SeedLegals introduces SEIS/EIS SAFE for US companies raising investment from UK investors

We explain what US companies need to do to offer SEIS/EIS to investors - and how to use the SeedLegals SEIS/EIS compatib...

SeedFASTs are a fast and easy way to raise from individual investors before a funding round. Investments made by a SeedFAST convert into shares when the company does a funding round, at a valuation to be determined in the funding round.

SeedFASTs are SEIS/EIS compatible too, as long as they are set to convert in no more than six months from date of signing, if there is no new funding round before then.

SeedLegals’ SeedFAST is the de facto standard in the UK. Over 10,000 SeedFASTs have been created by UK startups, raising over £500M.

UK investors are familiar with SeedFASTs – if you’re raising with UK investors, it’s quick and easy to raise before a round with a SeedFAST.

But what if you’re raising from US investors?

US investors are familiar with YC SAFE… but that’s Delaware law, US share class names and other US provisions that don’t work in the UK.

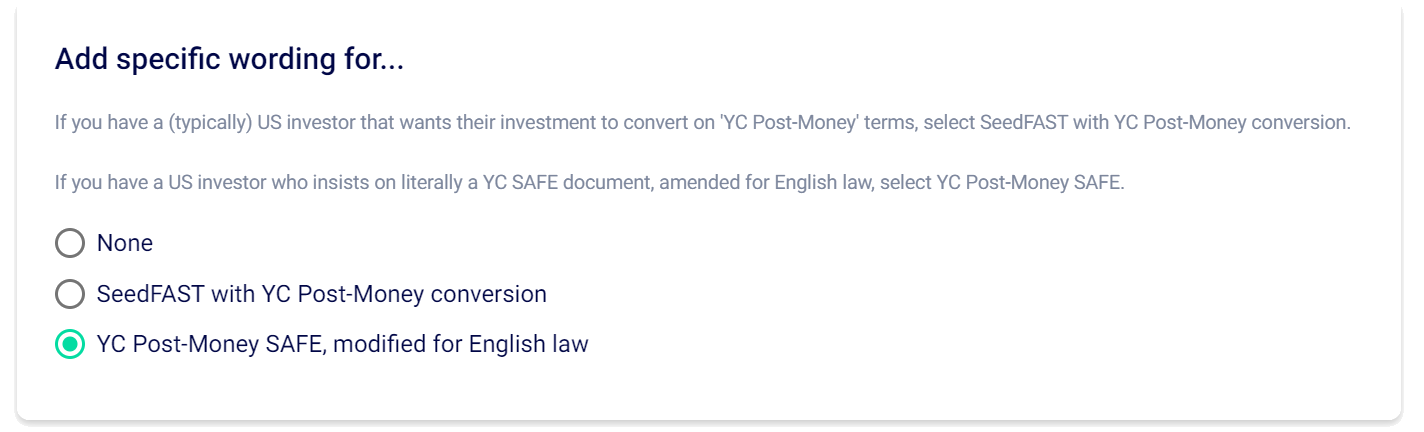

So we made it 1-click simple to create a SeedFAST that’s an English-law version of a YC SAFE, perfectly designed for UK companies raising from US investors.

Keep reading for how to create an English law YC SAFE on SeedLegals, what to watch out for in YC SAFEs, how we adapted it for UK needs, and what to think about when raising from US investors, particularly the problem with foreign exchange rates.

It’s as easy as that – you can log in and create yours now.

By the way, we recommend going with the regular SeedFAST option unless your US investor specifically asks for a SAFE, for reasons we explain below.

At SeedLegals we’re seeing an increasing number of companies raising from US investors. Many founders now see US investors as the preferred choice for fundraising, particularly for Seed and Series A rounds where they’re targeting funds instead of SEIS/EIS angel investors.

A combination of huge US fund sizes, increased willingness to make large investments and higher valuations common in the US means that after doing the circuit with UK funds and being disappointed by their risk appetite, lowball valuations and a standard response of, ‘We love what you’re doing, come back later’, founders switch focus to the other side of the Atlantic and look to raise from US investors.

At SeedLegals, our goal is to make it as easy as possible to raise investment. You still need to find the investors, we’ll help you sort the rest.

So we’re launching an English law YC SAFE, specifically to make it easier to raise from US investors.

Sometimes you can’t afford to wait.

Our SeedFAST, English law YC SAFE and SeedNOTE let you close investors early. Create and customise your agreement in minutes.

A SeedFAST works perfectly no matter where the investor is, it’s always the law of the country your company is in (for example, England) that applies. So if you’re raising from US investors, you can of course create a SeedFAST for them.

But, in the same way that SeedFASTs are the standard in the UK, in the US it’s Y Combinator’s SAFE that’s the standard pre-funding-round investment agreement, the so-called YC Post-Money SAFE. To make it as frictionless as possible for a US investor to invest in your company, offering them a YC SAFE could be the way to go (but it comes with potentially significant dilution disadvantages to you).

But you can’t just download a YC SAFE template, fill in the blanks and sign it. That isn’t going to work in the UK because:

To address the points above, we’ve amended the YC SAFE standard agreement.

Our goal is to create an agreement as familiar as possible to a US investor who’s used to the actual YC SAFE template – so we intentionally limited the changes to only those things needed to make it work for English law and UK companies.

We also addressed a key failing of the YC SAFE template which is that with a YC SAFE you only have the option of a Cap or a Discount, but not both. With SeedFASTs you have a much richer set of deal terms, including combinations of Cap and Discount. So on SeedLegals, you can generate an enhanced YC SAFE that gives more flexibility on deal terms.

To make sure your US investor understands it all, we include an optional Cover Letter that explains the deal terms in plain English, something that the YC SAFE fails to do.

And so that your US investor can see at a glance the differences compared to the YC SAFE template, we insert wording at the start of the agreement noting the key differences introduced for English law, addition of a longstop date, and any other changes based on the deal terms you select.

Compared to a SeedFAST, a YC SAFE has a significant disadvantage:

Example:

And that’s the problem: the more you raise in YC SAFEs and other convertibles, the lower the valuation that they all convert at… which can be a huge problem for founders being way more diluted than they expected if they aren’t aware of this and don’t factor it into their funding plans.

We’re not fans of this approach, and our standard SeedFAST doesn’t do this. If you specified that a SeedFAST converts at a £10M cap, then it will convert at that cap, no matter what other amounts were raised in SeedFASTs that are converting in that round.

Which is why we suggest you go with a SeedFAST, including for US investors, unless you know that the investor will be looking for a YC SAFE, or that they’ve specifically asked for YC Post-Money conversion terms.

In the UK, it’s standard that advance subscription agreements (SeedFASTs are ASAs) include a longstop date. If the company doesn’t have a funding round before the longstop date, then at that date the investment will convert into shares at the Longstop Valuation, which the company and the investor will have agreed and which forms part of the investment agreement.

The longstop date protects the investor – it avoids a situation where the company takes their money, then goes on to never do a funding round (for example, if the company grows organically from revenue and doesn’t need to raise further investment) in which case, without a longstop date, the investor would never get equity in the company before the sale of the company or the company going into liquidation.

Importantly, for an investment to qualify for SEIS or EIS, HMRC requires a longstop date no more than six months from the date of signing the investment agreement.

The YC SAFE doesn’t have the concept of a longstop date, probably because in the US companies might raise for years using SAFEs which then convert in a monster funding round way in the future.

But in the UK, the pattern is very different. Instead of being used instead of a funding round, SeedFASTs are largely used as bridge finance before a funding round. That, combined with the SEIS/EIS requirements, means that longstop dates are standard in the UK.

A problem arises if you raise with SeedFASTs and/or SAFEs from a mix of UK and US investors, and some have a longstop date and some don’t. Things get messy if you don’t have a funding round before the longstop date: the UK investments will convert, but the US ones won’t. And then when there is a new funding round, the US ones will convert at that time, diluting the UK investors who converted earlier.

This is why we added a longstop date into our English law YC SAFE – to avoid this problem. We’re mentioning this so you know how to explain it to US investors if they ask.

In Y Combinator’s desire to create a simple investment agreement, they removed so much that some terms investors commonly look for – such as Most Favoured Nation (‘MFN’) and board observer rights – aren’t included in the SAFE. As a result, investors often ask for a separate Side Letter with those terms, which somewhat defeats the purpose of trying to skim down the agreement.

We avoid the need for that side letter, for the most part by including the common side letter terms within the investment agreement, if you choose to enable them in the deal term questions.

The YC SAFE isn’t SEIS/EIS compatible (no longstop date, provisions for SEIS/EIS-incompatible return of capital). That’s fine for your US investors, they won’t be looking for SEIS or EIS.

But if you have UK investors looking for a YC SAFE-style investment agreement, or you want to use the identical type of investment agreement for your UK and US investors, you’ll be pleased to know that if you set the investment as SEIS or EIS we’ll automatically generate an SEIS/EIS compatible version of a YC SAFE (note that the longstop date must be no more than six months if the investor wants to claim SEIS or EIS).

Because of the YC SAFE’s unfavourable Post-Money Cap provisions, we recommend using the standard SeedFAST version, but the choice is there if you want it.

If you’re a UK company using a SeedFAST or SAFE to raise from US investors, an obvious question is whether you should raise in GBP or USD.

Your US investor is used to talking round-number dollar investments (‘I’m in for $100K, let’s do it!’), but we suggest that you should, if possible, specify the investment in pounds. Here’s an example showing why:

So, how many shares does the US investor get?

We’ve seen companies that have experienced this exact issue, with the investor getting a significantly different number of shares than they had expected because the USD/GBP exchange rate is very different to what it was a year ago.

To avoid these issues, we suggest that it’s fine to discuss round-number dollar amounts with your investor, but in the SeedFAST or SAFE, the investment amount is specified in pounds, using the exchange rate just before you sign the agreement.

What if the US investor really wants to send $100K rather than £89,465? You can still set the investment amount at £89,465, but use the Additional Items section to specify that the investor will wire $100K, which will be deemed to be £89,465 based on current exchange rate.

Got questions about our English law YC SAFE? Book a free chat with one of our funding experts:

Main image adapted from images by flaticon and pikisuperstar on Freepik