Hatched out of a passion for tech and entrepreneurship, Haatch supports B2B SaaS companies with pre-seed and seed funding.

With a portfolio valued £800M+, they’ve invested in over 100 B2B SaaS companies across the globe from their SEIS, EIS and Institutional funds. We sat down with Co-founder & General Partner Fred Soneya to get the details on how SeedLegals supported many of these investments.

Read ‘til the end for Fred’s expert tips to fellow investors and founders.

Background

With 2 exits under their belt, Fred Soneya and Scott Weavers-Wright started angel investing under the Haatch brand. They’d worked closely with tech companies while growing their businesses and realised the huge opportunity in B2B SaaS. But they wanted to invest as a company, rather than individual angels. And so, Haatch began.

Haatch accelerates pre-seed and seed B2B SaaS companies to their first £1m ARR and builds the infrastructure to get to £10m+. They’re experts in founder-led-sales and building early sales teams. Check out their impressive portfolio.

For startup investments, Haatch focuses on:

(Deep) pains in the present: because the largest motivator of a buying decision is a solution that solves a real pain in the present.

Defined personas: because in B2B, it’s not a company you’re selling to, it’s a collection of employees who make the buying decision – who are those employees? What are their firmographics?

Market Product Fit: because you need a detailed map of how your solution addresses customer pain points if you’re going to get people to adopt it.

Fred SoneyaWe’ve become laser focused on the types of companies that we like. Before, we were very opportunistic. Now, we know what we like, and we stick to that. We’re still broad in terms of verticals. But we only invest in B2B SaaS companies. We like B2B SaaS because it’s very metric-driven and we know what good looks like.

Co-founder & General Partner,

When it comes to closing deals with startups, SeedLegals plays an integral role to help Haatch:

✅Move fast

✅Maximise transparency

✅Simplify and standardise

We spoke to Fred to get the lowdown on how Haatch uses SeedLegals. Read on to learn more.

How Haatch uses SeedLegals

Move fast

Fred SoneyaMoving at pace is really important. Using SeedLegals is the fastest way to close a deal. The ability to issue an investment proposal, term sheet and long forms within a few minutes is really powerful. For sure quicker than what’s possible anywhere else.

Co-founder & General Partner,

Using SeedLegals means that Haatch can get deals signed and closed ultra-fast (like within a day 🤯).

Fun fact: during the end of tax year 2024, we helped Haatch close a deal – from term sheet to money in the bank and closed – in just over 24 hours. That was while they had four other rounds closing at the same time. And we were still more than two weeks from the final April 5th deadline.

Craving this kinda speed in your rounds? As an investor on SeedLegals, you can:

✅Generate deal docs in minutes

✅Negotiate with founders directly via comments, saving everyone time

✅Sign, share and store all deal docs on the platform

Maximise Transparency

Fred SoneyaWe like that SeedLegals gives transparency on where everyone is in the process. You can see where signatures are, where documents are and what founders are saying via comments.

Transparency is one of our core values at SeedLegals. Full transparency in the deal process helps investors and founders save time, understand where everyone is and stay organised. Our platform is designed to help everyone understand and easily negotiate the terms they’re signing.

As an investor on SeedLegals, you can:

✅Stay in the loop with email notifications on all doc activity

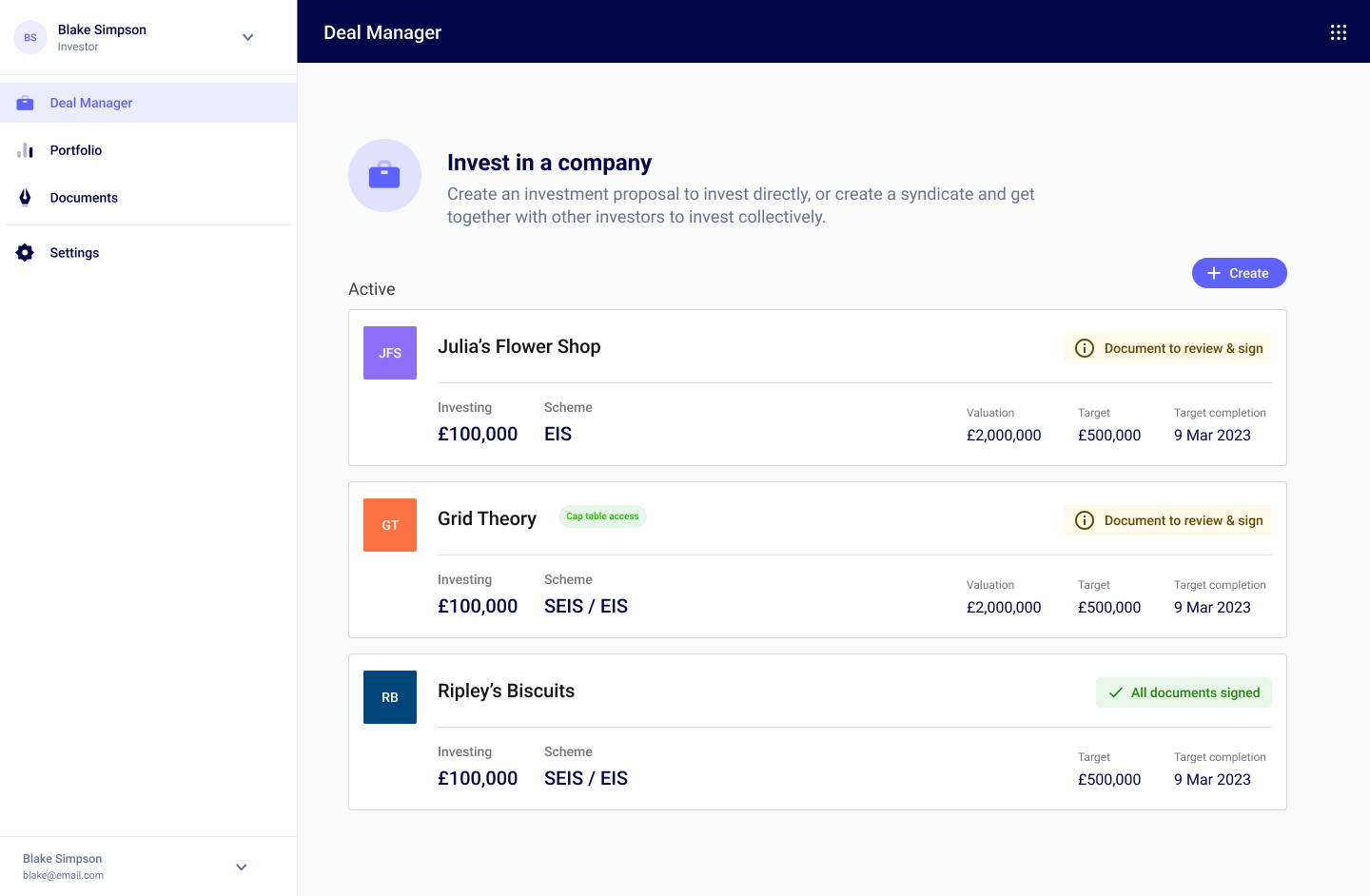

✅View all your deals at a glance in the Deal Manager dashboard

✅Ask our team for help any time you have a question

Simplify and standardise

Fred SoneyaThese types of legals are standardised. We don’t need a lawyer to write a term sheet for us. We know what terms we like, and we know what we don’t like. It doesn’t vary that much from deal to deal, it’s really just a matter of changing some headline terms, generally just numbers.

So it doesn’t make sense for us to go and open a new case with solicitors for every single company when we may not invest in every single company, because not every term sheet we issue gets signed, and not every signed term sheet ends up in a closed deal.

Co-founder & General partner,

SeedLegals allows investors and founders to save time and money by using customisable document templates. This helps you:

✅Work on multiple deals at once in a simple workflow

✅Send investment proposals within minutes

✅Close deals faster than anywhere else

✅Stay in control of all your deal docs and negotiations

Fred’s advice for fellow investors

- “Companies will say they’re raising their last round… it’s never the last round.

- It’s incredibly hard to know what the end outcome is going to be. Some of what I thought would have been the best possible fund returners or exit opportunities in the past have gone to 0 because of some macro-economic environment change or a complete shift in strategy. And the same is true the other way around. So some investments that I thought, not quite sure these guys are going to make it, have managed to pull it off and be transformational.

- Try to get a seat at the table. Particularly for angel investors, I think getting a seat at the table is really difficult with a small check. Pooling money together is a great way to go about it. Whether that’s a fund or a syndicate, it definitely opens more doors, gives better diversification, and more sway.”

Fred’s advice to founders

“We want to invest in companies that are solving a real world problem today, not some kind of future opportunistic thing. We look for major detail on what the pain point is that you’re solving, and who’s willing to pay for that solution.”

Find out how we can help you

SeedLegals supports angels and funds to sort the documentation they need, speed up negotiations and close deals in record time. Book a time to chat with us to find out how we can help.

Book a free call

Fill in the form so we can match you with the right expert.

![Enhanced Fertility]](https://seedlegals.com/wp-content/uploads/2025/09/enhanced-fertility-600x400.jpg)