SEIS: Guide to the Seed Enterprise Investment Scheme

Founders guide to SEIS. Find out how it helps startups and investors, eligibility criteria, how to get Advance Assurance...

Got your Advance Assurance? Congrats! Founders often ask us if Advance Assurance has an expiry date. It doesn’t. But your Advance Assurance will lapse and you won’t be able to offer SEIS/EIS tax relief to your investors if there are changes to your company’s situation that make it no longer eligible for SEIS/EIS.

In this post, we explain how and when your SEIS/EIS Advance Assurance can expire.

SEIS/EIS Advance Assurance isn’t a guarantee that investments in your company will qualify for tax relief. It’s proof that if nothing changes for the company, and the deal documents for the SeedFAST or funding round are in line with the documents shown to HMRC when you applied for Advance Assurance, then the investments should qualify.

And Advance Assurance can’t tell you if your investors themselves are eligible for SEIS / EIS tax relief.

If it helps, you can think of Advance Assurance as an assurance that the investment is not disqualified.

Zlatina TrifonovaSometimes an investor might ask you to re-apply – to effectively renew – your Advance Assurance if you obtained it more than a year from the time you started fundraising. This mostly happens with SEIS and EIS VC funds, because generally they do more due diligence than angel investors.

CX Team Lead, SEIS/EIS Specialist,

When it comes to SEIS and EIS Advance Assurance, there are some time limits to watch out for. If you go over these, your Advance Assurance is invalid and an investment in your company won’t be eligible for the scheme:

If you’ve raised some EIS investment in the first seven years you were trading (ten years for Knowledge Intensive Companies, KICs), you can then submit a new application for Advance Assurance under what’s known as Condition A.

You can continue to raise with EIS for as long as you like, as long as:

and:

There’s a limit to how much you can raise though:

Read more about Condition A in our post, EIS: What to do if you have been trading for more than 7 years and want to issue EIS shares

If your company is beyond the trading limit for EIS and you start a new business activity that HMRC considers to be a new startup for the purposes of the scheme, then you can reset the clock to raise with EIS.

This is called Condition B – if you can show HMRC that your pivot, whether it’s a different product or geographical market, makes your company very risky, then you can reset the clock for EIS. (Not for SEIS – this only applies for EIS.)

Read more about Condition B in our post, EIS: What to do if you have been trading for more than 7 years and want to issue EIS shares

Got questions about SEIS / EIS? We’ve helped thousands of companies obtain Advance Assurance and our SEIS/EIS experts are here to help you. To message us, hit the chat button (at the bottom right of your screen).

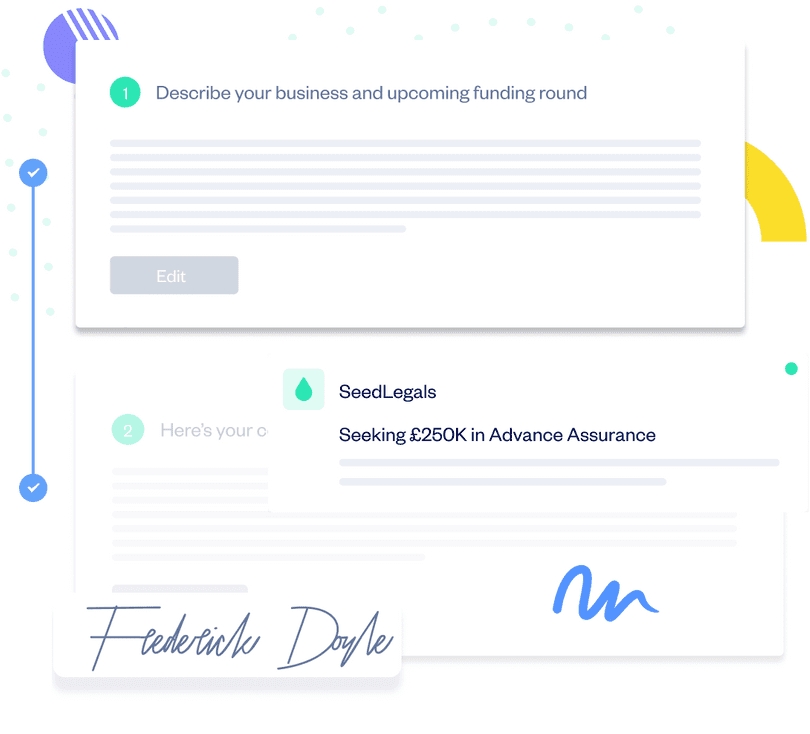

With Advance Assurance, your company is dramatically more investable. Use SeedLegals to apply and get approved fast.

Get started