Raising a glass to flexible fundraising: Shandy Shack’s road to exit

Discover Shandy Shack’s journey to a successful exit, made possible by SeedLegals’ flexible funding tools: SeedFAST and...

With a global pandemic causing unforeseen challenges, The Little Car Company set out to raise funding quickly from both private and government sources. SeedLegals helped close their multi-million Series A round in less than 8 weeks and saved The Little Car Company over £40,000 in legal fees.*

The Little Car Company is a specialist electric car manufacturer that makes half-size and three-quarter size replicas of very high-end performance vehicles, from the Bugatti Baby to the Aston Martin DB5 to a Ferrari model.

The company was born out of its founder Ben Hedley’s passion for driving and classic cars, and launched its first car to the public in 2019.

All startups face the challenge of managing their runway. And there’s nothing quite like a global crisis to focus the mind.

“We dealt with quite significant supply chain issues during the pandemic,” says Freddie New, Legal Consultant at The Little Car Company. “So we had to be smart about making sure the business was able to continue producing cars, and think carefully around adapting our business plan and maintaining our focus both on funding and on engineering.”

The team had originally planned to raise a Series A round during 2021, which turned out to have its own pandemic-related challenges!

“Understanding your finances is absolutely key,” says Freddie. “Accurate financial models afford you the time to identify and address issues before they become problematic. Fortunately we have a great finance team at the company, so even despite the macro environment we were in a strong position to raise.”

But while they received interest from a number of investors, the raise wasn’t straightforward.

“The raise presented its own challenges as we had a variety of different parties in the room,” says Freddie. “We had to manage a number of interested investors, a significant family office, and several existing investors who were following on.”

On top of this, at the height of the pandemic they had applied for additional funding from the Future Fund – a government scheme that matches private investor funding up to £5 million.

“Working with a government entity isn’t the same as working with a private sector entity,” says Freddie. “So despite having to work with a fair number of private investors, it was actually this part that was probably the most challenging part of the raise for us. We didn’t have much previous experience in that area as opposed to raising from private sector investors.”

1. Expertise

At SeedLegals, we’ve helped over 70 companies raise more than £56M total from the government’s Future Fund scheme (over 20% of all funds raised via the scheme).

“We relied heavily on SeedLegals’ expertise dealing with the Future Fund,” says Freddie. “It was clear that SeedLegals had worked with them many times before – we obviously hadn’t – so we were extremely grateful for the advice received.”

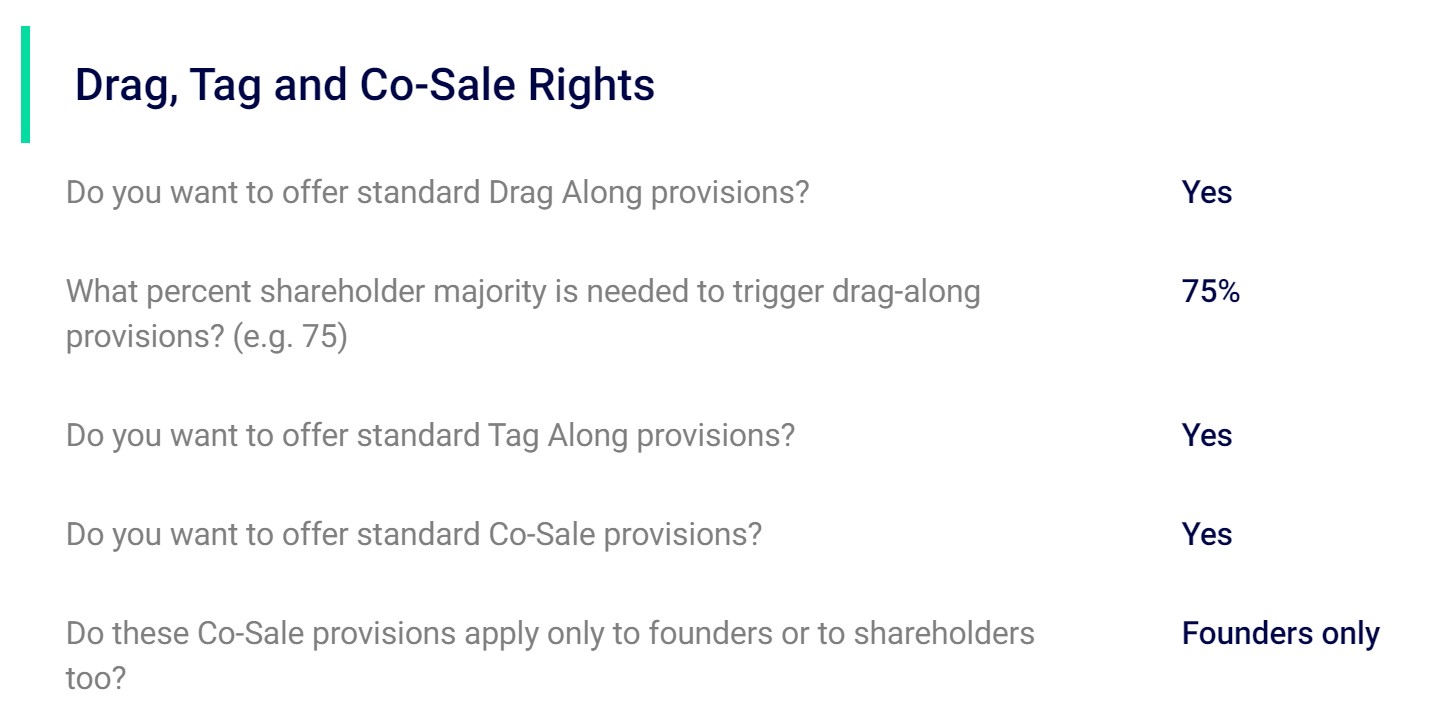

SeedLegals supported The Little Car Company by making sure the correct use of wording was used in all documentation, as this differs from that required for private investors. And we had appropriate clauses ready to include in the Articles of Association and Shareholders Agreement.

“I’m not sure if we’d have been able to close the deal without their input on that front,” says Freddie.

2. Speed and responsiveness

As well as providing smart online tools, we also have a team of experts ready to guide and assist customers when required.

“The combination of computer assisted tools – such as automatically populated macros – and assistance from knowledgeable people is really great,” says Freddie. “Speaking as a lawyer, I’m doubtful it would have been possible to do things in the same timeframe if we had to do everything manually.”

The Little Car Company was especially happy with the level of service that SeedLegals provided.

“I’d particularly like to thank Tudor and Emma for their terrific service. They were continuously available, even right before Christmas, so I’d like to highlight their efforts in helping us get things over the line.”

When raising with SeedLegals, you’ll have instant access to our team who’ll be on hand to answer questions seven days a week.

Plus you’ll have a dedicated Investment Expert who’ll help guide you through your raise.

3. Ease of use

SeedLegals exists to simplify the legals of growing a startup, so our online experience is designed with founders in mind.

“We chose SeedLegals partly because everything’s so clear and simple to use,” says Freddie.

With SeedLegals we match careful automation and data with expert service, allowing you to set the terms of your funding round in one powerful, yet simple, workflow.

“The fact that documentation can be automatically populated is absolutely genius. I’ve been practising law since 2007 and being able to plug in the terms you want and to have that automatically translated into a working agreement is a brilliant innovation. Personally, I think more firms should be using SeedLegals.”

The Little Car Company closed their Series A Round round in just 53 days, thanks to SeedLegals – that’s around 130 days faster than it takes the average round of this size. And it’s been a vital shot in the arm.

“It really helped to kick-started our growth plans,” says Freddie. “We already had deals with Bugatti, Aston Martin and Ferrari. Now we’ve got more in the pipeline which we’ll announce soon. We’re also working on a new partnership that could allow customers to build kits at home, which would be great fun.”

As well as expanding their existing offering, the funding has allowed the company to consider completely new areas of business too.

“We’re also working on other business lines – still in the automotive arena – which we hope to be able to announce in the very near future.”

Despite the challenges of raising money from both private and government funds during a pandemic, Freddie and his team were able to get the deal done with SeedLegals. Now

they’re in a strong position to continue their mission: “to create beautiful vehicles that allow the joy of driving to be shared across generations.”

Check out their website here 👉 The Little Car Company

*We’ve estimated the money saved on legal fees by comparing the cost of using SeedLegals with the cost of using a law firm which, according to our research, will charge an average total fee of 0.85% of the amount raised, for funding rounds >£1M.

Talk to one of our funding experts to see how we can help. Book a call today!