Startup boards explained and tips to manage your board

The founder's guide to creating and managing a startup board. Responsibilities, what to pay and how to ace the admin.

When negotiating funding deal terms, investors will often ask for a board seat, known as an Investor Director position. Founders then need to decide whether or not to allocate investors a seat on the board or not.

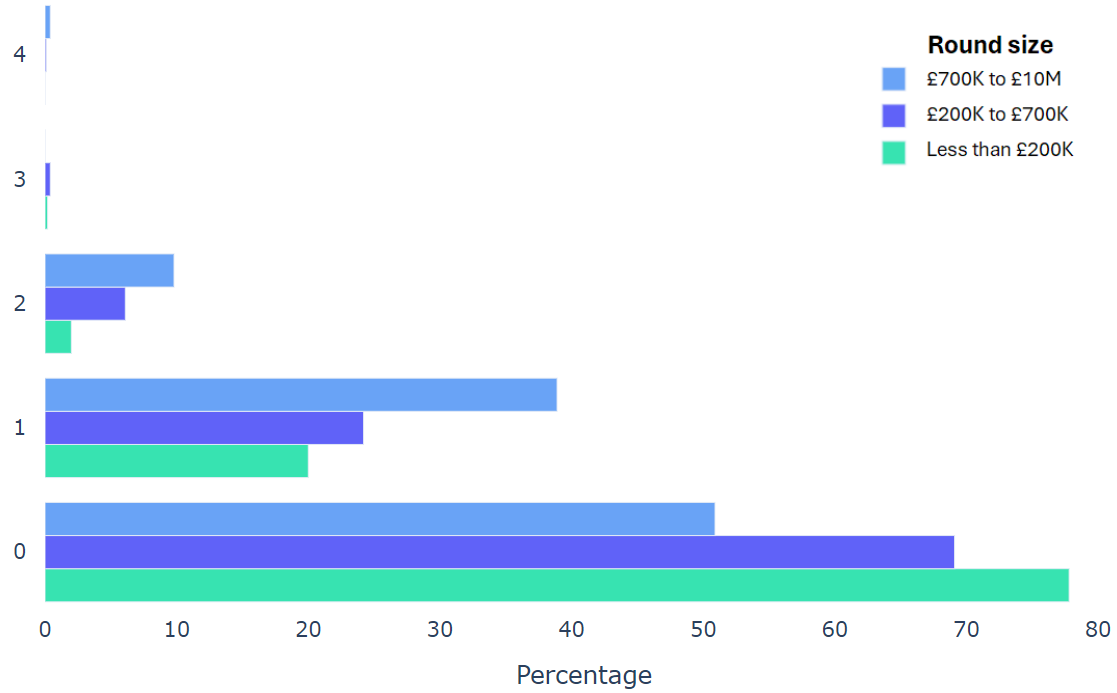

Until now that was all done without any knowledge of whether you were the only person in the world to be agreeing to this, or the only one not agreeing to it. Now, thanks to the SeedLegals Termometer, we can provide unbiased insight to help founders with this important decision. Our unique data set collates the decisions from over 2,000 funding rounds on SeedLegals so you can access insights from completed funding rounds of all sizes.

In this post

Let’s start with some background to this. The board of directors agrees and signs off strategic company decisions, including long-term vision, hiring and firing of key personnel, major business changes, etc., and so who sits on it is an important decision for the founding team to make.

Investors typically have specialised knowledge that can add great value to your board, and they generally ask for a board seat so that they can have a say in company decisions and the strategic direction of the company.

The question is then, at what point is it common to add one or more Investor Directors to the board? We ran the numbers to find out.

From the data set, we can see that in smaller funding rounds, founders rarely need to offer their investors a seat on the board, but it becomes more common to give a board seat at larger funding rounds.

What’s behind this increase in board seats as round sizes go up? The most obvious reason is that the type of investor (friends and family, angel, fund) investing in the company varies with the size of the investment. This impacts the likelihood of whether they want an investor director appointment and whether the founder wants to give them one.

Friends and family investors

Smaller raises will typically be funded by friends and family or crowdfunding backers, who are less likely to have the financial or technical expertise which would add input to the board.

Angel investors

Smaller raises will also typically be furnished by angel investors or accelerators, who will be making several investments every year and may not have the time to be a board member to all of them. Some angel investors are passive investors but many of them will be genuinely interested in your business and have one interesting perspective to bring. They represent a collective force that can help your business in terms of expertise and network as investors or entrepreneurs themselves.

Venture Funds

Funds and VCs invest larger amounts and will want to have more control over a company’s decisions and so typically demand a seat on the board. VCs have a duty of care over their investors’ money, and so must take reasonable steps to ‘look after’ their money as well as ensure maximum return on their investment – even if this includes steering the company in another direction.

Furthermore, VCs are often ex-entrepreneurs and pride themselves on their ability to help their portfolio companies, therefore being on the board is a natural position from which to do this. They often fully control the investor majority and have a huge influence on the key decisions and should do so. They are generally aligned except on the timing of the exit since they are usually late investors and are ready to wait longer in order to see a return on their investment.

Regardless of whether the investor is an Angel or a VC, the more they invest, the more they care about the outcome of the investment and the more likely they are to want a board seat. This is where the balance of representation on the board is the most critical factor in your success so all the parties can be heard.

If you don’t want to give the investor a seat on the board, there is an intermediate position available. You could offer that the investor becomes a board Observer, able to attend board meetings and have their say, yet without the right to a vote.

As a founder, you should be pushing for what you believe to be the best possible outcome for the company. In our view, if a particular person will add value to your board then, great, appoint them as a director. If not, then push back on that.

No board wants to be prevented from making operational decisions and giving a board seat does mean there is another opinion to consider around the table. However, in smaller rounds several factors combine to mean that a board seat is typically not required, and at intermediate amounts it is not a must, but mostly depends on the type of investor that the money is coming from.

Our team is here to help. When you do your funding round on SeedLegals, you’ll work with a funding specialist who’ll help you draft your term sheet and communicate with your investors. Choose a time below to speak to us and get started.