EIS explained: the UK startup’s guide to the Enterprise Investment Scheme

Get investment-ready with this EIS guide. Find out what EIS is, what types of companies qualify and why it makes attract...

Knowledge Intensive Companies (KICs) are companies that are carrying out research, development or innovation at the time they are issuing shares. They have a special status under HMRC’s Enterprise Investment Scheme (EIS) which means they can raise more EIS investment, more flexibly, than non-KICs.

In this post, we cover the different EIS limits for KICs and explain when and how to apply.

SEIS/EIS Advance Assurance is the secret to getting investors on board. Use SeedLegals to apply and get approved fast.

Get startedUnder EIS, investors get various forms of tax relief as an incentive to support early-stage businesses. The goal of this scheme is to encourage the growth of innovative companies, so that they can succeed, go on to provide jobs and power the UK economy.

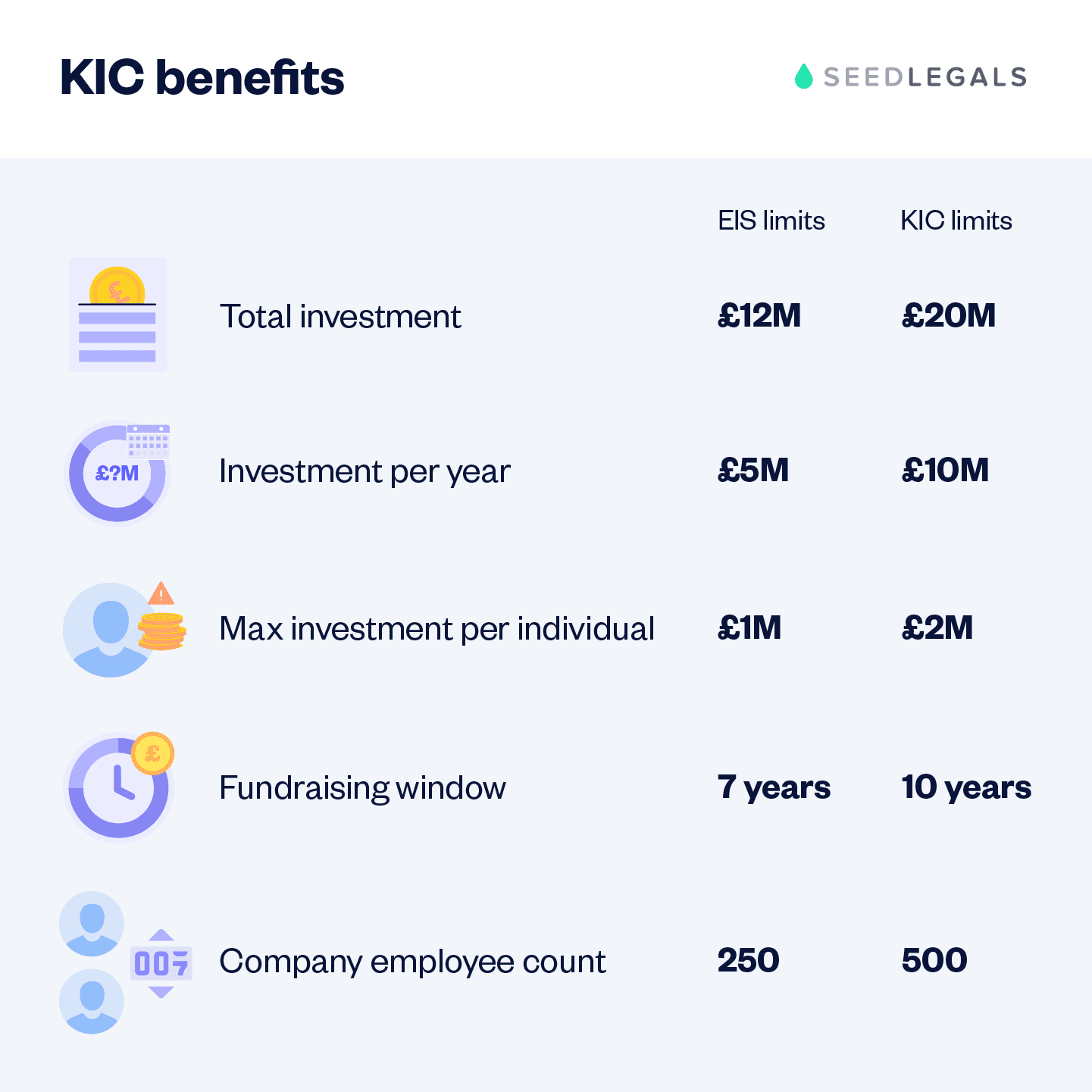

Companies that are ‘knowledge intensive’ get extra support under EIS. KICs can raise more money under EIS, for longer, to compensate for the money, effort, and risks they take creating new IP and fuelling innovation.

There are limits to the amount of EIS funding you can raise in a year and over the total lifetime of your company. As a KIC, you can raise:

Investors can claim more in EIS tax relief when they invest in KICs. Usually, the total amount an individual can invest and claim EIS tax relief on is £1M per tax year.

But, as long as the investor puts £1M towards KICs, they can invest £2M in a tax year across EIS-eligible businesses and claim tax relief.

Companies only have a limited window in which they can fundraise with EIS. It’s usually seven years from the date of your first commercial sale. As a KIC, you have 10 years.

Zlatina TrifonovaIf it’s been more than seven years since your first commercial sale – and you qualify as a KIC – you can take the date when your annual turnover surpasses £200,000 as the start of your fundraising window.

Here’s an example:

1. Company X had their first commercial sale in 2015

2. X’s annual turnover only reached £200K in 2020

3. X is applying for KIC status because technically, they’re outside the seven-year limit for EIS (this would have been in 2022)

4. However, in their application, X asks that the 10-year KIC limit starts from the £200K turnover date. So they have 10 years from 2020 to raise EIS investment, instead of 10 years from 2015.SEIS/EIS Specialist,

KICs can have a maximum of 500 full-time employees, whereas other types of companies must have no more than 250 full-time employees.

If you’re already working on product development, or raising funding so that you can work on product development, you might qualify as a KIC.

As set out in the government’s rules, at the time of the investment a Knowledge Intensive Company must meet:

and

To get the extra KIC benefits, at the time of issuing the EIS shares your company must meet either:

or

To see what documents you need to submit to prove you meet either condition, jump down to the section on the evidence you need for your KIC application.

There are also rules specifying how much of your overall operating costs you spend on research, development or innovation. These rules depend on how old your business is.

If your company is three years old or older

You must have spent (at least) the following percentages of your operating costs on research, development or innovation:

If your company is less than 3 years old

You must spend (at least) the following percentages of your operating costs on research, development or innovation:

KIC status isn’t use-it-or-lose-it. You can raise as normal under the SEIS and EIS schemes and only get certified as a KIC at the point where you need the extra flexibility.

In general, HMRC won’t confirm on a speculative basis whether they’ll accept your KIC status. Instead, they’ll only consider your KIC application at the point where you have a specific investment on the line that falls outside the usual EIS limits.

Zlatina TrifonovaKIC applications are complicated because HMRC asks for a lot of additional information and evidence and subjects your application to extra scrutiny, because of the extended benefits that companies get.

If you don’t need KIC status right now, we usually suggest that companies don’t go to the effort of applying for it. After all, you can always submit another Advance Assurance or Compliance application if and when you do need it.

If you do need to rely on KIC status to close an investment, then we recommend applying for KIC status through Advance Assurance before taking the money. You and your investors want to avoid a situation where you take in funds assuming they’ll qualify for the extra KIC benefits, only to be refused during Compliance.

SEIS/EIS Specialist,

As part of a KIC application, you will need to submit proof of how you meet the innovation/skilled employee condition and the operating cost conditions.

The evidence you need to show includes:

Finally, to tie it all together, you should write a separate letter explaining how you meet these conditions.

If you apply for Advance Assurance through SeedLegals, our specialist team reviews all your documentation to help you build the best case possible for KIC approval.

Boost your cash flow by claiming back money you spend on research and development.

Learn more

Questions about the KIC criteria? Or what you need for your Advance Assurance application? Choose a time to speak to the SeedLegals team, and we’ll help you get your EIS sorted.

Article sources

gov.uk | Venture capital schemes – accessed 14/07/23

gov.uk | HMRC internal manuals | Venture capital schemes | vcm8162 – accessed 14/07/23

gov.uk | Use the enterprise investment scheme eis to raise money for research, development or innovation – accessed 14/07/23