How Curvo raised from US investors as a UK startup

SeedLegals Co-Founder Anthony Rose interviews Curvo’s Leo Rogers on launching as a US C-Corp, securing UK SEIS and scali...

Raise from US investors and unlock global growth – without losing your SEIS/EIS benefits. Once you flip your UK company to a Delaware C corp, you can continue raising with SeedLegals in the US and manage both companies in one place.

We’re the only platform that lets you manage your UK and US companies all from one platform, ready to expand whenever you are.

companies use SeedLegals

on Google, Capterra & Trustpilot

investment deals closed

Ready to unlock investment from US backers? Set up a Delaware C corp and start raising with confidence. Whether you’re just starting out or already have SEIS/EIS investors, explore whether you can flip your company without losing your UK advantages.

Manage both companies in one place, switch between UK and US views, and stay in control as you grow.

Raise from US investors with your new Delaware C corp

Raise from US investors with your new Delaware C corp Keep your UK investors and SEIS/EIS benefits

Keep your UK investors and SEIS/EIS benefits Run both companies from one platform with support from trusted legal partners

Run both companies from one platform with support from trusted legal partners

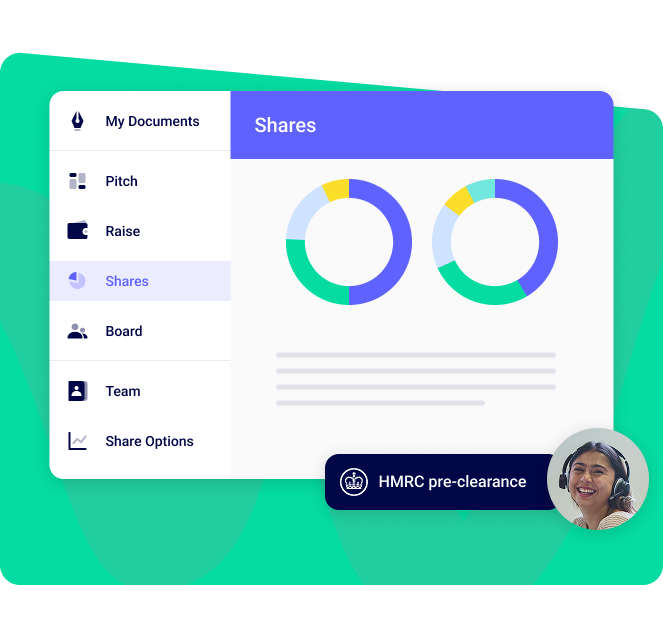

Flipping to a Delaware C corp doesn’t mean giving up SEIS or EIS. With HMRC pre-clearance, your UK investors may be able to keep their tax relief. Provided you keep a permanent UK establishment, you can apply for Advanced Assurance and continue raising SEIS investment after the flip.

Raise using SEIS/EIS-compatible versions of YC SAFEs in your US company, then convert them within six months or at your next funding round on SeedLegals. It’s the simplest way to stay compliant and give investors the SEIS/EIS benefits they’re expecting.

Get HMRC pre-clearance to preserve SEIS/EIS

Get HMRC pre-clearance to preserve SEIS/EIS Secure Advanced Assurance and raise with SEIS/EIS-compatible SAFEs post-flip

Secure Advanced Assurance and raise with SEIS/EIS-compatible SAFEs post-flip Convert SAFEs and stay compliant with a SeedLegals funding round or at the longstop date

Convert SAFEs and stay compliant with a SeedLegals funding round or at the longstop date

Make yourself more attractive to US investors. After flipping to a Delaware C corp, you can raise from both. Continue to offer SEIS/EIS from new and existing UK investors while reaching out to US investors.

Use SAFEs to raise from US investors and SEIS/EIS-compatible SAFEs for UK funding, all in one place. SeedLegals gives you the tools and support to stay compliant with HMRC while fundraising across borders.

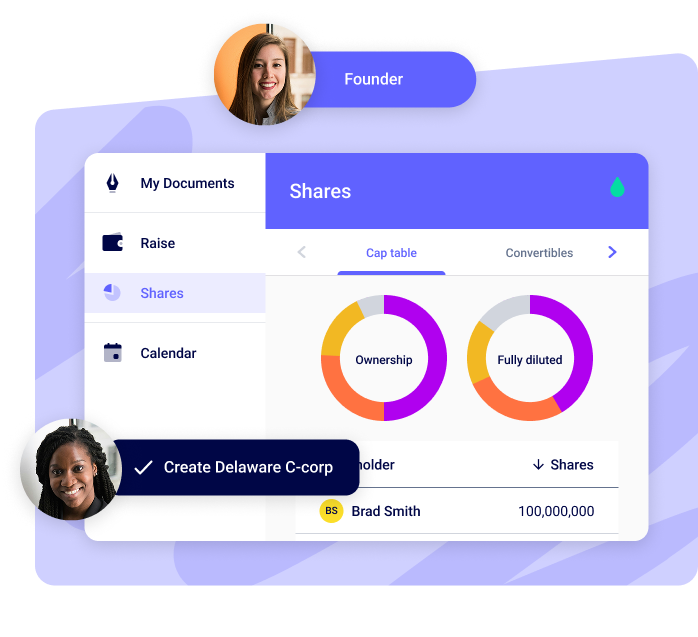

If you're planning to raise from US investors, there's no need to set up in the UK first. You can launch directly with a Delaware C corp and start building from there.

Our trusted US legal partners will handle your incorporation and you'll use SeedLegals to set up your cap table, create agreements and get everything in place to start raising.

Incorporate with help from our US legal partners

Incorporate with help from our US legal partners Build your cap table and prepare for investment

Build your cap table and prepare for investment Get all your fundraising tools in one place with SeedLegals

Get all your fundraising tools in one place with SeedLegals

All your fundraising tools in one place – for both sides of the Atlantic.

SeedLegals Co-Founder Anthony Rose interviews Curvo’s Leo Rogers on launching as a US C-Corp, securing UK SEIS and scali...

Get expert tips on US expansion, fundraising, and the Delaware Flip with Daniel Glazer of Wilson Sonsini and Anthony Ros...

Learn how UK and EU startups can confidently navigate the Delaware flip to raise US investment, preserve SEIS/EIS, and s...

Can I keep SEIS/EIS tax relief when I flip to a US company?

Can I still raise SEIS investment after flipping to Delaware?

Do I need to set up a UK company first?

What if one of my UK shareholders doesn’t want to flip?

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Your company's core agreements, all in one place

Share and collect signatures online via SeedLegals

Create the exact documents you need at every stage of growth

Your information stays safe and confidential in our secure system

Talk to one of our friendly team anytime on live chat

Don't worry, our insurance covers claims related to our platform

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories