Sunbathing or scaling? Founder tips to beat the quiet season

Summers can be slow for startups but Ava Shoraka and Yanki Kizilates are here to help founders gain momentum during thi...

If you’re an investor or a founder you’ve either created or been on the receiving end of a term sheet. Simply put, a term sheet is the document that lays out in writing the basic conditions under which an investment will take place.

A term sheet is a light-weight document that plugs the gap between a coffee shop conversation between investors and founders, and the 150-pages of legal docs that spell out each detail of the investment.

In a world of limitless time, in which all of us were trained lawyers, each of us would read and understand those long-form legal documents. But we’re busy people, we’re not lawyers, and reading and parsing those documents is immensely time-consuming, even for lawyers. And, worryingly, key deal terms get buried inside the legalese. I’ve met founders who’ve closed Series A funding rounds who signed legal docs who didn’t understand some of the key rights that they and their investors signed up to.

The question then – and the focus of this article – is what makes for the perfect term sheet? Should a term sheet simply outline the barest essential deal terms (valuation, board seats, founder vesting, etc.), or should it cover all the key deal points that will crop up in the Shareholders Agreement and Articles that will form the basis for the funding round?

Super-simple term sheet:

“Wanna see a movie? We’ll figure out the next steps later.”

Comprehensive term sheet:

“I’m thinking the two of us, a house in the countryside, three kids, a dog…. good with you?”

A short and simple term sheet that covers just the basics will get you in the door quickly, but things can easily fall apart when you get to the details later. Far better to have not wasted time on something that clearly wasn’t going to work, if only you’d listed the requirements up front!

On the other hand, spelling out all the deal terms in detail up front is more efficient in that if it’s not the right match you’ll discover that before you waste more time. On the other hand, a lengthy set of up-front requirements might mean you never get past first base.

Make a term sheet too simple and, while both parties might find themselves in full agreement on the five points you’ve distilled your deal down to, things could break down later when dozens of other terms are unveiled.

So, which approach is best when it comes to term sheets?

Before answering that, let’s take one deal term, Drag Along, as an example.

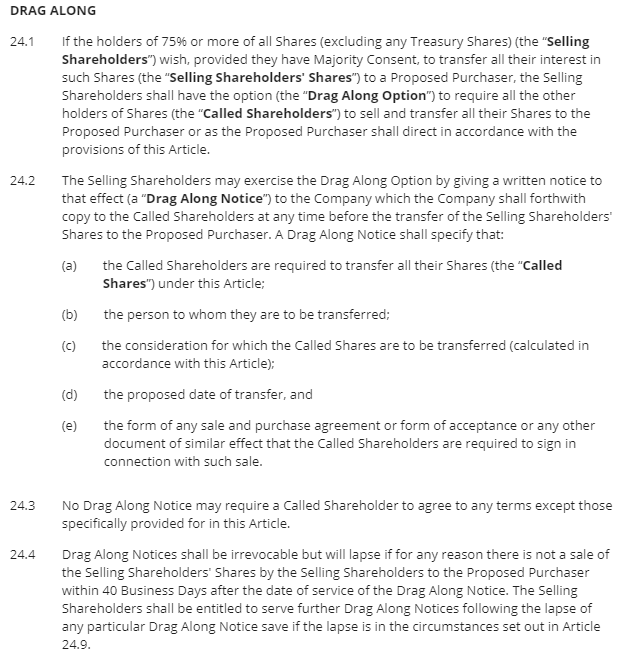

Drag Along is a very important deal term, it’s something investors usually insist on, and it’s described in the company’s Articles in a few hundred words, here’s an excerpt:

Unless you’re an expert in funding rounds that probably didn’t make much sense to you. And, even if you were, it’s on page 15 of a 48-page document so spotting that Drag Along needs 75% shareholder approval together with investor consent – a super-important deal term – is not so easy.

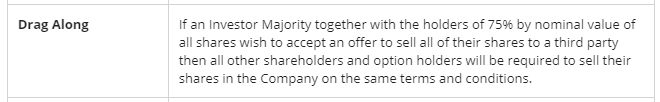

That’s where a well-designed and comprehensive term sheet comes in, where Drag Along appears like this:

That makes much more sense!

And, that’s pretty much the state of play for funding rounds today. One note: we now recommend Drag Along at 50% shareholder approval, not 75%. We changed to align with the BVCA model documents which set Drag Along at 50%.

But, can we do better…?

If we agree that the purpose of a term sheet is to summarize the key terms in a funding round, then the way they’re drafted today isn’t quite right because they’re not just a summary – there’s a lot of padding.

In fact, all the wording in a term sheet is really neither a summary nor a legally binding document… it’s a bit of a hybrid, containing the deal terms of interest with words to turn it into English sentences.

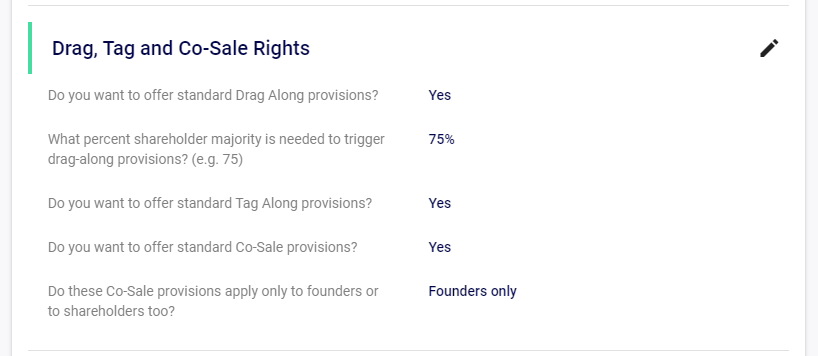

So at SeedLegals we decided to provide an alternate version of a term sheet, we call it a Deal Term Summary, and it looks like this:

Stripped right back of extraneous words, it lets an investor who knows what they’re after see in an instant every key deal term in a round. The essence of the round comes through directly, all the noise is removed.

When founders set up their funding round on SeedLegals they can choose to display the term sheet in either regular Term Sheet format or in Deal Term Summary form. We initially set this up as a mostly internal tool to allow us to check term sheets more easily, but then discovered that some founders and investors preferred this format. All killer, no filler.

Okay, so now we’ve reduced a funding round to a set of key deal terms. The next step, surely, is to provide an elegant interface that allows founders and investors a way to specify those terms, and then use technology to automatically build the term sheet and all the downstream documents from those deal terms.

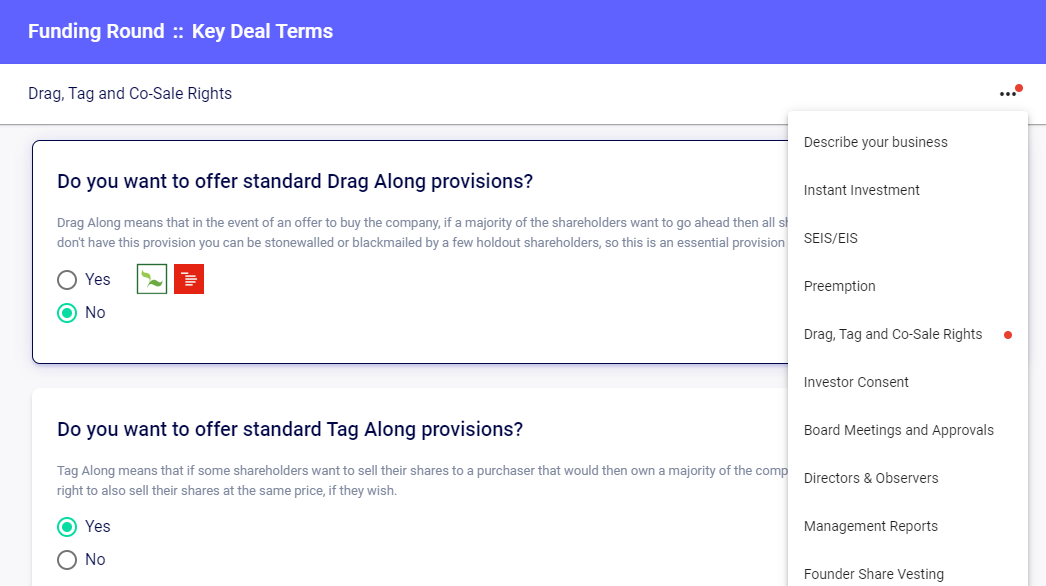

And that’s exactly what we’ve built at SeedLegals. The parties start by choosing their preferred deal terms:

The SeedLegals platform uses those inputs (which we divide into about 50 Key Terms and another 50 or so Advanced Terms) to instantly build the Term Sheet, Shareholders Agreement, Articles, and other deal documents.

The Shareholders Agreement and Articles are each machine-generated using over 1000 conditional clauses and conditions, based on those inputs, the cap table, the investors, the known set of founders and directors, and more.

The method we’ve developed has transformed the way UK startups raise investment, with something like 1 in 12 of all UK early-stage investments now done on SeedLegals, and growing.

But that not the end, in fact it’s just the start.

The next step is to use this technology and deal term summary approach to transform the way deals are negotiated.

Right now that’s a bit of a mess – as a founder you receive a bunch of term sheets from investors, you lay them side by side on the kitchen table, trying figure out what the deal terms are. Investor A is will invest £500K at a £4M valuation but wants investor consent, an investor director seat, and Preference shares with weighted average anti-dilution. Investor B will invest £400K at a £3.8M valuation, is happy with an observer seat, and isn’t asking for anti-dilution.

Enter the SeedLegals Deal Term Negotiator.

By transforming the process into deal terms, we can now create a user interface that lets you see at a glance which terms you and the investors are in agreement on, and which ones you differ on:

The SeedLegals Deal Term Negotiator launches in August 2020, allowing investors to create investment proposals on SeedLegals in minutes, send those proposals to any company, and, if the company wishes to pursue that opportunity, then the system automatically tracks, highlights and helps resolve the deal term differences, allowing rounds to be negotiated and closed even faster.

If you’d like early access, hit the chat bubble, we’d love to hear from you.

Oh, and by the way that’s still the beginning… stay tuned for deal term DNA, economic value comparator, and more…