Sunbathing or scaling? Founder tips to beat the quiet season

Summers can be slow for startups but Ava Shoraka and Yanki Kizilates are here to help founders gain momentum during thi...

Series C is a good place to be. Often the last stop before a high-return exit or a successful IPO, this later-stage funding round marks the point at which a company’s focus switches from surviving to thriving.

In this post, we explain when a company is ready for Series C funding, what kinds of investors provide Series C financing and alternative ways to take in cash quickly.

A Series C funding round is one the later stages of formal funding rounds. It typically comes after pre-seed, seed, Series A and Series B rounds, though there’s no need to go through the full sequence. The different rounds correspond to the development stage the company is at, not whether they’re raising for the first, third or fifth time.

At this advanced stage, the company seeking Series C funding will have already found success and established themselves firmly in the market. Series C is the point at which a company stops being considered a scrappy, upstart startup – and instead becomes the company to beat.

To be ready for Series C funding, a company should have:

Series C funding amounts differ hugely by region and sector. UK companies at Series C tend to raise between £15 million and £100 million, with valuations starting at £200 million and, on occasion, smashing the unicorn threshold of £1 billion+.

Save time and money with easy-to-use software combined with expert legal advice.

Learn moreBecause a Series C company has already proven itself, they’re considered a less risky investment compared to a seed or Series A business that hasn’t (usually) hit profitability yet. For this reason, different types of investors usually appear during Series C rounds.

While angel investors and (early-stage) venture capital funds dominate startup funding, by Series C larger financial institutions with a more conservative approach to risk are ready to get on board and cut giant cheques.

New sources of funding at Series C include:

Jonny SeamanAt Series C, you likely already know the score when it comes to fundraising, but the usual rules apply: if you take Series C funding, those investors will be looking for a return on their deployed capital, so plan to make a 2 to 5x jump in valuation between this round and the eventual exit / IPO valuation. Venture capitalists will still feature, but with cheque sizes running into £10m to £100m, you’ll also see some strategic investors and growth investors (private equity, hedge funds and banks) enter the fray.

Funding strategist,

Earlier funding rounds provide companies with what they need to get off the ground and find traction. A Series C company is almost always already profitable and can support itself.

Series C finances activities that contribute to dramatic, strategic growth and a large boost in value for shareholders.

Often Series C funding is used for significant expansion – to enter new markets, the tactical acquisition of another company or research and development for new products.

In theory, you can keep going indefinitely through the alphabet. But in practice, Series C is often the last round where companies negotiate for external funding.

While some companies might go on to raise Series D, E and beyond, Series C is often the final funding round before going public with an IPO (initial public offering).

IPO is when your shares become available for the general public to buy on a public stock exchange. It involves issuing new shares to raise money, but investors, founders and other shareholders also have the opportunity to sell their existing shares and cash out.

If IPO is your ultimate goal, performing well at Series C is a vital step. Occasionally, the Series C is done in large part to fund the IPO process which can be very expensive. You should aim to raise enough money to get you to the IPO finish line. A generous Series C valuation will also help build the case for a high share price at IPO.

In terms of process, Series C broadly follows the same protocols as Series A and B. But with the much greater pressure on due diligence checks that comes with larger amounts invested.

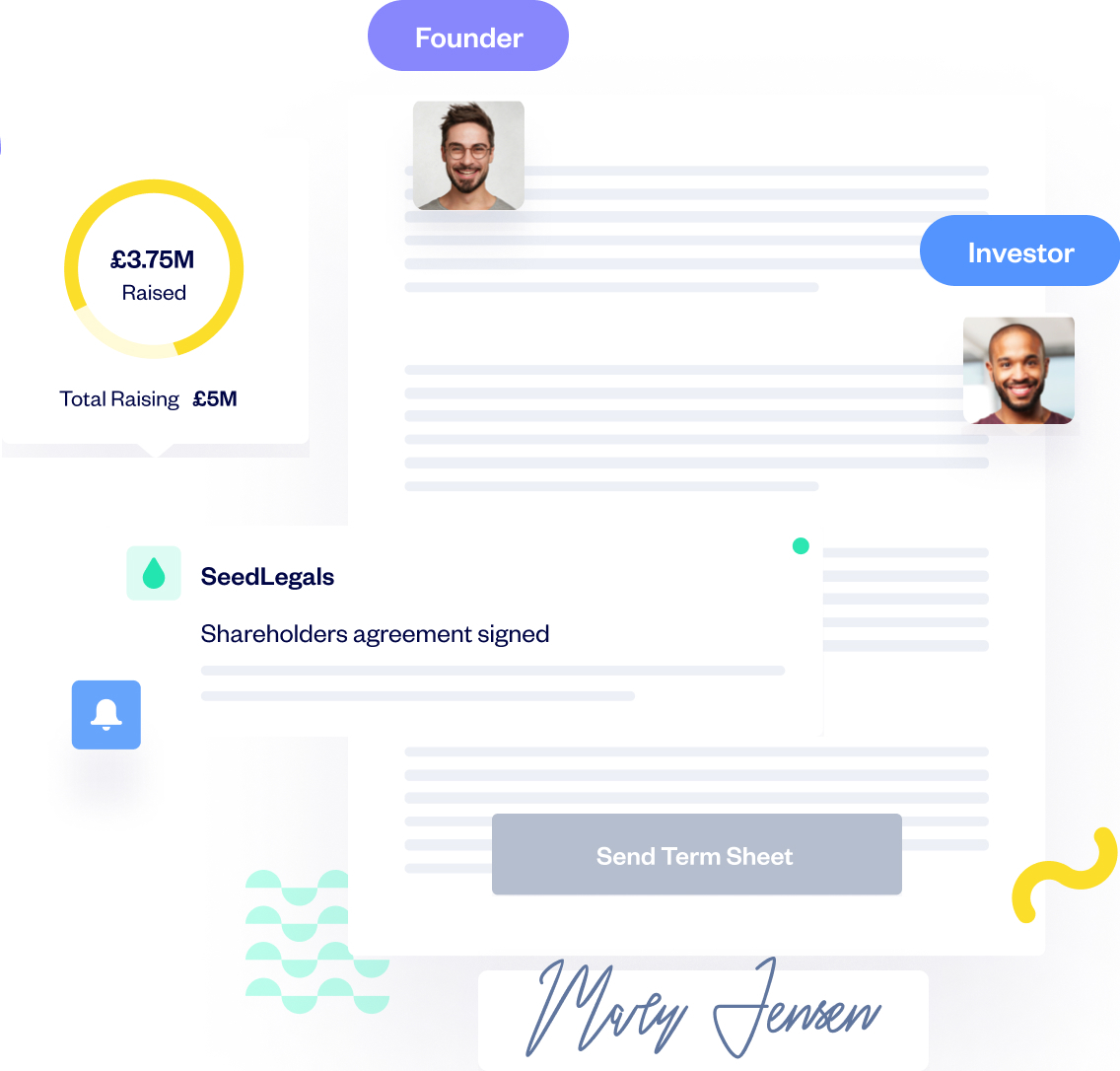

The main funding documents you’ll need for your Series C funding round are:

Start with your inner circle and work out. Your first port of call should be investors who’ve already backed you. They might want to write you another cheque and, crucially, they might be able to put you in contact with bigger investors.

On the trail to Series C, you’ll want to make sure you:

Negotiating a Series C round is a long process that takes up a lot of time and energy. If you’re looking for a cash injection to fund growth activities, but you don’t need a full round with multiple investors, there are more flexible ways to raise with SeedLegals.

Not sure what funding stage you’re at? Need to check whether a SeedLegals agile funding method is the right choice? Book a slot to speak with an expert funding strategist – no charge, no pressure.