Deal Data Room: Securely share documents with investors

Be ready for investor due diligence with Deal Data Room. Store and share your confidential files and funding round docum...

When we launched SeedLegals, we focused on creating a platform for founders to do their funding rounds, issue share options to their team and create contracts. For investors, the SeedLegals platform allows you to review and sign documents, access those documents anytime, all in one place.

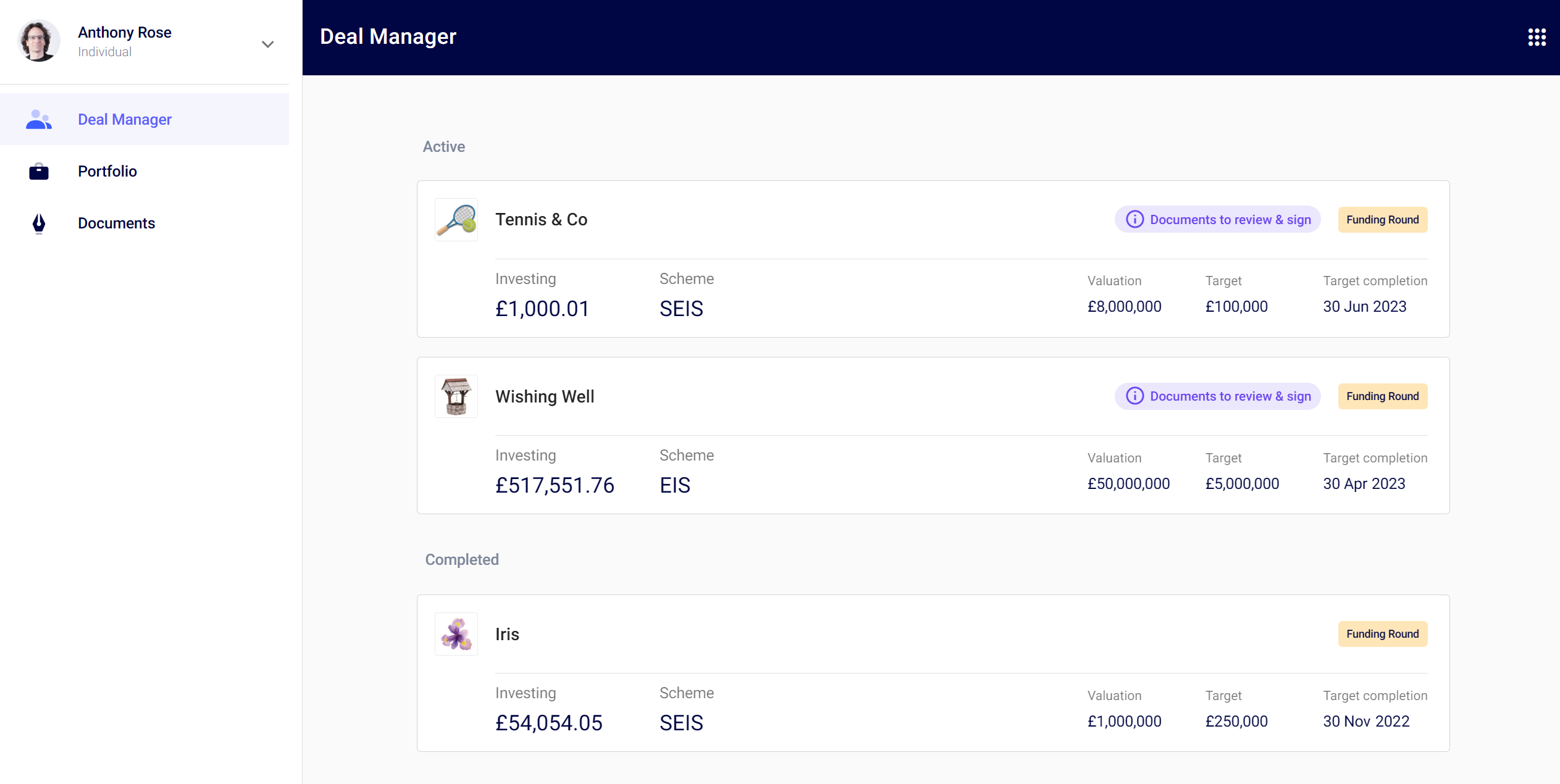

Today we’re taking the next step by launching invest.seedlegals.com, a dedicated portal for angels and funds who’ve invested in companies via funding rounds on SeedLegals. Investors can log in to see all their deals, view the total value of their investments, send out term sheets, complete deals even faster, and more.

Here’s a quick overview of what’s available and how it works.

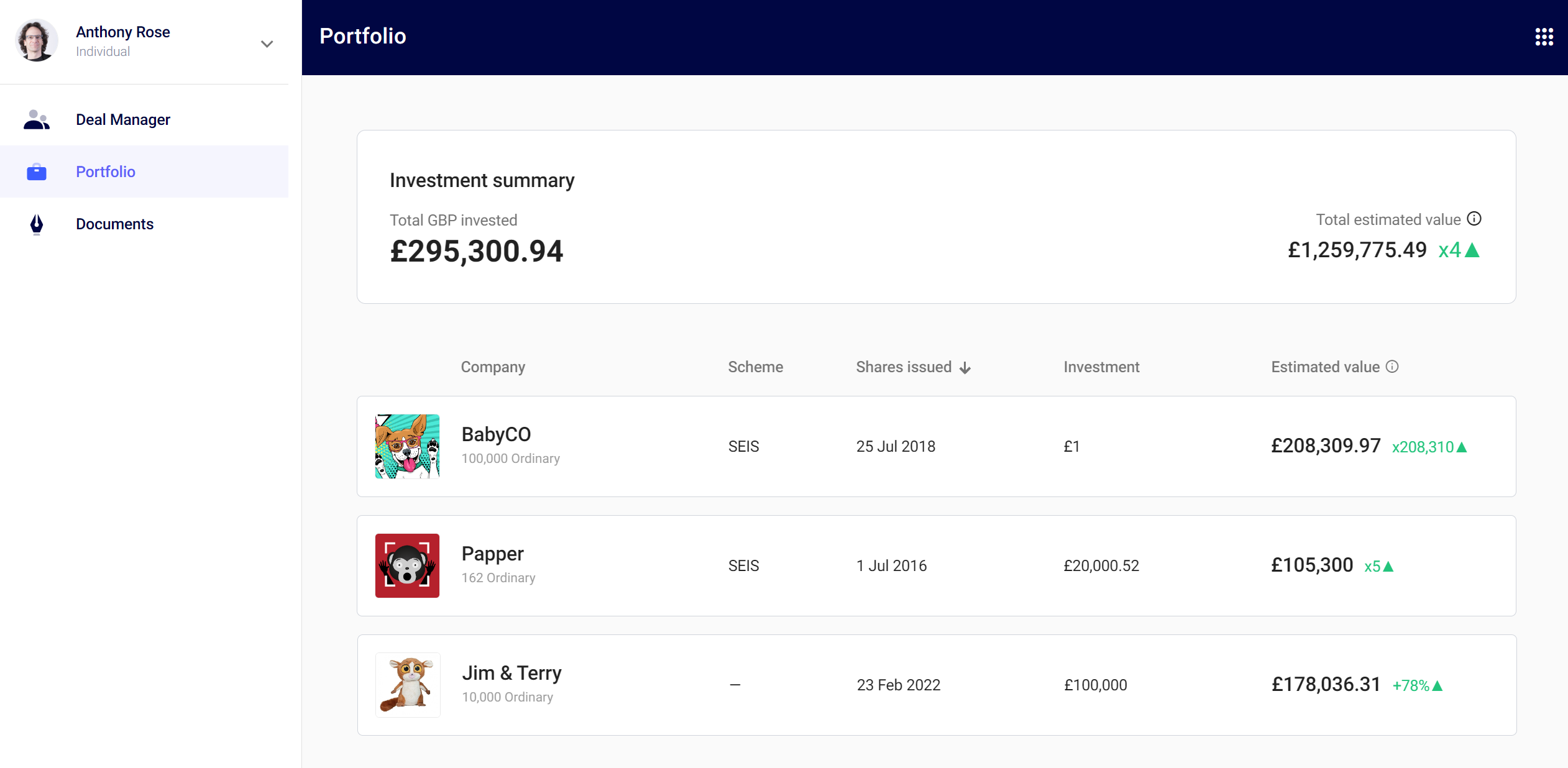

Log into invest.seedlegals.com and head to Portfolio to see at a glance all the companies you’ve invested in or have shares in, and the value of your investments.

For now, we base the value of your investment on the price per share of the last shares issued by that company on SeedLegals. We’ll soon enhance this to allow you to enter your best estimate of the company valuation, and the value of your shares will change to be based on that.

If you and/or other shareholders have preference shares (or SEIS/EIS-compatible liquidation preference shares), this is automatically factored into the calculations.

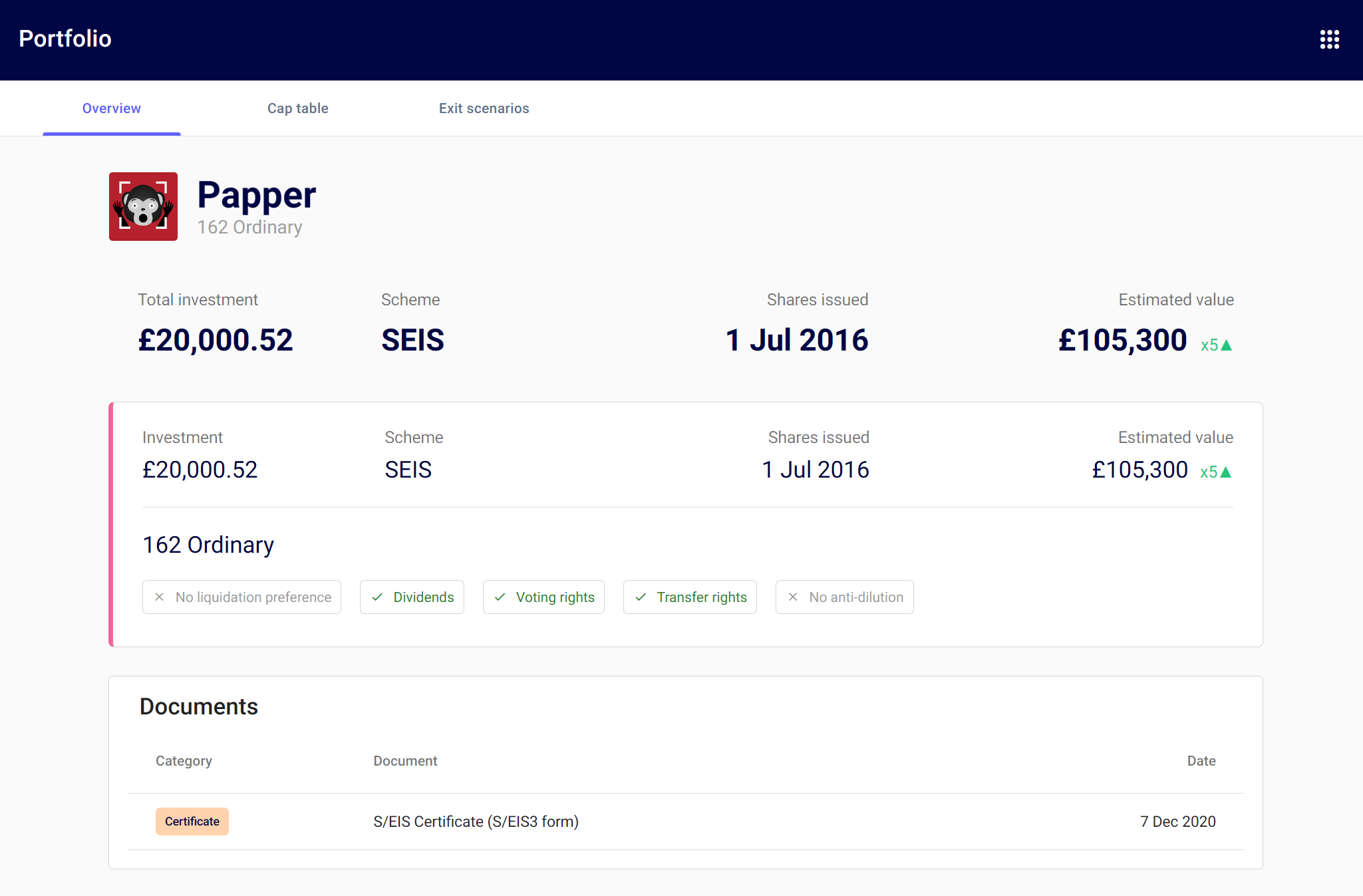

In Portfolio, click on a company for a more detailed view of your investment(s) in that company, the share class rights of your shares, and the SEIS/EIS status.

You’ll find your SEIS/EIS certificates here too – no need to rummage in your paperwork to find them when the time comes to claim your SEIS/EIS tax relief.

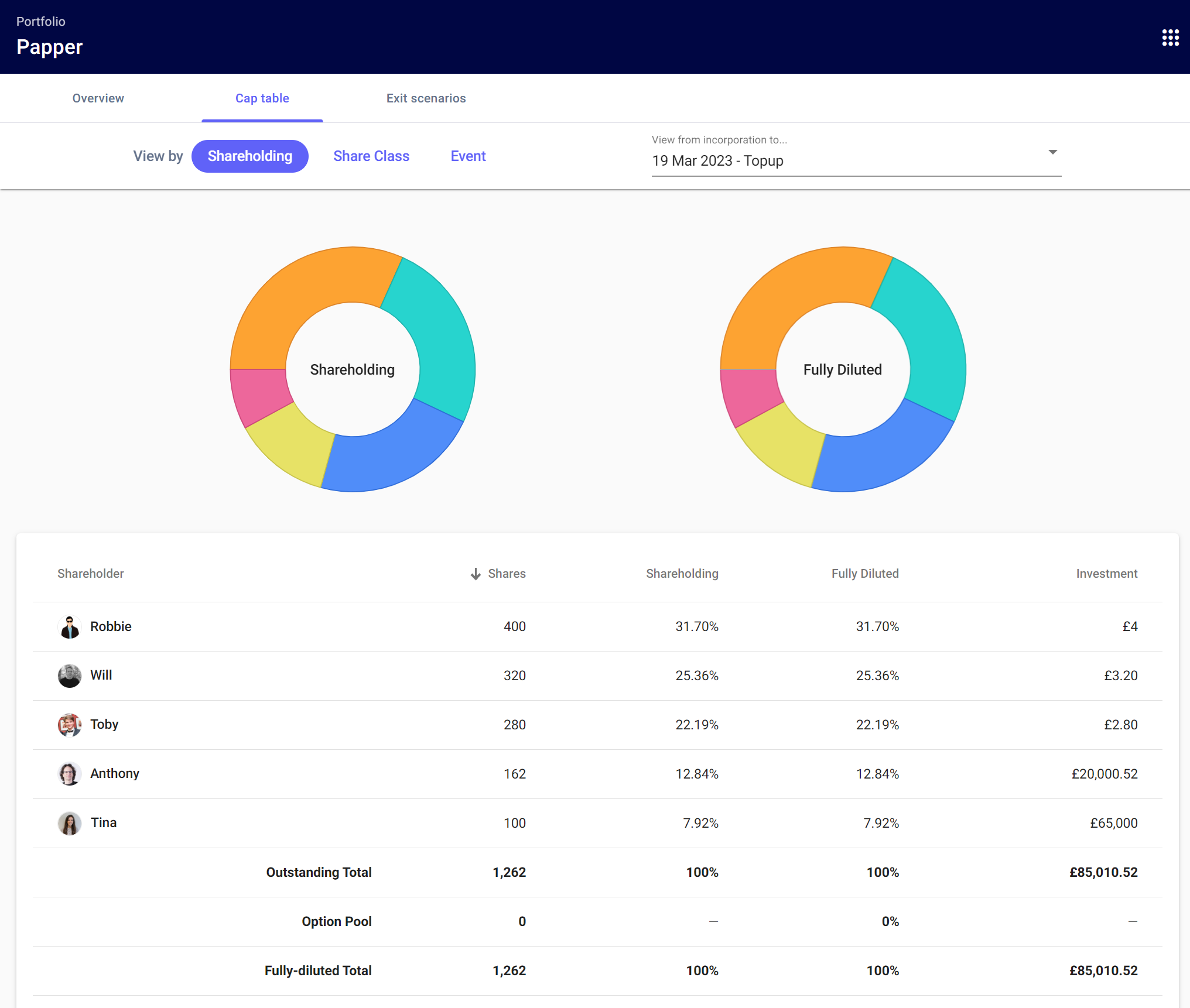

In Portfolio, click on a company and if they’ve given you access to their cap table, you’ll be able to see all the shareholders, your shareholding, option pool and more.

If the company has given you access to their cap table, you’ll also be able to model how much your shares are worth at different valuations.

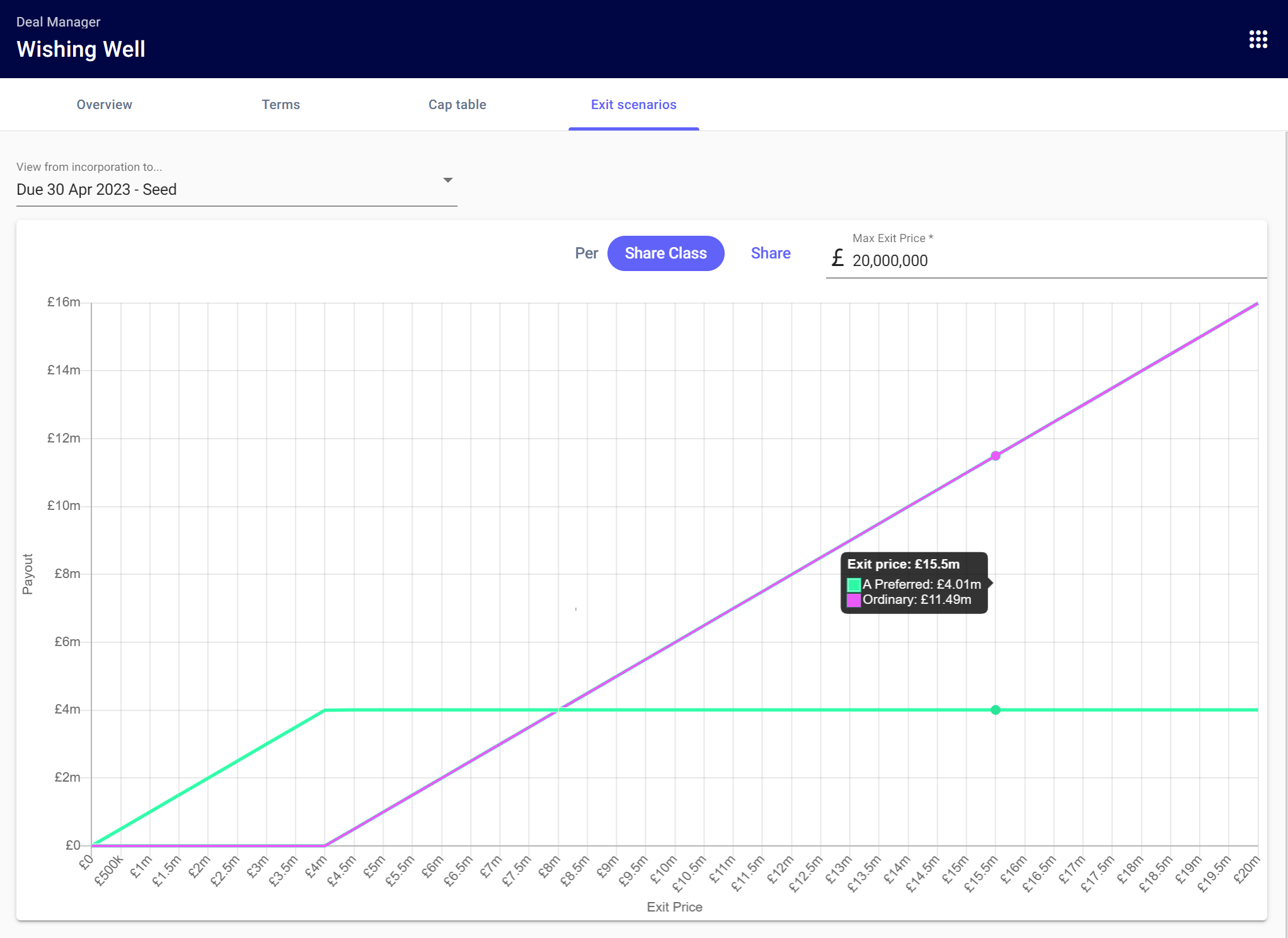

You’ll also be able to see the effect of preference shares on the payout to shareholders for different exit valuations.

As an example, take a look at the exit modelling below. The A Preferred shareholders have a 1X Non-Participating Liquidation Preference, which means that on a sale of the company, these shareholders have the choice of either:

The graph shows the A Preferred shareholders would be better off than investors with ordinary shares up to an exit of £8 million, but for a sale of the company above £8 million, the A Preferred shareholders would choose to convert their preference shares into ordinary shares, to get a share of the proceeds rather than their money back.

Did you know that investors can use SeedLegals to send investment proposals to companies? This feature – Deal Manager – has been live for a while (it was one of our best-kept secrets) but we’ve now made it easier to use.

In the same way that we make it faster and easier for founders to lead and close a round, with Deal Manager investors can:

You can quickly clone previous investment proposals so after you’ve created one proposal with your preferred deal terms, it takes a few minutes to send out another investment proposal.

Previously, you had to enable Deal Manager in Settings before it was visible, now it’s available front and centre (and with many enhancements) in SeedLegals for Investors.

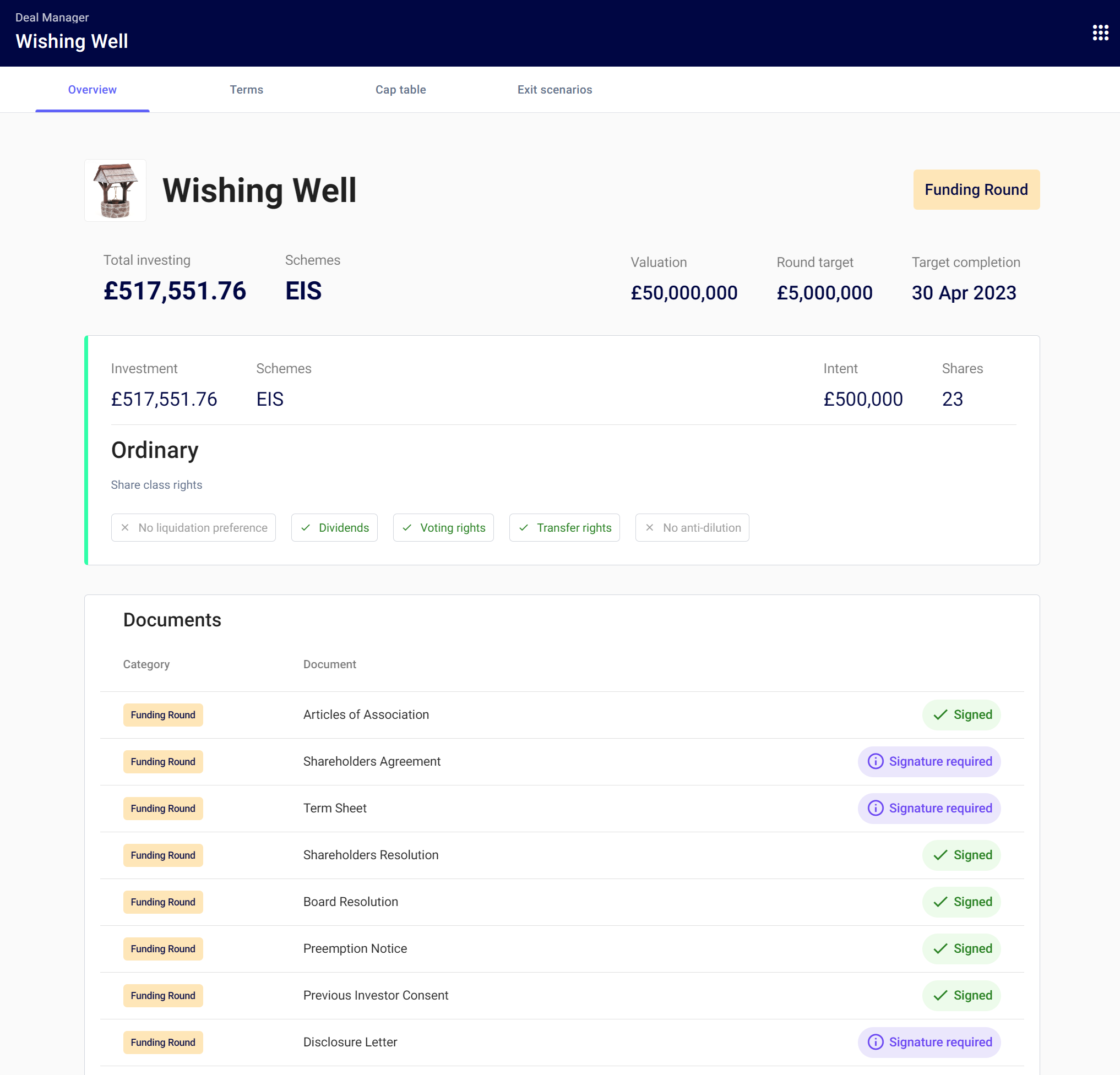

When a company has accepted your investment proposal, or has otherwise added you to a round, you can see the round status and all the documents in one place.

To review and/or sign a document, log in and go to Portfolio, click on the company and then click on the document in the list.

Somehow it’s become normal for deals between companies and investors to be negotiated by email exchange – sending Word or GDocs documents back and forth, peppered with tracked changes. We think this is irrational – it’s prone to errors and far too time-consuming.

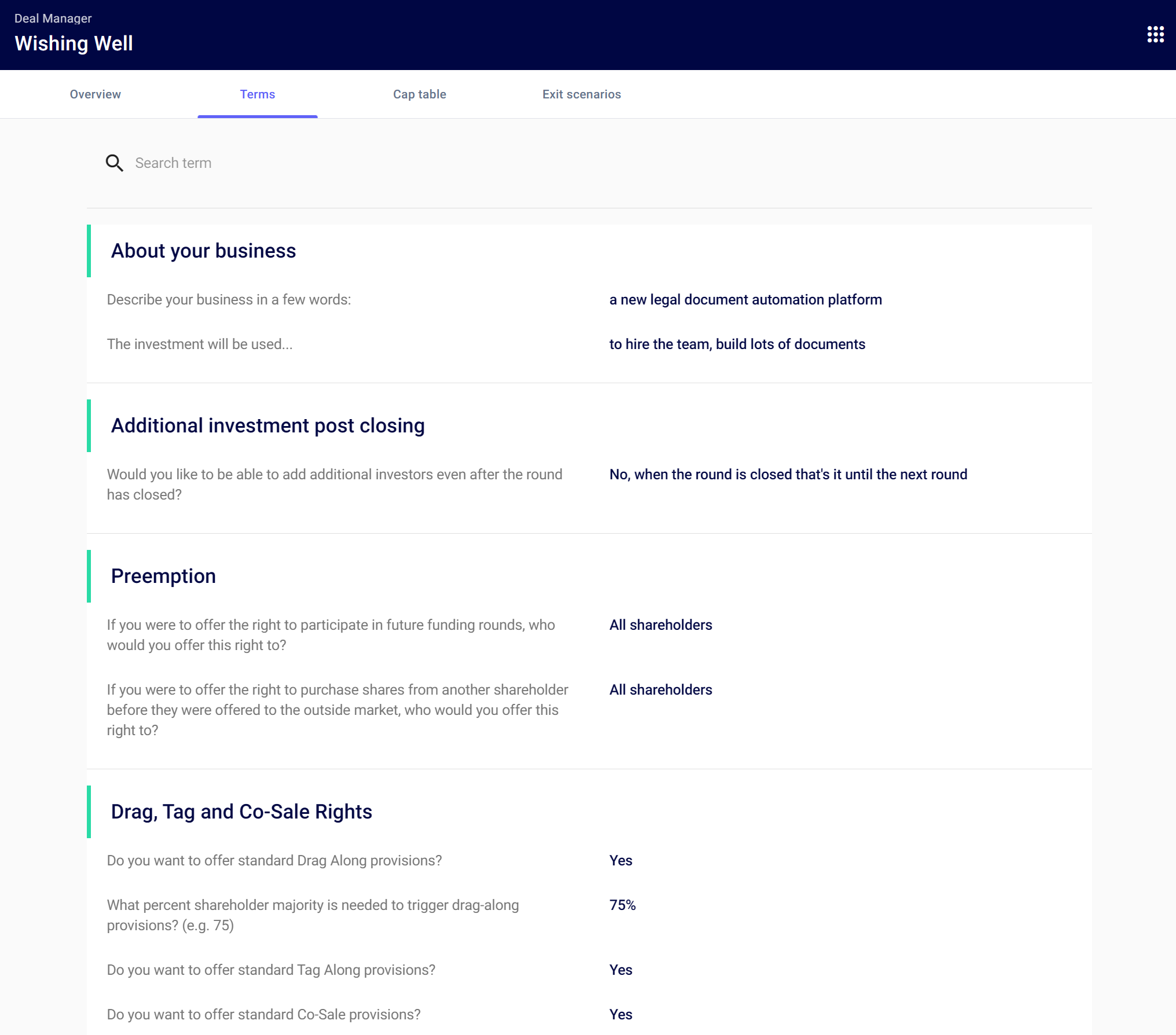

Fortunately, on SeedLegals there’s a better way. You can now see all the terms for your deal at a glance. As you negotiate and update the terms, the documents are updated automatically to match.

We reckon that compared to negotiating via back-and-forth emails, closing rounds on SeedLegals is ten times faster.

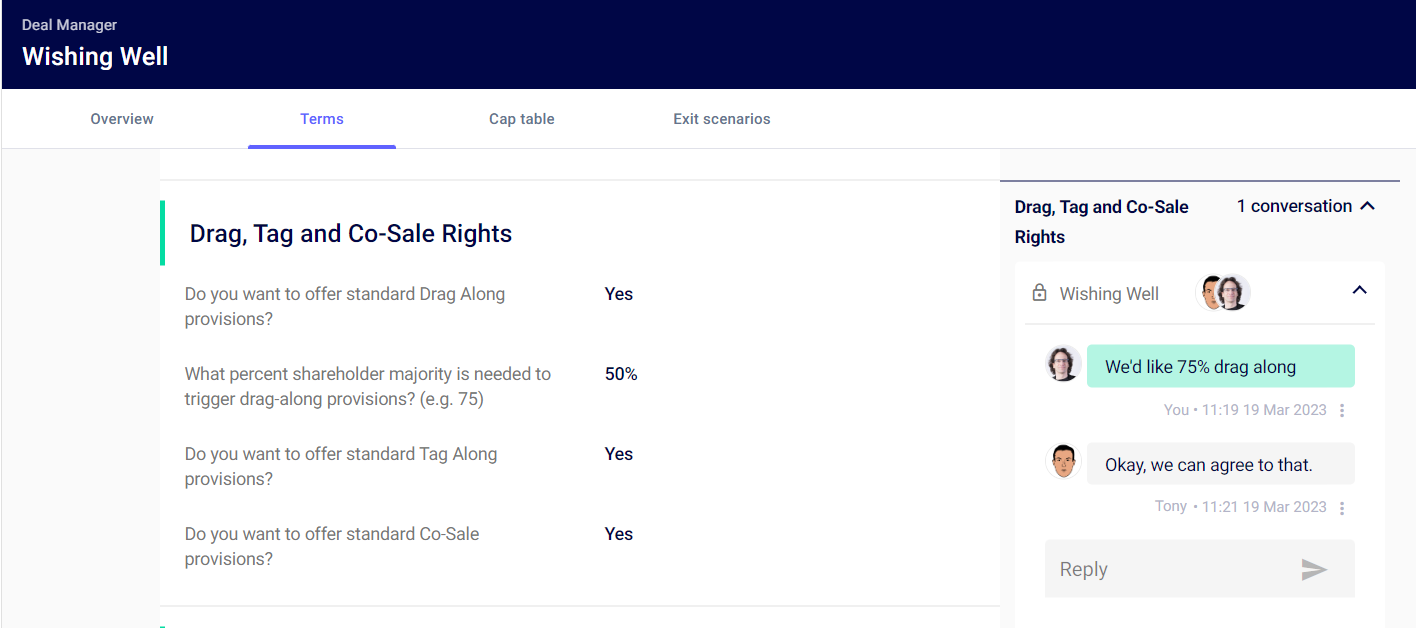

With Deal Manager you can set your preferred deal terms – but what happens if you send a proposal to a company and they don’t agree with your terms?

When a company adds you to their round, log in and select the company, click on the document, then go to Terms. If the company doesn’t agree with a preferred term (for example, you asked for a seat on their board but they’re not offering one), you’ll see a comment on that term.

To negotiate, simply add a comment to start the discussion. (Companies get an instant email notification when you add a comment – and you’ll get a notification as soon as they reply.)

There are two ways to access SeedLegals for Investors:

Access to SeedLegals for Investors is free of charge.

If you’ve made investments through SeedLegals, you don’t need to do anything – your companies are already there in Portfolio.

If you’d like to make a new investment, VCs and funds can do this via Deal Manager (Deal Manager for angel investors coming soon).

Invested in companies that aren’t on SeedLegals? To see those investments on SeedLegals, you’ll need to invite those companies to get set up on SeedLegals…

The launch of SeedLegals for Investors is only the first release of many we have in the pipeline for investors. Stay tuned…

Got questions about SeedLegals for Investors or want a demo? Book a free call with one of our experts.

Fill in the form so we can match you to the right specialist