New: AI Health Check for SEIS/EIS Advance Assurance applications

🎉 Introducing the AI Health Check – a smart, 2-minute step that helps you get your SEIS/EIS Advance Assurance applicatio...

Managing your company’s equity used to mean wrestling with spreadsheets and paying lawyers steep, unpredictable fees.

Today, UK founders use cap table and equity management software to automate ownership tracking, manage employee share option schemes and forecast how fundraising or exits will affect their stake. The best cap table tools for startups combine real-time updates, scenario modelling and legal document automation to make equity management faster, clearer and effortlessly compliant.

Two leading platforms in this space are SeedLegals and Vestd. Both help startups issue shares, manage options and keep an accurate cap table, but they differ in pricing, features and support.

In this comparison, we’ll focus on employee share option schemes, and show how each platform handles the legal, compliance and fundraising aspects of equity management. You’ll see where they overlap, where they differ and which solution is built to grow with your startup.

The only UK platform that brings cap table management, fundraising tools and employee option schemes together with unlimited support and EMI valuations included. Everything you need to manage your equity, scale smart and exit – in one place.

Talk to the teamSeedLegals gives you everything you need to set up and run your employee option scheme for a single annual price of £2,490.

That includes unlimited option schemes, unlimited EMI valuations and unlimited support from our experienced team. Whether you need to tweak your scheme design, issue more options or talk through a new EMI valuation with your dedicated options specialist, you’ll never hit a ceiling or get charged extra.

To get the same level of service on Vestd, you’d need their highest-tier plan at £4,200 per year – £1,710 more than SeedLegals.

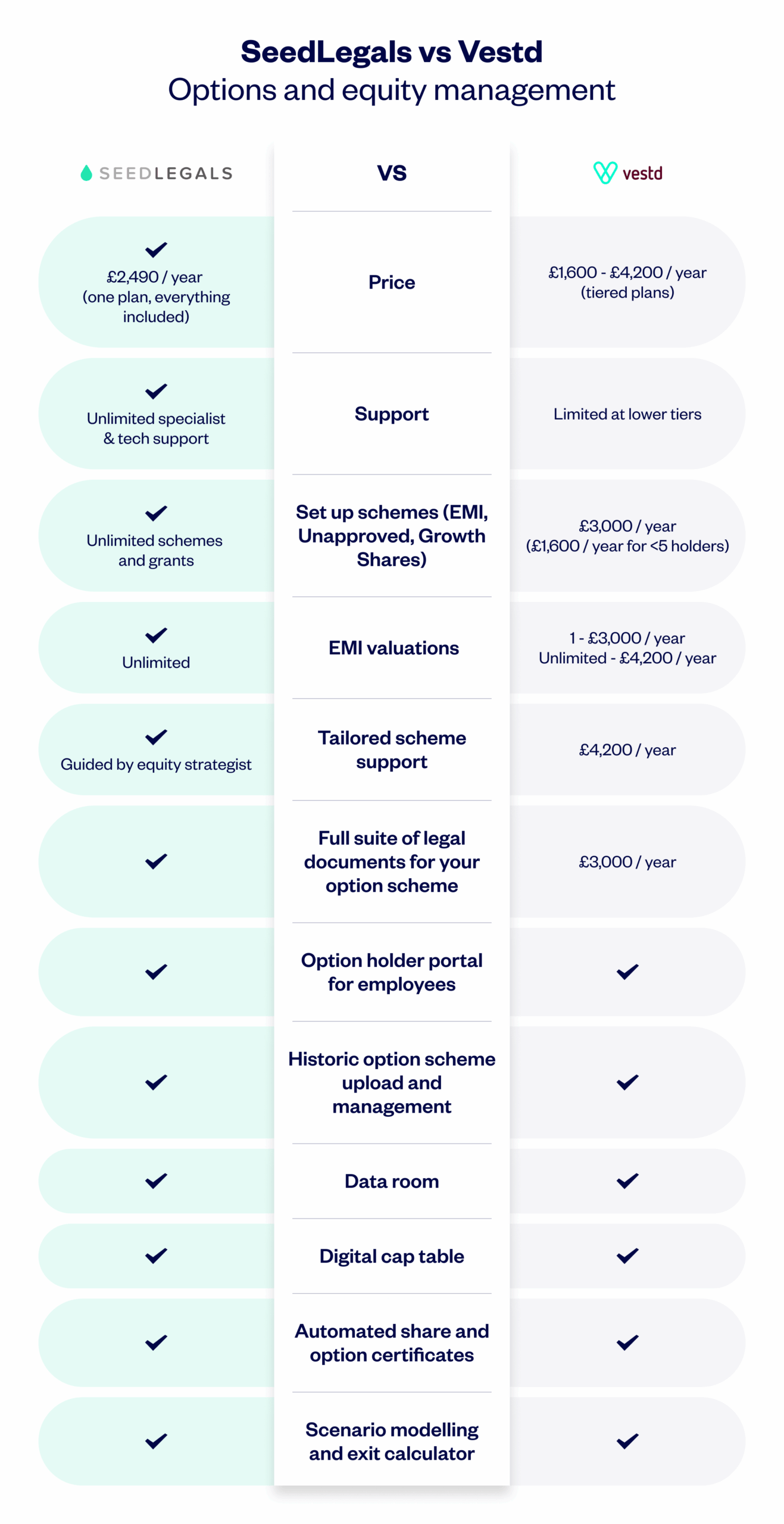

The table below compares what’s included in each provider’s plan for more than five option holders so you can see how far your money goes.

Get everything you need in one convenient package – from expert support to unlimited different scheme setups – for a simple, low annual fee.

Explore optionsBecause running an option scheme isn’t a one-and-done job. As your team grows, your plans change or you head into a funding round, you’ll need to update documents, issue new options and sometimes revisit earlier decisions. With SeedLegals, you can make these changes as often as you need, without worrying about extra fees.

Take EMI valuations as an example. They’re only valid for 90 days, so if you’re fundraising and your valuation expires, unlimited valuations mean you can simply refresh it at no additional cost. It’s one of the many ways SeedLegals lets you adapt quickly as your company evolves.

On Vestd, that flexibility comes at a much higher price. Their lower tiers limit valuations and restrict support, so costs rise quickly as your team or scheme grows. For very small teams (fewer than five option holders), Vestd’s entry plan starts at £1,600 per year – but it doesn’t include any valuations. Most companies will need at least one, which adds around £1,000 extra. And as soon as you scale beyond five option holders, you’ll move into a higher price bracket.

Setting up an option scheme or running a funding round isn’t just a box-ticking exercise – it’s a complex sequence of legal, tax and compliance steps that need to line up perfectly.

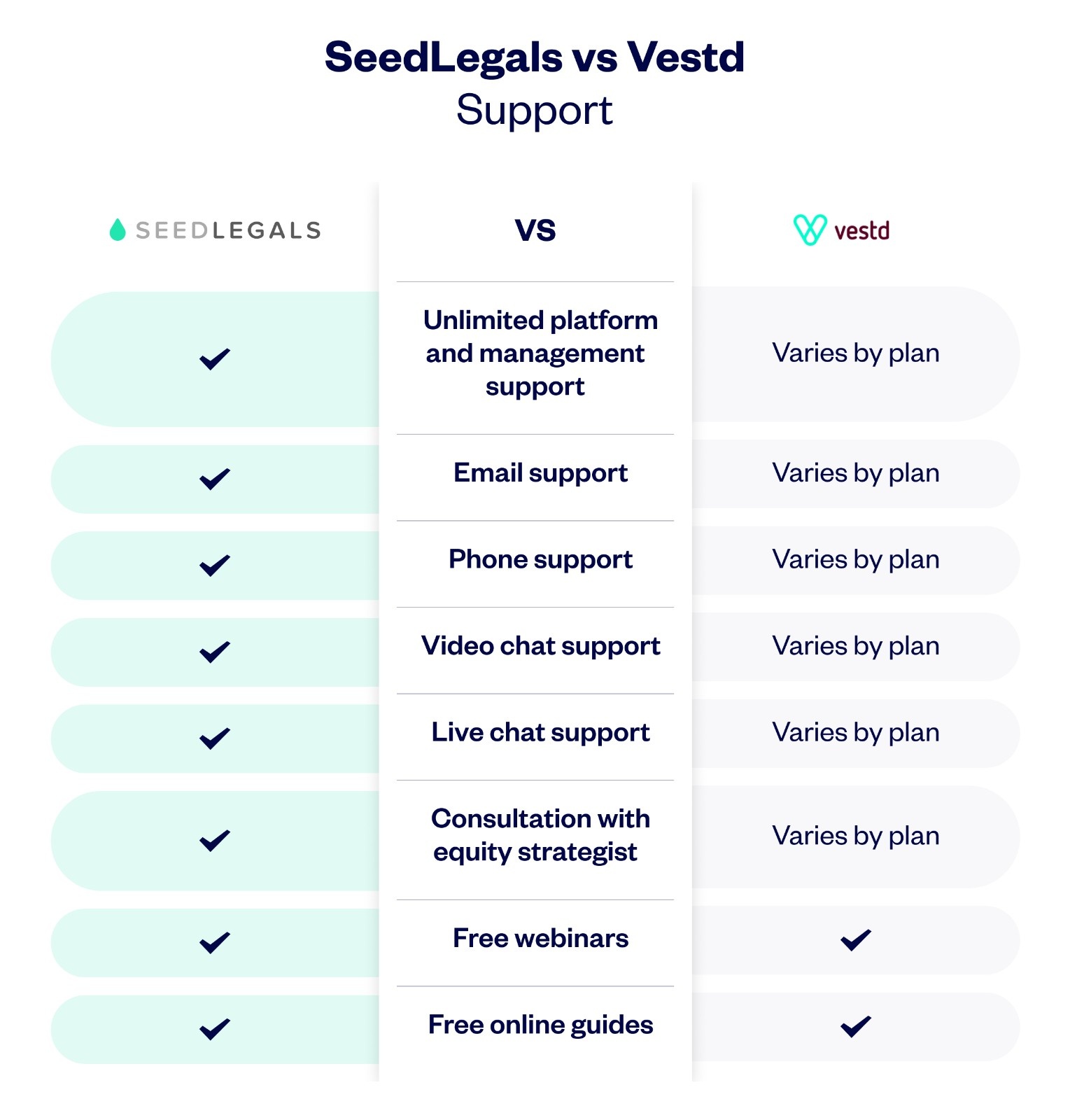

That’s why support makes all the difference. On some Vestd plans, founders are left to manage the process themselves. At SeedLegals, you’re never on your own.

Every plan includes unlimited live chat and one-to-one guidance from our legal and funding specialists. Behind the scenes, our platform automates the complex parts – valuations, documents, approvals – while our team helps you understand each step and avoid common pitfalls.

It’s the best of both worlds: smart automation plus human expertise, so you can set up your scheme and grow your company with confidence.

Magda LobjanidzeThe process of granting options involves multiple legal and compliance steps, so guided support is essential – especially for first-time founders. Doing everything yourself on a self-managed plan can create risks if anything’s missed.

At SeedLegals, you always get personal guidance to make sure your option scheme is set up correctly and fully compliant.

CX Manager - Options,

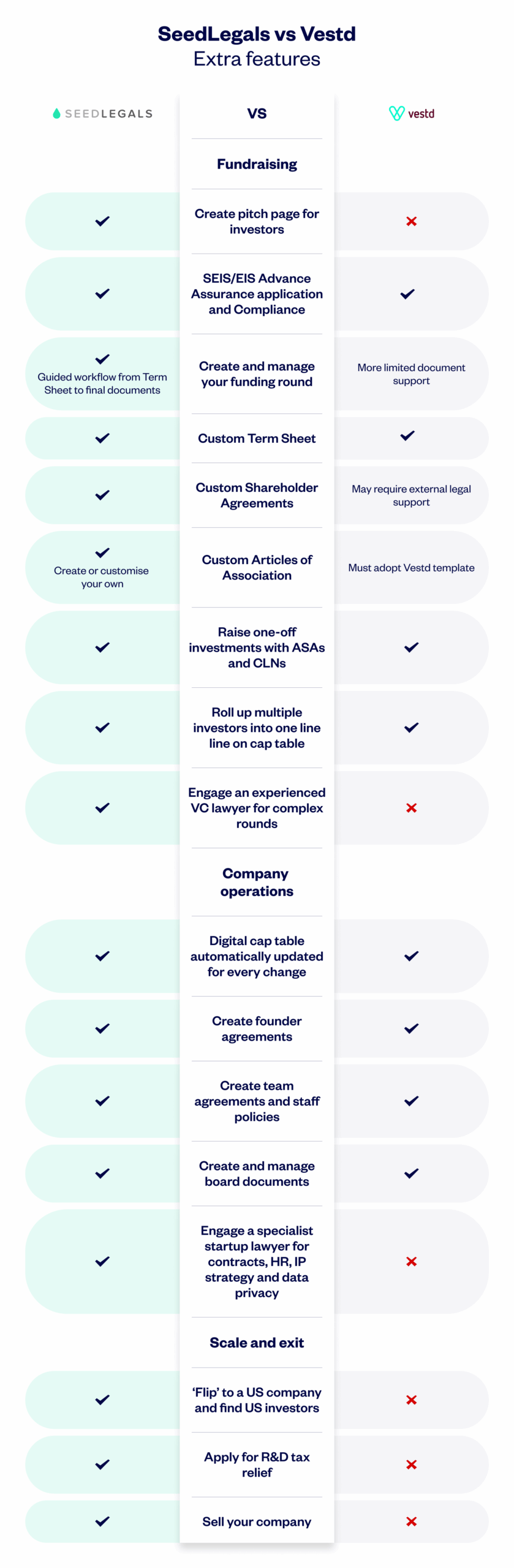

Both SeedLegals and Vestd include fundraising tools alongside their equity management features. The table below gives a quick overview of what’s available on each platform.

With SeedLegals, you’re not just getting document templates – you’re using the same platform that’s helped founders raise more than £2 billion in investment. Our tools are built from the ground up for early-stage startups and fully aligned with UK market standards.

You’ll find everything you need to raise investment, stay compliant and plan for growth – from SEIS/EIS applications and ready-to-use ASAs and CLNs, to founder agreements, cap table automation and access to startup lawyers when you need them. Because we handle thousands of early-stage rounds, we know what investors expect – and what’s standard in today’s market.

SeedLegals has also won multiple awards for our SEIS/EIS support (most recently, EISA 2025 Best Legal/Regulatory Adviser, Ecosystem Champion), so you can be sure you’re in expert hands.

Vestd includes some fundraising and compliance functionality, such as data rooms and basic investment documents, but its core focus remains on employee options and equity management.

The table above shows a snapshot of the key fundraising, compliance and growth tools available on each platform. For a full breakdown of what’s included and pricing details, see our pricing page.

SeedLegals takes the hard work and the guesswork out of setting up and managing employee share option schemes. But that’s just the start.

On SeedLegals, you can manage every stage of your company’s equity and funding journey – from building your cap table to closing your next investment round – all with expert support built in.

✅ Support from legal and funding specialists when you need it

✅ Data insights from 60,000+ UK startups to help you make smart, confident decisions

✅ Guided workflows with built-in tutorials for every legal and equity task

✅ Exclusive founder community access – WhatsApp group, events, and webinars

✅ 500+ expert articles and guides to help you navigate growth with confidence

✅ Partner perks worth £10k+, including discounts on accounting, HR, legal, and tech tools

Whether you’re creating your first option scheme or planning your next raise, our team can help you do it right – and do it faster.

Book a slot for a free 30-minute chat to get started.