Fundraising in 2026 – VC insights on what founders must get right

Fundraising expectations have shifted. In this webinar, Sapphire Capital shares how VCs are investing today, what will m...

SeedLegals’ Deal Manager is the fastest and easiest way to manage the end-to-end legals for your investments. Deal Manager helps you start a funding round, negotiate deal terms and close the deal quickly and easily.

In this article, we’ll take you through the steps on how to use Deal Manager to propose an investment and close the round effortlessly.

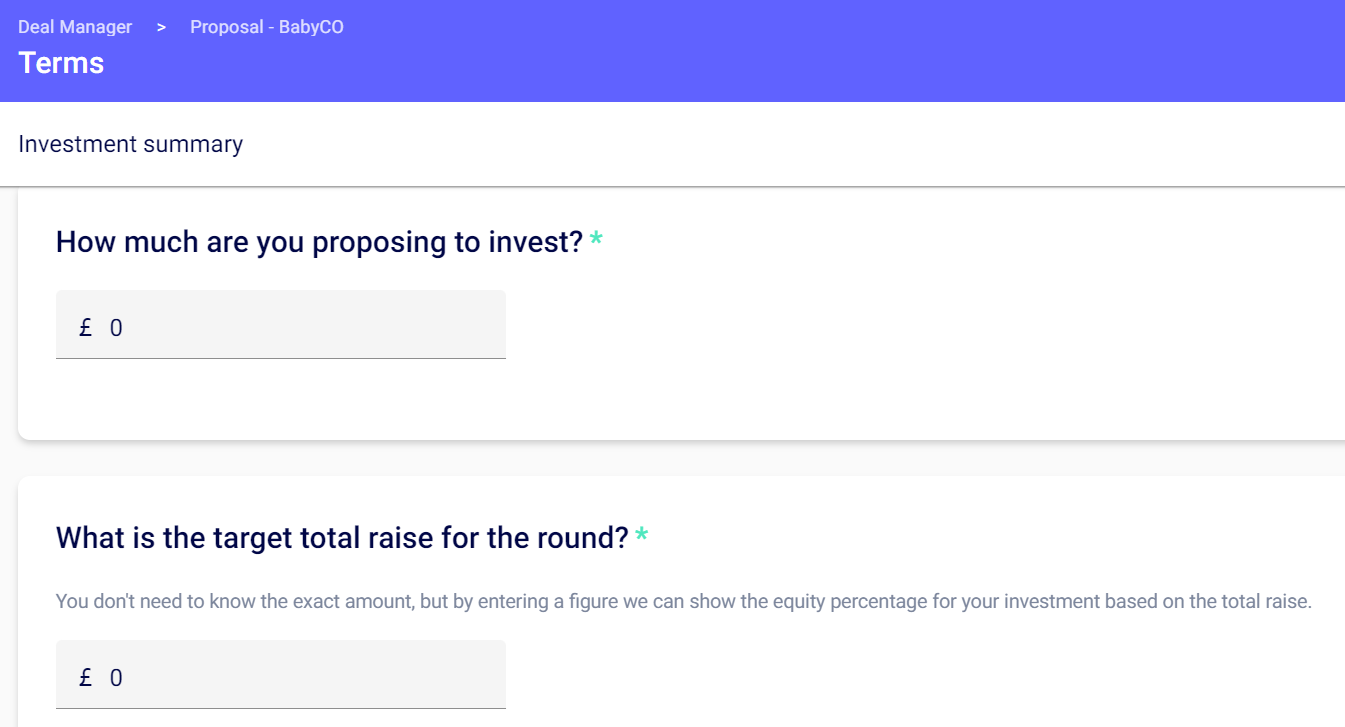

Sign up to SeedLegals to share your investment proposal with the company you’d like to invest in. Our automated platform will create your deal terms, and once agreed, we’ll generate a perfectly matched set of legal documents to close the round, such as:

Talk to someone from our team to learn how it works and how it can help you.

Book a callWhen you’ve entered all the terms, you will be taken back to your deal page where you can review your long-form Investment Proposal – just hit ‘Create’ on the Investment Proposal card.

You’ll first see this as a long-form document but you can hit the ‘Terms’ button in the top left-hand corner to see a bullet-point summary of what you are proposing. Here’s an example:

When you’re ready to proceed:

The founder will receive a notification via email that you’ve sent an Investment Proposal to them. They’ll be asked to view your long-form document by signing in to SeedLegals.

When the founders log in they’ll see your investment proposal waiting for them. They can view your investment proposal, and, if they’d like to proceed, they can click to start a new round. If they already have a round in progress, they can add you to their current round. In this case, they’d be using the existing current round deal terms, not yours.

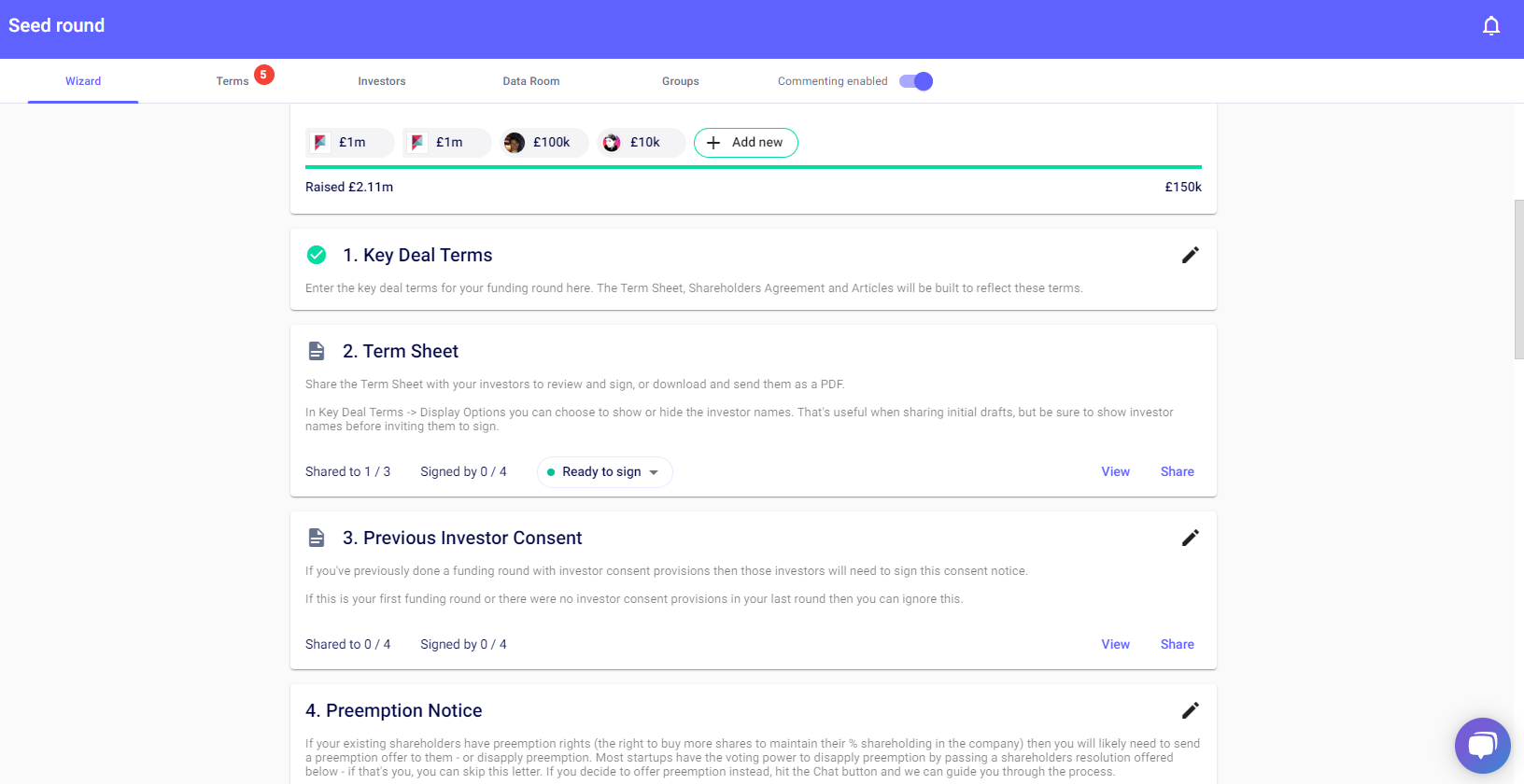

When the founders create their round, SeedLegals will generate:

The first thing the founder needs to do after receiving your proposal is to complete the Term Sheet, based on the terms you proposed. The founder will be able to accept terms you propose or propose alternatives. Any misalignment on terms between founder and investor is highlighted to the founder on the platform as they build their term sheet.

When the founder has completed the term sheet, they will send it to you via SeedLegals. You’ll receive an email notification from SeedLegals that there is a term sheet to review.

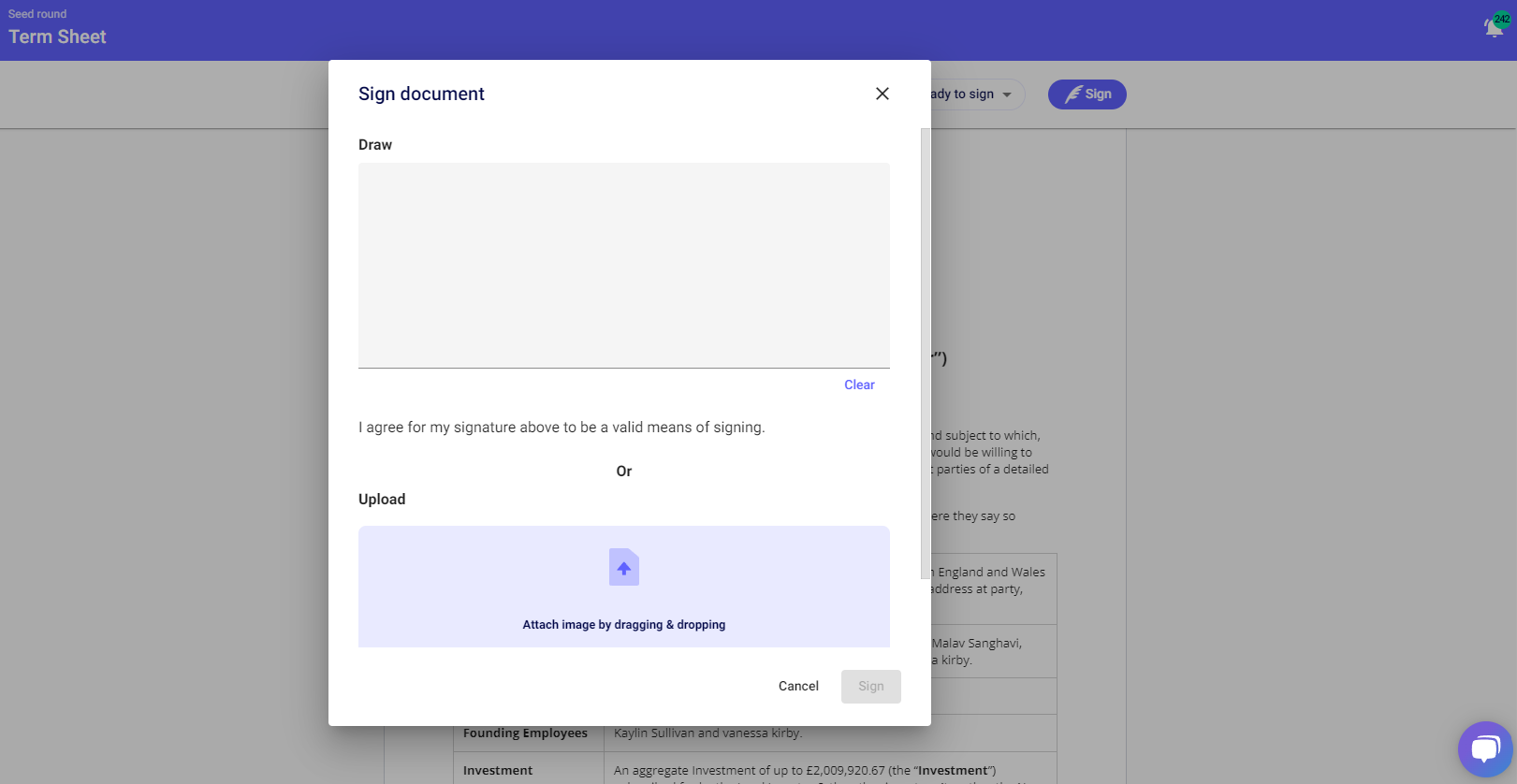

When you’ve agreed the term sheet with the founder on SeedLegals, you can e-sign it. The founder can then build the remaining deal documents on SeedLegals to complete the round.

After the Term Sheet is agreed upon, a dedicated SeedLegals funding specialist will work with you and the founder to finalise the remaining deal documents such as Shareholders Agreement, Articles of Association, Disclosure Letter and Board minutes.

The founder will share new documents produced on SeedLegals as and when needed with you. You will be notified of documents to review.

All you’ll need to do is sit back, do a final review and sign the remaining documents to finalise your investment swiftly.

All your deal documents will be kept in one place for you on your SeedLegals account.

When you do your next deal on SeedLegals, you can easily clone your terms from a previous deal for your next one (and tweak them if you need to).

When you start a new Investment Proposal, you’ll be asked to either use SeedLegals’ default terms or simply click your previous deal to mimic and edit those terms.

To find out more about how Deal Manager works and how much it would cost you, please book a call with our team.