How much should I pay my team? UK startup salaries revealed

As a founder, getting your team’s pay right can feel like a guessing game - but it doesn’t have to be. In this post, we...

Founders often put their own money into their business in the early days. In addition to being vital for the survival of the company, lending money to the company is often seen as a sign of their commitment to the business to future investors.

This early injection of capital will usually cover everything from web development, design, desk space and even hiring some early employees. It will basically carry the company to its next stage.

Later on, when the company seeks investment, founders have the option to disclose the cash they injected into the business to potential investors. Disclosing the cash as a loan offers the potential for reclaiming it after the funding round. However, it’s often the case that founders do not expect to recoup the money they spent prior to the investment round. This is partly to do with a lack of available information about Director Loan Account repayments and the equity funding process.

At SeedLegals we know that founder investment of personal capital is extremely common so we have built a feature into our term sheet builder which allows founders to propose repayment of their early loans to the business.

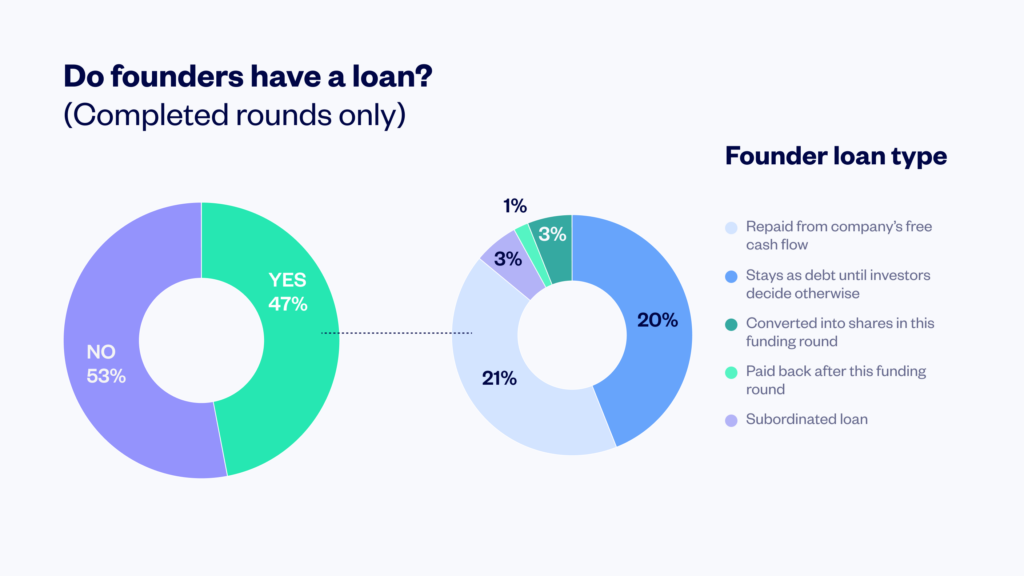

Our data shows that 47% of founders disclose and claim back a loan they made to the company. Interestingly the percentage of founders that attempt to recoup their personal investment is lower in incomplete funding rounds. Only 30% of founders check the box to acknowledge an existing founder loan initially, and this proportion shoots up to 47% when the round has closed.

It could well be the case that founders often do not expect to be able to claim back the investment and assume it’s write-off, but on further discussions throughout the funding process eventually realise the option to claim it back is a real possibility.

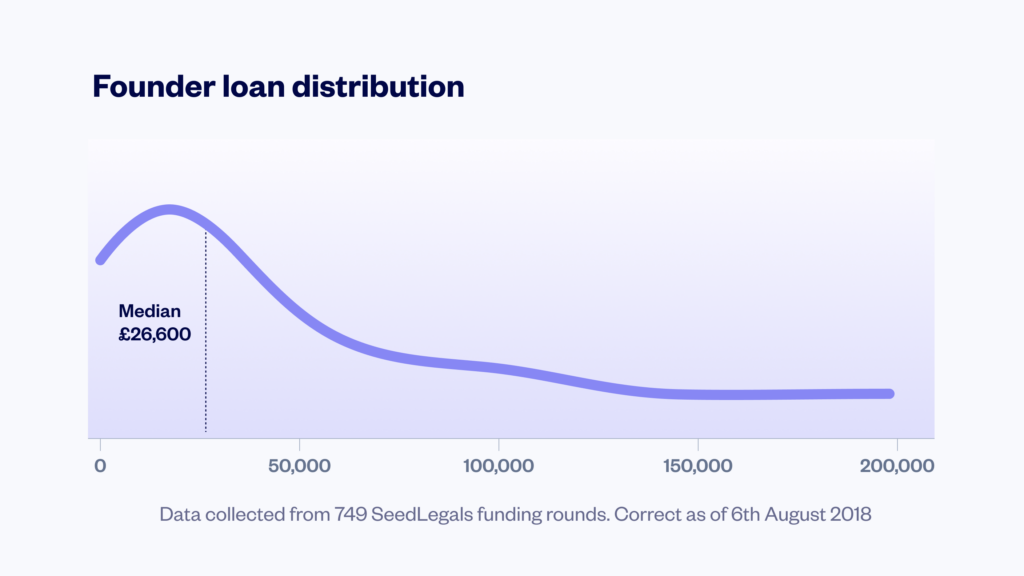

Once founders disclose they made a personal investment in the company, the final amount needs to be accepted and agreed to by investors in the round. On SeedLegals, the median amount acknowledged as a loan from the founder is £26,600. Higher loans of £100k+ are more common in larger founding rounds since investors will naturally anchor themselves to the size of the round.

Broadly speaking, there are two main approaches to handling founders’ early investment:

Our data shows that the ‘equity based’ approach is extremely uncommon, with only 3% of the completed rounds adopting this approach, and vast majority (97%) opting for the ‘cash based’ approach. The equity based approach removes debt from the company balance sheet, and materalizes it into equity right after the round. This approach is usually appealing to founders that want some kind of anti-dilution protection, and so they choose this option to increase their ownership in the company. The legal process for converting founder loans into shares is usually quite complex. On SeedLegals, we’ve made it a simple ‘loan conversion’ feature that can be easily selected, and automatically adds the loan conversion data to funding agreements and generates all the exact forms that are needed.

After analysing the historic rounds in the UK market, we identified 4 broad categories by which founder loans are usually treated, listed below in increasing order of risk to the founder:

The chart below shows you how frequently each of these options is agreed to in UK funding rounds:

Only 1% of the completed rounds include an immediate repayment of the loans to the founders after the round. One of the main reasons for this low percentage is that the majority of early stage rounds in the UK are EIS investments, under which investment can not be used for a loan repayment. (N.B. Founder loan repayment is permissible under SEIS investments). Additionally, investors will almost always prefer to have their investment be used to fuel growth rather than service outstanding debts.

The majority of funding rounds (21%) with a loan repayment provision agree to repay founders from the companies Free Cash Flow (FCF), which is the most popular option for repayment.

20% of funding rounds agree to acknowledge the loan, and commit to repayment subject to a number of terms which are often laid out in additional documents as part of a funding round. As such the commitment for the loan to be repaid can be revoked if these conditions are not met.

A small percentage (3%) of funding rounds opt to treat outstanding money as a ‘junior debt’ which will be repaid after more senior loans are repaid.This commitment cannot be revoked by investors after the round closes.

In summary, early founder contribution can be repaid, and there are several ways to treat the early investment. However, it seems that while investors are willing to acknowledge founder contribution, and do so about half the time, investors usually agree to a repayment date in the future, and immediate repayment is rare.

It’s also clear that investors favour certain repayment structures over others so a considered approach to structuring the loan may increase the odds of investors agreeing to its repayment.

When creating your term sheet on SeedLegals, simply select the ‘Founder Loan’ feature and select your preferred treatment you would like to be applied to your loan for your investors to review.

On a final note, regardless of whether you plan to reclaim early financial contribution to your business, it’s very important to have all the expenses well-documented from day 1, and keep your business money separate from personal money.

If you have any questions about founder loans or are interested in hearing about how SeedLegals can help you with your funding round, you can book a chat with a member of the team here.