SEIS for investors: Deduct up to 50% of your next investment from your UK income tax

Invest in SEIS eligible companies to get generous tax relief. We set out the rules and benefits for investors.

The UK government created the Enterprise Investment Scheme (EIS) to encourage private investors to invest in early-stage, medium-sized companies. The scheme gives investors significant tax benefits, to make investing in qualifying companies more attractive.

In this article, we’ll cover the EIS benefits and rules so you can better understand whether you could claim tax relief for your investment.

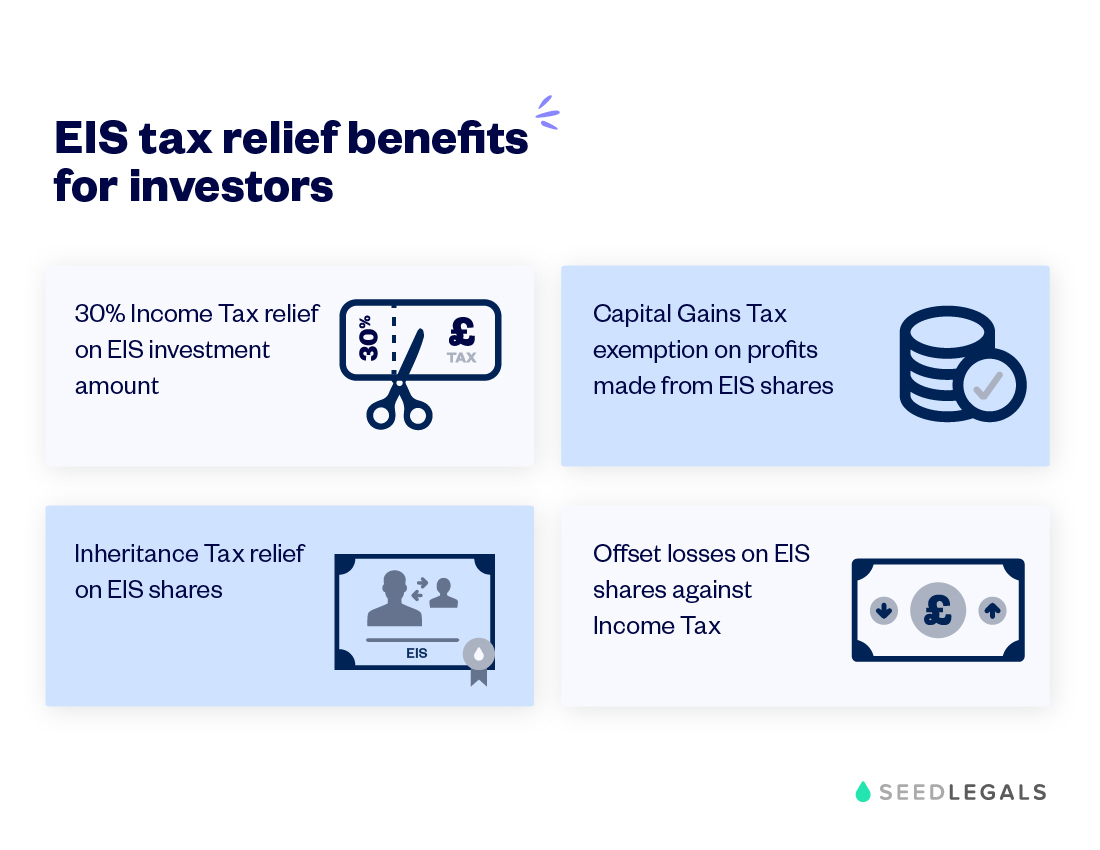

The EIS benefits for investors include various types of tax relief. We’ve covered them all below.

Income Tax relief

Capital Gains Tax relief

Loss relief

Inheritance Tax relief

Exploring tax-saving opportunities? Just enter the investment amount, forecast the return and see how SEIS/EIS could maximise your potential gains.

Try SEIS/EIS calculator

1. The company must be eligible

First and foremost, the company you invest in must be eligible for EIS for you to claim tax benefits. To be eligible for EIS, a company must meet certain criteria, such as:

Read the full criteria in our article EIS explained and make sure you check that the company you are considering investing in meets these criteria before investing – ask if they have Advance Assurance.

Zlatina TrifonovaAdvance Assurance gives you the security you need to make an investment and know that the company you’re investing in meets the eligibility criteria of the EIS scheme. This is a very important element of your due diligence – investing in companies without Advance Assurance puts you at risk of not getting the tax relief.

SEIS/ EIS Specialist,

2. You must be liable for UK income tax

You don’t need to be a UK resident to claim EIS, but to claim Income Tax relief, you must have income which is liable for UK Income Tax.

3. No substantial interest in the company

You must not have any ‘substantial interest’ in the company you’re investing in, at any time from the incorporation of the company until the third anniversary of the date of the share issue.

4. You can’t be an employee of the company you’re investing in

You and any of your associates must not be an employee of the company you’re investing in – but you can be a director. Unpaid directors are eligible for EIS relief. Paid directors could also be eligible, as long as they meet certain criteria. For more details, read our post SEIS/EIS rules for directors.

5. No linked loans

No loans should be made to you (or your associates) by the company you’re investing in. This applies from the date of incorporation of the company until the third anniversary date of the share issue.

If shares are issued more than two years after the company is incorporated, the start date for this condition will be at two years before the shares were issued and also lasts until the third anniversary date of the share issue.

There are more rules within this condition. You can read the full details on HMRC’s website.

6. No tax avoidance

To be eligible for EIS relief, an investment must be made for genuine commercial reasons and not as part of a scheme or arrangement intended to avoid tax.

7. Your investment must be less than £1 million

You can invest a maximum of £1 million per tax year to benefit from EIS relief, or £2 million if at least £1 million of that is invested in knowledge-intensive companies.

8. You must keep the shares for at least three years

If you sell or dispose of your shares in a company before the third anniversary of your share issue, your EIS relief can be withdrawn or reduced. You must hold your shares for a minimum of three years to receive the full EIS tax benefits.

9. You must pay for your shares upfront

To receive the full EIS tax benefits, you must pay for your shares upfront in full and the shares issued must be ordinary shares.

10. You must not receive value from the company for three years

Your EIS relief could be withdrawn or reduced if you receive value from the company or from a person connected with that company at any time from the incorporation of the company to the third anniversary of the share issue date.

11. No put option or call option for three years

Your EIS relief could be withdrawn or reduced if there’s a put option or call option over the shares at any time before the third anniversary of the date the shares are issued. Read the definition of put and call options in HMRC’s tax manual.

Want to work smarter and manage your deals seamlessly? We can help you:

Learn more about our tools for investors.

Fill in the form so we can match you to the right specialist

Article Sources

Tax relief for investors using venture capital schemes | HMRC – accessed 20 March 2023

Capital Gains Manual | HMRC – accessed 20 March 2023