In case you missed it: January 2023

We’re only one month into 2023 and the new services keep on launching at SeedLegals. Here's what’s new for January 2023...

This month, we’ve launched our Exit service, added option schemes to our services in Ireland and improved SeedLegals for investors.

Read on to find out more about these launches, plus other updates and what’s coming soon.

What’s new for founders

What’s new for investors

Coming soon

We’re making it as easy to sell your company on SeedLegals as it is to do an SEIS funding round.

When you’re ready to sell your startup, our Exit service includes all the documents you need – from the Heads of Terms and Share Purchase Agreement to the J30 and new share certificates – with unlimited support from our friendly experts.

Find out more: SeedLegals Exit – Sell your business

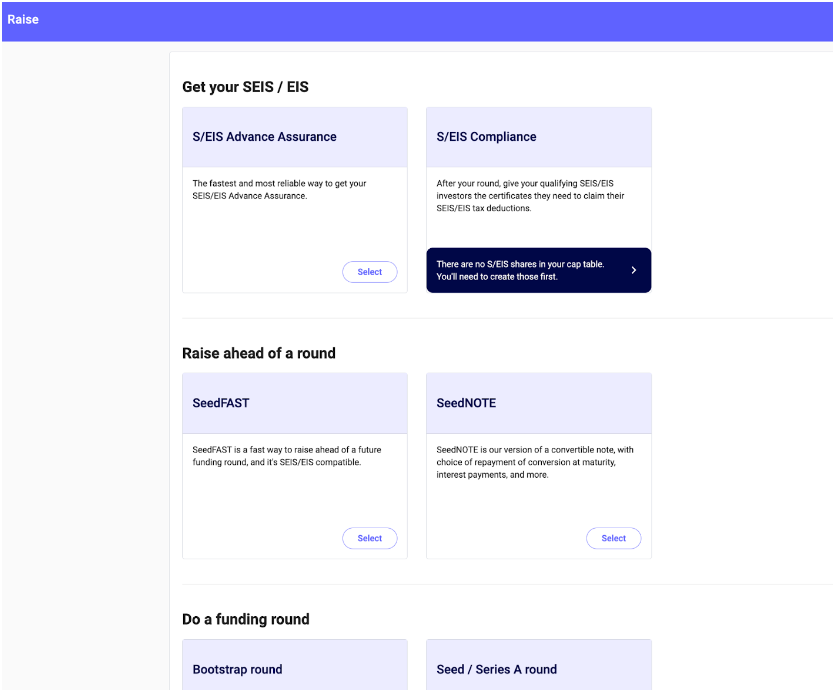

When you log into SeedLegals, you might have noticed the Raise page now contains cards displaying what we offer. We redesigned the page to make it easier to find the service you need. We hope it’s especially useful for first-time fundraisers to get to know how we can help.

Can’t see the cards? If you’ve already done or recently started fundraising on SeedLegals, you’ll see a page showing your fundraise, without all the other cards. To start another fundraise – for example, if you’re doing a funding round but want to create a SeedFAST – click the Create button at the top right of your screen. Then you’ll be able to see the cards showing all our fundraising services.

You can now create growth shares when you do a funding round on SeedLegals.

How to offer growth shares

We automatically update the corresponding wording in your Articles of Association.

Read more about this type of shares in our post:

Growth shares: what are they and should you issue them?

If you aren’t planning to do a funding round, we can help via our General Counsel as a Service. To find out more, book a free call.

We’ve improved our option schemes so you now have more flexibility when you need to stop the vesting for an individual option holder.

When you need to do this, we’ll automatically calculate how many more options the person should get based on the time left in their vesting schedule. Then, you can decide if you want to accept this amount, or offer them more or fewer options.

For example, if a leaver has over–performed in their role, then you might want to offer more than the automated calculation, as a gesture of goodwill. Or if someone is leaving because of misconduct, we recommend giving them no options at all – and you can now choose exactly how many options to offer them.

What happens to a leaver’s unallocated options? Any options you’d allocated to the leaver but which haven’t yet vested will go back into the option pool.

Just launched on SeedLegals Ireland: Irish companies can now set up and manage share option schemes.

An option scheme can be your secret weapon to attract, retain and incentivise employees, advisors, contractors and freelancers. To help you offer options to your team in Ireland, in the UK or overseas, we’re offering both our Unapproved and EMI schemes.

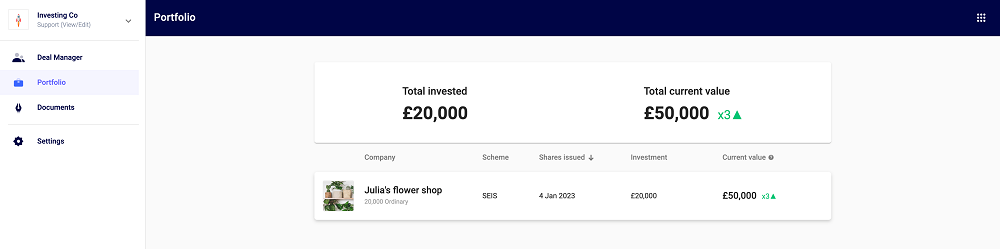

Brand new at SeedLegals for the start of March, we’ve just launched a version of SeedLegals especially for investors. Currently it’s being beta tested by investors who already use our Deal Manager – but it will be available to all investors very soon.

To create an investor login, here’s the URL you’ll need:

invest.seedlegals.com

With an investor account, you can view your shareholdings and documents for your entire portfolio of investments made on SeedLegals – of course, you could always do this but what’s new is that it’s now much easier to see the information all on one screen. Beautifully organised, and much faster to find the details you need.

Our SEIS/EIS compliance service already makes it easy for you to give your investors what they need to claim their tax relief. But coming soon in March 2023, our service will improve to save you even more time.

We’ll be able to act as your agent so we’ll communicate directly with HMRC for you. Our SEIS and EIS specialists will look after the compliance process with HMRC on your behalf, from start to finish.

No need to email HMRC yourself, we’ll take care of it and email you when it’s all confirmed. All you’ll need to do is click the button on SeedLegals to share the compliance certificates with your investors.

Got an idea for us? Is there something we can do better? We love to hear your feedback – good, bad and ugly. Let us know by email: hi@seedlegals.com

If you aren’t already a SeedLegals member, head over to our Pricing page to find the right membership for your company.

Main image adapted from an image by Freepik

Learn and be inspired at our online masterclasses, webinars and in-person meet-ups. Don’t miss our weekly email listing events for founders.