R&D tax credits changed in April 2023 - find out how those changes affect your business

Find out how the qualifying cost categories and rates are changing for the SME and RDEC schemes and how corporation tax...

R&D often conjures up images of white-coated chemists gathered round a test tube. But the UK government’s R&D tax credits scheme is actually accessible to a wider range of businesses than you might expect.

In this post, we celebrate some of the innovative companies who have submitted successful claims through our R&D Tax Credits service.

The UK government rewards companies that contribute to technological and scientific innovation by investing in their own research and development (R&D). The incentive comes in the form of a reduced Corporation Tax bill or, for loss-making companies, a cash payment.

Innovation doesn’t exist in just one sector. The R&D tax relief scheme is designed to benefit companies across industries.

Because you claim specifically for expenses incurred within projects that qualify as R&D, many startups find they can get money back for their dev team spends, for example.

While the rewards of a successful R&D claim can be high, it can also be a big investment in time and effort to ensure all your costs are captured and categorised properly. HMRC scrutinises each claim, so it pays to work with a partner who can help you navigate the complex submission process.

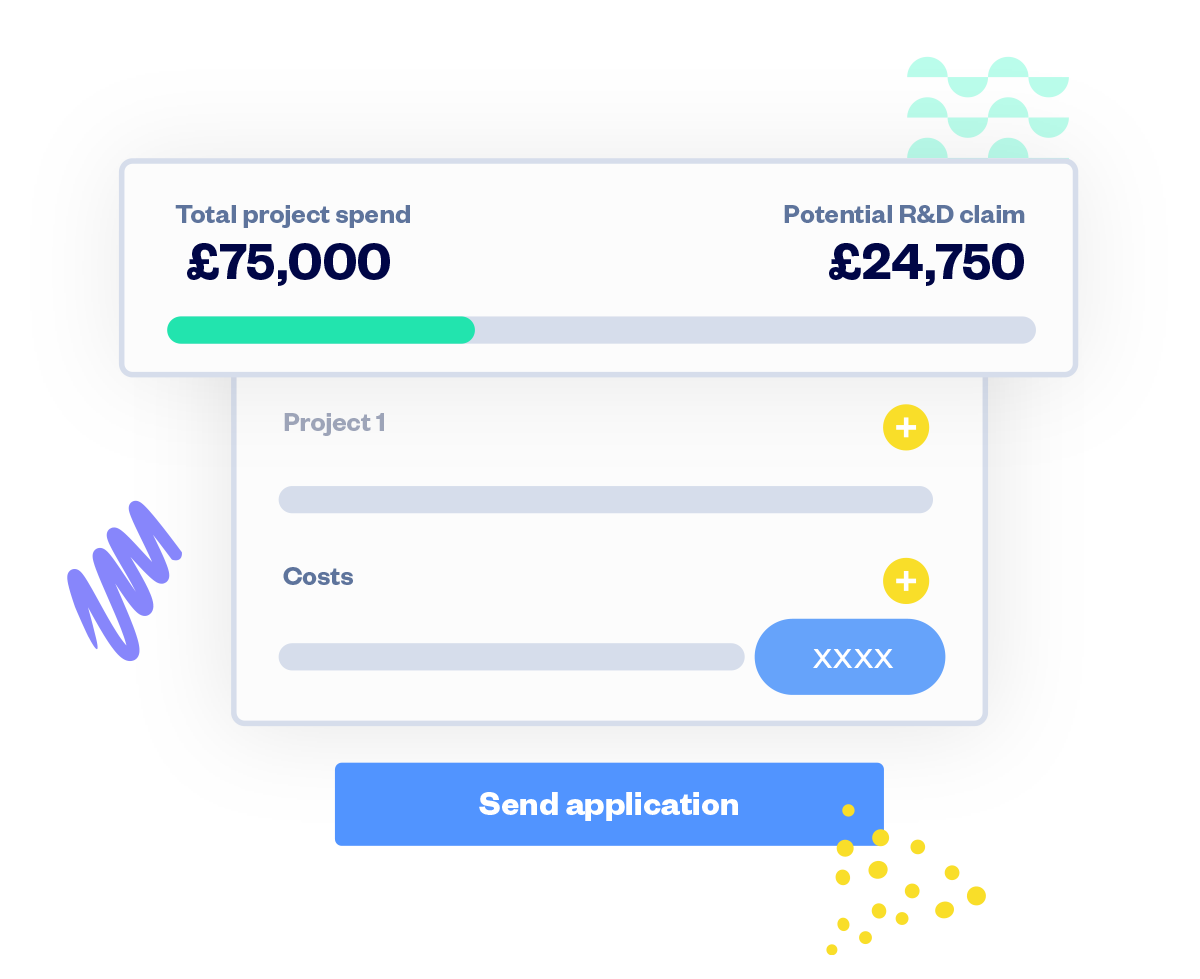

At SeedLegals, we’ve got this process down to a fine art. We combine smart automation with a series of expert reviews to build your claim efficiently and accurately – saving you both time and money as you continue to build your business.

Ben ConryGetting help to prepare your R&D claim is essential. R&D tax credits are a great way to boost your cash flow by rewarding you for the R&D activity you’ve already done. With changes to the scheme coming soon, and an increased level of HMRC scrutiny, you want to make sure your claim is robust and compliant but that you don’t leave any money on the table.

Tax Specialist,

That’s how much, on average, companies claim in R&D tax credits through SeedLegals. We make it easy to build an HMRC-ready claim for a faster, more reliable payout.

Find out moreThe SeedLegals R&D team gets to go deep into the detail of the innovation happening across UK startups. Now, we want to shine a spotlight on just some of the cutting-edge work we see on a daily basis. Read on for a quick introduction to a few of our favourite success stories, and see the impact their R&D claim had on their business.

AgriDex is using the security and traceability offered by blockchain to fortify the global food supply chain and reduce avoidable food waste.

By connecting buyers and sellers directly, they aim to support quicker payments and greater transparency along every stage of the food growing, processing and distribution process.

To reliably deliver the accurate, real-time information about market demand and pricing that their users need, AgriDex needs to continuously invest in their tech stack.

We were pleased to be able to support the important work AgriDex is doing, by helping them recoup some of their costs.

Russell DuckworthAt AgriDex, we firmly believe that technology is the solution to building a more secure and resilient global food chain that serves more people’s needs, more effectively.

Due to the nature of our business, the technical aspects of our work are complex and multifaceted, but Ben at SeedLegals was able to guide us through the preparation of the technical report and the claim submission. We are delighted with the quick and efficient way they handled this – it meant we could focus on developing our technology, while trusting that the important admin was being taken care of.

Our claim will really help us achieve our goals for 2023.

Director,

Celix Pharma brings high-quality, affordable and sustainable generic medicines to the UK and EU.

The founding team has a wealth of pharmaceutical experience ranging from lab research to distribution and marketing. They started Celix Pharma to address unmet needs in the healthcare system with their growing portfolio of medicines and products.

Subir KohliResearch and development is central to our work as a pharmaceutical company. Because it was our first time filing, it was especially important to partner with an R&D tax credits service that understood how to capture everything we do – and how to present it to ensure the application went smoothly through HMRC’s checks. The templates for the technical narrative and our R&D expenses really helped simplify the overall task.

We appreciate the effort SeedLegals put into understanding our business and making sure no opportunity to claim was left on the table. We had a fantastic outcome, which we’ll use to reinvest in research and development in 2023.

Co-Founder and CEO,

CurveBlock is a real estate fintech that allows anyone to earn passive income by investing in carbon zero, energy positive home development.

With their platform currently at prototype stage, CurveBlock’s successful R&D claim is a valuable cash boost that will help power them on towards their goals of greater financial inclusion and sustainable housing. CurveBlock has launched their first fund and are welcoming their first few customers.

Joey JonesWe’re still pre-revenue so raising money has been a huge part of our job to keep the company going. Our R&D expenses have been a big part of what we do so being able to reclaim some of those expenditures meant we could refresh the bank account and continue on.

It’s very difficult to fully understand HMRC’s guidelines for the R&D scheme. We didn’t want to risk misunderstanding something or making mistakes, so we needed to work with experts who understand the process.

Co-Founder,

Skyverse develops online tools that allow Air Traffic services and their users to share clearer, faster and richer information. Currently, many aerodromes still rely on manual, time-intensive paper-based processes and calls by radio or phone. Skyverse’s SaaS model allows for more efficient and safer internet-based communication.

No strangers to runways, Skyverse’s successful R&D claim is helping the company prolong their financial runway before their next funding round takes off, so they can onboard more customers and accelerate their valuation.

Michael BramworthThe SeedLegals platform enabled us to quickly assess the R&D tax credit amount we could expect to claim.

The best thing about working with SeedLegals is that they’ve seemed to have nailed a perfect balance between providing an efficient, low cost automated platform coupled with instant access to friendly, knowledgeable and professional human beings (thanks Rob M.) to guide us through the trickier bits.

CEO,

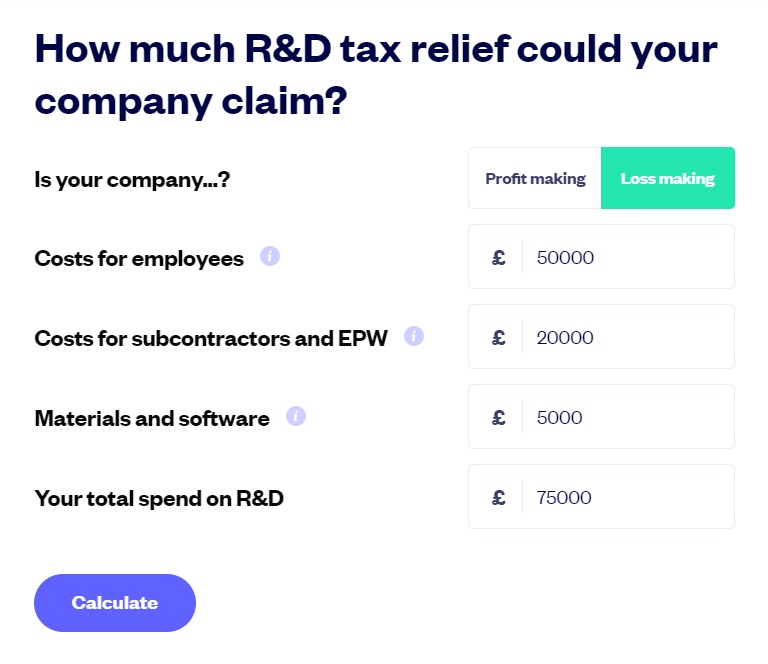

How much R&D tax relief could your company claim? Find out with our calculator.

Calculate my claimR&D tax credits are often overlooked as a source of funds, but they can give your cash reserves a generous boost and even help you extend your runway.

Not sure whether you qualify or how to get started with your claim? Jump on a quick call with an R&D specialist to get your questions answered.