Autumn Budget 2022: What startup founders need to know

How will Chancellor Jeremy Hunt's Autumn Statement affect your business and your income? We explain what's been announce...

On 22 November, Chancellor of the Exchequer Jeremy Hunt announced the Autumn Statement. The key focus of this budget is to reduce inflation, stimulate growth and attract more investment into UK businesses.

So do any of the changes announced affect your business? In this post, we cover the points that relate to small businesses and tech, and discuss what they mean for you.

The Chancellor confirmed that the two R&D schemes (SME & RDEC) will merge to create a new scheme for all companies, regardless of size.

Under the new scheme, the credit for loss-making companies will be taxed at 19% rather than the corporation tax main rate of 25%.

Ben ConryThe merging of the two R&D schemes was proposed a number of years ago and was not necessarily a surprise. Both SMEs and large companies will make R&D claims using a system which is based on the existing RDEC system. It’s a move that will simplify claims for R&D tax credits.

However, depending on the new rate of relief which hasn’t yet been confirmed, it has the potential to make R&D tax relief much less beneficial for small businesses.

R&D Tax Lead,

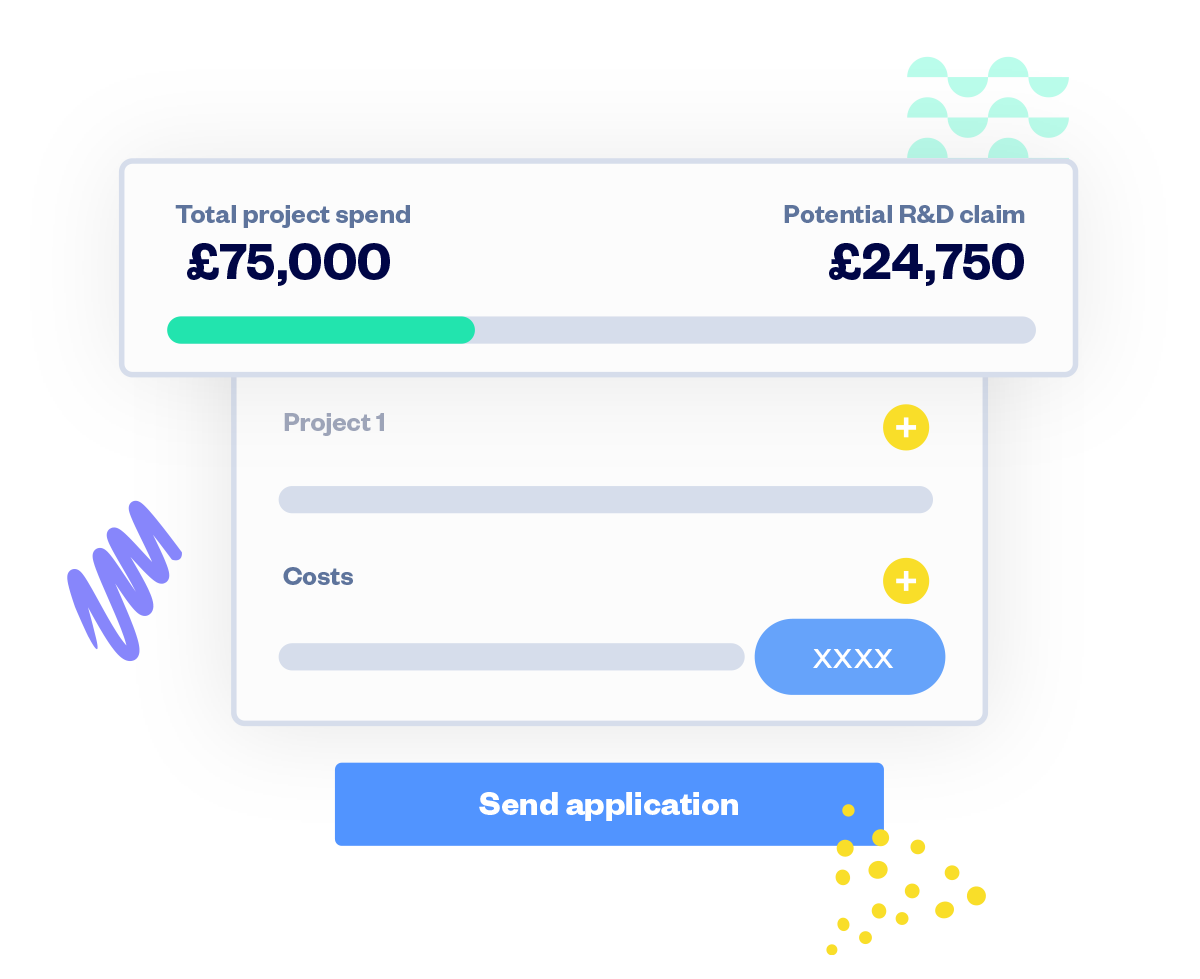

At SeedLegals, we’ve been working on our R&D service to be ready for the merging of the schemes. Our team is monitoring the changes to rates and rules closely, and we’ll have an update ready to go as soon as the changes are confirmed.

Good news for companies who spend extensively on R&D, but didn’t quite meet the threshold for the ‘enhanced credit’. The R&D intensive requirements will be reduced from 40% of total spend on R&D to 30% of total spend on R&D. The government claims this will allow around 5,000 more SMEs to qualify for the enhanced rate of tax, worth £27 for every £100 spent on R&D.

Founders hoping to raise capital under the SEIS and EIS schemes can breathe a sigh of relief. The Chancellor didn’t mention this in his speech in Parliament but the full document of the Autumn Statement confirms the government’s support for these schemes. They plan to extend the sunset clause (essentially an expiry date) from 2025 to 2035.

Full expensing was introduced in April 2023 to replace the super deduction for small businesses. It was intended to only last for three years, but in this budget it was confirmed that full expensing will remain in place for the foreseeable future.

Full expensing means that the amount you invest in IT, plant or machinery equipment can be deducted in full and immediately from your profits, as well as allowing you to save 25p in every pound you spend on other types of investment.

Hunt claimed this measure is designed to increase the incentive for companies to invest.

You can read more about full expensing and how it works on the gov.uk site.

The National Living Wage (also called the Minimum Wage) is set to rise from its current rate of £10.42 to £11.44

Traditionally this has only applied to people aged over 23, with employers allowed to pay younger people a lower minimum rate. However the Chancellor has now also reduced the age for the National Living Wage from 23 to 21 from 1 April 2024.

You’ll have to ensure that you meet these National Living Wage requirements if you hire staff or third party workers (such as agency staff). This could make your payroll costs more expensive.

The National Insurance Contribution (Class 1) paid by employees has been cut by 2% from 12% to 10%. Unlike the rest of the measures which take effect from April 2024, this tax cut will be brought in by emergency legislation to start from 6 January 2024.

This cut means that employees will get more from their salary. Hunt claims that 27 million people will gain from this measure. For example, if you’re on a salary of £35,000, you’ll save £450 a year.

For businesses, it means you’ll need to update your payroll systems in advance of the January deadline.

From 6 April 2024, self-employed people with profits above £12,570 will no longer have to pay Class 2 National Insurance Contributions, but will continue to receive access to contributory benefits including the State Pension.

The Chancellor announced that the 75% discount on business rates for retail, hospitality and leisure which is currently in place has been extended for another year.

This is welcome news for small businesses in these sectors with a premises.

Millions of pounds are owed to small businesses in the UK in unpaid invoices. To help ease this situation, Hunt announced measures to bring in terms for prompt payment.

Hunt recapped the introduction of the Procurement Act this year which means companies supplying the public or utility sector must be paid within 30 days. He announced that from April 2024, companies bidding for large government contracts will have to demonstrate that they pay their own invoices within 55 days, which will incrementally reduce to 30 days.

For small businesses, this top-down approach to tackling late payments means that if your customers are companies which have contracts to supply the government, then your customers will have to start paying you on time – within 30 days.

Hunt announced many measures designed to increase investment in UK businesses, particularly startups and innovative companies.

The Mansions House pension reforms Hunt announced early this year aim to flow money from pension schemes into UK industry, by setting a percentage of pension funds that must be invested in high growth UK businesses.

The Chancellor also announced plans to encourage companies to list on UK markets.

The government plans to spend £4.5 billion over the next five years to attract investment into manufacturing in key sectors including automotive, aerospace, life sciences and green energy industries. This spending will attract an estimated £2 billion in additional investment per year for over the next decade, claimed Hunt.

Hunt announced three more investment zones, as part of Levelling Up: West Midlands, East Midlands and Greater Manchester. These zones will focus on advanced manufacturing, with the aim of creating 65,000 new jobs. Wrexham and Flintshire will also be another investment zone.

The Chancellor announced a consultation on giving people a legal right to require a new employer to pay into their existing pension, if the employee prefers that. This move would be designed to simplify saving for a pension and allow people to maintain one pension pot for life.

This is an initiative to keep an eye on. If you have employees, then you already have a company pension scheme. Making payments into different pension schemes would add an extra layer of admin and complexity. But this is only at the consultation stage for now.

✅Full expensing made permanent

✅R&D tax credit scheme merger is going ahead

✅SEIS and EIS extended until 2035

✅Rise in National Living Wage

✅Cuts to National Insurance for employees and Class 2 NICs for self-employed

Hunt emphasised that this budget statement focuses on growth and investment in UK business, both in terms of enabling existing businesses to grow, and to develop and encourage a skilled workforce. What was absent from Hunt’s statement was an announcement about the bands for income tax. These will remain the same so workers will take home less pay as their income increases over the next few years.

Ready to raise funding under the SEIS/EIS tax relief scheme? Or want to find out more about how R&D tax credits can boost your cash flow? Pick a time to talk to an expert.

✔ Automate the admin, leave the rest to our experts

✔ Maximise your R&D Tax Credits claim

✔ Get unlimited support from R&D specialists

Sources

HM Treasury – Autumn Statement 2023 – accessed 23/11/2023

HM Treasury – Spring Budget 2023 – Full expensing – accessed 23/11/2023