What are SEIS & EIS? The essential guide for UK startups

SEIS and EIS are UK tax relief schemes that reward investment in early-stage startups. Find out if your company is eligi...

SEIS and EIS Advance Assurance helps you attract angel investors and VCs by reducing their risk. Our team can help you get approved fast.

of UK angel investors only invest in SEIS/EIS eligible startups.

success rate through SeedLegals vs. 62% industry average (HMRC stats)

Find out why founders use SeedLegals to certify their SEIS status. Our CEO Anthony Rose explains what SEIS is, why it’s so important and how you can use it to attract investment.

Investors in qualifying startups can claim huge tax benefits with SEIS and EIS. Are you a founder looking to make a compelling case to investors? Or an investor exploring tax-saving opportunities? Just enter the investment amount, forecast the return and see how SEIS/EIS can maximise your potential gains.

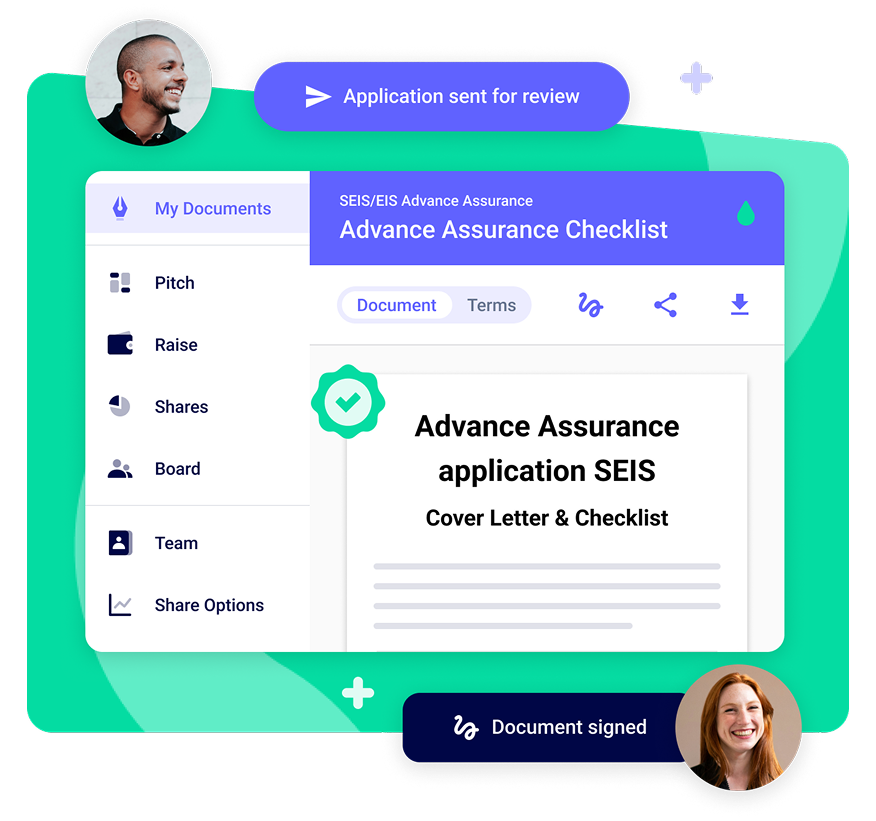

Get your SEIS/EIS Advance Assurance application handled by the experts. We generate your completed application, check it’s ready to go and submit it to HMRC for you.

Answer questions to quickly build your application

Answer questions to quickly build your application Get a full review from SEIS/EIS experts

Get a full review from SEIS/EIS experts Submit through SeedLegals in one smooth end-to-end process

Submit through SeedLegals in one smooth end-to-end process Based outside the UK? We can help you apply

Based outside the UK? We can help you apply

We make sure your application complies with the latest HMRC guidelines (even the ones they don’t tell you about!) to get you the most reliable approval possible.

Get your application right first time

Get your application right first time We act as your agent with HMRC and handle all comms

We act as your agent with HMRC and handle all comms All your SEIS/EIS documents securely stored, ready for SEIS/EIS Compliance

All your SEIS/EIS documents securely stored, ready for SEIS/EIS Compliance

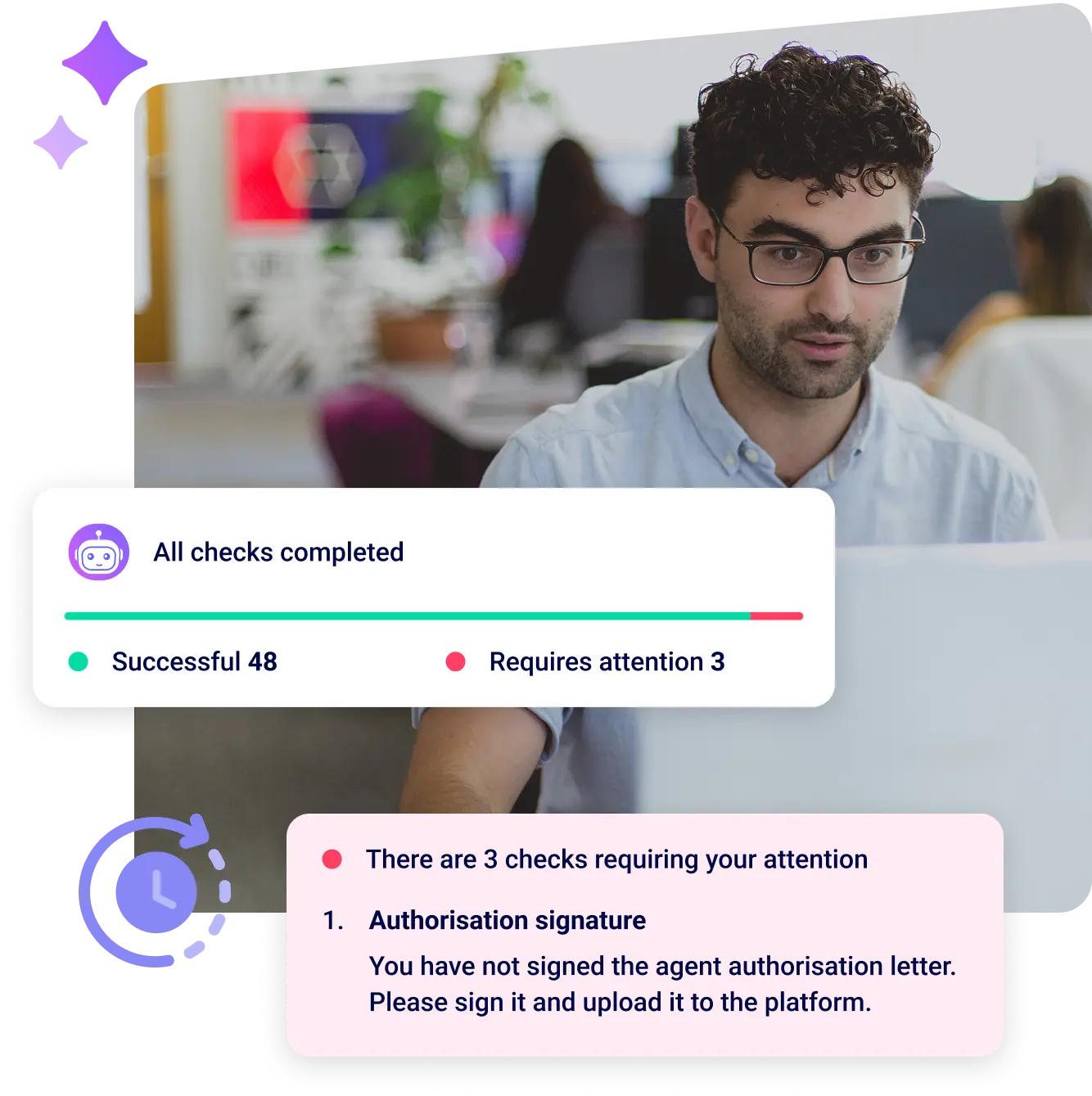

Our AI performs the initial review, running 50+ checks in minutes. This lets you fix simple errors instantly, so our team can focus on what matters.

Get instant, AI-powered feedback

Get instant, AI-powered feedback Keeps dates, share classes, and your cap table consistent

Keeps dates, share classes, and your cap table consistent Keeps the process quick, clear, and compliant

Keeps the process quick, clear, and compliant

SEIS and EIS are UK tax relief schemes that reward investment in early-stage startups. Find out if your company is eligi...

Make your company more attractive to UK investors - startups from France, Germany, Spain, the US or anywhere can qualify...

Founders guide to SEIS. Find out how it helps startups and investors, eligibility criteria, how to get Advance Assurance...

Frequently asked questions about SEIS/EIS Advance Assurance

Do I need SEIS/EIS Advance Assurance?

Do I need SEIS Advance Assurance or EIS Advance Assurance?

How do I find out if my company is eligible for SEIS and/or EIS?

My company isn't based in the UK. Can I still benefit from SEIS/EIS?

What are the changes to SEIS from April 2023?

Why should I apply for SEIS/EIS Advance Assurance through SeedLegals?

How long does Advance Assurance take?

What documents do I need for the application?

Do I need to create a new business plan for my SEIS/EIS application?

What are the excluded activities that stop my company from being SEIS/EIS eligible?

We incorporated over 2 years ago, can we qualify?

Why do I need to give the details of a potential investor?

How long does SEIS/EIS Advance Assurance last?

SEIS and EIS for Film & Television production companies

Introduction to SEIS & EIS for foreign / non-UK companies

What is Trading for SEIS or EIS?

How to address the SEIS/EIS New Qualifying Trade Requirement

What level of commitment do we need from investors to apply for Advance Assurance?

S-EIS Existing Shareholder Requirement

Can my mother / brother / child / divorced partner get SEIS/EIS?

SEIS/EIS Rules for Investor Directors

Is Your Business a SEIS or EIS Qualifying Trade?

How to check you meet the SEIS - EIS Gross Assets requirement?

How long do I have to be SEIS eligible?

I have a holding and a subsidiary company, what to do about SEIS - EIS?

How can I qualify as a Knowledge Intensive Company for EIS?

Where can I find my UTR Number?

Common mistakes to look out for in your business plan

What business plan is needed for my SEIS/EIS Advance Assurance application?

How to address the SEIS/EIS Risk to Capital requirement in your business plan - a slide template

What should and should I not include in my business plan for Advance Assurance

How long do HMRC take to approve SEIS/EIS applications?

How do I follow up with HMRC on my SEIS/EIS application?

What to do once you've completed your Advance Assurance

SEIS/EIS Advance Assurance and Compliance - What's the difference?

The Control and Independence Requirement under SEIS/EIS Explained

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Your company's core agreements, all in one place

Share and collect signatures online via SeedLegals

Create the exact documents you need at every stage of growth

Your information stays safe and confidential in our secure system

Talk to one of our friendly team anytime on live chat

Don't worry, our insurance covers claims related to our platform

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories