What are Unapproved share options?

Unapproved share options are the more flexible, but less tax-advantageous, way to grant equity to your team. Find out ho...

Share options schemes are a popular way to attract, retain and incentivise employees. Thousands of UK startups use share options schemes to build and grow their business every year.

In this article, we’ll explain what share options are, the different types of share option schemes and how to set up a scheme for your company. We’ll also look at the tax implications of share options and how to make your share scheme cost-effective.

To share equity with your team, you can offer them shares or share options. What you decide to offer will depend on your company and the contribution your team member will make – either way, it’s important to understand the difference between shares and options:

Read more in our post: Shares vs options: what’s the difference?

A share option scheme is a way to distribute share options to employees, advisors, freelancers and consultants. Team members who receive share options can exercise their options at a later date and convert their options into shares and own equity in the company. Giving share options can be a great way to motivate your team – it gives them a personal interest in the success of your company.

There’s a lot to consider when it comes to setting up your share option schemes, such as how much equity to give employees or how much equity to give advisors and which option scheme is right for you.

It’s a tricky balance for founders. How do you decide how much equity to give away when you don’t yet know how much value option holders will bring to your company? The brilliant thing about share option schemes is that you design your own. You can make your scheme work in the best interests of your company and your employees by setting the parameters and customising the terms to fit your company exactly. It’s a neat, controlled way to reward your employees and helps you avoid giving away too much equity too soon.

Motivated, talented employees play a major part in your success, so making your company a rewarding place to work is in everyone’s best interests. Here’s how offering share options can be a big advantage, not just to your team but to the company as well:

You can give share options to employees, advisors and consultants – and even customers and influencers too.

The optimal time to set up an options scheme is when you want to do one or both of these:

1. Raise funds

Set up your scheme before a funding round to become more attractive to investors. You might want to consider getting your EMI valuation at least three months before you start to fundraise so that you can get a low strike price for your future employees.

Read more in our post: When is the right time to put an EMI Scheme in place?

2. Grow your team

If you have your options scheme in place before you hire, you can highlight this perk for employees to attract job-seekers.

Anthony RoseYou don’t need to have an option scheme to offer share options.

When you hire people, you can create an Employment Agreement on SeedLegals, including terms that promise them share options. Then, when you’re ready, you can create your option scheme on SeedLegals.

You can do the same for freelancers, consultants and advisors – for them, use our Consultancy Agreement or Advisor Agreement.

CEO and Co-Founder,

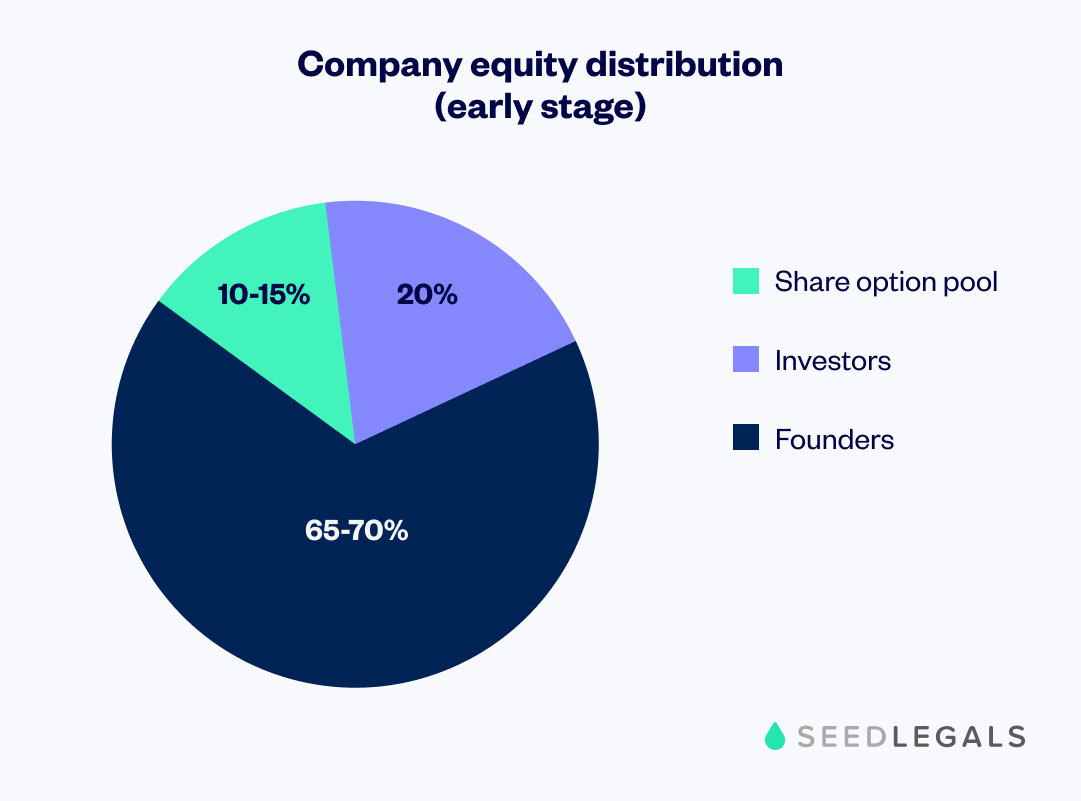

To set up a share option scheme, you’ll need a share option pool. A share option pool is a percentage of equity that you set aside for your share option schemes. The average size for share option pools in the UK is 10 to 15% of total equity. You can give options to employees, advisors, consultants as well as customers and influencers – all from the same share option pool.

Read more in our post: How to size an employee option pool

‘What’s the best type of employee share scheme for startups?’ This is a question we’re asked all the time. Our answer is simple: an EMI option scheme is the best for giving options to UK-based, full-time employees. This is because it’s the most tax-efficient scheme for both companies and employees.

Hit the chat button (lower right of this screen) and a member of our experienced team will be in touch with answers.

There are two types of share option schemes that are the most useful for UK startups:

This type of scheme is backed by HMRC and designed for UK-based PAYE employees who work for your company for at least 25 hours a week or 75% of their working hours. The EMI scheme has significant tax advantages for both the employee and the company. Below, we’ll explore how tax works for share option schemes.

Mo SaedAn EMI scheme allows you to price your options at a much lower valuation (80% lower) compared to the valuation you’ll use to sell shares to investors. This helps to maximise the gain for employees. It’s seen as a risk-free investment because they’re paying the lowest possible price for shares that are worth a lot more in the market.

Share options expert,

Employee tax benefits – your employee won’t pay Income Tax or National

Insurance Contributions when the options are granted. After exercising their options and holding the shares for over two years, they may qualify for Business Asset Disposal Relief, which reduces Capital Gains Tax from the standard rate (currently 24%) to 14% on qualifying gains.

Employer tax benefits – you get a Corporation Tax deduction on the difference between the market value of the shares at exercise and what your employee pays for them.

Set your own terms – you can protect your company by choosing

exact terms for vesting and exercise provisions. Bear in mind that there are some constraints on when the option can be exercised to benefit from the EMI treatment.

Limited EMI options value – you can only grant up to £3M of EMI options in total and up to £250,000 to an individual. This limitation on the value of options is why it’s important to set up your EMI scheme early and get the best valuation possible.

Restricted to UK full-time employees – not available to employees based outside the UK or non-PAYE team members, like consultants, advisors and contractors.

Extra admin – as well as agreeing the valuation and exercise price with HMRC upfront, you have to register every option grant within 92 days. This can be a headache, but if you set up your scheme through SeedLegals we’ll give you all the support you need to keep everything compliant.

This scheme is for everyone the EMI scheme doesn’t cover and for companies that aren’t eligible for an EMI scheme. An unapproved scheme is perfect for giving options to employees abroad – we explain more in How to give share options to overseas employees.

Unapproved scheme pros

Flexibility – you’re free to set an exercise price and there’s no limit to the number or value of the options you can grant in total or to an individual.

Less admin – don’t have to go through a valuation process with HMRC.

Set your own terms – you can protect your company by choosing exact terms for vesting and exercise provisions.

Unapproved scheme cons

No tax benefits for employees – there is no special tax treatment for unapproved option holders.

No tax benefits for employers – there is no special tax treatment for companies.

While other HMRC-approved option schemes are available, they don’t offer either the tax benefits of the EMI or the flexibility of an unapproved scheme.

Companies that don’t qualify for an EMI scheme could consider growth shares. This type of shares only have a value when the company’s share price goes over a certain amount. Growth shares are a way to incentivise employees with equity either without an option scheme or separately from your option scheme.

Read more in our post: Growth shares: what are they and should you issue them?

1. Check eligibility

If you want to set up an EMI scheme, the first step is to find out if you’re eligible.

Your company is eligible for EMI if:

Your employee is eligible for EMI options if:

For the unapproved scheme, there are no eligibility requirements from the government. However, if you’d like to set up an Unapproved Scheme on SeedLegals, to be eligible, the option holder has to be an employee, director, advisor or consultant at the time of grant (past employees, directors, advisors or consultants who don’t currently provide services to the company are not eligible).

2. Create an option pool

You need to agree on the option pool size with your shareholders and investors. It’s usually 10-15% of the shares in the company.

3. Get your HMRC valuation (EMI only)

Register your scheme with HMRC and submit your EMI valuation. This contains a proposal for the price your employees will pay to exercise their options.

4. Set your terms

Decide which vesting and exercising rules you want to include in your scheme. If you’re using SeedLegals, decide whether you want to use time-based or milestone-based vesting.

5. Grant options

If you use a digital platform like SeedLegals, it’s easy to get everything signed and to issue options certificates.

6. Notify HMRC about the grant

You must notify HMRC within 92 days of the date you grant EMI options, and unapproved grants to UK tax-paying employees and directors need to be notified as part of your annual report due by 6 July.

In practice, many companies use both an EMI scheme for their full-time UK-based employees and an unapproved scheme for anyone who falls outside the eligibility criteria, such as anyone outside the UK or consultants, advisors and non-executive directors.

EMI schemes are the most tax-efficient share option scheme for UK employees and employers. Below we explain how tax works for EMI and Unapproved options:

Employees don’t need to pay Income Tax or National Insurance Contributions when EMI options are granted. And, assuming they exercise their options at the pre-agreed valuation with HMRC, those taxes are not due on exercise either.

When they later sell their shares, they may qualify for Business Asset Disposal Relief, which reduces Capital Gains Tax from the standard rate of 24% to 14%, provided they’ve held the shares (including time under option) for at least two years.

With an EMI option scheme, when your employee exercises their options your company can claim a Corporation Tax (CT) deduction equal to the financial gain of your employee. This gain is the difference between the market value of the shares at exercise and the amount your employee pays for them. It’s essential to consult your accountant or tax advisor to ensure the valuation and structure of your option grant are correctly handled. This helps avoid the risk of unexpected tax liabilities for either the company or your employees.

With the unapproved scheme there are no tax benefits for employees or companies. The only advantage is that tax is delayed until shares are exercised – your options holders don’t owe any tax when you grant their options.

This depends on how you choose to go about it. There are two ways:

If you choose to hire accountants or lawyers, it usually costs upwards of £5,000 for one scheme, plus extra admin fees.

At SeedLegals we offer personalised help from our experienced team alongside all the tools and documents to set up your scheme – automating the legal admin means our pricing is very efficient.

With SeedLegals, you can fix your options costs for the year at just £2,490 per year.

This includes:

Find out more:

Has your company offered you share options? In this must-watch video, Anthony Rose, CEO of SeedLegals, explains what share options are, how options vest and exercise work, how to work out how much your options might be worth, the tax advantages of EMI options, and more.

If you’ve got questions about how to set up a share option scheme, book a call with one of our experienced team to get answers fast.