Run multiple option grants in one go – now live on SeedLegals

We’ve made option grants faster and easier to run on SeedLegals. Set shared terms once, tailor where needed and send agr...

Motivated, engaged employees play a key role in the success of your company. Share Incentive Plans (SIPs) have become a common benefit that companies offer to incentivise their staff and drive success. They’re a way to give employees shares in the company to foster a sense of ownership and engagement. In this article, we’ll explain what Share Incentive Plans are, the different types, how they work and the benefits of having a SIP, for both your employees and your company.

In the article:

In the UK, share incentive plans are a government-supported way for companies to give employees tax-advantaged shares in the company they work for. Share incentive plans give employees the opportunity to gain a financial reward from the company beyond their annual salary. They’re a popular way for companies to give employees a sense of ownership of the business, with the aim of improving engagement and motivation.

Employees are given shares upfront, according to the plan rules set by the company that issues them. There are different types of share incentive plans (covered below) which usually come with tax benefits. If the employee keeps their shares in the plan for a specified number of years, they can get the tax benefits (more on this below).

In the UK, there are four main types of share incentive plans:

Share option schemes are another type of share incentive, but they fall under different regulations. We’ll explain that further down.

Share incentive plans can give employees a sense of ownership in the company and the opportunity to receive financial rewards on top of their salaries. Rewarding your employees in this way can also help your company:

💪Cultivate a culture of engaged and motivated employees

🏆Attract and retain top talent

🥅Align employees with company goals

🙏Build a company culture where employees are valued

HMRC gives employees and companies tax relief on shares issued via a share incentive plan if employees keep their shares in the plan for five years (or three for dividend shares).

If the employee keeps their shares in the plan for the specified number of years, they’ll get the following tax benefits:

If an employee takes the shares out of the plan and sells them before five years are up (or three for dividend shares), they’ll have to:

No Income Tax or National Insurance Tax will be due, however, if an employee leaves the company for the following reasons:

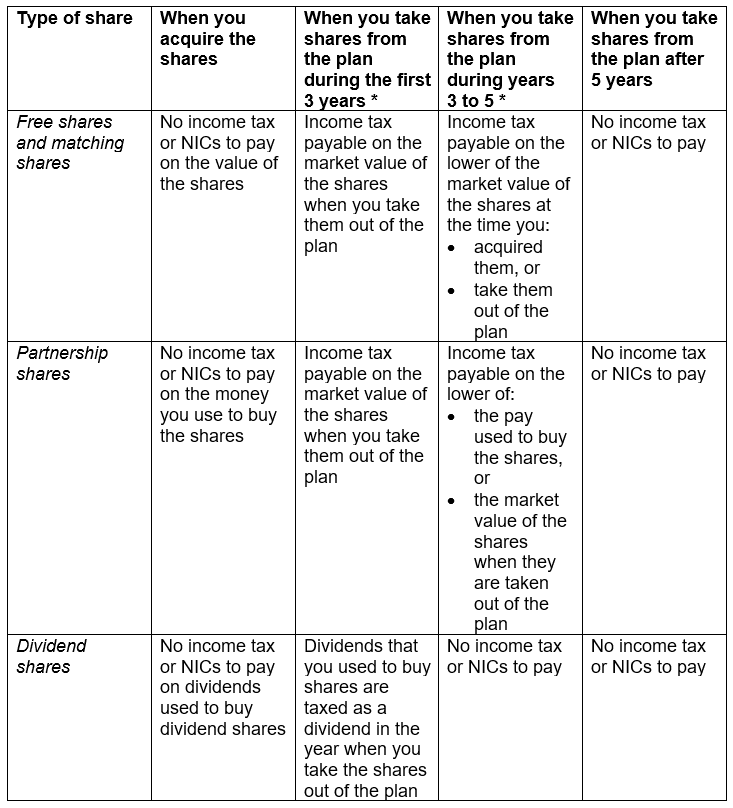

Take a look at HMRC’s table below to understand how tax works in each scenario for the different types of share incentive plans.

Companies get the following tax benefits from SIPs:

To get these tax benefits, share incentive plans must be registered with HMRC. The SIPs regulations provide the framework for companies to establish and give SIPs. The plan must be approved by HMRC to make sure your scheme complies with the regulations.

When an employee is awarded shares in the company, that employee owns the shares and can decide what they want to do with them. If an employee leaves the company after they’ve been issued shares, those shares still belong to them, but must come out of the plan.

The employee can choose when they want to sell their shares after they remove them from the plan.

With Free, Matching and Partnership shares (explained above), if an employee leaves the company before five years pass (after being issued with the shares) they will have to pay Income Tax and National Insurance Contributions (NICs) on the shares. However, after five years, they won’t need to pay Income Tax and NICs.

For Dividend Shares, if the employee only needs to keep the shares for three years to benefit from no Income Tax or National Insurance due on shares.

Both share option schemes and share incentive plans are valuable tools for companies to motivate and engage employees.

The main difference is that share options are the right to buy shares later if certain conditions are met, while other share incentive plans give employees the opportunity to buy shares immediately (within certain criteria).

Companies can set up two types of share option schemes:

Want to learn more about share option schemes? We have a library of resources. Start with these:

Mo SaedShare options benefit both companies and employees:

Companies: set exact rules and time restraints on how and when option holders can get shares. By offering share options, you protect your company because you’re not giving away shares instantly without properly assessing the person’s work. In contrast, when you give shares it’s extremely difficult to get them back, and can be costly.

Employees: In the case of EMI (Enterprise Management Incentive) share options, employees pay a reduced market value for their shares rather than the actual market value, which means they get a significant discount. There are also tax benefits such as reduced Capital Gains Tax and no Income Tax.

Share Options Expert,

If you want to explore setting up a share option scheme, you’re in the right place. We help thousands of founders set up and run their share option schemes in the quickest, most cost-efficient way possible. Book a free call with one of our experts and we’ll talk you through how it works.

Article Sources

Share Incentive Plans Guide for employees │GOV.UK – accessed 20 July 2023