SEIS investment funds: 35 active UK funds in 2025

Find funding for your startup with our guide to 35 of the most active SEIS funds in the UK. From food to fintech, there’...

SEIS/EIS Advance Assurance reassures your investors that they’ll get tax relief in return for supporting your company. That makes it a very useful tool in your talks with potential investors. In fact, by our calculations, two thirds of angel investors won’t even consider investing in companies that don’t have their SEIS/EIS Advance Assurance.

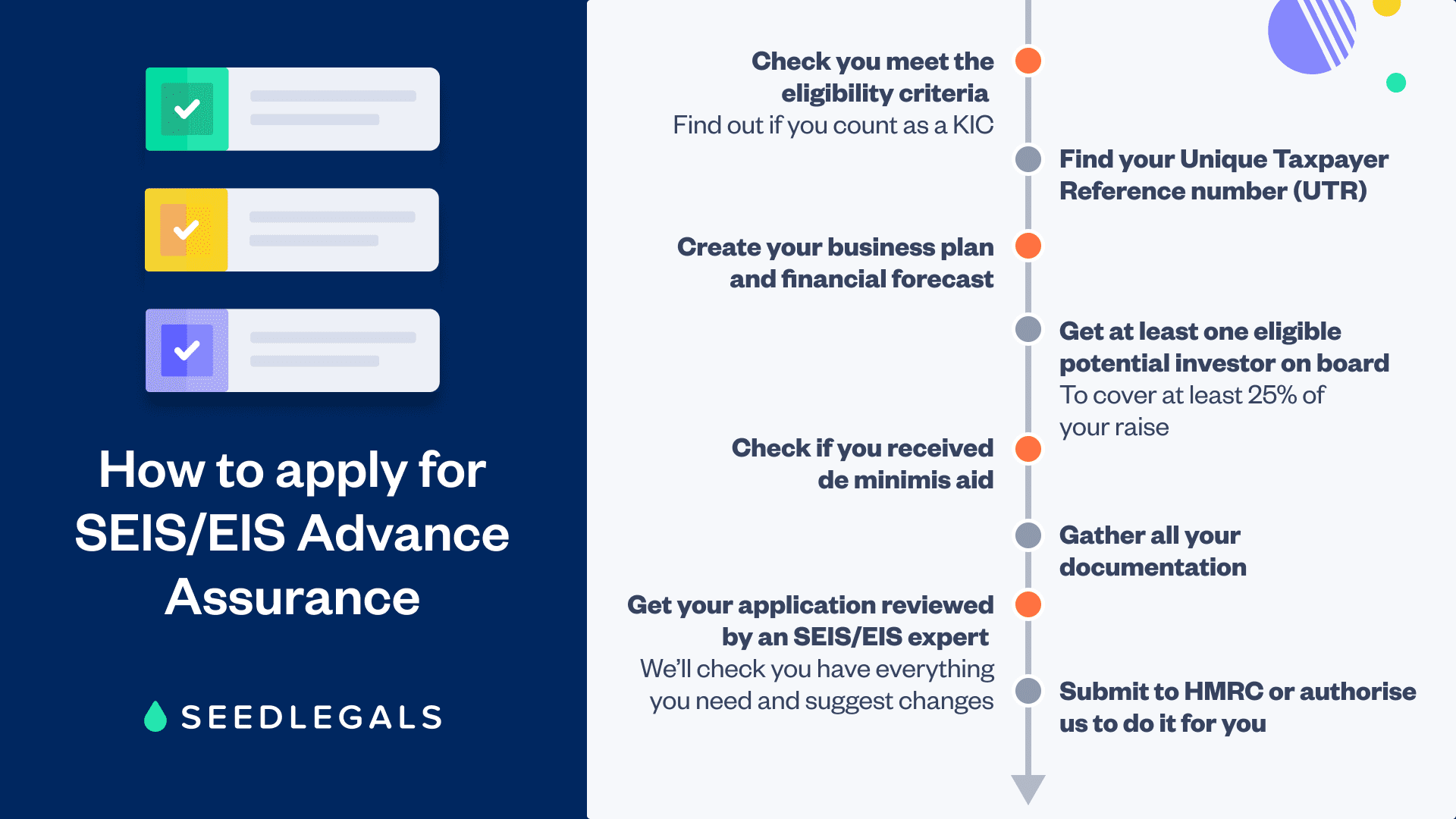

In this post, we’ll explain the steps involved in creating your application, the documents you need and the mistakes to avoid.

The Seed Enterprise Investment Scheme (SEIS for short) and the Enterprise Investment Scheme (EIS) are two of the UK government’s venture capital schemes.

These schemes reward private investors who invest in early-stage companies by giving them tax relief on their investment.

These schemes are so popular in the UK startup scene that many investors expect companies to be pre-approved by HMRC before they consider parting with any money. The pre-approval is called Advance Assurance.

At SeedLegals we’re experts at helping UK startups secure SEIS/EIS Advance Assurance from HMRC. We know it can be hard to navigate what’s needed for a successful application, especially considering that any mistakes mean you have to reapply which can set back your funding round weeks or even months.

To help you get started, we put together this step-by-step guide on how to apply. We update this post regularly so you know it’s always up-to-date with the latest SEIS/EIS application rules from HMRC.

Make your startup dramatically more investable. Use SeedLegals for your SEIS/EIS Advance Assurance and get approved fast.

Get started

SEIS and EIS are designed to support newer, and riskier, companies by making it more attractive to invest in them.

For this reason, your company has to be under a certain size and stage of development to qualify. You can find full details about the eligibility criteria in our guide to SEIS and EIS. Here’s a quick summary of the most important current* eligibility criteria:

SeedLegals CEO Anthony Rose explains how to make the upcoming SEIS changes work for you, starting right now.

Get Anthony's insightsAs well as the above, your company might not be eligible for SEIS or EIS if your company directly operates in any of HMRC’s excluded activities. The excluded trades include:

Your level of involvement in the excluded activities affects whether or not you can still qualify for SEIS/EIS. To be disqualified, a substantial percentage of your trade activity (more than 20%) has to be in the restricted area.

You also need to be directly providing the restricted services to be disqualified from SEIS/EIS. So, for example, you could still qualify for SEIS/EIS if you’re building a SaaS technology platform for financial services companies, so long as you don’t directly handle money or bear any financial risk.

Applying for EIS Advance Assurance? If you qualify as a Knowledge Intensive Company (KIC), you can raise more, with greater flexibility, under EIS.

You could be a KIC if you:

If you think that could be you, it’s worth being aware of the benefits which are:

If you don’t need those extra EIS benefits straightaway, you don’t need to worry about proving your KIC status immediately. You can apply for KIC status later when you need it.

You’ll need your company’s 10-digit Unique Taxpayer Reference (UTR) number to apply for SEIS/EIS Advance Assurance.

You should have automatically been sent your UTR when you registered with Companies House. If you can’t find it, you can request it online. This process can take about a week so it’s good to find this number before you start your Advance Assurance application.

For your SEIS/EIS Advance Assurance application, you need to include a 3-year business plan and financial forecast at the same level of detail that you would ordinarily provide to investors – like your pitch deck.

The materials you’ve created for investors are a great starting point. But there’s an important difference between your investor-facing business plan and your HMRC-facing business plan. To qualify for SEIS/EIS, you have to show how your startup meets the risk to capital condition.

The clearest way to make sure you’re ticking HMRC’s risk to capital box is to include a brief SWOT analysis and focus on the weaknesses of and threats to your business. It’s a good idea to explain how these factors contribute to the risk of the investment and/or show the company’s objective to develop and grow.

Zlatina TrifonovaIt’s important to remember that HMRC do not want to see the same things as your investors. Actually, it’s pretty much the exact opposite! HMRC wants to see the risks to your business and its likelihood to fail (as a new company), and not your potential grand success.

When you apply for AA through SeedLegals, we’ll check your business plan or pitch deck in detail (like we do all your supporting documents) so you can be confident you’re covering everything you need to.

SEIS/EIS Specialist,

If you haven’t raised funds under one of HMRC’s venture capital schemes before, you need to include the name and details of at least one investor who is – in theory – committed to invest 25% or more of your raise.

This is a bit of a chicken and egg situation, because you need to know who your investors are to obtain Advance Assurance. But investors will often only commit to investing after you have obtained your Advance Assurance…

The good news is that the investor names and amounts aren’t locked in at this stage, and you can change them at any time. But don’t make something up or give someone’s name without their consent. Find investors who are, on balance, likely to invest – even if they’re only a soft commitment at this stage.

If you’ve received any de minimis state aid in the past three years, this counts towards the SEIS investment cap of £250,000.

De minimis aid usually comes from government or university grants.

Whether or not the aid you received counts as de minimis is judged on a case by case basis. The body awarding the aid or grant usually makes it clear at the time of issuance if it’s classed as de minimis aid. So, double-check the comms that came with the money or check with the body that awarded you the grant, and if it’s de minimis, simply add the details to your application.

Our handy SEIS/EIS AA checklist helps you make sure you’re ticking off everything you need for a speedy approval.

Download checklistIn your Advance Assurance application, you’ll need to demonstrate that you fulfil the SEIS/EIS criteria. You’ll need to provide:

You’ll also need these supporting documents:

When you apply through SeedLegals, our experts carefully review all your documents to verify you have everything you need to successfully obtain your Advance Assurance.

Zlatina TrifonovaIn your pitch deck, remember to be very clear about what your trade is and how exactly you generate revenue. Often founders get so wrapped up in their brilliant ideas that they assume HMRC have the industry knowledge to understand them – but this is not always the case. Clarity is key!

SEIS/EIS Specialist,

After you’ve gathered all your documents and information, you can apply directly through HMRC using their online portal.

You can also create your application with SeedLegals. Our combined expert support and automated workflow help to streamline the process. Our SEIS experts are with you every step of the way and can guide you through the process from start to finish – unlimited support is included at no extra cost.

At the end of the process after your documents are finalised, we’ll also submit on your behalf to HMRC.

Not sure where to start with your SEIS/EIS Advance Assurance application? Need help with your docs? Our SEIS/EIS team of experts is here to help. Book a call with a friendly member of the team to get your application on track.