How to get investment-ready, with Nina Raab

What does it actually take to go from founder dream to investor-ready? It’s more than just polishing a pitch – it’s abou...

With investors anxious to limit risk and valuations falling, it’s now more important than ever that companies can raise funds quickly and flexibly.

That’s why we’re pleased to announce updates to our SeedNOTE agreement. It’s now an even more flexible way to raise ahead of a funding round.

In this post, we’ll run you through the changes we’ve made to SeedNOTEs and explain why they’re an indispensable tool for raising in uncertain times.

Under the SeedNOTE agreement, the investor provides a short-term loan, which the company either repays (optionally, with interest) or converts into shares at the maturity date. If the company successfully raises a funding round of a predetermined amount before the maturity date, the SeedNOTE automatically converts.

It used to be prohibitively expensive and complicated to raise capital by convertible debt. But as part of our agile fundraising revolution, we’ve developed SeedNOTEs as a simple yet powerful way to take in one-off investments.

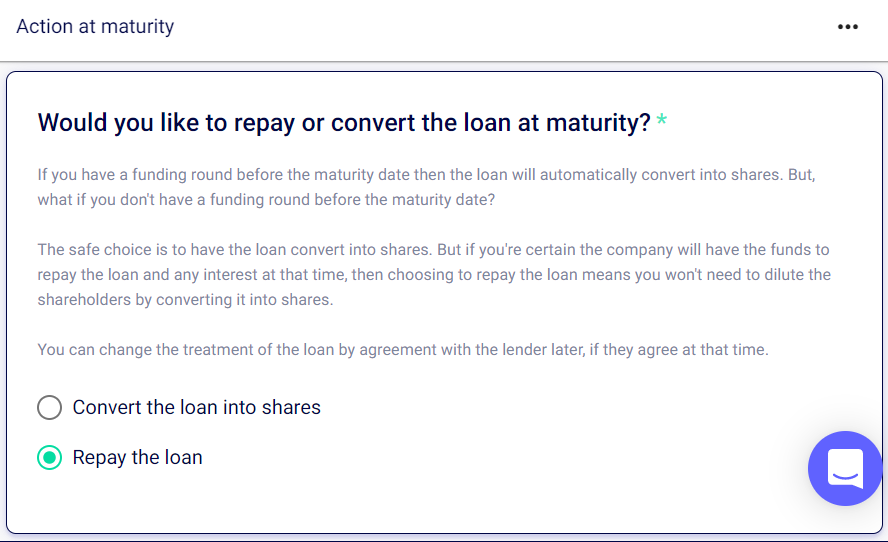

Before this update, SeedNOTEs converted into equity at the maturity date. Now when you create your SeedNOTE you can choose to convert or repay.

This gives founders the ability to avoid diluting shareholders when raising money. The downside is that you need to be confident you’ll have the cash at the deadline.

We’ve made new wording available that allows you and your investor to change whether the SeedNOTE converts or repays after the agreement is signed. Both parties need to agree to the change.

This flexibility is especially useful in the current economic climate. What might have looked like the best option when you signed the agreement could be very different by the maturity date. The updated wording gives you breathing room to decide what works.

You can now arrange to pay interest every month, quarter or year. Previously, you paid off interest in one large sum at the end of the contract – or added it to the amount you convert into shares.

For founders, the option to pay interest periodically gives you better control over your cash flow. To investors, the guarantee of set, regular payments makes SeedNOTEs more attractive, especially considering that interest rates and the cost of capital have gone up.

… And that makes them particularly attractive to investors in the current climate. As many investors become more risk-averse, agile fundraising tools like SeedNOTEs are invaluable for raising capital quickly.

Here’s why SeedNOTEs are a good sell to investors.

The SeedNOTE agreement typically comes with interest, which the company pays to the investor. It’s a small but reliable way for the investor to get guaranteed value from their investment.

Because it’s a debt instrument – not an equity instrument – investors via SeedNOTE count as creditors. If your company is insolvent or looking to liquidate or wind up, debt ranks higher than equity – so if there’s money available, creditors get paid (with interest) ahead of any shareholders.

SeedNOTEs allow investors to hedge their bets. If the company doesn’t meet its growth targets by raising a funding round, they can get their money back plus interest. But if the company thrives, their loan converts to equity and they get a stake – often at a discounted price.

Often, investors prefer investing via SeedNOTE, because it gives them specific protections and a way to secure a discount on a future funding round. This was the case for Ping Culture, the curated event app that spotlights local events and experiences. Ping Culture raised £250K by SeedNOTE at their investor’s request.

Oliver Andersen-CoxThe SeedNOTE meant we were able to get the investment into the account with less hassle and instantly which was huge for us as a startup. It was as simple as signing the documentation and awaiting the payment.

CEO,

If your investor is primarily interested in equity, there’s an even simpler agreement available at SeedLegals.

SeedFASTs allow investors to pre-pay for shares at the next funding round. And best of all, they’re eligible for SEIS/EIS investment, meaning your SeedFAST investors get significant tax breaks as an incentive to support early-stage companies.

Because they deal with less complex terms, SeedFASTs are often signed and sorted in just 24 hours. Find out more >>

SeedFAST

SeedNOTE

Not sure if a SeedNOTE is the right fundraising mechanism for your company? Want to find out more about how it works? Book a call with a funding expert to talk through your options.