Optimising your LinkedIn profile with Ekky Manoilenko and Rob Cossins

Learn how to optimise your LinkedIn profile to turn impressions into funding with Ekky Manoilenko and Rob Cossins from S...

We never stop at SeedLegals. We’re always working to make our platform better and give you the tools you need to start and grow your business.

Every month, we’ll put together a summary of what we’ve been up to, both big and small, to make sure you never miss a beat.

Let’s get into what’s new in October.

We’ve launched SeedLegals Plus, a cost-effective annual membership with easier access to the services your startup needs to thrive, including fundraising, EMI valuations, share transfers and R&D tax credits.

You’ll also get discounts and perks from our carefully selected partners including Stripe, AWS and HubSpot.

Looking to raise with US investors? With YC Safe for English law, we’ve made it easier to do just that.

We’re seeing an increasing number of companies raise from US investors and many founders now see US investors as the preferred choice for fundraising.

Our YC Safe with English law makes it super easy for UK companies to fundraise in a way that follows the US standards investors will be used to.

We’ve partnered with WorkinStartups – the UK’s number 1 site for startup jobs.

WorkinStartups have helped thousands of startups to find the right talent. And better still, if you’re a SeedLegals member, you get 10% off their job posting packages.

We’ve heard your feedback. That’s why we’ve made SeedNOTE way more flexible.

SeedNOTEs are becoming more and more popular for founders and investors in uncertain times because they can offer additional protections.

For example, you can now choose to convert OR repay at maturity, change terms and arrange to pay (or be paid) interest in stages, instead of a lump sum.

We’re working to make it as easy to sell your business on SeedLegals as it is to do an SEIS funding round.

We’d love your input: if you’re considering selling your company soon, get in touch with us for a confidential chat.

There’s no standard for SAFTs (simple agreement for future tokens). They range from super-simple to hugely complex, involving lawyers, auditors and more.

We’re going to change that by creating a standard that will make it as easy to do a SAFT as it is to do a SeedFAST.

Email us if you’re looking for a SAFT – we’d like to learn more.

We’ve also made several smaller updates to make our platform even better.

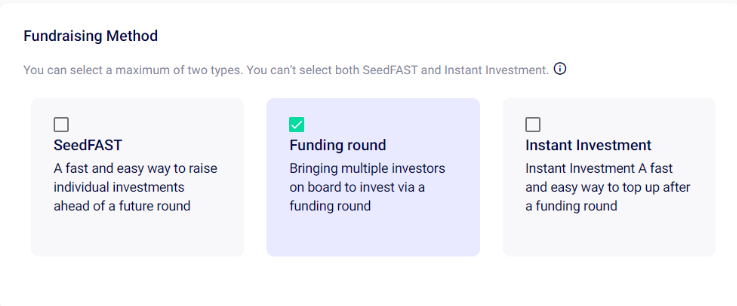

Pitch page owners can now change their fundraising status to let investors know you’re fundraising and how you plan to raise.

We’ve made it simpler to get back to the previous page as you go through terms.

You’ll now be able to reach the previous page by clicking on the top left of the page.

Noticed something that we could improve? Email us with any feedback or suggestions. We always love to hear from you.

If you aren’t already a SeedLegals member, take a look at our Pricing page to find a plan that’s right for your company.