What is a Knowledge Intensive Company (KIC)? EIS benefits and criteria

Knowledge Intensive Companies (KICs) are companies that are carrying out research, development or innovation at the time that they are issuing shares.

Advance Assurance attracts investors to your startup by showing that an investment in your company is likely to qualify...

Get investment-ready with this EIS guide. Find out what EIS is, what types of companies qualify and why it makes attract...

Make your company more attractive to UK investors - startups from France, Germany, Spain, the US or anywhere can qualify...

Invest in EIS-eligible companies to get generous tax relief. We set out the rules and benefits for investors.

7 min read

7 min readGreat news for startups! We explain how to make the most of the new rules coming to SEIS from April 2023 - how to raise...

6 min read

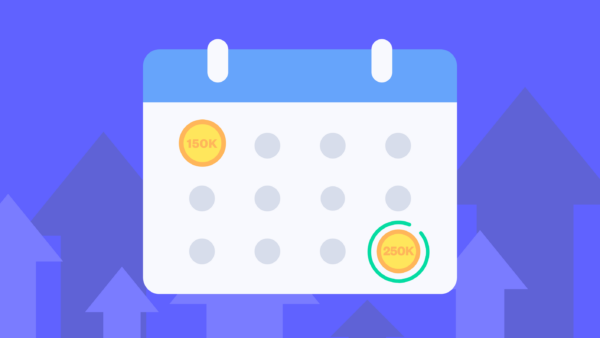

6 min readIn April 2023 the SEIS limit changes from £150K to £250K. That's awesome. But those changes haven't yet become law. So s...

Raised with SEIS? Here’s how to complete the SEIS compliance statement and send investors the certificates they need to...

Get a step-by-step guide to wrapping up EIS compliance and getting your investors the tax relief they expect.

Read our recap of the key announcements for startups made by Chancellor Jeremy Hunt in his statement to Parliament on 17...

Founders guide to SEIS. Find out how it helps startups and investors, eligibility criteria, how to get Advance Assurance...

Startup not working out? Haven’t been able to raise investment? Here’s how to make sure the SEIS/EIS investors who’ve su...

The right to buy out your investors later, or giving your investors the right to sell their shares can be problematic. I...