R&D success stories: meet the companies claiming back cash

Meet the innovative companies who have successfully recovered money through the SeedLegals R&D Tax Credits service.

In 2021, we launched our R&D Tax Credits service to help founders claim money back they’ve spent on research and development.

R&D tax relief is an HMRC initiative that pays your company back up to 33% of what you spend on qualifying activity for research and development. You get the money back in the form of Corporation Tax relief or, if you’re a loss making company, as a tax credit (that is, a cash payment). You can now make your R&D claim with SeedLegals.

Let’s answer some of your questions

Am I eligible for R&D tax relief?

For how many years can I claim R&D tax relief?

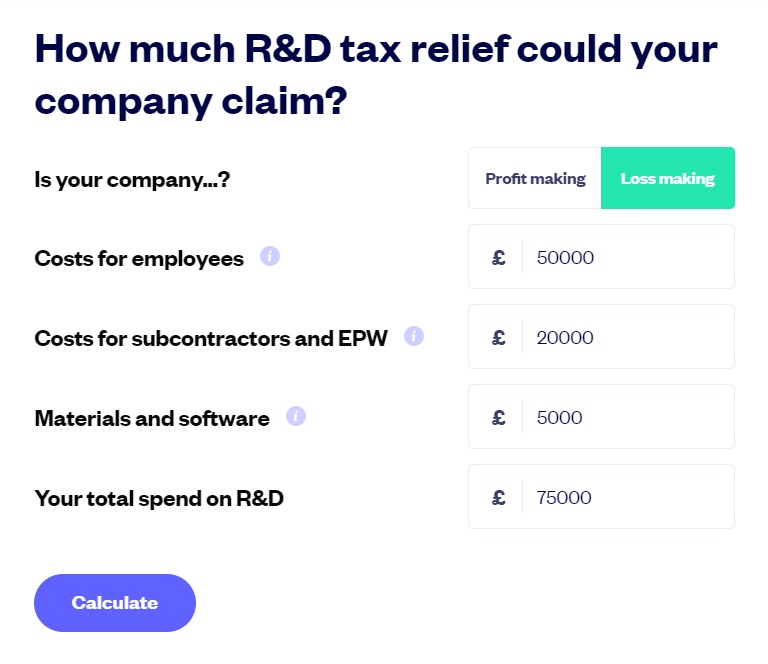

How much R&D tax relief could your company claim?

How to make your R&D claim with SeedLegals?

Maybe! It isn’t only tech companies that qualify for R&D tax relief. As long as your company is innovative, you could be eligible.

To find out if you’d be eligible for tax relief, book a call with us. Our team includes specialist accountants and lawyers – you’ll speak directly with one of our experts.

You can claim R&D tax relief retrospectively for the previous two accounting periods.

To find out how much your company could claim, try our quick calculator »

As you’d expect, we’ve made it as easy as possible to create a comprehensive and accurate claim.

Here’s what happens:

That’s it! All you need to do is wait for the response from HMRC. You’ll usually hear from them in four to six weeks.

How much R&D tax relief could your company claim? Find out with our calculator.

Go to calculator