SEIS for investors: Deduct 50% of your next investment from your UK income tax

SEIS is a fantastic UK government tax incentive to increase investment in UK startups. When you invest in an eligible st...

Investors, do you want to spend more time investing, and less time worrying about the admin? Great news: we’ve just launched our investor membership, SeedLegals for Investors. It’s built to make life easier for all investors, from first-time deal makers to career veterans and leading VCs.

In this post, we explain what comes with SeedLegals investor membership and how to join.

In this post

If you choose to take up a SeedLegals for Investors membership, here’s what you’ll get:

All SeedLegals members get unlimited help from our expert team -not just when you’re doing a deal but anytime you need it. We don’t do billable hours. Consult a lawyer instead and you could land a bill for thousands, just for a chat.

Whether you’re an experienced angel investor, a VC who wants to call in expert support for the admin and niche SEIS questions or a new investor keen to learn more, we’re here to help.

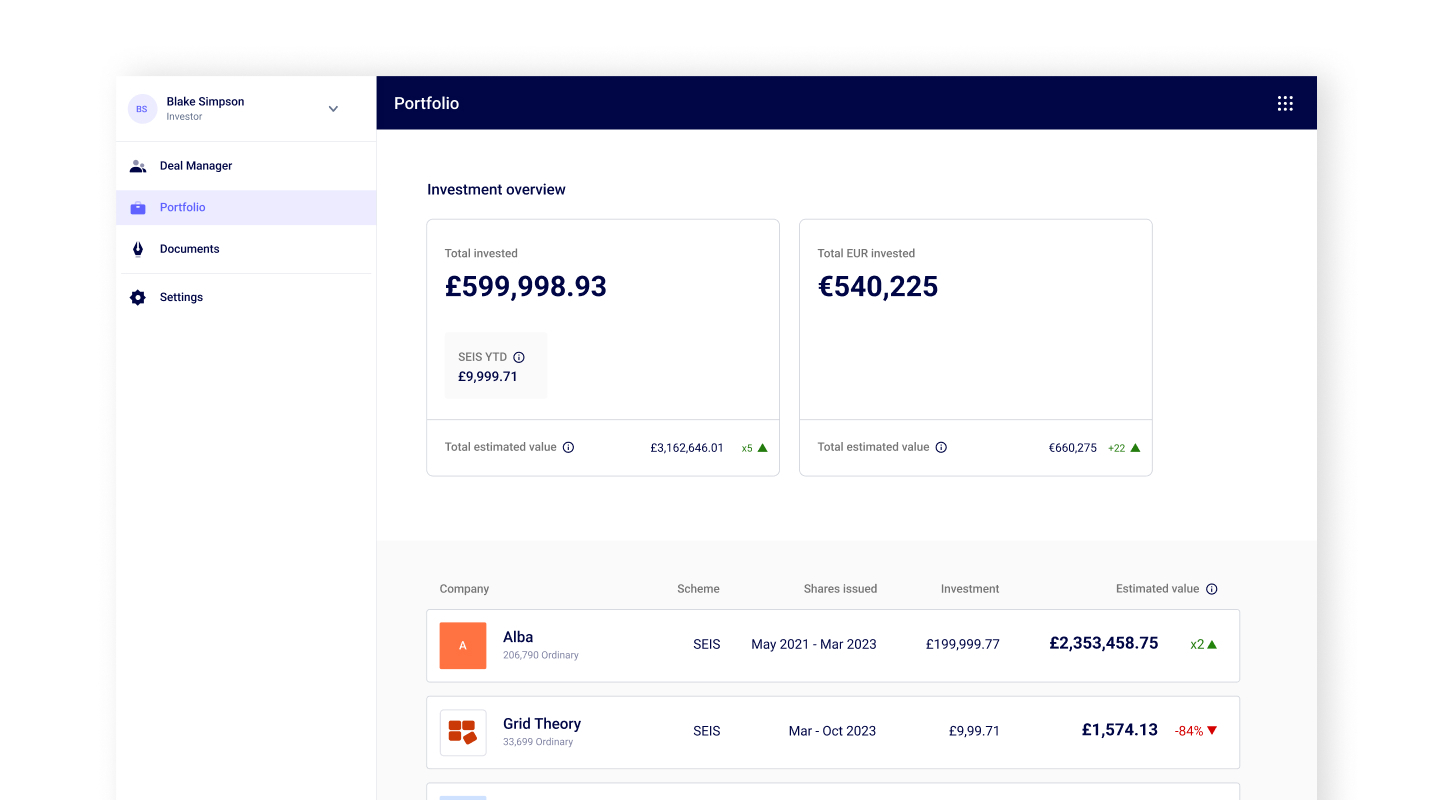

In your Portfolio, you can see at a glance the companies you’ve invested in or have shares in on SeedLegals, and the estimated value of your investments. The value is based on the price per share of the last shares issued by that company on SeedLegals.

In Portfolio, you can also keep track of the cap tables of companies you’ve invested in. To do so, simply click on a company and if they’ve given you access to their cap table, you’ll be able to see all the shareholders, your shareholding, option pool and more.

You’ll also be able to model how much your shares are worth at different valuations and what your return will be on exit.

Have your investee companies completed their SEIS/EIS compliance through SeedLegals?

From the Portfolio dashboard, you’ll find those S/EIS3 certificates stored safely ready for tax season, so there’ll be no rummaging through paperwork to find them when the time comes to claim SEIS/EIS tax relief.

As a SeedLegals for Investors member, we’ll also work with you to make sure you have all the documentation you need to claim SEIS/EIS, however you pay your taxes.

If you submit an online tax return, we can provide detailed guidance on which sections to complete to claim the full relief. If you submit a postal return, we can provide the additional forms (SH101) required to claim the relief. Your accountant can then collate this information into your full tax return submission. And finally if you pay tax solely through PAYE and don’t submit a return, we can complete the relevant sections of your S/EIS3 forms that you received after investing.

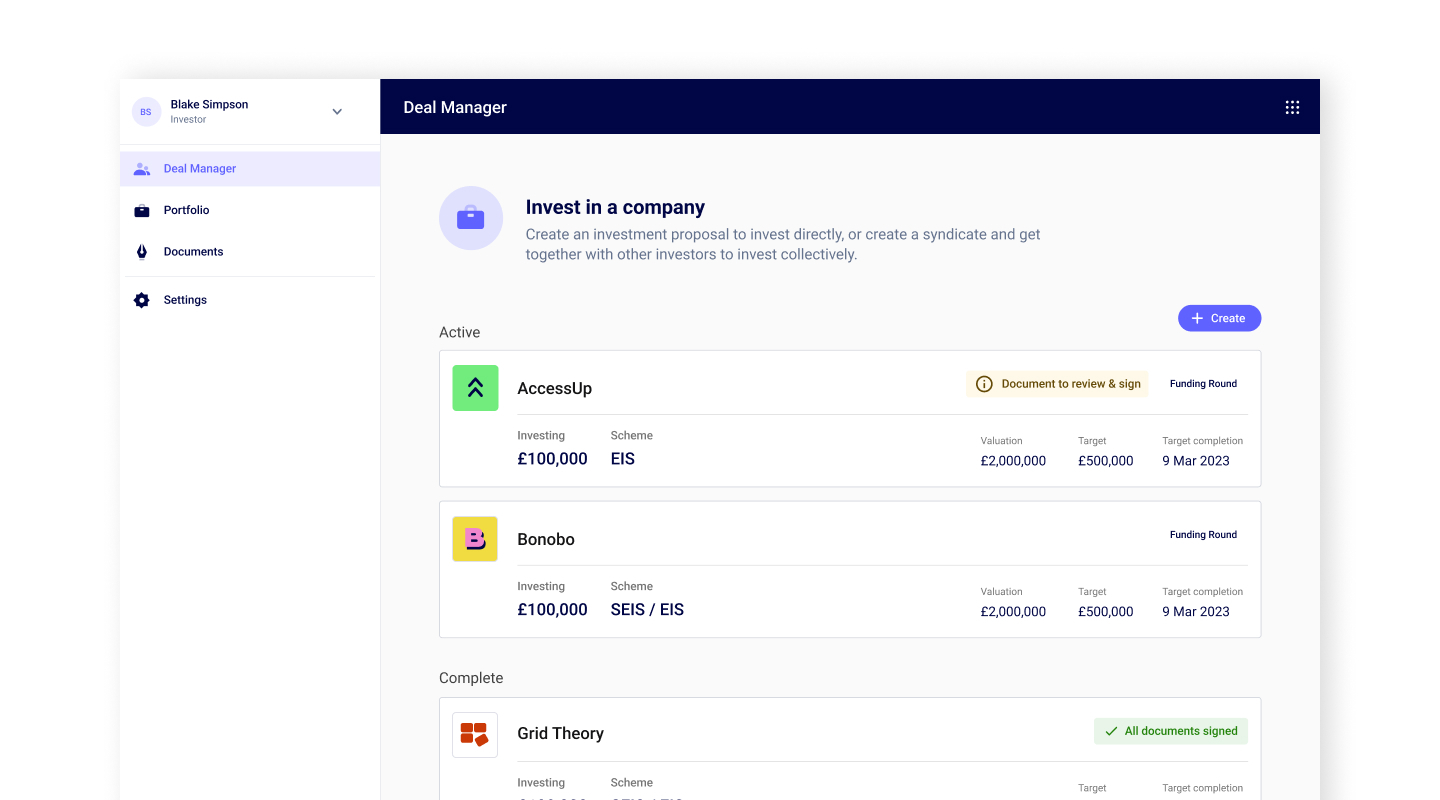

Investors can use SeedLegals to create and send term sheets to companies. Deal Manager is now our most popular feature with active VC investors like Haatch Ventures, Fuel Ventures, SFC Capital and more.

In the same way that we make it faster and easier for founders to lead and close a round, with Deal Manager investors can:

With Deal Manager, it’s quick to clone previous investment proposals. After one proposal has been populated with the preferred deal terms, it only takes a few minutes to send out another one.

Lead investors can use SeedLegals Syndicate to generate and share the legal documents to create a syndicate before investing together. No need to create an SPV for the deal, the syndicate can invest as a group using the SeedLegals MPL Nominees company.

Please note that there’s an extra charge to use Syndicate, on top of the investor membership fee.

When you join the SeedLegals for Investors, you’ll also get a free membership to the UK Business Angel Association for a year if you’re joining the UKBAA for the first time. With it, you get invitations to exclusive networking and pitch events, access to their Deal Share platform to explore a curated pool of investment opportunities and a suite of online learning resources.

SeedLegals for Investors comes with perks for your investee companies too.

To access the investor portal and learn more about your membership, simply:

Got questions about SeedLegals for Investors or want a demo? Book a free call with one of our experts.

Fill in the form so we can match you with the right specialist.