Agile fundraising has arrived. Don't do a funding round until you've read this

New data shows the way that startups are raising investment is changing, and SeedLegals is pioneering that change.

Are you wondering how to fund your startup? Maybe you’re just curious about how the world of startup funding works. Either way, in this guide, we’ll explain what startup funding is and how to raise it.

We’ll walk you through some practical first steps you can take and how to make the startup funding journey as smooth and simple as possible. Let’s get started.

Startup funding is money that’s used to start and grow your business. New and growing businesses raise funding from various sources to cover the costs of developing, improving and getting their products or services to market.

Startup funding comes in various forms, which fall under these categories:

We’ll cover these in more detail in the section on six ways to get funding.

Startups need funding to pay for the resources they need to get off the ground and to start growing. What startups need funding for depends on what stage of development they’re in.

Early stage

If you’re just starting out, your company is referred to as ‘early stage’. At this stage, you need funding for things such as:

Early-stage funding rounds are known as bootstrap, pre-seed and seed. We’ll explain these in more detail in the section on funding rounds.

Growth stage

When your company is up and running you’ll need funding to take your business to the next level – if you want the company to grow and generate a profit, you’ll need resources – and more money to pay for those resources. Growth stage funding is often used to:

Growth stage funding rounds are referred to as Series A, B, C, etc. The Series A round sometimes falls into the category of early stage, but by Series A, funding is needed for growth rather than getting started.

Each category of funding works differently. We explain them below:

This refers to giving part ownership of your company in exchange for capital.

Businesses with a lot of potential to grow often get funding from venture capital firms and angel investors. In exchange for the money, the startup gives investors a percentage of ownership in their company, known as equity.

Equity is given in the form of shares. This is how you sell equity:

For equity financing, startups go through a series of funding rounds. In each funding round, you set out to raise a certain amount of money to see you through the next stage of growth. In the past, that’d be 12 to 18 months, but nowadays, there are other ways to raise money so you don’t need to wait that long to take investments.

This refers to taking a loan that you pay back with interest. Debt financing allows companies to finance startup costs without giving away equity in the company.

You can opt to use a combination of debt and equity financing. A small loan when you’re just starting out can be manageable and helpful, but taking on large amounts of debt generally isn’t a good position to put yourself in.

For debt financing, you’ll approach financial institutions that provide business loans. You get the money you need upfront and agree to a fixed period of time and the interest rate at which you’ll pay back the money.

This is money provided, usually by governments, to encourage innovation in specific industries or stages of businesses. It doesn’t need to be repaid, and it doesn’t convert into equity.

There are sometimes restrictions on how the grant money is used, though. To raise grant financing, you can research grants online, choose the ones your company qualifies for and apply. We’ll cover grant financing in more detail below.

This is when you raise money from future customers. You do this by pre-selling the product – taking orders before creating it – or incentivising customers in some other way such as through rewards or equity. We’ll cover crowdfunding in more detail below.

There are many different ways to raise money. From using your personal savings to getting large sums of venture capital, each way of raising works in a different way and has its own pros and cons. We’ve set these out in this table, and below the table we explain each of the types of startup funding:

| Type of funding | How it works | Pros | Cons |

| Friends and family | You get Money from friends and family either as a loan, in exchange for equity or as a donation. |

|

|

| Angel investment | You get money from private investors in exchange for equity |

|

|

| Venture capital | You get money from venture capital firms in exchange for equity |

|

|

| Crowdfunding | You get small amounts of money from many people |

|

|

| Debt financing | You take out a business loan that you have to pay back with interest within a certain time. |

|

|

| Grant funding and tax relief schemes | You get a government grant and/or get money from a tax relief scheme |

|

|

Your first startup funding will most likely come from your personal savings. Being the first investor in your own company is risky but also has the upside that you won’t have to give away any equity.

After that, you might look to supportive friends and relatives who’d be willing to invest or loan you some cash.

Startup capital from friends and family is the least formal type of funding you can get. It could fall into either category of equity financing or debt financing, depending on the agreement you make with your friends and family members. Perhaps your friend Alex is happy to invest the money in exchange for 3% equity in your company but your sister Charlie just wants to help out and loans you the money for a period of five years.

At SeedLegals we’re often asked if investors have to be professional investors, or if any average Joe can invest in your company. The answer is yes, anyone can be an investor in your company and no, they don’t have to be professional investors.

When your friends and family (‘everyday investors’, also known as ‘restricted investors’) invest in your company, they must sign a statement saying they won’t invest more than 10% of their net assets (including savings) into shares that aren’t listed on the stock exchange and can’t be sold easily (i.e. your startup). You can create and customise agreements for everyday investors on SeedLegals.

Angel investors are private investors who provide money for startups and SMEs to grow. They could be wealthy people passionate about supporting startups, ordinary professionals looking for somewhere to invest their money and even friends and family of the founders.

You can work with individual angel investors or angel groups, where multiple angel investors come together as a syndicate to co-invest in companies. In both cases, you’ll approach angels and send them your pitch. Or sometimes they’ll approach you and ask for a pitch. You can meet angel investors at networking events and via LinkedIn, and search for angel groups and apply online.

Angels fall into the equity financing category – they provide money in exchange for equity (partial ownership of your company). They use their own money to invest in businesses. Because they invest in the early stages of a company’s growth, angel funding makes a good bridge between bootstrap funding from friends and family, and VC funding.

The amount individual angels invest varies – it could be anything between £1,000 to £150,000 or more. Angel groups can invest more because their investment money is pooled together by multiple angels. Angel groups often invest anywhere between £10,000 and £5 million per company.

Angel investors will do ‘due diligence’ before going ahead with a deal. This means they’ll make thorough checks to ensure that investing in your company is a good idea. They might want to check your bank account statements, talk to customers, and be walked through your product.

If you’re thinking about pursuing this type of funding, have a look at our 8 steps to making your first angel investment.

Venture capital comes from venture capital firms that manage funds to finance business ventures. These funds are made up of pooled money from wealthy private investors, financial institutions and investment banks, together known as limited partners (LPs).

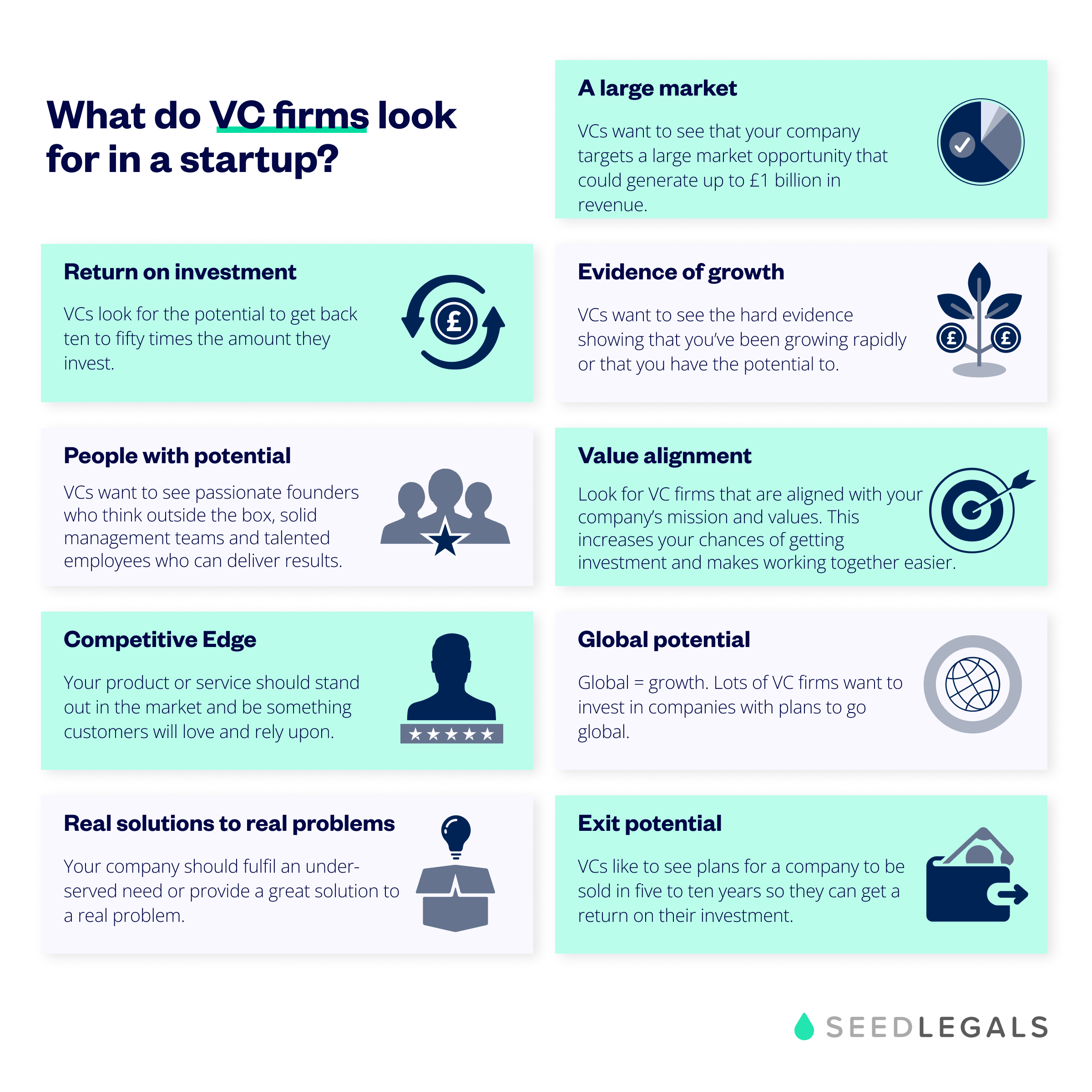

Many startups aspire to get VC funding because these firms can invest the large amounts of money that growing businesses need. On top of that, VC firms can offer plenty of extra support in the form of expertise and strong networks.

Venture capital is a form of equity funding. You’ll give away a percentage of company ownership to investors in exchange for capital.

There are thousands of venture capital firms across the UK. Some firms focus on early-stage (pre-seed and seed funding) and some firms fund startups at any stage – from seed to later series rounds. Some venture capital firms focus on specific sectors while others are ‘sector-agnostic’ (they invest in any sector).

Read more:

Crowdfunding is a way of raising money by getting large amounts of people to invest relatively small amounts of money.

There are various ways companies choose to incentivise and reward backers, which lead to the different types of crowdfunding. We’ll touch on each of them below, but for a more detailed breakdown, read our post: What is crowdfunding? An essential guide for UK startups. You can also have a look at our article on Crowdfunding advantages and disadvantages to learn about the pros and cons of this type of funding.

Debt financing is when companies take out a loan. This is also known as venture debt. The loan has to be paid back with interest within a certain amount of time. Companies get loans from banks, dedicated debt financing platforms and sometimes investors.

The UK is one of the most generous countries in the world when it comes to government funding for startups. Government funding refers to raising capital for your startup from grants and tax relief schemes provided by the government.

Government tax relief schemes which startups can benefit from include:

R&D tax credits

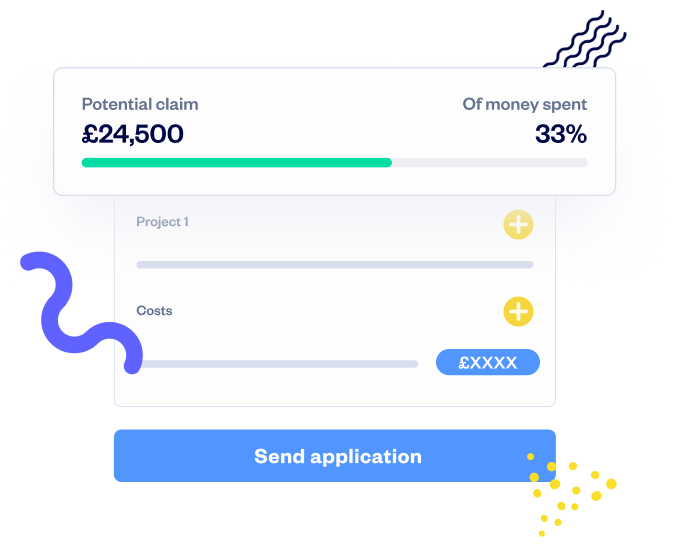

The research and development (R&D) tax relief scheme allows you to claim back up to 33% of your R&D costs if your company has spent money developing a new product or service or significantly improving one that already exists. Even if the project fails, you can still claim back money under the R&D scheme for the money you spent.

You can prepare your R&D Tax Credits claim on SeedLegals – find out if your company might be eligible and how it works in our post: R&D tax credits: the ultimate guide.

Creative Industries Tax Relief

Companies in the following sectors may qualify for this type of tax relief:

You can learn more about this type of tax relief on the UK government website: Creative industry tax reliefs for corporation tax

Patent Box

If your company has patented an invention, you could qualify to pay a lower rate of 10% corporation tax on the profits you earn from your patented inventions.

Your company might also qualify for this tax relief if you hold exclusive licences to use technology patented by someone else.

There are full details about this tax relief and how to ‘elect into the Patent Box’ on the gov.uk website.

We'll help you maximise your R&D claim

Tell me how

Government grants

There are also hundreds of government grants and competitions you could apply for to raise startup money. Some of the top grants worth exploring are:

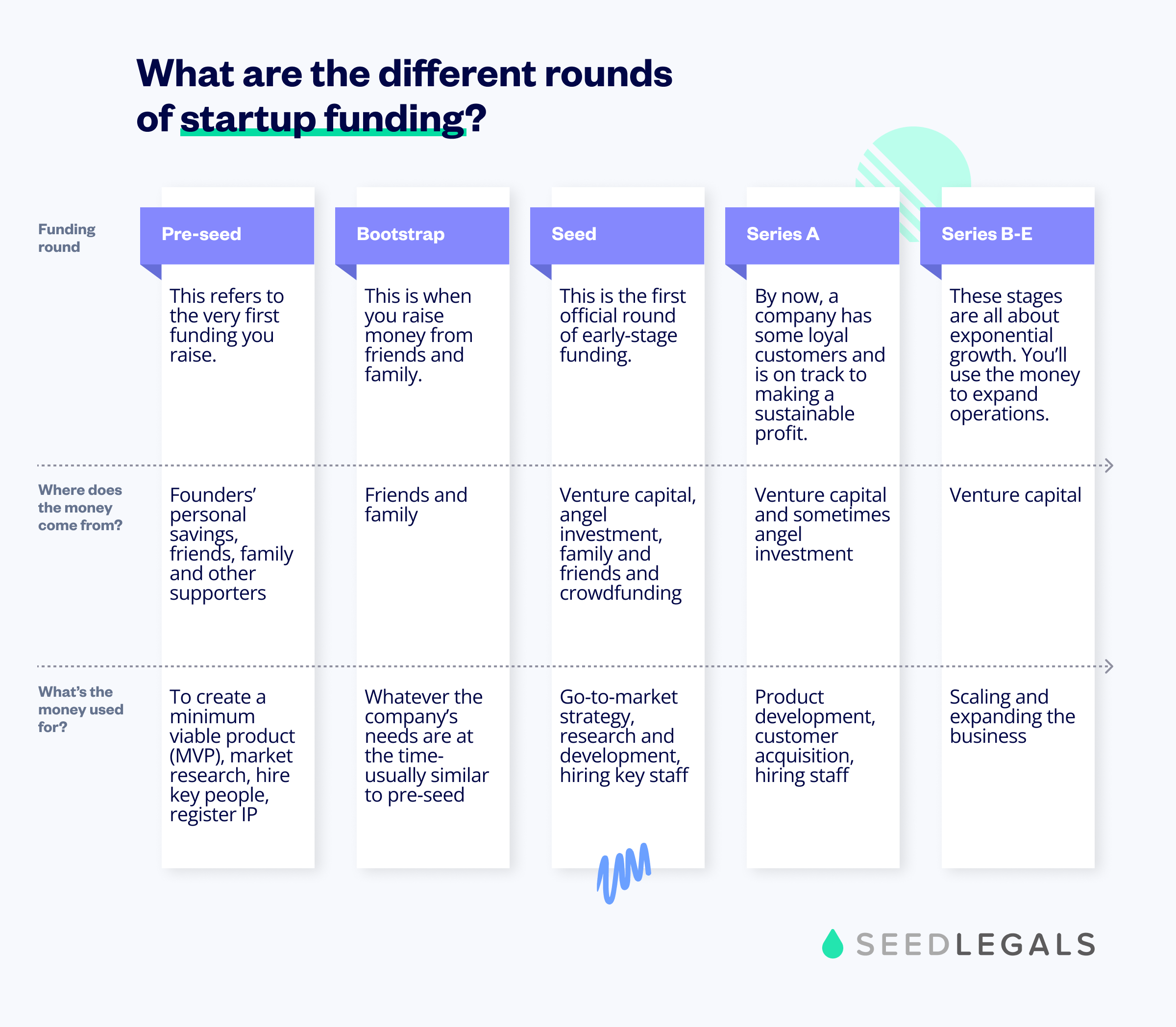

Traditionally, startups raise money by carrying out funding rounds. In each round, you’ll raise larger sums of capital and give away some equity. We’ll explain each round below.

Pre-seed funding is the very first capital you’ll raise for your startup during the early stages. This is the ‘unofficial’ round that comes before the seed round. Pre-seed funding usually comes from startup founders themselves, as well as friends, family and other supporters. You can also raise pre-seed funding from angel investors and venture capital firms, though this is more common in later stages of funding.

Pre-seed funding is usually used for:

Avg. amount raised: £100,000 to £300,000

Avg. equity given: 5 to 15%

A bootstrap round is when you raise startup capital from friends and family. While a pre-seed round is specific to the stage a company is at when it’s raised, a bootstrap round can be carried out at any time. Some companies raise money from friends and family again after a seed round. In this instance, it’d be referred to as a bootstrap round.

Bootstrapping means starting or operating a business purely off personal finances and money supplied by people you know.

Avg. amount raised: £10,000 to £100,000

Avg. equity given: 0% to 10%

Want to understand if doing a bootstrap round is right for you? Read: Should I do a Seed Round or a Bootstrap Round?

Seed funding is the first official round of raising money for your startup. This is an early-stage round and your company could be referred to as at ‘seed stage.’

Seed money allows you to buy the resources you need to get started and lay the foundations for rapid growth later on. During the seed round, companies give away equity in exchange for capital.

Seed funding is usually used for:

Seed funding usually comes from a combination of several sources including friends and family, venture capital, angel investment and crowdfunding.

Avg amount raised: £500,000 to £1.5 million

Avg. equity given: 10% to 20%

By the time your company is ready for a Series A round of funding, it will have grown considerably since its humble beginnings. The company should have some loyal customers by this stage and be on track towards making a sustainable profit.

Companies at Series A stage play in much bigger leagues than seed-stage companies. In a Series A round, you’ll be raising more money and much more pressure on you. You’re past the ideas stage at this point.

You’ll get Series A funding by raising venture capital and angel investment. At this stage, investors want to see a strong strategy for how you’re going to make money, how you’ll give them a 10 to 50x return on their investment and how you plan to exit the company.

Series A funding is usually used for:

Avg. amount raised: £2 million to £10 million

Avg. equity given: 15 to 25%

Learn how to get this type of funding in our article on how to raise series A VC funding

Between the Seed round and Series A round, startups will have established themselves in the market and gained a customer base. The purpose of doing a series of funding rounds is to raise larger and larger amounts of capital with each round and use it to create exponentially more revenue and growth each time. This is why it’s also known as ‘growth capital’.

Series B to E funding is usually used for:

Some companies go for Series B and Series C rounds of funding, few need or make it to Series D, and raising a Series E is very rare.

At each round of funding, the company has become worth more so for each new round, you’ll need to get the company valued again.

Series funding will most often be led by the same investors in each round. This is called ‘follow-on funding’. Investors like to reinvest so that their equity stake in the company remains significant. The amount of money raised with each round can vary greatly and depends on many factors like the company valuation, revenue and location (for example, companies in the US raise a lot more in these rounds than in the UK).

Avg. amount raised: In the UK Series B to E rounds can raise from £10 million to £30 million.

Avg. equity given: 10 to 20%, scaling down with each round, so you’d give away closer to 5% in the later stages.

Doing funding rounds takes a big commitment of your time and energy. It puts a lot of pressure on the business, and sometimes founders prefer to take investment immediately and don’t want to open a new round of funding. This could be because a great opportunity has come up and you don’t want to lose it by making the investor wait until the next funding round, or perhaps you need extra capital to extend your runway.

Agile funding is a way to get startup financing without doing a funding around. It works by either assigning shares to new investors based on the terms of your previous funding rounds, or promising new investors shares in your next funding round using future equity agreements.

At SeedLegals, we developed agile funding agreements that allow you to take investments before a round or after a round. Read more about it in our post about agile fundraising.

This isn’t one of the official funding rounds, but it’s a term you’ll hear in the startup world. A down round means that a company sells shares at a price per share that’s less than what they sold each share for in a previous round (best to avoid, if you can).

A bridge round is a capital injection to help give the company the final push it needs to get from one stage to the next.

Here are the first practical steps you can take to begin your funding journey.

1. Decide how much money you need

Before you start raising you have to know how much you need. Some advisors say to raise as much as you can. VCs and investors will usually say you should plan to raise enough to last 12 to 18 months before you need to raise money again.

Raising startup funding will take a significant amount of your time and energy. So before you begin the journey:

Jonny SeamanWhen you start a business, it’s natural to think “I need £2 million to get this product to market”. The issue here is that at the moment, it might just be an idea and impossible to justify a sky-high multi-million pound valuation needed for you to raise the money and still retain control of the company. So the tactic instead is to raise a smaller amount – say £150k – at a valuation you can justify, then use that money to grow to the next stage where a larger amount of money can be raised based on the progress you’ve made.

Funding expert,

2. Get your valuation

Valuation refers to the amount of money your company is worth. Investors need to know how much your company is worth so they can calculate the value of their investment and how much they could get back in five to ten years.

Before you can take capital in exchange for equity, you have to be clear on how much equity you’re willing to part with. The general rule of thumb for Seed rounds is that founders should sell between 10% and 20% of the equity in the company. If you want to know more about how much equity to give away, read our article on how to value your company and how much equity to give.

4. Create your pitch

To raise capital, you’ll pitch your company to investors. Pitching is an art: you need to sell them on what you’re doing and give the important information without taking up too much of your potential investors’ time. On SeedLegals, we’ve made it easy to deliver the perfect pitch to investors, in one click. To get started, create your Pitch on SeedLegals.

5. Write your business plan and financial forecast

While your business plan will change as you go, it’s important that you have a solid five-year financial forecast that shows investors what you’re going to do with their money and how you plan to give them a return.

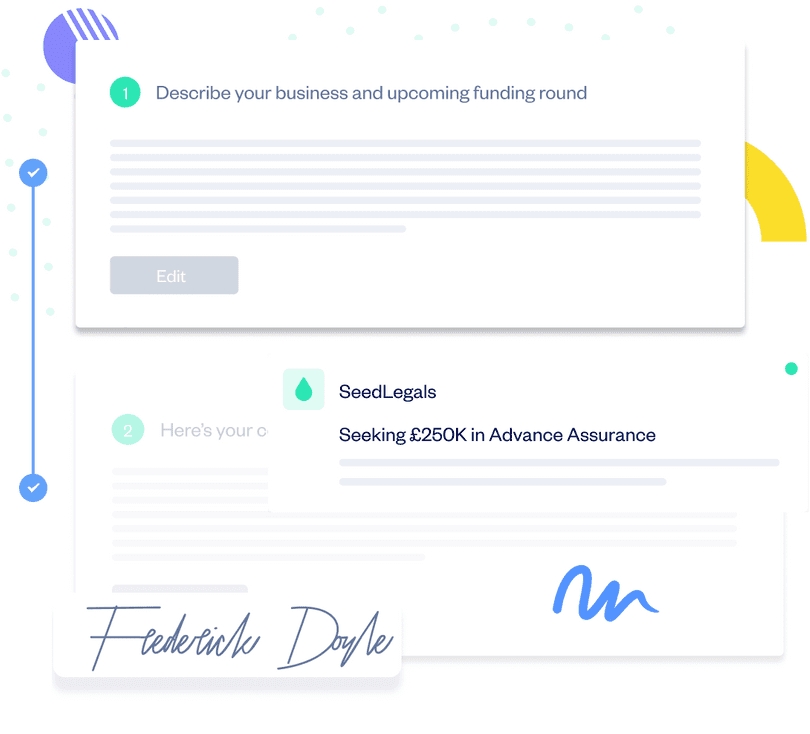

6. Apply for SEIS/EIS advance assurance

This is an essential step in raising startup funding. Most investors won’t invest in companies that aren’t SEIS/EIS compliant.

The Enterprise Investment Schemes (SEIS and EIS) give investors significant tax breaks for investing in early-stage ‘high-risk’ companies. Learn more about it in our post: What is SEIS and EIS? An essential read for UK startups

SEIS/EIS advance assurance is approval from HMRC that your company is eligible for the SEIS/EIS scheme. After getting advance assurance, you’ll apply for SEIS/EIS compliance, which is the official approval from HMRC that your investors can claim SEIS/EIS relief when they invest in your company.

You can apply for SEIS/EIS advance assurance with SeedLegals. The workflow is simple to use and you get unlimited support from a team of experts who review your application. We have a 98% success rate with SEIS/EIS advance assurance applications compared to the industry standard of 62%.

Team up with SeedLegals to get your Advance Assurance sorted the easy way

Get approved fast

7. Contact investors

It’s up to you to get out there and find investors. There are many ways to find investors, and you’ll have the most success if you make use of various ways both online and offline.

Top tips from our experts:

Raising capital requires a lot of paperwork and legal agreements because you’re dealing with large sums of other people’s money and allocating shares in your company. Here’s our list of the top ten documents you need to know about and/or have in place before you start fundraising:

If you’re about to begin your startup funding journey, book a free call with our dedicated experts to find out how we can help.