How to give out shares and share options in your startup

Find out the best way to distribute equity to investors and your team, and the tax implications to consider.

Get all the options essentials - share option schemes, EMI valuations, legal docs - plus unlimited expert support for £2...

When you sell your company, if there are unallocated shares in your option pool, how do you make sure you get them back?...

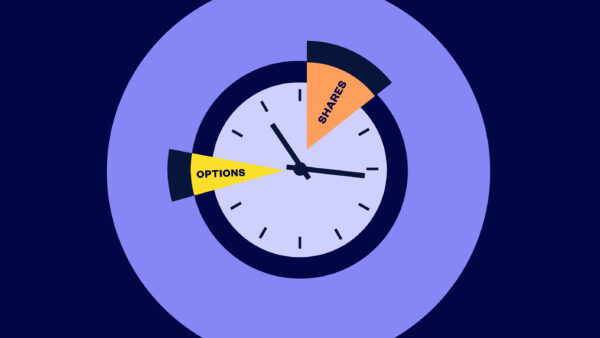

The important difference is that if someone owns shares, they are a shareholder immediately. With options, they have own...

Do share options make a better bonus than cash? Find out why an option scheme could be a better long-term and cash-smart...

6 min read

6 min readThe days of painstakingly tracking equity allocation on a series of spreadsheets are over. In this post, we explore two...

6 min read

6 min readShares… Growth Shares… EMI Options… Unapproved Options… it all sounds so complicated. But actua...

We explain what a share option pool is, how to set it up and how much equity to put aside for your UK share option pool....

Startups commonly give 1% equity to General Advisors paid only in equity, who work less than 2 days a month. Discover m...

To give shares or options to your US taxpaying employees, you need to first establish the fair market value (FMV) of the...

We explain what share incentive plans are, how they work and how they’re different to share option schemes.

You might sign these tax elections if you run a company share option scheme or if you’re granted options. We explain wha...

How well developed does a startup need to be to consider an EMI scheme? Most founders understand the power of offering...