Option scheme insights: Explore UK trends for 2025, decoded by our experts

Want to know how other startups structure their share option schemes? You’re in the right place. We dive into the data for insights to help you plan or evaluate your own scheme.

Insights you won’t find anywhere else

This free report contains the findings of our January 2025 survey of all active option schemes on SeedLegals set up in between 2022 and 2024, both EMI and Unapproved schemes.

Discover what your peers are doing, how to make your scheme more attractive and the trends we’re seeing.

The report includes data insights about share option schemes with commentary from our experts.

Tommy HackleySenior Account ManagerTommy is an experienced equity strategist with a specialism in R&D tax credits and share option schemes. Find out more about Tommy

Tommy is an experienced equity strategist with a specialism in R&D tax credits and share option schemes. Find out more about Tommy

Justin LeeOptions ExpertJustin uses his law and business background to help SeedLegals customers strategise, set up and maintain their share option schemes. Find out more about Justin.

Justin uses his law and business background to help SeedLegals customers strategise, set up and maintain their share option schemes. Find out more about Justin.

Edward RobertsSenior Equity & Funding StrategistEdward is an expert in the startup and fundraising space, helping founders manage their equity, raise funding and scale sustainably. Find out more about Edward.

Edward is an expert in the startup and fundraising space, helping founders manage their equity, raise funding and scale sustainably. Find out more about Edward.

In this report

We’ve analysed the data from hundreds of share option schemes set up on SeedLegals in the UK between 2022 and 2024. Our experts highlight trends and share insights on the choices companies make for their EMI and Unapproved schemes.

✔ What % of shares companies set aside for the option pool

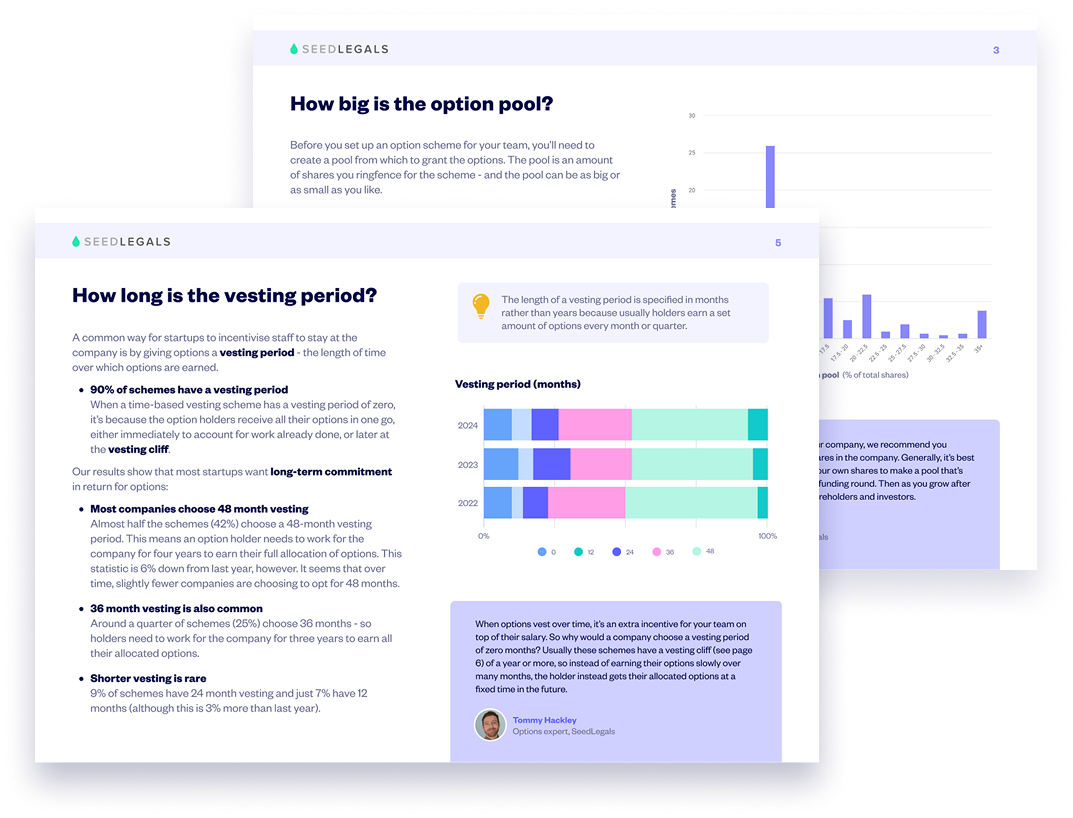

✔ How long companies choose for the options vesting period

✔ Whether companies opt for a vesting cliff and if so, how long

✔ What vesting frequency companies choose

✔ Whether companies offer accelerated vesting

✔ When companies allow holders to exercise options

✔ What % of companies have EMI and Unapproved schemes

Talk to the experts

Not sure what type of option scheme you need? Don’t know how to get started?

We’ve helped thousands of startups set up and manage their share option schemes. Choose a time to book a free call with one of our experts.