8 things you didn’t know about SEIS/EIS tax relief

8 things you (probably) didn't know about SEIS & EIS ... and it might make all the difference to your next investment.

When you raise investment for your startup, the company will be issuing new shares to investors in return for their investment.

Investors have the ability to sell their shares at any time in the future… as long as they can find a buyer. That’s the natural order of things in the startup world: investors are generally free to sell their shares at any time, and the company has no obligation to buy those shares from the investors. The company cannot force the investors to sell their shares (other than on a sale of the company as a whole).

Now, occasionally at SeedLegals we get requests asking for either

Both these requests sound reasonable at first glance but turn out to be seriously problematic – this article explains why.

In this article:

When you borrow money from the bank, the goal is to repay that loan to get the debt off your books.

When you raise equity investment you’re selling some fraction of your company… wouldn’t it be great to be able to buy it back later? Sounds like a great idea!

But it’s a bad idea, for the following reasons:

In summary, it sounds like a good idea that you raise investment now and then one day you’ll buy out your investors to own 100% of the company again. In most cases however, this is a bad idea.

In the section above, we looked at the founders asking for the right to buy out their investors later. Here we look at investors asking for the right to sell their shares later.

This sounds innocuous… why shouldn’t you give the investor a right to sell their shares…?

So, that’s our cue to examine the difference between an ability and a right:

In scenario 1, of course the company can make introductions to potential buyers and generally help a selling shareholder to find a buyer. But it has no obligation to buy the shares itself.

In scenario 2, if the investor has a right to sell their shares, it’s called a put option. The question is: who do they sell the shares to? The company can’t compel anyone to buy those shares, which leaves the company with the obligation to buy the shares itself.

And that’s a huge problem for all the reasons outlined above.

But it’s worse than that, because at least in the scenario of ‘the company has the right to buy out the investors later’, if the company doesn’t have the money they can simply not buy the shares. But in the scenario of ‘the investor has the right to sell their shares’, the company is obligated to buy the shares – if the company doesn’t have the money, this could bankrupt the company. Or the company might be in breach of contract because it’s unable to fulfil the obligation, for example due to the strict rules that apply whenever a company wants to buy back its own shares from a shareholder.

In summary, if an investor asks for a Put Option to sell their shares later, explain to them why you won’t enter into such an arrangement, for all the reasons listed above.

There’s one interesting variation of the put option described above: an investor asks for the right to sell their shares for £1. Why would an investor want to lose their entire investment by asking for the right to sell all their shares for just £1?

Well, it turns out some funds have mandates that only allow them to invest in companies with specific activities, for example: positive social impact or tackling climate change. Or companies that don’t sell arms and munitions (it might sound like an extreme example but we’ve seen at least one VC with this restriction in their mandate). Or they won’t invest in companies that might tarnish their reputation.

So if the company they’ve invested in pivots to become the next Only Fans, the investors want the right to just get out by dumping all their shares for £1.

If you see this in the term sheet from your investor it’s probably fine – although you’ll need to read through the wording carefully to make sure your company doesn’t fall into the pitfalls described above. You should ask an independent lawyer to review the wording before agreeing to it – for example, to make sure it works with the strict rules about share buybacks.

Got questions about fundraising, SEIS/EIS Advance Assurance or compliance? Hit the chat button to ask our expert team. We’re online seven days a week.

Disclaimer

SeedLegals does not provide legal, tax, accounting or financial advice. We provide information and access to industry standard documents, which should not be used as a substitute for qualified legal, tax or accounting advice. See our Terms for more.

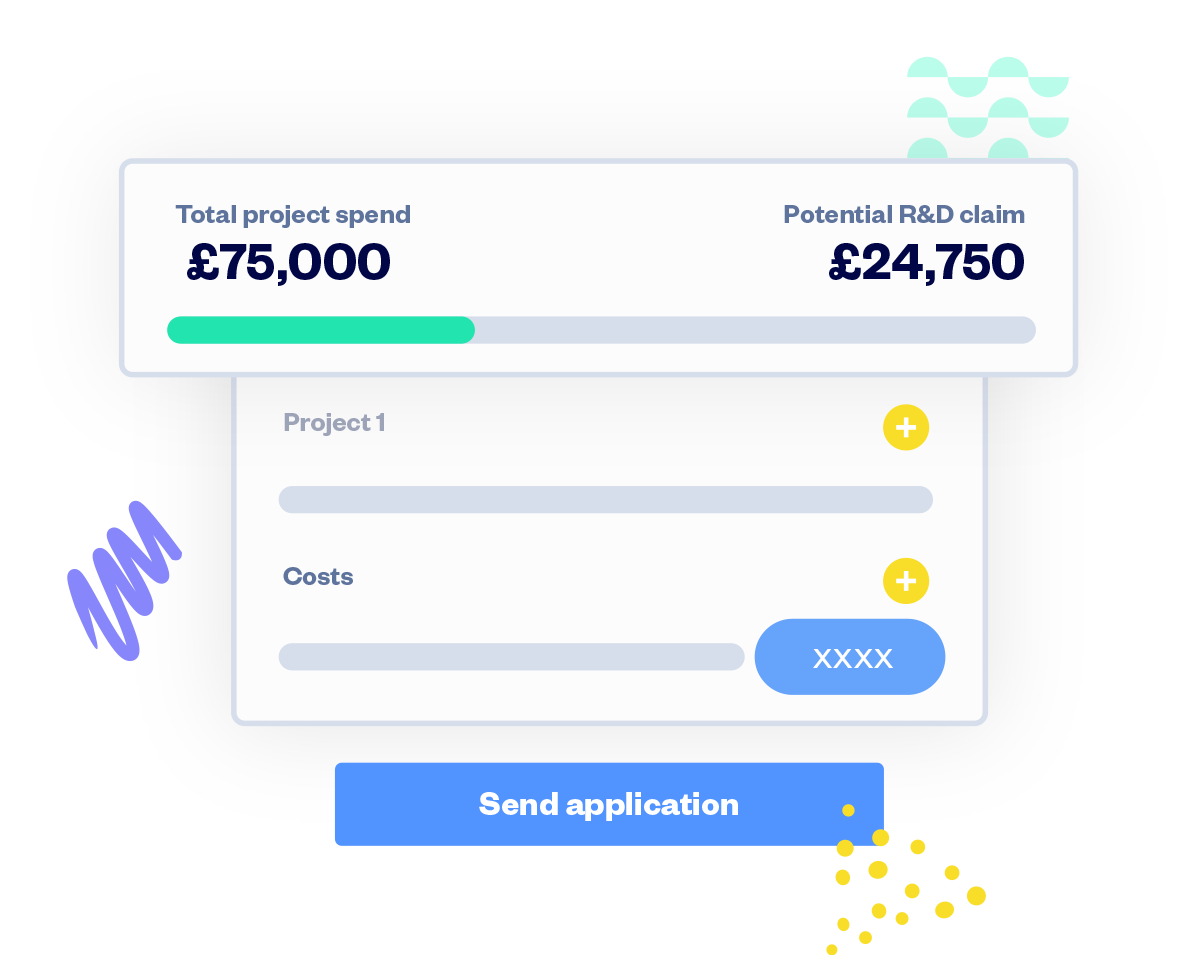

Get back up to 33% of your R&D expenses as cash or tax credits. Capture your claims on SeedLegals guided by our specialists.

Claim R&D Tax Credits