Must-Know UK Startup Accelerators in 2025

Hit the gas with our list of some of the startup accelerators, incubators and bootcamps we see most frequently at SeedLe...

It’s no accident that the industrious bee is Manchester’s official symbol. With a thriving tech scene, a huge talent pool drawing from the city’s three universities and a hard-grafting spirit, Manchester is a hive of startup activity.

From accelerators to venture capital funds specialising in early-stage funding, here’s a round-up of the most active investors in and around Manchester. We’ve also listed North West-based business loan providers and organisations further afield with a record of investing in Manchester businesses.

For a more general introduction to the fundraising ecosystem, see our guide on how to find startup investors.

Additional information supplied by Beauhurst.

Ben DaviesThe North West is turning heads on the global tech stage. Beyond the great infrastructure, world-class access to talent, blossoming tech eco-system, plentiful accelerator programmes and preferable cost of living, there is a real buzz around the city as it continues to grow. Both large enterprise and smaller brands are choosing Manchester as their home. There is no better place to start a business in the UK right now.

Group Marketing Director,

The first Manchester-based VC to receive additional funding from the British Business Institute, Praetura Ventures supports entrepreneurs in the North with strategy and development as well as funding. They invest typically between £1 million and £3 million into 10 to 15 companies a year.

Headquartered in Manchester, DSW Ventures is an angel network specialising in startup and scaling companies in the North West. Their typical investment ranges from £300,000 to over £1 million as part of SEIS/EIS-qualifying rounds of up to £2 million.

Part of the Growth Company, GC Angels is made up of the former Co-Angel Investment Service, North West Business Angels and the GM Co-Investment fund. The fund supports early-stage founders based in the North and typically invests between £25,000 and £2 million as well as providing ongoing knowledge-sharing opportunities.

Another arm of the Growth Company, GC Business Finance is a not-for-profit lender specialising in startup and growth loans to business in the North West. Loans are available from £500 to £300,000.

The Core Business Fund invests between £200,000 and £5 million in either loans or equity in businesses which have matched funding from the private sector and will create jobs in the Greater Manchester area.

Based in Chester, Deepbridge Capital provides growth capital through investments between £10,000 and £5 million to micro, small and medium UK companies. The fund will invest across a variety of sectors, but most of its experience lies in renewable energy and technology sectors.

Ignite runs accelerator programmes across the UK. Currently, tech startups with a minimum viable product in the North East can apply. The programme includes workspace for up to six months, access to the fund’s incubator space, and growth support. The fund takes a 6% stake in exchange for investment.

A partnership between Lancashire County Council and GC Business Finance, Rosebud provides business loans from £10,000 to £300,000 to Lancashire businesses looking to expand their workforce. Finance is available as loans or a combination of equity and loans (‘mezzanine finance’), with no penalties for early repayment.

BOOST&Co Growth Loan typically invests between £1 million and £10 million in companies reporting over £3 million in revenue. The fund offers startup loans from £500,000 to £2 million, revenue loans of between £500,000 and £2 million, venture debt from £2 million to £10 million, and growth business loans of between £2 million and £10 million. The funds should be used for growth capital, R&D or M&A.

Formerly Draper Esprit, Molten Ventures is a European venture capital firm with a focus on technology. Typically investments span between £2 million and £50 million for high-growth companies in exchange for an average stake of 28.5%.

One of Europe’s largest investors with more than £1 billion under management. Octopus Ventures typically invests from around £1million for seed stages to up to £10 million for Series B rounds.

L Marks runs accelerator programmes globally with an average investment between £20,000 and £100,000 and a focus on enterprise and disruptive technology.

Catapult Ventures is an independent fund manager. Its owners operate a number of discrete venture capital funds on behalf of a range of public and private sector investors, with a total of £130 million under management.

Paid only if your fundraising is successful, fees on Seedrs are set at 6% on your first £150,000 raised, 4% on £150,000 to £350,000, and 2% on everything over £500,000.

Kickstarter is an all-or-nothing crowdfunding option, meaning you need to reach your goal to receive any pledged funds. The majority of successful campaigns on Kickstarter have goals under £10,000. If your campaign is successful, the fee is 5% of total funds raised.

Of course, finding potential investors is just the first step. Now it’s time to win them over with a killer pitch.

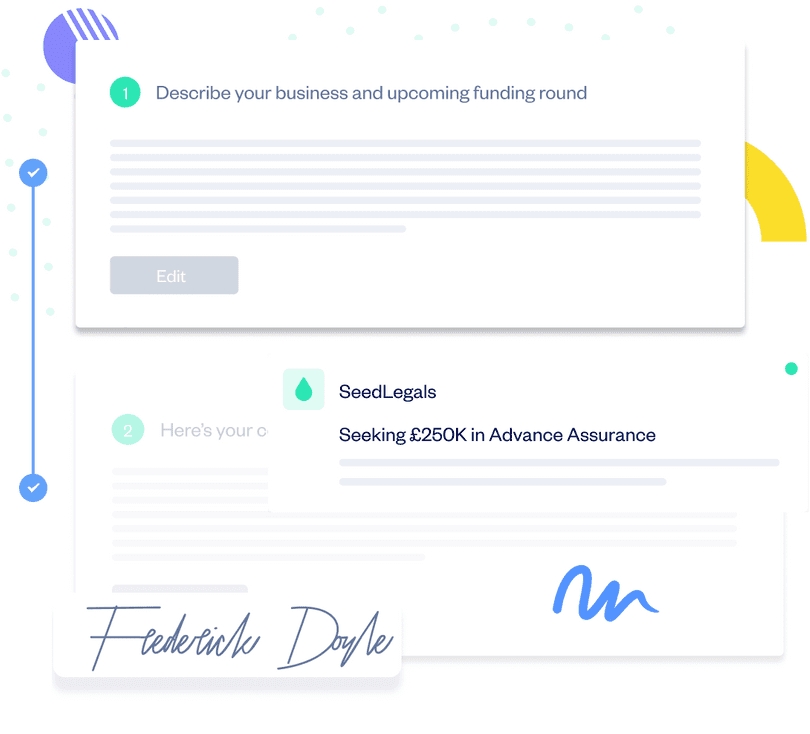

On SeedLegals we make it easy to create a compelling pitch page in minutes – and it’s completely free. We close more early-stage funding rounds than anyone else, so we know a thing or two about what investors want to see.

Just fill in our clean and clear template, then share the link with investors. You’ll get a notification whenever an investor expresses interest and you can log progress in the investment tracker.

Create your Pitch page and get sharing.

Many investors only invest in companies pre-approved for SEIS/EIS. We make it easy.

Apply for SEIS/EIS