SEIS: Guide to the Seed Enterprise Investment Scheme

Founders guide to SEIS. Find out how it helps startups and investors, eligibility criteria, how to get Advance Assurance...

Is your startup still just a cool idea you’ve yet to materialise? If so, it’s pre-seed funding you’ll need to get things off the ground. In this article, we’ll explain what pre-seed funding is and how to raise it in the UK.

Pre-seed funding (aka pre-seed capital) is the earliest stage of startup funding. This is when you need money to turn your ideas into something tangible and start laying the groundwork to get your offering into the market.

When you raise pre-seed funding, investors give you capital in exchange for equity in your company. In the UK, most startups give away 10% to 20% equity at the pre-seed stage.

AJ AlaoThe goal of pre-seed funding is to validate your idea by creating an MVP (minimum viable product) and perhaps even garnering some early-stage traction. Think of it as money for costs to create your product or service – whether that’s for software you need, a few skilled team members you have to hire to help you or even office space if that’s what you need. It’ll vary slightly for each startup.

Sales manager,

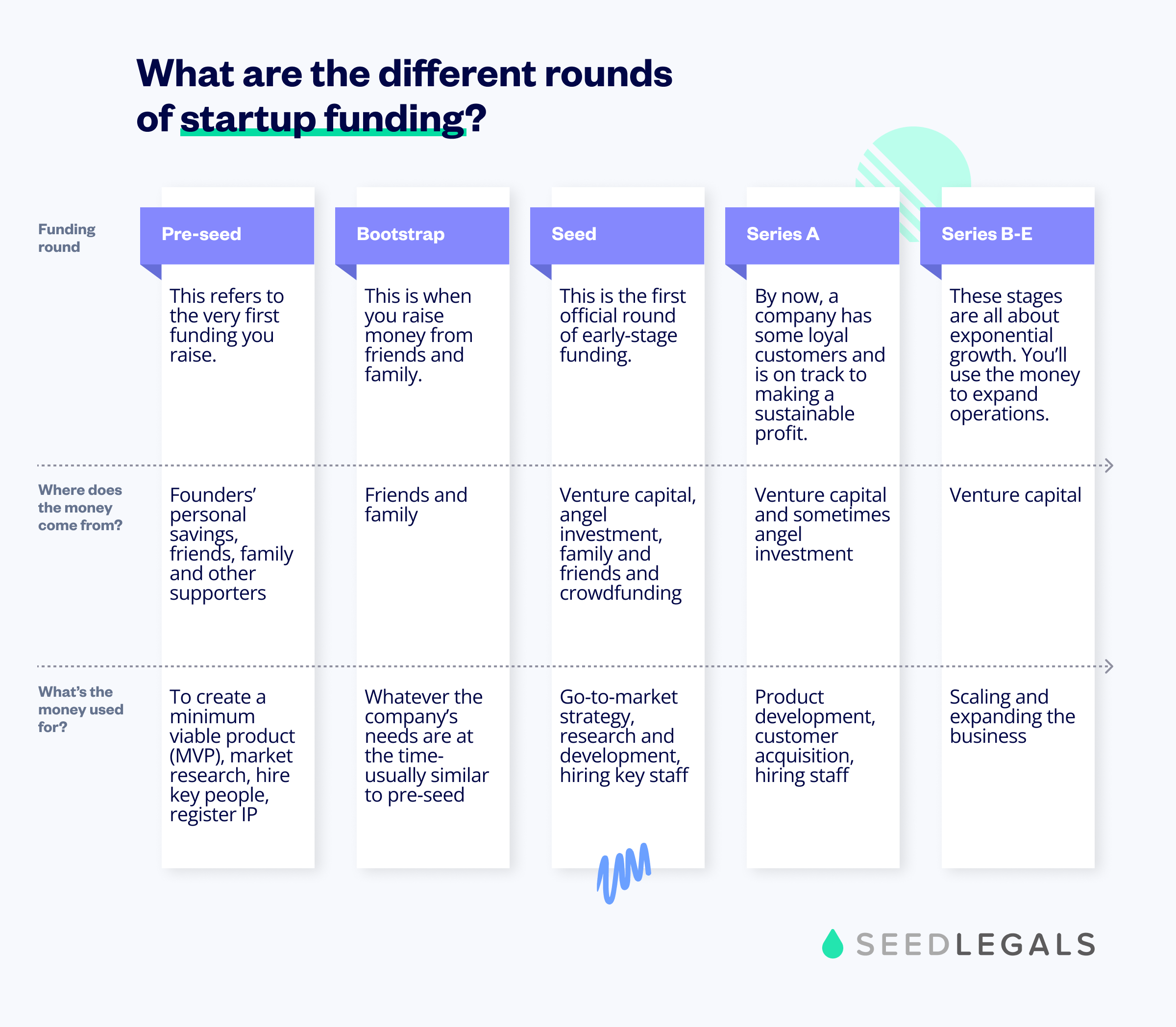

The difference between seed and pre-seed funding is that pre-seed funding is used to create your product and find the right product-market fit, while seed funding is more focused on getting that product to the market and refining the product-market fit. Think of it like this: pre-seed funding helps you create something from nothing and seed funding helps you take that something further.

If you want to understand exactly what each funding round is all about, read our founder’s guide to startup funding.

Pre-seed funding is used to build your foundation. It’s used to help your startup maximise the chances of securing future investments to help it grow.

Startups use pre-seed funding to:

Startup founders usually raise anywhere between £100,000 to £500,000 in pre-seed funding.

The amount of money you raise from investors will depend on:

Investors buy equity in your company at a certain price per share, so the higher your company valuation, the higher your share price and the more you can raise. You’ll have to set a ‘pre-money valuation’ to match the amount you want to raise and how much equity you’ll give for that amount.

For a target raise between £100,000 to £350,000 in the UK, your valuation will range from £750,000 to £1.4 million. You can learn more about valuation and how much to raise for your pre-seed stage startup in our article How to value a pre-revenue company.

This can be one of the most challenging tasks that startup founders face. After you break the ice with startup funding, you get used to the process and you learn how and where to find investors. But because pre-seed is the first time you’re raising money, it can seem like a daunting task because you don’t yet know where to start.

We understand – we deal with first-time founders all the time. Depending on what you need, one of the first things we do is direct you towards some of the angel groups and VCs that invest at the pre-seed stage in the UK (more on that below). We also share these six steps to success when you’re raising pre-seed funding:

1. Build your pitch deck

You can use our guide to 11 key elements to a great pitch deck. Think about how you can use storytelling to sell your startup and practice your verbal pitch too.

2. Make a list of investors

Focus on angel investors because they’re more likely to invest at this stage than VCs.

3. Research incubators or accelerators

Could this be a good strategic move for you? They can support you with knowledge, tools, access to a network and guidance but they might require a large chunk of equity or a large sum of money upfront before you can get in.

4. Work out your company valuation

Read How to value your company and how much equity to give away.

5. Prepare your term sheet

Decide on your key deal terms so you’re ready to present the term sheet to investors.

AJ AlaoGive yourself the advantage by having your term sheet mapped out and ready before you meet investors. We have seen that founders who do this close funding rounds faster.

Sales manager,

A term sheet is a non-legally binding agreement that summarises the key deal terms of the funding round. It’s one of the most important negotiation tools between founders and investors. Check out our resources about term sheets:

Pre-seed funding usually comes from:

For pre-seed funding, angel investors are the way to go for pre-seed funding. Make a list of angel investors to approach, and keep in mind that you need to check what sector(s) they invest in. These are our top picks for angel investors in the UK who invest in companies at pre-seed stage:

Read more: Top 16 angel groups in London.

These are some of the top VCs in the UK that invest in the pre-seed stage:

Learn more about venture capital in our articles: What is venture capital and Are you ready for VC funding?

Your pitch deck is the opportunity to prove that your idea is worth investing in. A pitch deck is a short presentation about:

It should be something you can easily share with investors via email or a link. It should be concise so that anyone who reads it could quickly understand what your company is about. When you create your pitch deck on SeedLegals, you can easily build your pitch page in minutes. We make it simple to share your pitch with investors using one link, plus you can update it whenever you like.

The purpose of your pitch deck is to convince investors to meet with you so you can discuss the potential deal in more detail. In that meeting, you’ll discuss the market potential of your product or service, your financial forecast and how you plan to execute your goals to make money.

Explain your product or service

What problem does it solve? How does it offer value? Your pre-seed pitch deck must explain what your company is going to give its customers.

Define your revenue streams

How are you going to make money? Explain all your revenue streams. Investors want to know that you’ve got a plan to get them their money back (plus an attractive ROI).

Identify the gap in the market that you’re filling

How big is the demand for your product or service? The opportunity in your potential market determines the success or failure of your company.

Communicate your company values, vision and mission

Who are you, as a company? Defining your values, vision and mission will help everyone in your company stay on track towards goals and will get the right investors excited about working with you. It’ll also help your market resonate with you, so think about the type of values your potential market would have.

State the amount of money you need to raise

Investors need to know how much you need from them.

Explain what you’re going to do with the investment money

What are you going to spend your pre-seed funding on? How it will lead to growth? Investors want to know that their money is going to be used well.

Include the deal summary slide

The deal summary is an essential slide. It summarises the deal between you and your investors to help potential investors understand what you’re proposing.

Got questions about raising pre-seed funding? Book a call with one of our funding experts below. We’re always happy to help.