Vesting schedules: how to choose the right one for your option scheme

In this post, we explain what vesting is, the pros and cons of different types of vesting schedules and reveal what the...

You’re exploring EMI schemes to reward your employees with equity – excellent! But where do you start with the legals?

We’re here to guide you. In this article, we’ll cover the legal documents you need for your EMI scheme.

If you’re looking for a quick and easy way to set it all up using EMI scheme legal document templates, we’ve got you covered there too. Learn how to create and run your EMI scheme the fast and affordable way with our EMI Option Scheme service. You can also book a call with an expert to help you at the end of this article.

Contents:

To issue share options, you need to set aside some equity for your team. The equity you set aside is called an option pool. The legal documents you need for your option pool are:

Board Resolution

Your company board members will need to agree on the decision to create an option pool for a share option scheme.

You will host a board meeting at which board members can vote in favour of creating the option pool, and the result of the vote will be recorded in your board minutes. Read more in Board meetings: what they are and why you need to hold them.

Shareholders resolution

The shareholders resolution needs to be circulated to your existing shareholders to approve the option pool. It needs to be signed by at least 75% (by number of shares held) of voting shareholders.

Investor consent notice

If you have an agreement with your investors to give their consent on any decisions regarding a share options pool, you’ll need them to sign an investor consent notice. By signing this document, investors give their permission for you to issue share options to team members. This only applies if you have such an agreement with your investors.

Share option scheme rules define how your share option scheme will work. They include rules governing the vesting of options and when options can be exercised.

Before you can create your options scheme, you need an EMI valuation.

An EMI valuation is an HMRC-approved report of the value of the shares in your company. It gives you a fair price per share for the share options, which will be the exercise price or the ‘strike’ price (i.e. the price option holders pay when they buy the shares).

The legal documents you need for your EMI valuation are:

EMI valuation report

An EMI valuation report explains a company’s ownership structure and cap table. It explains the method you used to get to your proposed share price and includes details about events that affect the value of the shares such as fundraising.

Val231 form

The Val231 form is the application you make to HMRC to approve your EMI valuation.

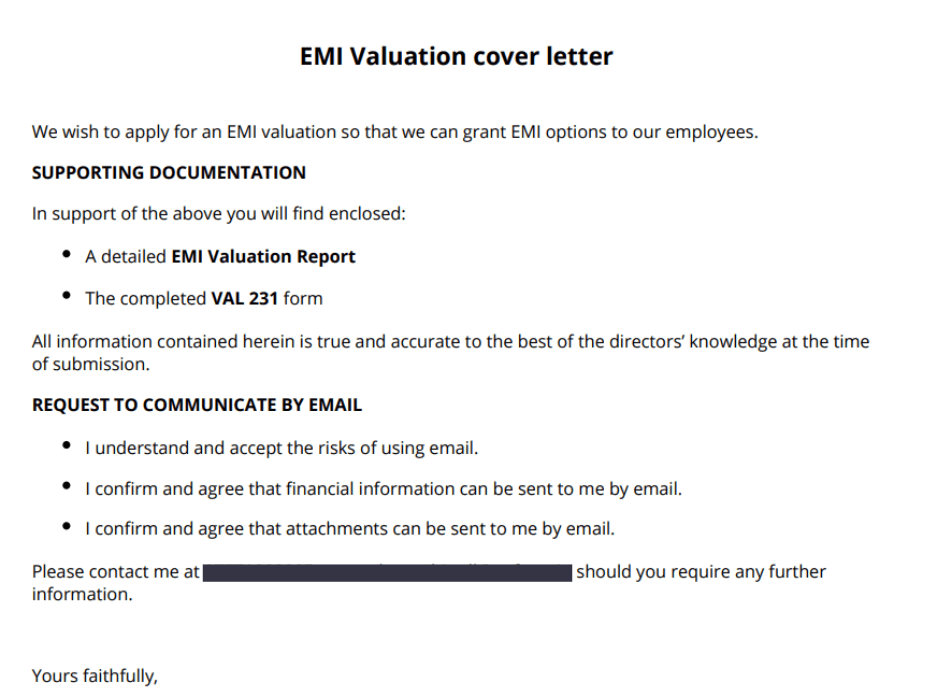

Cover Letter

The cover letter sets out what documents you’ve included in your application and gives consent that you agree to email communication with HMRC. Here’s an example of a cover letter below 👇

Supporting documents

The supporting documents for your application pack include:

Learn how to do your EMI valuation on SeedLegals in our Step-by-step guide to your EMI valuation.

We’ll help you get the best valuation quickly and easily for a low, transparent fee.

Tell me howThe legal documents you need to set your option scheme rules are:

Board resolution

Your company board members will need to agree on the decision to create an option pool for a share option scheme.

You will host a board meeting at which board members can vote in favour of creating the option pool, and the result of the vote will be recorded in your board minutes. Read more in Board meetings; what they are and why you need to hold them.

HMRC requires companies to register their EMI Option Scheme using an online service. For this, you’ll need to sign into the government gateway and log in with your company’s details or create an account. Via the online portal you’ll then need to submit an:

Employment Related Securities (ERS) return

This is an online application that you make to register your scheme with HMRC. You can find the online application on HMRC’s Employment Related Securities Return page.

To grant share options, a share option agreement must be signed.

EMI option agreement

This is the official document you give to each team member you’re issuing options to, and includes the scheme rules and all necessary details about the share options.

You’ll issue an option agreement to each option recipient. It must be signed by the company and the option holder, and be signed in presence of a witness by the company and option holder.

When you use SeedLegals to set up and run your scheme, we automatically generate your customised option agreements for you in minutes.

We make it fast, easy and affordable to create and run an EMI scheme. Create documents in just a few clicks.

After you have successfully registered your EMI Scheme with HMRC you need to notify them about the grant of any EMI Options within 92 days from the date they were granted. To do this, you’ll need to create an:

EMI notification

This is completed online via HMRC’s employment related securities website. You can read all about how to complete the notification in How to notify HMRC about granting EMI options.

When an option holder exercises options, that means they convert them into shares. These are the documents needed to exercise options:

Notice of exercise

The notice of exercise is a document that the option holder sends to the company to confirm they want to use their option and claim their shares. You can easily create it with one click when you use SeedLegals to run your EMI scheme.

Joint elections

These documents are needed for the employee to take on the liability for the employer’s National Insurance (NI) contributions and bring forward the charge to income tax to avoid getting taxed later, when they sell the shares.

Deed of adherence to the shareholders agreement

You are about to have a new shareholder in your company, which means they should agree and sign onto any existing shareholder agreements you have in place. Provide your employee with a copy of the shareholder’s agreement, and then they can sign the Deed of Adherence, through which they are bound by the same terms as all other shareholders.

SH01

This is the official form that must be sent to Companies House to give notice about the new shares you’ve issued.

In your annual return, you need to provide information about the share options your company issued and recipients exercised in the most recent tax year.

Ria SangalThe purpose of the annual return is to let HMRC know if there has been any activity on the options in the last tax year. When you grant the options, you have 92 days to notify HMRC they were granted and then the annual return is a way of updating them on the status of those grants. It must be done by 6th July each year to report on the previous tax year’s option activity.

Share Options Associate,

Want to see what the documents look like and how easy it is to create EMI scheme documents on SeedLegals? You can log in and explore right now. Just start the free 7-day trial – you don’t need to enter any card details.

We’ve got a library of resources to help you understand and run share option schemes. Here are are top picks for you:

✅Free checklist: EMI option schemes – a simple step-by-step guide on how to set up an EMI scheme. Tick off the to-do’s ass you go.

📖Free ebook: The founders guide to share option schemes – a comprehensive guide to share option schemes

📑UK report 2025: How does your share option scheme compare? – check out our latest stats and how other startups are running their schemes

📄Articles: browse everything option schemes in our resource centre

Got questions? Need guidance? We’re here to help. Book a free 30-minute call with one of our experts below.