Introducing SeedLegals for Investors

Manage your deals, view the value of investments, send term sheets, negotiate online and complete deals even faster. Her...

Want to invest in a startup but not sure how to begin? Maybe you’ve already invested but want to improve how you find and close deals. In this step-by-step guide, we’ll walk you through the most important things to know about investing in startups.

1 week. 5 lessons. Expertise from thousands of startup investments.

Sign up nowWatch this first. SeedLegals CEO Anthony Rose explains what to look for in startup founders and their pitches.

There are several ways to invest in startups. In this article, we’ll focus on angel investing but it’s good to know about the other options so you can explore those and decide what’s right for you.

Angel investing

Angel investors are private individual investors who invest directly in startups. Angels often bring their expertise, network and mentorship to the investment alongside capital.

Crowdfunding

Individuals invest small amounts into a company or project as part of a large group, which results in large amounts of capital being raised. Read our post, What is crowdfunding?

VC funds

Want to leave it to the pros to invest your money in the right startups? You can invest in a VC fund, which is a pool of money made up from different private investors. Professional investors (venture capitalists) use the fund to invest in startups.

IPO

Technically, at this stage, a company is no longer a startup because IPO means the company is listed on the stock exchange, for the public to freely buy and sell shares. This is a common way for people to invest money in companies.

Bonds

When you purchase bonds in a company, you’re lending the company money. The company pay the money back to you with interest by a certain date.

Private equity trusts

Similarly to VC funds, private equity trusts are run by professional investment firms and pool money together to invest in private companies.

Your pension

Did you know you can invest in startups via your pension fund? Britain’s largest pension firms are now putting more of their investor’s money into early-stage startups. If you have a self-invested personal pension (SIPP), investing in private equity trusts could give your pension a boost.

Angel investors invest their personal money in startups in exchange for an equity stake in the company and, often, a seat on the board too. They take a vested interest in helping the startup thrive and often give expertise, access to their professional network and mentorship too.

Angel investors are often willing to take risks on good ideas and founders they like, so they’re willing to invest at an earlier stage of the company’s development than institutional investors. Angels understand that their investment might not get a return (because up to 60% of startups reportedly fail in the first three years) but they like to support the startup ecosystem and ideas that excite them. Because it’s such a high-risk investment, startups usually don’t take up more than 10% of the angel’s investment portfolio, with the rest of it allocated to less risky assets.

Angel investors are often seasoned entrepreneurs or industry experts who have experienced their own successes and failures. This gives them insights and the ability to guide startups through challenges.

In exchange for their investment, angel investors take an equity stake in the companies they invest in, becoming co-owners alongside the founders.

Each angel investor has their own motivations for investing in startups: some prioritise the financial return while others want to support specific industries and social causes.

Angel investors usually find startups to invest in via their own network, at pitching events and on platforms that connect founders and angel investors.

There are different types of investors. To find out what they are and how your investor status affects how much you can invest and what protections you have, read the investor types section in our article for founders on raising investment.

And there are different ways to invest as an angel:

🙌 Support friends and family who are founders

🗣️ Build your own network and find startups

💼 Join a syndicate (also known as an angel group)

For startups, angel investors:

💸 provide capital to help the company grow

☝️ support founders with expertise, mentorship and strategic advice

🪴 cultivate new opportunities for further funding

For investors, being an angel can lead to great financial and personal rewards as well as career growth. You can:

📈 diversify your investment portfolio

🪙 receive tax relief benefits (more on this below)

🔭 support innovation and economic growth

👩💼 build a strong network

💷 make a significant ROI if the company is successful

How solid is your understanding of the startup ecosystem? Before you begin, do some research to understand:

💸 how startup funding works

🤔 what interests you most

📈 where industry trends are leading

This will help you discover and understand the industries and growth stages you want to invest in.

A good way to learn more and stay on top of trends is to sign up for newsletters and attend events. You can sign up for our events newsletter to receive weekly updates on the hottest events for founders and investors.

To understand how startup funding works, you can read our article all about startup funding. It’s aimed at founders, but it’ll give you a good understanding of the funding process.

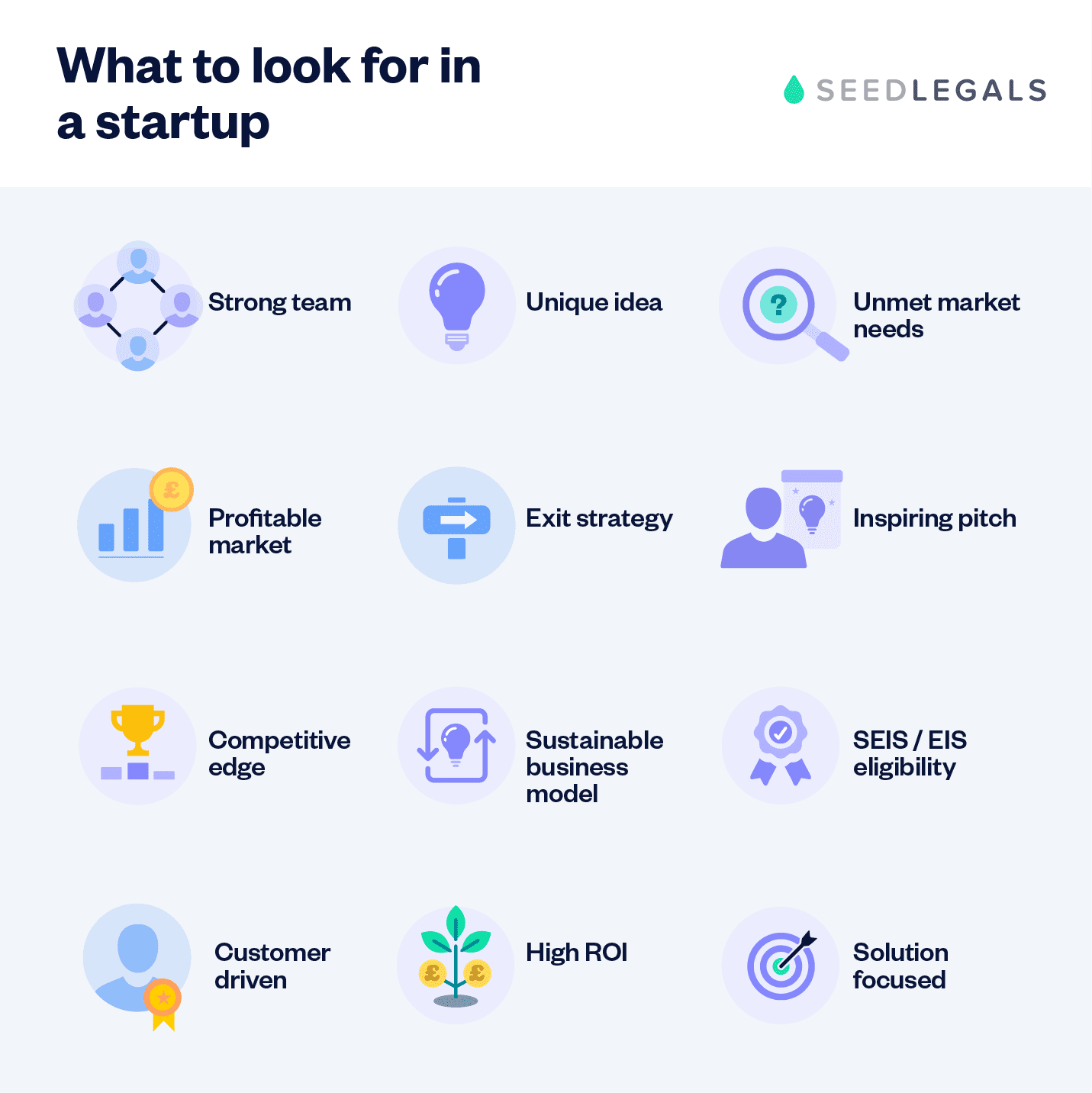

What makes a company investible? Other than being excited by the idea, there are some key factors that should guide your decision to make the investment:

Compelling vision

Does the company have a clear road to success? A startup should have a strong mission and a unique value proposition that sets it apart from competitors. Founders need to show investors that they have more than just a good idea. They also need the right plan and team in place to make it happen.

Strong founding team

Is the team talented and cohesive? A startup needs a team with the right skills and experience to execute their vision. Look for capable, passionate, and committed founders you can trust to drive the company’s success.

Good market potential

Does the startup target a big, growing market? The product or service should have the potential to reach a large customer base and generate substantial revenue.

Solid business model

Does the company have a well-defined and scalable business model? You need to see how a startup plans to make money and achieve profitability. Investible founders must demonstrate a clear understanding of their target market, revenue streams, and cost structure.

Traction and validation

Has the startup made some progress already and achieved milestones? Evidence of traction (ie progress) includes customer acquisition, revenue growth, partnerships, or user engagement. Positive feedback or endorsements can also be proof that their concept works.

Competitive advantage

Does the company stand out from its competitors through a unique competitive advantage? Whether it’s technology, intellectual property or a strong brand, a promising company should have an edge in the market.

Clear path to growth

Do they have a clear roadmap for growth and expansion? Founders must outline their strategies for scaling the business, acquiring customers, entering new markets, or launching new products.

Investor-friendly terms

Are you comfortable with the terms of the investment deal? When you negotiate the deal, make sure there’s transparency about potential risks and returns in the term sheet, along with fair and reasonable terms that align with both party’s interests.

Angel investments usually range between £10,000 and £100,000. But if you’re just getting started, you can invest a much smaller amount. There aren’t any rules. It’s entirely up to you and the founders of the company you want to invest in.

Why do you want to invest? Ask yourself: is your main motivation to see a financial return on your investment or is it more than that? When you’ve worked out why you want to invest, then work out what you want to invest in. Do you want to support companies that are making a positive impact on the planet or their communities? Or maybe you’d like to support the development of AI?

When you’re clear on your reasons for investing, you’ll narrow down the startups to invest in. We recommend you develop an investment strategy that defines the following:

The best way to connect with founders is via your own network of angel investors and founders you already know.

Jonny SeamanGet involved! Go to founder events, involve yourself in the startup scene, grow your network, add value and help where you can. Then, when you find a founder or company you really believe in, you’ll be in a prime position to make an investment because you’re already immersed in the scene and founders will know you and want to work with you.

Investor Partnerships Manager,

Here are some more ways to discover startups to invest in:

It’s essential to get to know the founders of a startup you want to invest in. Talk to founders to get a better idea of:

You want to invest in people you believe in and can work well with and an idea you want to support. Finding the right founder-investor fit is an important part of making your investment decision.

When you’ve found a startup you’re interested in investing in, you need to assess it holistically so you can make an informed decision. Below are key areas to assess:

Credentials of the founding team

Startup founders are the foundation of the company’s success. You should consider whether they have the right:

🏅 track record

❤️🔥 passion for the venture

💪 ability to adapt to challenges

🤝 integrity and commitment

🧲 ability to attract and retain talent

You can assess founders by talking with them, looking them up online and asking for additional information such as their CV and past experience.

The idea

Is the idea innovative, solving a genuine problem, or disrupting an existing market? Do market research, analyse competition, and identify the market size and growth potential to gauge the idea’s viability and potential to capture a significant share.

Intellectual property

Intellectual property, including patents, copyrights, trademarks, or trade secrets, can provide a competitive advantage. Find out if the startup’s IP is adequately protected, how much potential there is for expansion or licensing and how it fits into the company’s long term plans.

Business plan

A well-structured and comprehensive business plan demonstrates the founders’ understanding of the market, their strategy, and the path to profitability. Assess key elements such as the target market, revenue streams, marketing and sales strategies, operational capabilities, and financial projections. Look for a realistic and scalable plan with a clear value proposition and a clear route to launch in the market.

You need to know the value of the company to know how much to pay for the shares. Valuation is an important part of the investment process. Below are the most common ways investors value startups:

Comparable analysis

Compare the startup you’re investing in with similar companies in the industry that have recently been funded or acquired.

Discounted Cash Flow (DCF) analysis

Estimate the present value of the startup’s future cash flows. You make projections of the startup’s expected revenue, costs, and cash flows over a specific period and then apply a discount based on their current stage of development or growth. This method requires making assumptions about future growth rates, market conditions, and the startup’s ability to generate cash flows.

Multiply the amount being raised by five

Our CEO Anthony Rose explains:

Anthony RoseSeedLegals data shows companies dilute a median 15% in early-stage rounds – ie. the investors (collectively) will own 15% of the business. Mathematically, that’s equivalent to a valuation of 5X the amount they’re raising. So if it’s a startup’s first funding round, they should figure out how much they need to raise, multiply it by five, and that’s the valuation.

Of course, that still needs to be within reason according to how much traction the startup has gained so far.

CEO & co-founder,

Here’s a worked example:

You can read more about how to value a company in our posts:

This is one of the most important parts of making an investment. Doing due diligence involves verifying information, conducting background checks, assessing financials, and seeking expert opinions. Check that there are no financial, tax, regulatory, HR and environmental issues. Validate the information you’re given by the founder.

When you and the founders have decided to move ahead with a deal, it’s time to create the term sheet and negotiate the key deal terms. A term sheet is a legal document that covers the most important aspects of the deal – it includes clauses about:

Read more about each of these clauses in our post: Term sheets explained: the founder’s guide.

One of the perks of angel investing is that you can benefit from significant tax relief by investing in qualifying startups.

The Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS) are two of a number of UK government initiatives designed to encourage innovation.

Under the SEIS and EIS schemes, private investors get a significant tax break as a reward for investing in early-stage, ‘high-risk’ companies.

For SEIS, investors claim up to 50% Income Tax relief. For example, if you make an investment of £100,000 that qualifies for SEIS, you can claim an Income Tax reduction of £50,000

For EIS, investors can claim up to 30% Income Tax relief. For example, if you make an investment of £100,000 that qualifies for EIS, you can claim an Income Tax reduction of £30,000

There are more benefits too. Read more:

Claim your SEIS or EIS tax relief in just a few clicks.

Learn moreAfter the deal is complete and you’ve sent the company the money for your investment, you’ll manage your investment according to the agreement you made with the founders. To manage your investment, you might:

📋 attend board meetings

📃 read quarterly board reports

➡️ give strategic guidance

☕ mentor founders

💡 support the company with your expertise

Carry out deals and view your portfolio - all on SeedLegals. Speed up negotiations and cut down on admin with the help of our experts.

Learn moreYour equity has to grow in value before you can make a return on investment. And if the startup fails… you lose your money.

Investing in startups is risky because up to 60% of startups fail in the first three years (reported by Beauhurst). However, if you invest in a solid startup that’s on the road to success, you could see a 5X to 50X return on investment (ROI).

You make a return on your investment when you sell your shares in the company. There are a few ways this can happen:

Angel investors usually hold their shares for at least five years so that they increase significantly in value and you make a profit on your initial investment.

At SeedLegals, we help startup founders and investors simplify the investment process. When you use SeedLegals as an investor, you can:

🔍 Find, run and manage your deals on the platform trusted by 25,000+ investors

💸 Get your SEIS/EIS tax relief done correctly, the quick and easy way.

📚 Manage your portfolio and model exit scenarios

💻 Help your founders simplify due diligence with our Data Room

Use our tools for investors to close your investment deal and sign and store your investment documents on SeedLegals. Want a demo? Book a free 30-minute call with one of our experts and we’ll show you how we can help.