Share options explained: the essential guide for UK startups

Want to offer your team equity in your company? Our guide covers the facts about share options: how and when to set up a...

Do you want to reward your team with share options? Great. Here’s what you need to know about tax on share options in the UK (and for your employees outside the UK). In this article, we’ll cover both EMI and Unapproved schemes and how tax on options works on grant, exercise and sale.

Key facts to know for context:

HMRC’s very popular EMI scheme allows tax advantages for both employees and companies that are eligible for the scheme. The tax advantages of EMI options for employees include:

Let’s take a closer look at the tax implications of EMI options for employees on exercise and sale.

If the employee is terminated

If an employee is terminated by a company, the tax implications of their share options will depend on when they exercise the options:

Let’s take a closer look at the tax implications of EMI options for employees on exercise and sale.

If the exercise price of the options is the same or above the market value (AMV) agreed with HMRC when they were granted, the employee won’t owe Income Tax or NICs when options are exercised.

If the employee was given a discount on the market value (AMV) agreed with HMRC, they’ll have to pay Income Tax (and in some circumstances, NICs) on the difference between what they paid and the market value of the shares at the time the options were granted. There’s more about this on the HMRC website.

So if the employee owes Income Tax, how is the amount they owe calculated? This depends on whether the shares acquired are readily convertible assets or not (see box below for definition).

When an employee sells their shares, they may have to pay Capital Gains Tax, which will be reduced from 20% to 14% (18% from April 2026) if they have held the options or shares for at least 2 years and qualify for Business Asset Disposal Relief.

Example:

Jessica is granted 10,000 share options and HMRC have agreed to an Actual Market Value (AMV) of £2 per share. However, she is granted the share options at a discount – a nominal value of £0.001 per share. In Jessica’s case, there will be two tax events.

Tax event 1

Five years after being granted options, Jessica exercises her options and, at this stage, the shares are worth £100,000. When she exercises her options, she will be taxed on the difference between what she paid, £0.001 and the market value at the time of grant, £2:

10,000 shares at £0.001 per shares is £10 (what she paid)

10,000 shares x £2 per share = £20,000 (market value at the time of grant)

£20,000 – £10 = £19,990 is the amount Jessica needs to pay Income Tax* on.

*Income Tax is paid at 20% for basic rate tax payers, 40% for higher rate, 45% for additional rate + NIC, if shares are readily convertible.

Tax event 2

Three years later, Jessica decides to sell the shares and they are now worth £150,000.

Capital Gains Tax (CGT) is payable on the gain between the market value at the time of grant (£20,000) and the sale price (£150,000), as she already paid Income Tax on the difference between what she paid and the value at grant.

From April 2025, the CGT rate on qualifying business assets increased from 10% to 14%, and is expected to rise to 18% from April 2026. The rate Jessica pays will depend on when she sells her shares.

If Jessica had been granted options at the market value at the time of grant (£2 per share), she would not have needed to pay Income Tax when exercising. In that case, she would pay CGT on the full gain from £20,000 to £150,000 – £130,000 – when she sold the shares, at whatever CGT rate applied at that time.

Michael AtherdenIf the share options have been issued at a discount but you and your employee would like to ensure they only pay capital gains tax when they sell their shares, as opposed to paying part in income tax and part in capital gains tax, then a joint s431 election can be signed by the company and the employee.

This election will mean that the individual is immediately chargeable to income tax on the discount provided (e.g. 10,000 shares at a 50p discount will lead to an immediate £5,000 tax charge). An s431 election does not need to be formally submitted to HMRC, however a copy should be kept by the employer and employee in the case of a tax enquiry. You can easily create a joint S431 election on SeedLegals.

Corporation Tax Specialist,

As a company, you don’t need to pay tax on EMI schemes:

With an EMI option scheme, your company may be able to claim Corporation Tax relief when an employee exercises their share options and sells their shares – even if those shares were granted at a discount.

We’ve highlighted the potential for a Corporation Tax deduction in the examples below. However, please check this with your accountant or tax advisor, as any relief will need to be claimed correctly in your financial statements.

If share options were issued at a discount (£0.001 per share), Corporation Tax deduction would be worked out like this:

If the market value at exercise was £100,000, you’d subtract £10 (the price paid for the shares), which is £99,990. This £99,990 is tax deductible for the company, which at 19% corporation tax works out to £18,992 in tax savings for the company.

If share options were not issued at a discount and £2 were paid per share for 10,000 shares, for example, the Corporation Tax deduction would be worked out like this:

If the market value at exercise was £100,000, you’d subtract £20,000 (the price paid for the shares), which is £80,000. This £80,000 is tax deductible for the company, which at 19% corporation tax works out to £15,200 in tax savings for the company.

These tax deductions can be claimed during the accounting period in which the exercise takes place.

Set up your share option scheme in minutes on SeedLegals and get unlimited help from our experienced team.

Design my scheme

Unapproved options can be given to people the EMI Scheme doesn’t cover. It’s a good way to give equity to contractors, consultants and team members abroad. The Unapproved scheme has fewer tax advantages than the EMI scheme, particularly for employee recipients. The only advantage is that the employee’s tax is delayed until shares are exercised – your option holders don’t owe any tax when you grant their options. Some jurisdictions differ on this rule (such as Isle of Man, for example) so be sure to check the rule for your jurisdiction. There are more complex rules that come into play when Unapproved Options are awarded to non-employee advisors, which we have detailed in the link below.

The Income Tax and Capital Gains Tax recipients of Unapproved options will pay depends on their circumstances – in particular, where they’re located. Because you can grant Unapproved options to contractors and employees abroad, they will have to pay Income Tax according to the tax rules of where they are a tax resident. If you’re interested in granting options to employees abroad, read our article How to give share options to your overseas employees.

For more detail on the tax liabilities that come with Unapproved options for employees, directors, consultants and advisors, see this summary of tax on Unapproved options for team members.

When an employee pays Income Tax on their Unapproved share options, your company is liable for an Employer’s National Insurance Contribution (NIC) if the shares the employee acquires are a Readily Convertible Asset (RCA).

Your company’s exact tax liability depends on how you structure your scheme and your team member’s role within the company. For more detail, hit this link Tax on Unapproved share options for companies.

After helping thousands of companies set up their share option schemes, we’ve seen that there are two optimal times to set up a scheme:

1. Raising funds

Set up your scheme before a funding round to become more attractive to investors. You might want to consider getting your EMI valuation at least three months before you start to fundraise so that you can get a low strike price for your future employees.

2. Growing your team

If you have your options scheme in place before you hire, you can highlight this perk to attract job-seekers.

Learn more about the optimal times to set up your scheme in our article: When is the right time to put your EMI scheme in place?

You can set up an option scheme through lawyers or accountants who’ll do it for you, or you can use SeedLegals to set up your scheme online.

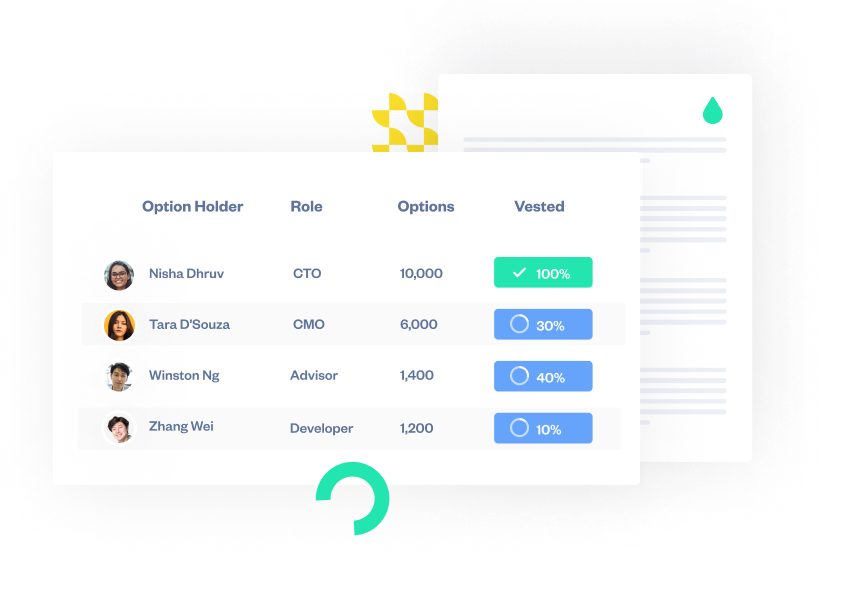

We combine automation with standout support from our experienced team. You can easily set up your scheme in minutes on SeedLegals using our guided workflow, and if you need some help, support is just a call, instant message or email away.

Set up a share option scheme with SeedLegals: how it works

To get started, log in or register and go to Share Options. There’s built-in guidance but if you need any help, hit the chat button to message the team.

Still got questions? Get them answered fast by booking a call with the SeedLegals team.

Article sources

HMRC Guidance | Tax and employee share schemes | Accessed 12/01/23

HMRC Guidance | Employee tax advantaged share scheme user manual| Accessed 12/01/23