Term Sheets explained: the founder’s guide

A Term Sheet is a nonbinding agreement summarising the basic terms of an investment. It's the main negotiating tool betw...

The Term Sheet is where your investment deal takes shape. It’s a non-legally binding summary of the most important terms, which both you and your investor sign to show you’re ready to move ahead with the deal.

In this post, we explain how to strike the balance between keeping the money on the table and getting a fair deal. Find out the red flags to watch out for and how to negotiate with angel investors and VCs.

In this post

The Term Sheet is a non-legally binding agreement between the company and the investor that sets out the main terms of the investment deal.

It’s the next step after you get that all-important yes from an investor during pitch meetings. The Term Sheet is simply a shortlist of the dozen or so most important deal terms.

The idea is that after you’ve agreed those, then and only then do you move onto the next step – the longform agreements like the Articles of Association and Shareholders Agreement.

Raise your funding round on the UK’s #1 platform. Create and negotiate all your investment documents in one powerful, streamlined workflow. Unlimited expert help included.

Get startedThe terms you agree to can greatly affect how you run your company and the control you give up for the investment. It’s a delicate balancing act to make sure you’re acting in the best long-term interests of your company. Sometimes that means a strategic compromise for the funds you need. Other times it might mean declining the investment if the terms are too unfavourable.

How you negotiate the Term Sheet will also lay the groundwork for your relationship with your investor. You and your investors are entering into a partnership, with some give-and-take needed on both sides. Through your negotiations, you want to show that you’re a credible, business-savvy founder who’s capable of steering your company to success. You also want to avoid being combative or obstructive, and making investors think that the potential return isn’t worth the hassle of working with you.

While the Term Sheet isn’t legally-binding, after it’s signed, you’re effectively locked into those terms. Going back to the investors later with proposed changes could harm your relationship and the deal. That’s why it’s so important to negotiate to reach terms you’re comfortable with during the Term Sheet stage.

Are you and your investor happy to skip the negotiation stage? SeedFASTs are a quick way to take in funds now at terms decided at your next funding round.

Find out moreOur Term Sheet guide goes into more detail about the clauses that make up a Term Sheet. To help you decide what’s worth negotiating on, here’s a summary of the most important aspects of the deal.

Valuation: You and your investors need to agree on a fair valuation that accurately reflects your company’s current worth and future potential.

Your valuation determines the percentage of ownership that the investor gets in exchange for their investment. For the founder, a higher valuation means they keep more control of their company. For the investor, a lower valuation means they get more equity at a lower price.

💡Read more: how to value your company

Board seats: Some investors make their funds conditional on getting a board seat to appoint an Investor Director.

The right Investor Director can bring invaluable experience and insight to your board. But keep in mind that the more people involved in key decisions, the harder it is to get things done.

💡 Read more: investors and board seats

Abdul KhanYou might find that having an Investor Director onboard during your seed round brings value when you’re an early-stage company. It’s helpful to obtain references from founders who have worked with the proposed Investor Director so you can easily assess whether they are the right fit for taking your business to the next level.

As your company grows, there may come a time when a different type of investor will be helpful and that investor will want a board seat to help guide your business through the next stages of the company life cycle. At that stage, the expertise and experience of your seed Investor Director may or may not be relevant to your business.

To address this, you could tie the board position of your Investor Director to owning a certain percentage of your company. This way, unless the Investor maintains the specified level of shareholding over time, they would lose their appointment right as an Investor Director. This gives your company the option to build a board that’s relevant to each stage of its growth.

Legal Counsel,

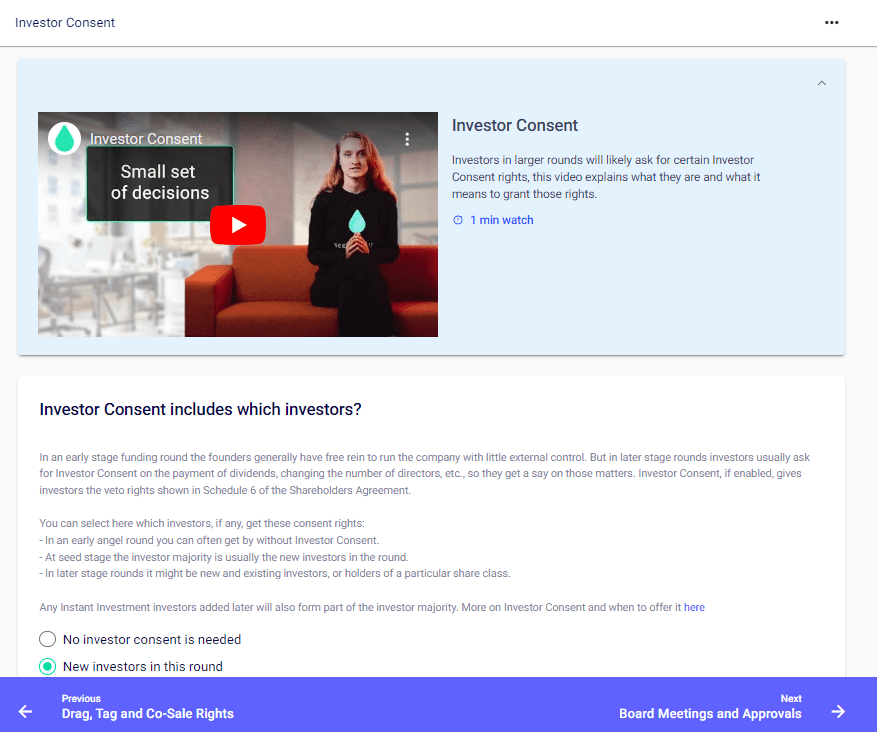

Investor Consent: These rights give investors a voice in certain high-level company decisions, for example expenditure over a certain amount.

For founders, this can represent a loss of autonomy. For investors, consent rights help safeguard their investment from potentially costly decisions.

💡 Read more: Investor Consent

Liquidation preferences: With a liquidation preference agreed, investors get priority on proceeds from a company’s exit over other shareholders.

Here’s how it works: say you sold your company for a modest but not stellar amount. If no investors have a liquidation preference, the amount raised from the sale is split between the shareholders according to the number of shares they hold. If one shareholder has a 1x liquidation preference over the £500K they invested, that amount is paid back to them first, and the rest is shared among the other shareholders. This problem compounds if investors are entitled to a 2x or 3x liquidation preference.

As soon as you’ve given a liquidation preference to one investor, you’ll most likely have to give it to all. This is because other investors will see on your cap table that an investor is getting preferential treatment – and won’t be happy to sign on lesser terms.

💡Read more: liquidation preferences

Abdul KhanIt’s worth noting that when you’re early-stage, you’re under no obligation to give liquidation preferences and anti-dilution preferences. As you move on to VC-led rounds, these provisions are harder to avoid. If you’re raising less than a million, try pushing back on these terms. You can make the argument that where possible, at the early stage in a company’s journey, the economic downside interests of all the shareholders should be aligned.

Legal Counsel,

Anti-dilution preferences: These protect the investor’s shareholding if the company raises at a lower valuation in the future (called a ‘down round’). The anti-dilution clause tops up the existing shareholder’s equity stake by compelling the company to issue additional shares to them.

This makes dilution worse for the founders and other shareholders. When possible, you should avoid giving anti-dilution preferences.

💡 Read more: anti-dilution and non-dilution shares

Founder vesting: Founders often earn their shares over a specific period, typically several years. If a founder leaves the company before the vesting period is complete, they only keep the portion of their equity they’ve already earned. This stops a departing founder from leaving with a significant amount of the available equity.

Investors expect a vesting schedule to be in place as a reassurance that founders are in it for the long haul, and that the company’s equity is adequately protected.

When you negotiate your Term Sheet, keep in mind that vesting conditions aren’t designed to restrict your ownership of the company. They’re an important mechanism to reassure your investors that the founding team is committed and aligned.

💡Read more: founder vesting

Fintan WhiteWe always tell founders to focus on battles you can win. If an investor comes into the negotiation wanting Investor Consent or an Investor Director position, they’re unlikely to budge and you’ll waste your energy and your investor’s goodwill trying to change their mind.

But what you can do is use their insistence on those terms to push for a shorter vesting period or a higher valuation. Those are the terms on which investors are typically more likely to move.

Senior Funding Expert,

Angel investors typically invest smaller amounts of money into earlier-stage businesses (compared to VCs, see below).

An angel’s appetite for negotiation will depend on their level of experience and general disposition. By and large though, their priorities are to put their money to work and receive favourable tax treatment, support the startup ecosystem and collect a return at some point. They’re less likely to want to get involved in many of the finer details of the deal.

When it comes to venture capital Term Sheet negotiation, you’ll probably have much less flexibility. VCs generally expect to use their own Term Sheets and will be less willing to capitulate on terms that grant them generous operational and economic controls.

For example, you’ll find that having an Investor Director position on the board is a hard line for many VCs. They won’t want to tie up their investors’ money without the ability to vote on how to spend it.

Be careful about the amount of decision-making power you give away as part of this. Where possible, you should keep the number of things you need to seek consent from the Investor Director as low as possible. You don’t want to get in a position where you can’t make normal decisions without a long process of back-and-forth.

Abdul KhanWe work with many tech businesses that want to grow fast. That’s why it’s so important that the consent rights you attach to the Investor Director position don’t stop you making day-to-day decisions.

As a rule of thumb, nothing that’s within the budget approved by the board should need consent from the Investor Director. Set a high threshold for matters requiring Investor Director consent so you can move fast.

Legal Counsel,

Your priority should be making sure you’re not getting lost in the legalese. Be careful you understand the nuances and implications of every term you’re agreeing to – otherwise you could find yourself in a difficult situation later. That’s where the knowledge and experience of a legal professional becomes invaluable.

When you do your funding round on SeedLegals, you’ll have a funding expert on hand to talk through your funding and negotiation strategy. They’ll be your point of contact throughout your negotiations – before you write a Term Sheet (or when you receive one from your investor), while you push back on terms and for a final review before you sign.

As well as having the direct support of your funding expert, when you create your Term Sheet on the SeedLegals platform, you’ll see built-in guidance and data-led expert insights as you go along.

For the vast majority of rounds, founders find that our platform, alongside expert guidance from our funding team, is enough. On occasion – especially when a VC hits you with their own Term Sheet – you might want some extra firepower.

With the SeedLegals VC Advisory service, you can pay a flat fee for a bank of 25 hours of expert legal advice. A dedicated senior venture capital lawyer with experience at leading City law firms will support you from start to finish.

Abdul KhanThere are some ‘red flag’ terms we recommend founders don’t accept in a ‘vanilla’ financing round. If the investor is pushing for any of the below, speak to a lawyer to understand your options:

🚩Multiple liquidation preference – above the standard of 1X

🚩Participating preference – where investors recoup their investment and then share in the rest of the proceeds pro-rata with all other equity shareholders

🚩 Preference dividends – an accrued dividend, paid on a company’s preference shares

Legal Counsel,

Here are some general tips to help you negotiate your Term Sheet.

Firstly, you should have a good understanding of the different deal terms and what they mean. It also helps to have a sense of what’s market standard, so you can spot if an investor is insisting on something unreasonable or unfair.

Lean on your network for support. Talk with other founders and investors in your circles and learn from their experiences.

1 in 4 early-stage UK rounds are closed on SeedLegals. This means we have incredible insight into the terms founders and investors are agreeing for their deals. Read our Term Sheet guide for insights about the terms we see most often.

We encourage founders to lead the deal with their own Term Sheet to:

VCs will often send you their Term Sheet, but if you’ve already gone through the exercise of building yours on SeedLegals, you’ll be better prepared to negotiate.

Keep a clear understanding of your company’s vision and long-term objectives, and understand where you’re prepared to compromise and where you aren’t. Determine your funding requirements, the level of control you’re willing to relinquish, and the types of investors you want to partner with. Identifying your priorities will guide your negotiation strategy and help you to articulate what you need more effectively.

Empathy can be a valuable asset in negotiations. Different investors have different objectives. Investor X might be most motivated by the potential for a high return on their investment. Investor Y might be passionate about supporting your industry, or looking for strategic partnerships.

When you know what’s most important to your investor, you can see where they might be willing to compromise. Or you can re-frame your argument so you can show that what you’re asking for actually does align with their interests.

💡Find out if an investor is right for you: 10 questions to ask potential investors during your pitch

Our experts are here to help. Whether you’re working with a funding strategist as part of your funding round or you’ve engaged a dedicated VC lawyer through our Advisory Service, the SeedLegals specialists will be your guides from start to finish.

We make it simple to create, sign and store all the legal docs you need for your funding round.

When you use SeedLegals to raise, you get unlimited support from our funding strategists. With over £1.3 billion in deals closed through our platform, we have the experience and data to help you:

✅ Use the right funding method for your business

✅ Build a founder-friendly, investor-ready Term Sheet

✅ Decide reasonable terms for your investment deal

✅ Negotiate directly through comments on your Term Sheet

Choose a time below to book a free call with one of our experts. We’ll listen to what you need and explain how we can help.