle many of those things myself.”

So, like many founders, Oliver had to grapple with a steep learning curve.

“Building a startup means dealing with challenges every single day, many of which you’ve never experienced before. So like many founders, I needed a bit of hand-holding in those early days.”

Thankfully, legals was one area Oliver didn’t have to worry about.

“Someone in my network recommended SeedLegals to me,” he says. “I’m very pleased they did. The platform has been incredibly straightforward to use, and the support team was always available. I felt confident the whole way through our first round of funding. And since then, we’ve raised a mix of seed and Instant Investment funding without any problems at all. I guess I didn’t need to be surrounded by a team of legal experts after all!”

1. Simplifying the legal process

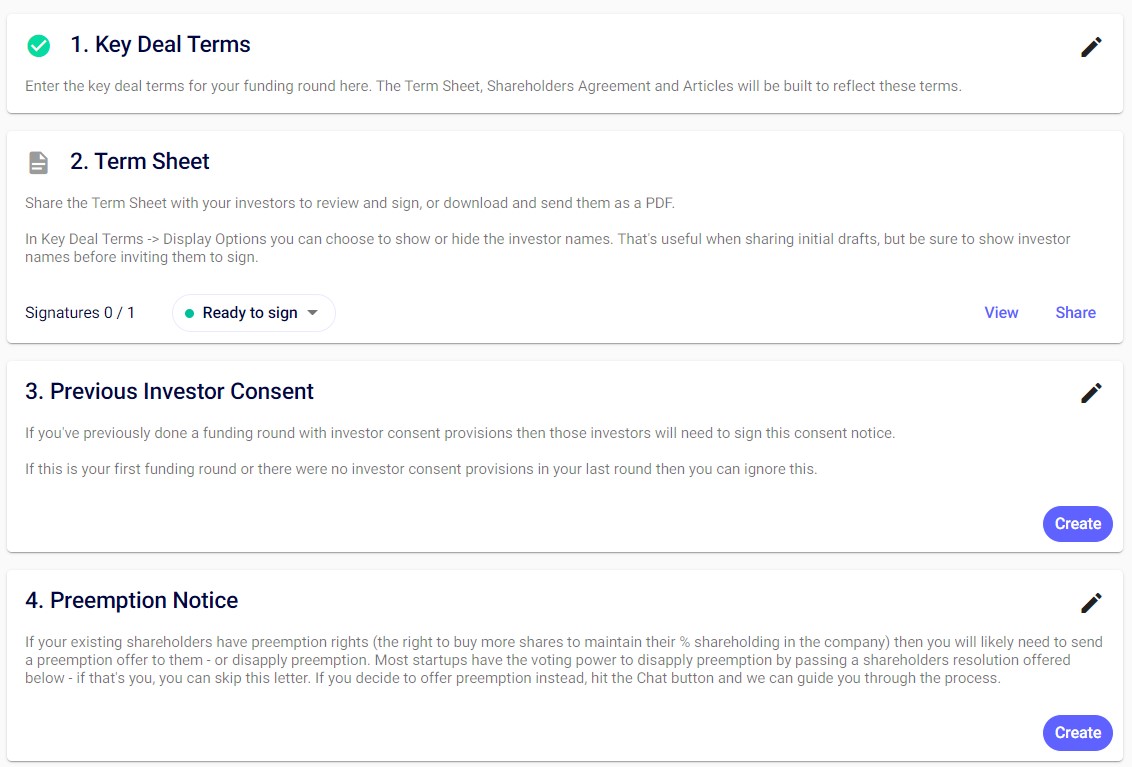

With SeedLegals, the process of getting your fundraising legals done is intentionally simple.

“If I had to describe SeedLegals in a word, it would be ‘easy’,” says Oliver. “Everything’s approached in a sequence of simple steps.”

This applies if you’re raising a traditional round of funding or using our Instant Investment service to raise lots of smaller investments over a period of time.

“I didn’t understand the process of top-ups (Instant Investments) at the beginning, but SeedLegals made it easy to understand. Now that I can raise money when the opportunities arise, it’s really boosted the company’s prospects.”

2. Saving time

Founders like building businesses, not getting bogged down in legal admin. So at SeedLegals, we’ve worked hard to streamline every part of our service.

“Time was a key factor when choosing SeedLegals,” says Oliver. “Fundraising can be such a long process and we didn’t want to spend more time than absolutely necessary. So we were really pleased to discover there were some real benefits to SeedLegals over using traditional lawyers.”

What benefits exactly?

“With lawyers, it doesn’t really matter how fast they are – they simply can’t beat how SeedLegals instantly generates contracts for you. You don’t have to wait around for days or weeks while someone else drafts them up. And if you want to change something, you can do so immediately with the investor in the room. It’s not only impressive, it’s really valuable.”

3. Offering employees share options in a few clicks

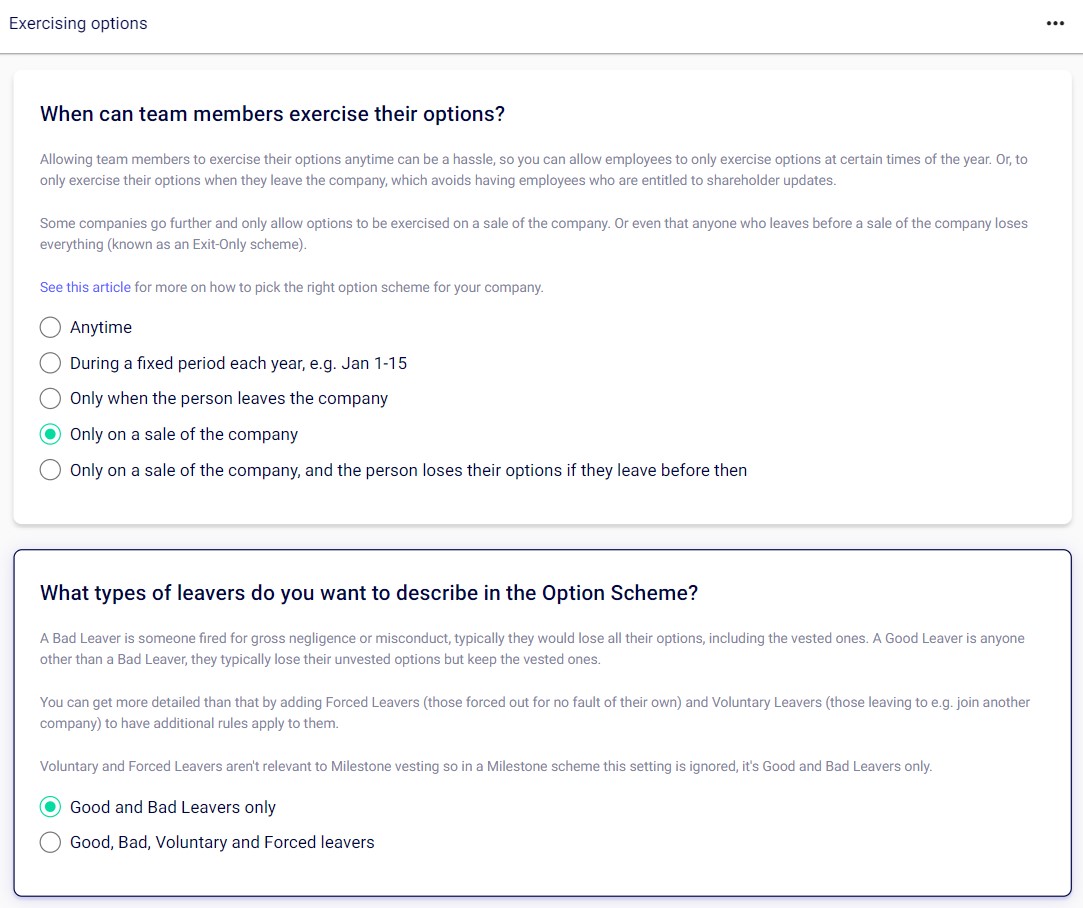

Startups often offer share options to help hire the best talent. So we’ve baked this into SeedLegals’ offering.

“I’ve done option schemes before,” says Oliver. “But this was the simplest process I’ve been through, by far!”

With SeedLegals, allocating share options to employees can be done in a few clicks. And you can customise those options for each of your employees.

“I was quite impressed how easy it was to set up. You can choose the share class and vesting schedule for each employee all from your dashboard. It’s worked out really well.”

Sweet Analytics closed more than £1.4 million using a mix of seed and Instant Investment funding, thanks to SeedLegals.

“The funding’s allowed us to survive!” says Oliver, jokingly. “But really, it’s helped secure a firm foundation upon which to build.”

With funding secured, the Sweet Analytics team has been able to focus on building their business.

“We’ve been developing some exciting new products, particularly around benchmarking. We also launched our self-serve platform, which has had a big impact on our customers.”

And Oliver has ambitious plans for the future.

“Something I’ve learned working on my first startup, is that you have no momentum,” he says. “You get up every day and have to make the whole thing happen. But since we got the fundraising done, we’ve been able to grow our team. Now the momentum is there, we need to build on it. I hope we’re just at the beginning of that hockey-stick curve, and we’re looking at doing another round of funding soon to capitalise on the great work the team’s been doing.”

We wish Oliver and his team the best of luck. Check out their website here 👉 https://sweetanalytics.com/

*We’ve estimated the money saved on legal fees by comparing the cost of using SeedLegals with the cost of using a law firm which, according to our research, will charge an average fee of 0.85% of the amount raised.

Talk to one of our funding experts to see how we can help. Book a call today!